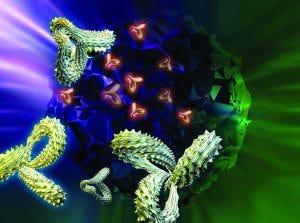

Protein structure is vital to function — and thus a critical parameter for determining biosimilarity. (STOCK.ADOBE.COM)

In a just a few years, the biopharmaceutical industry has gone from questioning the feasibility of “follow-on biologics” (around the time of BPI’s first issues) to fearing them (when we published our first supplement on the topic in 2013) to the acceptance and strategizing of today. Perhaps because of its more socialized medicine, Europe led the way in biosimilar regulation and approved its first such product nearly 10 years before the first US biosimilar launch in 2015. In between came 2009 approvals in Canada and Japan. And the World Health Organization adopted its own guidance in 2010 to encourage regulatory harmonization across markets.

Amgen is one innovator company that has embraced the concept wholeheartedly, calling it “our next chapter in healthcare” in a 2016 report (1). That publication cites product characterization, preclinical studies, nomenclature, reimbursement, and regulatory pathways as the primary challenges facing companies in biosimilar development. It also highlights the power of formulary decision makers, suggesting that they are likely to be more amenable to biosimilars with larger projected patient populations (e.g., anti–tumor necrosis factors, granulocyte-colony stimulating factors, erythropoiesis-stimulating agents, and interferons).

Technicalities

It’s true that biosimilars don’t face the same gauntlet of clinical testing that innovative biologics do. Generally, they can skip over phase 2 and go right from a large-scale phase 1 comparative pharmacokinetic/pharmacodynamic (PK/PD) and safety study right to large-scale comparative phase 3 trials. Data from testing just one indication may be extrapolated to others served by the comparator drug. Both of those options save developers substantial money, thus making it possible to sell biosimilars for lower prices than those of the innovator products.

However, that puts the onus on earlier testing — in particular, in vitro and animal testing as well as comparative characterization. At least three development batches are tested (fewer than for innovators, more than for generic drugs), and release testing remains a requirement. The Pharmaceutical Research and Manufacturers of America (PhRMA) estimates that development of a new biopharmaceutical may cost $2 billion over a decade or more; the Federal Trade Commission has estimated that biosimilar development could cost just $200 million over eight to 10 years.

A significant portion of that money is spent on product analysis. The Association for Accessible Medicines (AAM) claims that “there is a misconception that clinical trials will assure the safety of biosimilars, when instead, analytical comparisons will be the most powerful tool in determining whether a biosimilar is ‘highly similar’ to its reference product.”

When a biosimilar application is made, regulators will have had up to 20 years of history with its reference comparator. Prescribers will be familiar with clinical responses to that product, and it will have a documented adverse-event history. Meanwhile, the technology for evaluating the structure and function of biologics has improved over time.

Most adverse events for protein therapeutics are caused by their pharmacological properties or amplified drug effects. Contrary to public opinion, impurities do not cause adverse events for most biotech products. Purity is controlled to regulatory-defined levels and needs to be identified and controlled for biosimilars just as for any other medicine. Impurity differences (within specified limits) do not justify large clinical trials even if a biosimilar’s impurity profile may be different from its comparator’s. Preclinical testing (e.g., on animals and cells) should provide the necessary data.

As AAM points out, laboratory analyses can detect product differences more directly than clinical trials can. Modern analytical methods are more sensitive, precise, and reproducible than ever before. Functional assays confirm whether a biosimilar has the same activity as its reference originator. And after product approval, postmarket pharmacovigilance systems help companies monitor adverse events for years to come.

The box below describes just one of many analytical advancements that have helped companies realize the concept of well-characterized biologics in recent years. The many capabilities of mass spectrometry have made it an essential technology for every biopharmaceutical laboratory. Other valuable methods include high-performance liquid chromatography (HPLC), circular dicrhoism (CD), differential scanning calorimetry (DSC), light-scattering and electrophoretic technologies, analytical ultracentrifugation (AUC), and surface plasmon resonance (SPR) analysis.

Bioassays such as enzyme-linked immunosorbent assays (ELISAs) are just as important to biosimilar development as to innovators — and with the clinical testing differences, maybe even more so. Ulrike Herbrand provides much more detail on that in this report’s third article. And Bruno Speder follows with a focus on the biosimilar clinical development path.

“A sound understanding of a molecule, its mechanism of action (MoA), and potential impurities and degradation products during its production will assist a biosimilar applicant in discussions with regulatory authorities when considering safety and efficacy study designs” (2). Thus preclinical studies and characterization are the keys to opening the door of an investigational new drug (IND) application for clinical testing. Well worth revisiting, two recent BPI articles have examined the role of biophysical analysis and the orthogonal approach (3) and how to overcome challenges of highly concentrated biosimilar formulations (4). Gaps in science remain even for monoclonal antibodies (MAbs), which are by many accounts the most well-understood biopharmaceutical molecules — lending themselves to “platform” approaches to many operations (5).

Regulatory Affairs

Our 2013 supplement was full of questions, many of which have been answered. Since 2015, the US Food and Drug Administration (FDA) has published five guidances related to biosimilar development (6–10). Now it’s all about interpretation. Three of those five documents involve the characterization and comparison issues described above. One focuses on nomenclature, the last on meetings between applicants and the agency.

The Alliance for Safe Biologic Medicines surveyed hundreds of healthcare providers in 2015, discovering that 80% of physicians and 76% of pharmacists want information in biosimilar product labels to specify for which indications they actually were studied (rather than extrapolated from other testing). Regulators around the world currently disagree on whether a biosimilar tested for one indication can be used for other indications that its comparator is used to treat. For example, the European Medicines Agency allows for full extrapolation, Health Canada specifies classes of disease that go together, and the FDA has yet to finalize its policy.

Every article in this report discusses regulatory aspects of biosimilar development. Ron Rader wraps things up at the end by looking at things from a global perspective, with a special focus on product names. Rader has been BPI’s “go-to” guy for nomenclature issues ever since he first brought them to our awareness back in 2007, before he joined BioPlan Associates (11–12).

A Wide-Open Market Beckons

Amgen is considering the following questions when it comes to the future of biosimilars (1): How will payers respond to their launch? How will pharmacy benefit managers influence uptake in the biosimilar market, and will market uptake reflect factors beyond cost savings? How will appropriate use in therapy evolve as different stakeholders become familiar with biosimilars? How will nomenclature be determined, and what are the ramifications? And how will stakeholders value factors related to reimbursement?

Clearly, market considerations are on everyone’s mind. So are regulations — especially in the United Kingdom (which since Brexit is severing its laws from those of the European Union) and the United States (where uncertainty suddenly has become the order of the day). How much of the EU approach will remain in the UK regulatory system? What would a new US paradigm of eliminating two regulations for every new one introduced mean for how regulated industry functions? And what will Tom Price’s influence be like on the Department of Health and Human Affairs (not to mention Seema Verma’s on Medicare and Medicaid)? All that remains to be seen — but for now, we must operate on the information we have rather than speculating on what may come.

A 2016 report from Industry Standard Research claims that nearly two out of three survey respondents said their companies were planning to sell biosimilars — a significant increase from one out of two in 2015 (13). The market at this point is wide open. Early adopters may have a head start, but the real winners will be those who can address and overcome the technical difficulties.

References

1 Adamson R, et al. 2016 Trends in Biosimilars Report. Amgen Inc.: Thousand Oaks, CA, 2016.

2 Dinwoodie N. Outsourcing Biosimilars Development. BioProcess Int. 14(5) 2016: S30–S35.

3 Greer FM. Primary and Higher-Order Structural Characterization Strategy for Biosimilarity Assessment. BioProcess Int. 13(11) 2015: 40–44.

4 Qi W, et al. Enhanced Biosimilar Product Characterization: A Case Study Using Raman Spectroscopy Combined with Dynamic Light Scattering. BioProcess Int. 14(6) 2016: 44–49.

5 Kaur SJ, et al. Biosimilar Therapeutic Monoclonal Antibodies: Gaps in Science Limit Development of an Industry Standard for Their Regulatory Approval (Parts 1 and 2). BioProcess Int. 14(9) 2016: 12–21; 14(10) 2016: 22–27.

6 CDER/CBER. Quality Considerations in Demonstrating Biosimilarity of a Therapeutic Protein Product to a Reference Product: Guidance for Industry. US Food and Drug Administration: Rockville, MD, April 2015.

7 CDER/CBER. Scientific Considerations in Demonstrating Biosimilarity to a Reference Product: Guidance for Industry. US Food and Drug Administration: Rockville, MD, April 2015.

8 CDER/CBER. Formal Meetings Between the FDA and Biosimilar Biological Product Sponsors or Applicants: Guidance for Industry. US Food and Drug Administration: Rockville, MD, November 2015.

9 CDER/CBER. Considerations in Demonstrating Interchangeability with a Reference Product: Guidance for Industry. US Food and Drug Administration: Rockville, MD, January 2017.

10 CDER/CBER. Nonproprietary Naming of Biological Products: Guidance for Industry. US Food and Drug Administration: Rockville, MD, January 2017.

11 Rader RA. What Is a Generic Biopharmaceutical? Biogeneric? Follow-On Protein? Biosimilar? Follow-On Biologic? (Parts 1 and 2) BioProcess Int. 5(3) 2007: 28–38; BioProcess Int. 5(5) 2007: 20–28.

12 Rader RA. Nomenclature of New Biosimilars Will Be Highly Controversial. BioProcess Int. 9(6) 2011: 26–33.

13 Bioprocessing Manufacturing: Key Considerations and Expected Outsourcing Practices (3rd Edition). ISR Reports: Cary, NC, May 2016.

Cheryl Scott is cofounder and senior technical editor of BioProcess International, PO Box 70, Dexter, OR 97431; 1-646-957-8879; [email protected]; www.bioprocessintl.com.