Content Spotlight

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

Speed and mass production capacity are key when manufacturing potential COVID-19 treatments, says Samsung Biologics as it becomes the latest CDMO to support Vir’s SARS-CoV-2 monoclonal antibody programs.

Vir Biotechnology has a technology that identifies antibodies in people who are protected from, or who have recovered, from infectious disease. The firm is using this platform to tackle the novel coronavirus, and has partnered with GlaxoSmithKline (GSK) to bring lead candidates VIR-7831 and VIR-7832 through the clinic.

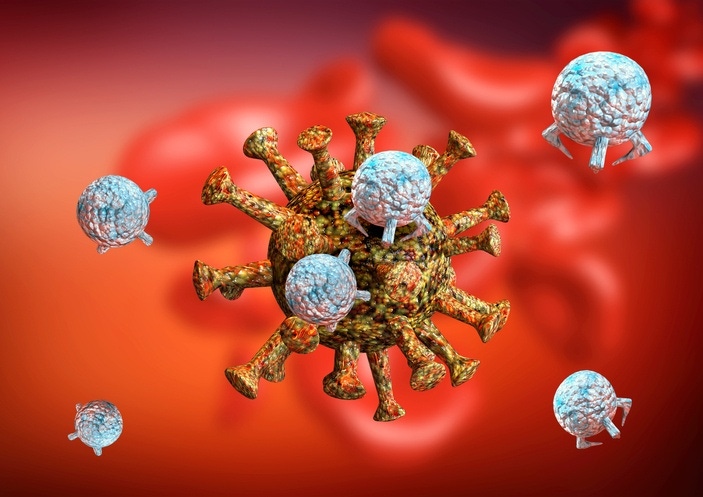

The company says both monoclonal antibodies (MAbs) have shown an affinity for binding to the spike protein, one of the proteins on the outer layer of the novel coronavirus, and – with the regulatory go ahead – Vir and GSK hope to take the two programs directly into Phase II trials within the next three to five months.

Image: iStock/Gilnature

To support these projects, Vir has inked a deal with Samsung Biologics worth $362 million for large scale production of the MAbs.

The Korean contract development and manufacturing organization (CDMO) has three plants at its site in Songdo, Incheon boasting a total of 362,000 L of mostly stainless-steel fermenter capacity, which, according to a company spokesperson, puts it in a good position to support COVID-19 efforts both for Vir and others.

“We believe that the speed and capacity of mass production is a key contributor in this COVID-19 pandemic situation to develop and manufacture potential treatments,” Claire Kim told Bioprocess Insider.

While specific manufacturing details have not been disclosed, the two companies will continue to negotiate additional terms in a definitive agreement, we were told.

Samsung Biologics is one of several manufacturers supporting these projects. GSK, under terms of its partnership with Vir, has some responsibility for manufacturing, while Biogen and WuXi Biologics are also on board.

“Vir is working to line up as much manufacturing capacity as possible in anticipation of bringing the MAbs to patients around the world,” a Vir spokesperson told this publication. “WuXi, Biogen, GSK and now Samsung will all be part of that effort.”

Like so many drugmakers, Samsung Biologics is continuing to do what it can to run operations as normal during this pandemic while supporting industry’s R&D efforts against COVID-19.

“Samsung Biologics is committed to making its maximum contribution to providing agile and competitive production capabilities to supply solutions for COVID-19 treatments,” said Kim.

“Since the coronavirus outbreak initiated in late January, Samsung Biologics has been taking proactive measures under its Business Continuity Plan with ongoing risk management of all facets of client impacting services to prevent any potential business disruption. There are no immediate threats to our supply chain to date, and our SCM [supply chain management] team is taking all necessary means to ensure the stable supply of critical raw materials.”

South Korea was, after China, one of the first countries to be hit by the coronavirus but has managed to successfully ‘flatten the curve’ and control the spread. At this time, Samsung Biologics has no employees diagnosed with COVID-19 but there is a contingency plan in place to continue business operations and minimize the spread should a case arise, Kim said.

“We are taking preventative measures to facilitate our full cGMP compliance, such as making efficient team shifts, deep cleaning and disinfection of plants, etc.”

You May Also Like