Content Spotlight

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

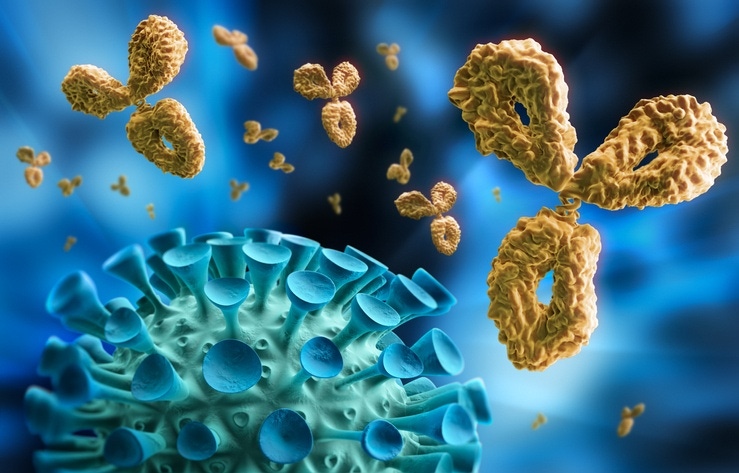

From Regeneron to GSK, monoclonal to bispecific, industry is increasingly looking at antibody (Ab) therapies to tackle the novel coronavirus. We bring you a comprehensive guide to what’s in the pipeline.

Only six weeks ago, Bioprocess Insider brought to you a highlights reel of the treatments and prophylaxis in the development pipeline to treat COVID-19, caused by the novel coronavirus (SARS-CoV-2).

But six weeks is a very long time in a global pandemic, and since then new projects have begun and partnerships created as all aspects of our industry mobilize to take on this virus.

Image: iStock/peterschreiber.media

Armed with data collected by Pharma Intelligence, owned by our parent company Informa, we now bring to you a guide to the antibody-based products in the COVID-19 pipeline.

According to the database, there are 204 products in development, 143 of which are treatments rather than preventative vaccines. Many of these are antiviral small molecules, but there are numerous other modalities, including plasma-derived therapies and peptides. Only a fraction of the programs are monoclonal antibodies (MAbs) and next-generation antibody-based products, and all of them, for now, are in the discovery and preclinical testing stages.

Monoclonal antibodies have not traditionally been the response to infectious diseases, due mainly to the difficult and cost of producing them. There are at present only a handful of MAbs licensed for infectious diseases: Synagis (palivizumab) for prevention of respiratory syncytial virus in high-risk infants; Zinplava (bezlotoxumab) for Clostridium difficile infection (CDI); Trogarzo (ibalizumab) for HIV; and ABthrax (raxibacumab) and Anthim (obiltoxaximab) for prophylaxis and treatment of anthrax. However, with costs and complexities falling, and antibodies remaining a major focus in other disease areas, it is no surprise that industry is attempting to turn the modality towards coronavirus.

All details are correct at the date of publication, but for constant updates, insights, and complete COVID analytics, please visit the Pharma Intelligence coronavirus content hub here.

One of the first to announce its intentions to develop coronavirus MAbs, Regeneron is using its VelociSuite technologies – which includes the VelocImmune mouse technology, a genetically modified strain in which genes encoding mouse immune system proteins have been replaced by their human equivalents – to identify and validate preclinical candidates and bring them to development.

The firm is using experience garnered to develop its investigational Ebola treatment REGN-EB3, a triple antibody cocktail treatment, to expedite COVID-19 efforts. And on April 16, the US FDA accepted for priority review a new Biologics License Application (BLA) for REGN-EB3.

Having identified more than 500 antibodies that could potentially be turned into coronavirus treatments, Vancouver, Canada-based biotech AbCellera Biologics has entered the most promising candidates into screening and hopes to have an antibody product ready for human testing by the end of July.

The firm is partnered by pharma giant Eli Lilly, which said it was “impressed with the speed and quality of their efforts.” Development leverages AbCellera’s rapid pandemic response platform, developed under the DARPA Pandemic Prevention Platform (P3) Program, and Lilly’s global capabilities for rapid development, manufacturing and distribution.

Vir Biotechnology has identified and is developing two MAbs against novel coronavirus that bind to SARS-CoV-2. The antibodies target the SARS-CoV-2 spike protein in the region that the virus uses to enter cells through the cellular receptor ACE2.

The firm has teamed with GlaxoSmithKline (GSK) to develop the candidates VIR-7831 and VIR-7832 through the clinic and hope to take the two programs directly into Phase II trials within the next three to five months.

Vir has also put in place plans to manufacture the MAbs using capacity and capabilities at GSK, Biogen, WuXi Biologics and Samsung Biologics.

Like other big pharma firms, AstraZeneca has been vocal about assessing its assets for potential COVID-19 therapies. In April, the Anglo-Swedish firm announced it is harnessing internal expertise and adding new collaborations to identify MAbs that have the potential to recognize, bind to and neutralize the SARS-CoV-2 virus. This includes projects with the US Army Medical Research Institute of Infectious Diseases (USAMRIID) and the University of Maryland School of Medicine.

And earlier this month, Amgen threw its hat into the coronavirus ring teaming with Adaptive Biotechnologies to discover and develop fully human neutralizing antibodies. Adaptive will use its high throughput platform to screen the massive genetic diversity of the B cell receptors from individuals that have recovered from COVID-19, and Amgen will use its capabilities to select, develop and manufacture antibodies designed to bind and neutralize SARS-CoV-2. deCODE Genetics, a subsidiary of Amgen located in Iceland, will provide genetic insights from patients who were previously infected with COVID-19.

In Korea, Celltrion recently completed neutralization tests on MAb candidates for COVID-19 and is commencing cell-line development ahead of an anticipated move into clinical trials in July. Concurrently the firm is developing a ‘super-antibody’ or an ‘antibody cocktail’ therapy to target potential mutations of SARS-CoV-2.

Korean firm Abclon is developing therapeutic human antibodies using its NEST antibody platform for the treatment of COVID-19 infection. They will neutralize the virus by binding specifically to a receptor binding domain that ACE2 binds to. Thirteen types of antibodies have been selected from

And also in Korea, Eutilix is developing a coronavirus MAb, according to Korea Biomedical Review.

Meanwhile in China, Shanghai Junshi Biosciences has collaborated with the Institute of Microbiology of the Chinese Academy of Sciences (IMCAS) to develop novel coronavirus-neutralizing antibodies (NAbs).

Mount Sinai Health System and China’s Harbour BioMed teamed up to develop numerous MAbs in early March. Among the disease areas the collaboration hopes to take on is COVID-19, using Harbour’s H2L2 Harbour Mice platform to generate monoclonal antibodies against the SARS-CoV-2.

“These fully human monoclonal antibodies could be used therapeutically for people who have been exposed to the virus, or prophylactically for individuals with a high risk of exposure, such as healthcare workers,” the firms said.

Tsinghua University, 3rd People’s Hospital of Shenzhen and Brii Biosciences have teamed to develop MAbs against COVID-19, characterized from patients in China who have recovered from the virus.

“We have been able to move very quickly by virtue of our proximity to the initial outbreak and our expertise from prior research in SARS and MERS,” said Professor Linqi Zhang, Tsinghua University. “Our investigators have worked day and night since the beginning of the outbreak. With Brii Bio joining and the dedicated focus afforded by this new venture, we expect to accelerate our development efforts with the shared goal of bringing forward an effective therapy to benefit people around the world affected by this pandemic.”

CSL Behring and SAB Biotherapeutics (SAB) hope the rapid development of candidate SAB-185 will be on track for clinical evaluation by early summer. The human polyclonal antibody candidate is generated without the need for blood plasma donations using SAB’s DiversitAb platform.

Also focused on recombinant polyclonal antibodies, GigaGen announced in March that rCIG (recombinant anti-coronavirus 19 hyperimmune gammaglobulin) is in development to treat high-risk and severely ill individuals infected with COVID-19.

“Unlike plasma-based polyclonal antibodies, such as convalescent serum therapies in development for COVID-19, rCIG does not rely on the constant supply of plasma from recovered COVID-19 donors to provide a regular source of the therapy to patients in need,” the firm said. “GigaGen uses its leading single cell technology to capture and recreate complete libraries of antibodies from COVID-19 convalescent patients that can directly translate into antibody therapies.”

Neurimmune and Ethris have partnered to develop mRNA-encoded, neutralizing anti-SARS-CoV-2 antibodies administered by inhalation. Neurimmune is identifying human antibodies from the immune cells of recovered COVID-19 patients using its RTMTM Technology platform, which will then be translated into therapeutic SNIM RNA products for inhalation using Ethris’ mRNA technology. Clinical testing is expected in the fourth quarter of 2020, pending regulatory approval.

Ossianix is developing single domain VNAR (Variable parts of IgNARs) antibodies for the treatment of COVID-19. The approach uses the firm’s VNAR phage display libraries to identify single domain antibodies with high affinity and specificity against the COVID-19 spike protein. The spike protein is the site of attachment of the virus with its cellular receptor ACE-2 and blockade at that site will neutralize its activity. Once screening is complete, the Stevenage, UK-based firm is hoping to partner with interested parties in government, academia or biotech and pharma to develop the virus blocking VNAR antibodies and move the project to a therapeutic reality in the shortest possible time.

ImmunoPrecise, a full-service, therapeutic antibody discovery Contract Research Organization (CRO), hopes to develop a PolyTope MAb Therapy against the new coronavirus.

The therapy, discovered through its artificial intelligence capabilities, “combines the benefits of using well-defined and fully characterized monoclonal antibodies with the essential need for a multi-targeting strategy to tackle this quickly emerging virus, thereby significantly accelerating effective clinical application.”

Californian Mateon Therapeutics has rummaged through its pipeline and clinical assets, and launched a new division focusing on COVID-19 and future emergent zoonotic outbreaks.

While this approach harnesses a number of technologies and modalities, Mateon will be deploying its internal antibody discovery/engineering to produce new therapeutic monoclonal antibodies or to identify antibodies derived from patients that have mounted a protective response to the COVID-19 virus infection.

Sorrento Therapeutics and SmartPharm Therapeutics have teamed up to develop a gene-encoded antibody therapy. The collaboration will utilize monoclonal antibodies against SARS-CoV-2 virus discovered and/or generated by Sorrento that will be encoded into a gene for delivery utilizing SmartPharm’s non-viral nanoparticle platform. Known as ACE-MAB, the candidate is in the cell line development stage, and the firms are using Chinese manufacturer Mabpharm to prepare for potential large-scale production.

Disclaimer: This list was taken from the Pharma Intelligence coronavirus content hub on April 17 and was the most comprehensive list available. There may be a few projects missed off it – GT Biopharma teamed with Cytovance Biologics in March for example – and new projects are likely to be started in the coming days, weeks, and months. Feel free to add your company’s antibody projects through the comments section below.

Correction: The original piece claimed ImmunoPrecise was using EVQLV’s tech platform when in fact the Polytope Therapy is proprietary to ImmunoPrecise.

You May Also Like