Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

March 1, 2009

In the 1980s biotechnology began to transform medicine with the introduction of recombinant hormone treatments and “magic-bullet” drugs based on monoclonal antibodies. In the 1990s, protein kinases offered a key to cancer treatment, and gene therapies promised to address many diseases at their most basic, genetic level. The 21st Century has brought us stem cells, RNA interference, biomarkers, and predictive medicine. None of these things has supplanted the others; instead, they merely expand on the basic idea of biopharmaceuticals. The future of healthcare can be glimpsed in modern molecular medicine.

Biomarkers

The US FDA’s critical path initiative has put pressure on companies to find new and valid biomarkers in their pharmaceutical development. A biomarker was traditionally considered to be any specific physical trait used to measure or indicate the effects or progress of a disease or condition (wrinkles and hair loss, for example, were biomarkers of aging). But biotechnology has refined the concept to molecular indicators of specific biological properties. These biochemical entities can be useful in measuring the progress of a disease or the effects of its treatment. As such, they are important in modern drug discovery and clinical trials, among other aspects of drug development. And they will be vital to making personalized medicine a reality.

FLAVIO TAKEMOTO (WWW.SXC.HU)

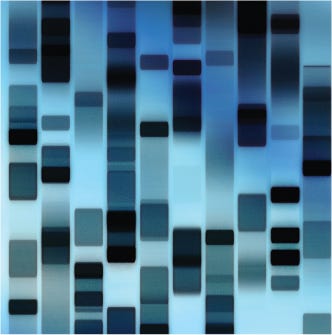

Integrating Genetic Markers in Drug Development: Single-nucleotide polymorphisms (SNPs) in DNA sequences have been successfully used in drug develoment for patient subpopulation screening, disease risk assessments, and predictions of therapeutic response. SNP pattern identification is already finding utility in clinical trials, represent a range of new opportunities for developers of both therapeutics and diagnostics. Some successful research relates to genetic tests for cardiovascular disease, osteoporosis, and osteoarthritis. Genetic diagnostic tools are already being applied in the development of cancer therapeutics. However, the promise of personalized medicine for other disease areas remain unfulfilled.

Drug developers need reliable biomarkers to predict patient response, disease severity, and progression rates of many complex diseases. Use of genetic variation and other biomarkers represents an exciting opportunity for such companies, proper study design is vital to success. The key to successfully integrating genetic and other biomarker tests into drug development begins with proper study design in both prospective and retrospective clinical trials. Both dynamic biomarkers and genetic risk markers could help companies develop therapeutic solutions to many common complex diseases.

One promising benefits of genetic testing is in identification of patients who are most at risk of developing a given disease. Monitoring resources and therapies can thus be allocated to those people who are most in need. Some companies have identified genetic panels for selection of clinical trial patients by screening out likely nonresponders for the drug being tested. The genetic test market represents a global opportunity for companies looking to explore innovative approaches to personalized medicine.

Kenneth Kornman, president and chief scientific officer of Interleukin Genetics Inc., will be speaking on this subject at the 2009 BIO International Convention. He says his panel discussion “will present a strategic communications blueprint for pharmaceutical and biotech firms struggling with an unstable international financial climate. The panel members will engage in a dialogue about the communication challenges facing the biotech and pharmaceutical industries and how best to reach a wide array of stakeholders including investors, key opinion leaders, venture capitalists, consumers, and other customers.”

Like so many involved with this year’s convention, Kornman believes it is especially a must-attend event for 2009. “Because of the economic conditions and the change in administration, there are critical discussions that will be important for all members of our industry across the management spectrum including regulatory, legal, communications, clinical, business development, and so on. This topic is a must for all.”

Lewis Bender, Interleukin’s chief executive officer, adds “There are a number of items that make attending the 2009 BIO International Convention (and particularly our biomarker session) critical. Capital markets are tightening, and there is low R&D productivity currently facing the industry. Because of this turmoil, all companies developing therapeutics — small, medium, and large — are cutting programs significantly. For biotech companies, the first eliminations (along with staff) will be their secondary and tertiary programs.”

He says most biotechs are dramatically increasing risk in hopes of getting that one great product into a successful clinical trial. “Molecular diagnostics tests have been shown to help reduce development risk by being able to better identify those patients who could most benefit from the therapy, as well as the ability to subtype the patients’ disease states. Companies that attend biomarker sessions at BIO will gain a much better idea as to how to mitigate their increased development risk.” He says attendees will take away with them the understanding of how genetic and other biomarkers can lower development cost, speed clinical testing timelines, and reduce risk in drug development. “The panelists in our session are experts in understanding the need for diagnostic tools. They come from big pharma, biotech, and diagnostic companies and will provide insight from several perspectives. The attendees choosing our session will be exposed to a breadth of experience and state-of-art thinking in the use of molecular diagnostic tools in drug development.”

The Business of Product Development Collaborations: It’s not easy for a biopharmaceutical company to collaborate with a diagnostic partner to codevelop diagnostic tests for predicting efficacy and safety in various patient populations. In a classic R&D collaboration model, collaborators speak with one voice to regulatory agencies and peg their respective profits to revenue streams on drug sales. Colabeling of these two types of products may or may not encourage drug sales. So is it fair for a diagnostic developer to share in all sales revenues, or are there better models for both parties involved?

The biopharmaceutical industry is still looking for ways to use biomarkers in drug development. It’s an ardent search because new biomarkers can save time and money in both preclinical and clinical development as well as generate new concepts for drug marketing. So exchange between drug and diagnostic companies is key.

Medical Devices and Predictive Diagnostics

Naturally, the makers of medical devices and diagnostics have their own take on those business strategies. Many new entrants to the diagnostic field are seeking to develop proprietary diagnostics with value-based margins. Other companies hope to leverage their installed instrument bases and large test portfolios and make money as contract developers of diagnostic products. It may be possible to combine the distribution and instrument-base advantages with the value-based attitude of the new entrants. Such business models, however, will present hurdles to investors and management that may prove too high for all but a few major players to overcome.

Like so many subjects, the personalized medicine dialogue is becoming polarized. Some people (usually in diagnostic companies) perceive inadequate incentives and unfair value division. Others (usually payers and drug developers) believe the current approach may be strained but remains the best approach. Discussions at 2009’s BIO International Convention will try to find some common ground by showing how the various business models work (or don’t) from the perspective of each key stakeholder. One model may move forward, but none is perfect, and all models will require substantial change as well as some risk taking.

RELATED SESSIONS AT THE BIO INTERNATIONAL CONVENTION

Biomarkers Sessions: Monday 18 May 2009

Biomarker and Business Models

Last Year’s Clothes Just Don’t Fit Anymore: New Approaches to Product Development Collaborations Between Drug and Diagnostic Companies

Biomarkers Sessions: Tuesday 19 May 2009

Biomarkers for Traumatic Brain Injury: An Emerging Diagnostic Area

Integrating Genetic Markers in Drug Development: How Personalized Medicine Is Evolving Predictive Treatment

Devices and Predictive Diagnostics Sessions: Tuesday 19 May 2009

Nanomedicine Applications for Cancer Detection and Diagnosis

Codevelopment of Therapies and Diagnostics: Opportunities and Barriers

Creating New Markets Where Doctors Don’t Want Them

Devices and Predictive Diagnostics Sessions: Wednesday 20 May 2009

Bench to Bedside: Formulating Winning Strategies in Molecular Diagnostics

Devices and Predictive Diagnostics: When Disease Information Prcedes Treatment Advances

Advances in Predictive Diagnostics for Alzheimer’s Disease

Must Diagnostic Companies Choose Between Proprietary and CRO Business Models for Targeted Therapeutics?

Drug Discovery & Development Sessions: Tuesday 19 May 2009

Moving Preclinical Safety Evaluation from Toxicity Determination to Risk Assessment

From Productivity to Sustainability: New R&D Models for Life Sciences

Exciting Science Sessions: Tuesday 19 May 2009

Size Does Matter: The Increasing Importance of Nanotechnology to the Biotech Industry

Exciting Science Sessions: Wednesday 20 May 2009

Where to Find the Drugs: Are Ubiquitin Ligases the Next-Generation Kinases?

Transformational Tools: How New Research Technologies Are Changing the Rules of the Game

For complete session information, visit http://convention.bio.org.

Codevelopment of therapeutic and diagnostic products offers the possibility of many clinical benefits (e.g., identification of best responders to therapies, screening for patients most inclined to adverse events, optimization of drug dosing, and more efficient clinical trial processes), and the model suggests to some a pathway to personalized medicine. Business models may involve multiple commercial entities, regulatory pathways can be complex, and both healthcare providers and payers must be made to understand and accept the value of these combinations before the dream is realized.

The rapidly evolving science and technology of codeveloped products to enhance patient outcomes and reduce product development costs is timely in the current political climate. The FDA has stated that it plans to issue guidance on this topic soon as a follow-on to its 2005 concept paper on codevelopment. This evolving business model should enable the development of products for specific patient populations, which is a global concern. Clinical research is increasingly conducted internationally.

IN THE BIO EXHIBITION

As of press time, the exhibit hall product focus zones were only beginning to fill up. For updates, visit the BIO exhibitor floor-plan at http://convention.bio.org/vr/shows/bio2009/start.html.

The Bio IT Zone: Biological information technology connects the life sciences and information technology industries to promote innovation, investment, education, collaboration, and partnership. Bridging these technologies will lead to faster development and delivery of new therapies and diagnostics, better patient care, and other life-science–related technologies, goods, and services. Companies in this zone offer the following products and services: computer hardware and software, clinical study reporting and data management solutions, imaging software, and document management.

Exhibitors (as of 1 February 2009): AntiCancer Inc. (Booth #6133), AMRI (#3213), Axxiem Web Solutions (#6033), BravePoint, Inc. (#6034), and CambridgeSoft Corporation (#6032)

The Molecular Diagnostics Zone: Improving patient care through advances in the diagnosis of disease, new diagnostic technologies are at the forefront of translating biotechnology advances into improved medical care, particularly in developing personalized medicine. These exhibitors can help attendees understand more efficient ways to administer medicine. Their specialties include molecular testing, electronic microarrays, and immunoassay products.

Exhibitors (as of 1 February 2009): Algorithme Pharma Inc. (Booth #5832) and Cobra Biomanufacturing (#5833)

The Lab Automation Zone: Major advances in technology are made daily in the biotechnology industry — including advances in laboratory equipment. Exhibitors in this zone increase productivity, elevate experimental data quality, reduce lab process cycle times, or enable experimentation that otherwise would be impossible. Companies in this zone will offer the following products and services: automated liquid handling equipment, general labware, small-scale bioreactors, cold storage, synthesizers, and sequencers.

Exhibitors (as of 1 February 2009): ChemoMetec (Booth #5561)

When Disease Information Comes Before Treatment Advances: As the field of genomics has expanded, many diagnostic testing options have progressed ahead of accompanying treatment options. Patients may now access testing for individual risk factors associated with breast cancer, Alzheimer’s disease, and heart disease — but doctors may not have any treatments or preventive regimens to offer once those results are known.

Some emerging diagnostic tools may disrupt established standards of care by so profoundly affecting treatment that they are more appealing to patients than to physicians. Noninvasive diagnostic tests could significantly decrease healthcare costs and improve the quality of life for many people. But such tests may adversely affect the economics of medical practice, which could create barriers to their adoption. As people take increasing control of their own healthcare, how can they and their healthcare providers determine together the most appropriate testing options? The states of California and New York recently took action regarding direct access to genetic tests (without doctor authorization). Uncertainty in this cutting-edge field could allow regulations to stymie major scientific and/or technological advances.

Considerable nuances exist among available tests. Even physicians may have trouble deciphering the complicated landscape as this new technology advances. Diagnostics is already taking off in the United States; internationally, many consumers see access to genetic information is coming their way too.

The convergence of diagnostics and therapeutics through biotechnology could reshape healthcare, resulting in earlier diagnosis and patient-centered care, preventive medicine in addition to safer, more effective treatments. Many global analytic instrument companies have already entered the molecular diagnostics market through acquisitions and alliances for copromotion and/or codevelopment. Companies whose customers have traditionally been academic, commercial, and institutional laboratories now face a particularly steep learning curve. To be successful in molecular diagnostics, they must expand their core capabilities into commercial operations and develop new capabilities to meet the needs of their new diagnostics customers. Commercialization of molecular diagnostics (and the emergence of new applications for traditionally lab-based technologies) are emerging issues in a rapidly developing area of biotechnology, representing a largely untapped area for commercial collaboration.

Nanomedicine and Bioinformatics: Some of the deadliest cancers are made so by the lack of early detection, so the disease remains unchecked well into its late stages. Nanotechnology may offer compelling solutions for early detection especially of pancreatic and ovarian cancers. The ultimate goal is to provide more patient options as well as more effective cancer treatments through integration of bioinformatics and clinical information for accelerating targeted drug therapies. Together, nanomedicine and bioinformatics could provide a path to personalized medicine through nanoscience, engineering, and medicine leading to combined/multiplexed approaches of early detection, enhanced imaging techniques, targeted therapies, and personalized treatment for specific cancers.

Drug Discovery and Development

Biotechnology drug discovery has traditionally been a natural outgrowth of disease research. If, for example, a genetic disease manifests as a deficiency in a given hormone or naturally occuring protein, then the obvious biotech drug to treat it would be a recombinant version of that particular biomolecule — or perhaps a gene therapy to induce patients’ own cells to produce it. If the disease state represents the presence of too much of such a substance, then the treatment is likely to come in the form of an antibody or small molecule designed to bind and deactivate some of the problem molecules.

For some years, it looked as though high-throughput screening, molecular libraries, and “rational drug design” would usher in a new era of drug discovery. Whole companies were based on these concepts. But the explosion in early leads and targets they provided has not led to a subsequent increase in real drug candidates, much less product approvals. In fact, the life sciences industry is grappling with a well-publicized decrease in productivity from its clinical efforts.

Approvals have steadily decreased over the past decade even as industry investments in R&D have risen. And the economic downturn promises to lower such spending. Under myriad economic pressures, current funding models for clinical research have become unsustainable, placing a business imperative on the ability to identify and rationally evaluate only the most promising candidates for development. Companies will have to evolve beyond traditional clinical trial phases and implement novel methods for sharing development risks with third parties to securing and use regulatory and reimbursement intelligence earlier in the drug development process.

Research Technologies Change the Rules: From user-friendly flow cytometers to microfluidic droplets that serve as tiny test tubes to the coming of the $1,000 genome, revolutionary life-science technologies are changing the rules of the game in biomedical research. Their accessibility and affordability are empowering individual scientists to conduct high-level research, which may threaten the status quo.

Despite great progress in basic science, the worldwide demand for more effective and economical healthcare has not yet been matched by similar treatment advances. Game-changing research technologies provide bench scientists with powerful new tools that are also much more affordable than older instrumentation was. By unleashing those researchers’ creativity, such new technologies could open up new pathways in biological research.

Barbara Lindheim of GendeLLindheim BioCom Partners is organizing a session on this subject for 2009’s BIO International Convention. “Innovation is the watchword of scientific progress and economic growth,” she says. “This is an opportunity to see the latest and greatest that creative companies have to offer. In particular, our session brings together the leaders of start-up companies developing breakthroughs to explore several transformational technologies and how they are enabling new frontiers in science. The panelists will highlight the impact of new tools and how they can open up new opportunities for discovery.”

Toxicology studies are one area in which new technologies are offering real solutions. These preclinical tests are expensive in man-power as well as the amount of materials and time they require. Lower-cost, faster, high-throughput screens can predict which compounds won’t be worth the cost and expense of pilot toxicity studies. This should increase the success rate of molecules and compounds entering pilot studies, which not only provides significant savings to R&D companies, but also reduces unproductive laboratory animal use. And that’s good for public relations, something any pharmaceutical company could use these days.

WWW.PHOTOS.COM

Where to Find New Drugs: There has been a great deal of interest in the potential of the ubiquitin proteasome system (UPS), which some consider to be the next step beyond kinase research. Protein kinases are currently a top target, with nearly a third of drug discovery budgets spent on them alone. The broader roles of ubiquitin proteasomes in disease is driving increased academic and industrial attention. The FDA’s approval of the Millennium Pharmaceuticals’ Velcade treatment for multiple myeloma provides proof of principle and may drive investment in similar drugs. There is also increased interest and awareness especially in relation to the potential for new drug targets.

Deborah Spencer, business manager for the University of Dundee in Scotland, is organizing a UPS session at the 2009 BIO International Convention. “We have a strong international panel from industry, academia, and the investment community,” she says, “who will provide a holistic view of the protein ubiquitination arena. We have selected high-profile individuals who have a world-class reputation in both the kinase and ubiquitin field, including Professor Sir Philip Cohen who has just become a non-US member of the ‘National Academy of Science’ and was knighted by the Queen of England in 1998 — a good indicator of the international standing of this panel. There is also increased interest and awareness of this field especially in relation to the potential for new drug targets.”

Her session will provide an overview of UPS research to entrepreneurs and investors interested in potential products and drugs in development. Spencer says, “This session will be particularly attractive to those who have been involved in kinase research and drug discovery and who want to learn about the next source of emerging drug targets from this field of research. Attendees of this session will take away information on where the research is heading, where the hubs of activity are on a global platform and the potential impact on healthcare. They will also gain learning from the experiences imparted by the panel members who have all played a part in the success of the kinase field.”

The BIO International Convention, Spencer says, has “always been about learning and connecting for the entire community to find out about what’s fashionable, what’s cutting edge, and who’s doing what. In the current climate of change and redirection, it would be a mistake not to be where you can do this! Our session is about an exciting relatively new area of science ‘the protein ubiquitination arena’. We will provide an update on the ground breaking science, industry opportunities and an indication of where to invest if you’re looking for opportunities.”

One presenter at the UPS session will be Mark Manfredi, director of cancer pharmacology at Millennium (the Takeda Oncology Company). He plans to talk about MLN4924, a novel, first-in-class molecule that is currently in phase 1 development for oncology treatment.”

You May Also Like