Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

April 19, 2022

At Pluristem in Haifa, Israel, attachment-dependent cells are cultured on plastic discs in bioreactors for large-scale stem cell production.

Propelled by year after year of record-setting investments and regulatory approvals, cell and gene therapy (CGT) innovators are on track to revolutionize medicine by providing potential cures for many conditions. Now, CGT manufacturers must plan for a future beyond the production constraints of laboratories. What needs to happen now to prepare for a sustainable, commercially viable scale-up process in years to come?

To answer that and other important questions about CGT production, my company, the CRB Group, surveyed more than 500 leaders from the life-sciences industry and documented their perspectives in the new Horizons: Life Sciences report (1). Nearly half of those surveyed reported that their companies have or plan to include CGT products in their pipelines. The respondents’ insights reveal just how far the field has come in the past decade and indicate what to expect in the decade to come.

Our report finds that companies are shifting away from autologous cell-therapy production toward more commercially viable allogeneic processes. Closed, automated, single-equipment platforms are emerging as promising alternatives to expensive and inefficient open processes. Compared with results from 2020, more survey respondents have fully embraced their gene-modification technologies of choice, expressing little intent to switch in the future.

A Shift to Allogeneic Platforms

If efficacy was the only metric that mattered in the race toward commercialization of a potentially curative medicine, autologous cell therapies would win big. Consider patient-specific chimeric antigen receptor (CAR) T-cell therapies. Ten years of clinical data now prove that a single dose of those precisely engineered immune cells can eliminate certain targeted cancers. From that perspective, autologous cell therapy seems to be a “magic bullet.”

But a promising new drug needs a scalable manufacturing pathway to make the leap from niche to mainstream. Here, the bright promise of autologous therapy production loses its shine. To extract, transport, engineer, expand, and reintroduce patient-specific cells safely and consistently, CGT companies currently rely on open, labor-intensive tracking, manufacturing, and quality-testing processes. Making such processes work at laboratory scales is important, but how will you get individualized therapies to all of the patients who need them?

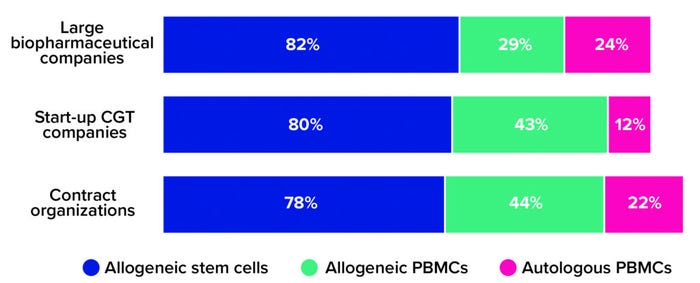

Our survey respondents are moving away from small, patient-specific batches and toward allogeneic (donor-based) processes. This is true especially for CGT companies that are new to drug development. Whereas nearly a quarter of large biopharmaceutical companies and contract development and/or manufacturing organizations (CMOs/CDMOs) said that their portfolios include autologous cell therapies, only 12% of respondents from the start-up community reported having autologous capabilities (Figure 1).

Figure 1: The 2021 Horizons survey asked advanced therapy companies, “What types of cell therapies are you developing?” Below are the percentages of large biopharmaceutical companies, start-up cell and gene therapy (CGT) companies, and contract research/development/manufacturing organizations that reported having programs based on allogeneic stem cells, allogeneic peripheral blood mononuclear cells (PBMCs), and autologous PBMCs, respectively (1).

One explanation for that trend is that most large biopharmaceutical companies obtained their cell-therapy development capabilities through acquisition, not through their own research pipelines. Such companies understood the potential of cell therapies early on and invested quickly in the sector’s first and most promising pioneers — many of whom would have been developing patient-specific products. That could explain why large biopharmaceutical companies account for so many autologous therapies in clinical development and commercial operations, whereas today’s start-ups focus their research on versatile allogeneic alternatives.

Versatility also is a reason why manufacturers of allogeneic stem cell therapies are likely to rely on induced pluripotent stem cells (iPSCs) as their starting material. Developers can induce and reprogram living donor cells of nearly any type to “wipe them clean” of the attributes that differentiate them. What remains are pluripotent stem cells, which can be gene-edited to target specific diseases, then differentiated into almost any other cell type in a human body — and for almost any patient.

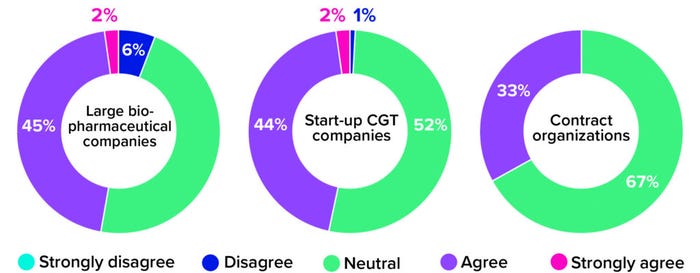

When using an allogeneic approach, biomanufacturers do not need to manipulate compromised immune cells from a sick individual. Instead, they can leverage scalable cell platforms and established manufacturing technologies from traditional biopharmaceutical operations to create banks of healthy, donor-sourced material. Such materials can undergo controlled genetic editing and then be prompted to propagate into large quantities of therapeutic cells. Despite this commercially viable alternative, though, roughly half of survey respondents from both large biopharmaceutical companies and small-scale start-ups remained neutral on the question of whether CGT developers should move away from autologous therapies. Among CDMOs, that number climbs to 67% (Figure 2). Why would therapy developers and manufacturers continue to pursue both product types when one is so clearly easier to manufacture?

Figure 2: The 2021 Horizons survey asked cell and gene therapy (CGT) developers and manufacturers whether their companies were eager to transition from autologous to allogeneic platforms. Below are responses, broken down by company type (1).

The answer might lie in the maturity gap between autologous and allogeneic cell therapies. Autologous products are expensive and time-consuming to manufacture, but they work. CGT manufacturers have the real-world data that they need to justify investing in such processes and be confident that those investments will yield effective therapies. Allogeneic therapies are not yet as well understood. Many still are progressing through early clinical studies. Drug developers are left with a difficult decision: Should they focus on developing products that are effective but complicated to manufacture or on scalable products that have yet to be supported by substantial clinical data?

As the research driving donor-based CGT development matures, and as promising clinical data continue to accumulate, biopharmaceutical manufacturers increasingly will embrace allogeneic advanced therapy production. Already, developers are using allogeneic technology not only to weaponize immune cells, but also to produce genetically edited lung, pancreas, and heart cells.

That’s not to say that autologous therapies are history. Process-in-a-box systems are on the cusp of significant advancements that could turn autologous production’s greatest burdens into advantages.

The Promise of Process-in-a-Box Systems

A big hurdle obstructing manufacturers of patient-scale therapies is cost, which stems primarily from open processing. Scaling a process to accommodate a large patient population requires considerable — and expensive — space for cleanrooms and the ancillary spaces that keep them sterile, including segregated corridors, gowning areas, and airlocks.

That helps to explain why so many respondents are moving toward process closure. CDMOs are the most aggressive companies in this push. Nearly three-quarters of respondents from that group are investing in closing most or all of their processes. Large biopharmaceutical companies seem to be more cautious. Although 27% of those respondents report that their companies are preparing to close entire processes, nearly the same percentage say that their companies have yet to explore process closure at all. Start-ups provided more complex responses than did either contract organizations or large biopharmaceutical companies. Nearly half of surveyed start-ups (44%) say that they plan to close most but not all of their processes. Perhaps they acknowledge the commercial benefits of process closure but understand that no single solution will get them to that point.

Such considerations prompt an important question: If two or three process steps need to happen outside of a closed system, what do developers have to gain by closing it at all? The answer is everything. Integrating a process into a closed system today, even if that means investing in a bespoke design, could provide a significant advantage in the future when those bespoke designs become templates for mainstream CGT production. By working with vendors from the start to close their processes, developers and biomanufacturers are setting themselves up for dense, economical uses of their facility footprints — a decision that could be rewarding over the long term.

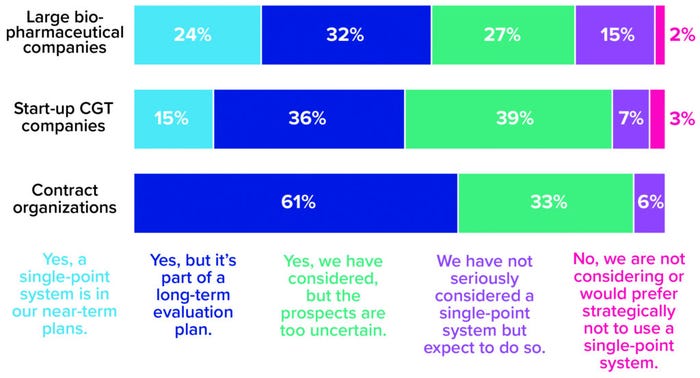

But the transition to closed processing is only the first step in a much larger shift in CGT manufacturing toward end-to-end, single-point process-in-a-box platforms. A segment of every company type represented in our survey shows serious interest in this manufacturing development (Figure 3). The results suggest that large biopharmaceutical companies are most likely to adopt it in the near term. A possible reason is that such companies have the resources and risk tolerance needed to explore the leading edge of technological innovation. In our survey, start-ups showed slightly more caution, maybe because they are under pressure to move through clinical research and into the marketplace as quickly as possible and aren’t (yet) focused on how to sustain commercial production once they get there. But perhaps they should be; by aligning today’s laboratory-scale activities with a future process that leverages single-equipment technologies, small companies could be positioned well to outpace competitors and run a dense, financially resilient manufacturing pipeline.

Figure 3: The 2021 Horizons survey asked cell and gene therapy (CGT) developers and manufacturers whether their companies are considering adoption of single-equipment, closed, and automated processing systems. Responses below are broken down by company type (1).

Process-in-a-box systems hold promise for eliminating the need for cleanrooms altogether, pushing segregation entirely to the equipment level. For developers with autologous therapies in their pipelines, that would be game-changing. Manufacturers could scale out by densely stacking large volumes of closed and automated systems inside individualized chambers within a warehouse environment. That strategy would help to maximize every square foot and reduce labor costs significantly while enabling manufacturers to continue focusing on small, individualized product batches.

Such systems could revolutionize allogeneic manufacturing, too. Advantages certainly come with leveraging equipment platforms from traditional biopharmaceutical operations to drive economies in donor-based therapy production, but that approach is not without its limitations. Manufacturers have just one hour to fill, inspect, and freeze cryoformulated therapies before cells begin deteriorating, for example. That’s relatively easy to do with a few samples in the laboratory — but much more difficult when filling thousands of vials. If manufacturers of allogeneic therapies could achieve commercial success by scaling out with small batches (as opposed to scaling up to large production volumes), then they could solve many such operational complexities.

As process-in-a-box platforms mature, the distribution in Figure 2 will change. Companies in the consideration stage are likely to shift to all-in-one platforms soon; if the platforms succeed, then remaining companies might be forced to rethink their production approaches or risk getting left behind.

Wherever you fall across the adoption continuum, the best thing you can do for the future of your operation is to adopt a “commercial state of mind.” You should weigh every decision that you make today against where you plan to be tomorrow, with a perspective on how technologies are changing and what such developments might mean for your future manufacturing processes. That way, you can help to ensure that you arrive at the threshold of a commercial launch with a scalable process and a flexible, innovation-ready manufacturing strategy.

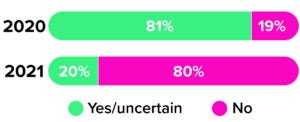

Figure 4: The 2020 and 2021 Horizons surveys asked cell therapy developers and manufacturers whether they planned to use another gene-modification technology for future operations. Companies expressed very different attitudes across the surveys (1, 3).

Choices for Gene-Modification Technology

As the earliest waves of the COVID-19 pandemic swept the globe in 2020, the CRB team asked CGT leaders to tell us about their strategies for choosing among gene-modifying technologies (2). One year later, we asked the same question — and received notably different results. Although the distribution of available options remains nearly the same, just 19% of respondents felt committed to their chosen technologies in 2020 (Figure 4). Today, that number has soared to 80%.

It appears that the successive cycles of innovation that defined the past few years of CGT manufacturing are beginning to settle, but without (yet) yielding a significant frontrunner. Each gene technology introduces its own obstacles and opportunities, and manufacturers are growing more comfortable with the nuances of their chosen technologies and the accommodations that such platforms require.

Viral vectors, for example, are well established and understood compared with other gene-modification technologies, but they are difficult to scale up because of transfection challenges and issues related to viral containment and segregation. The race for a SARS-CoV-2 vaccine, meanwhile, has thrust mRNA into the global spotlight, and many manufacturers are relying on the versatility of that technology to target a wide breadth of indications and applications. Then there are technologies based on clustered, regularly interspaced palindromic repeats (CRISPR), exalted in the media for their potential to edit genomes precisely. But researchers only recently injected a CRISPR-modified gene therapy into a human patient for the first time (3). Although the result was promising, we’re a long way from seeing approved, commercial-scale CRISPR therapies in action.

With all three technologies offering their own advantages and risks, the real question has shifted from “Which will you choose?” to “How will you leverage your chosen technology to drive commercial outcomes?” In practice, CGT developers might need to focus on a single technology to fuel a whole product pipeline instead of using an mRNA platform for vaccine research and viral vectors for development of gene and cell-modified gene therapies. By building technological synergies into a manufacturing strategy, a developer can leverage the same talent pool, facility layout, equipment platforms, supply-chain inputs, and other resources for as many products as possible — without handcuffing the company to a CMO or needing to fund incompatible capital projects.

For laboratory-scale start-ups trying to mitigate risks and deliver on promises to investors, the temptation to bet on divergent gene-modification technologies is strong. But aligning technologies in your laboratory with your business strategy should facilitate subsequent scale-up and diminish future costs. That is how tomorrow’s CGT leaders are distinguishing themselves today.

Toward the Next Frontier

Novel technologies and scientific approaches are emerging rapidly to support small-scale, commercially viable CGT manufacturing. Such advances could bring about a future in which patients survive previously incurable and life-threatening diseases. That is the great promise of CGTs. To deliver on it, developers and manufacturers in this field need to ready themselves for sustainable commercial success — assessing, selecting, and implementing the novel processes, systems, and technologies that will move them from where they are today to where they need to be tomorrow.

References

1 Horizons: Life Sciences (2021). CRB Group, 2022; https://go.crbgroup.com/horizons-life-sciences-report.

2 Horizons: Life Sciences (2020). CRB Group, 2021; https://go.crbgroup.com/2020-horizons-atmp.

3 Stanton D. Top 10 Advanced Therapy Milestones of 2019: Patient Access Takes Center Stage. BioProcess Insider 27 January 2020; https://bioprocessintl.com/bioprocess-insider/global-markets/top-10-advanced-therapy-milestones-of-2019-patient-access-takes-center-stage.

Suggestions for Further Reading

Bream A, Salzmann B. The Difficulties of Manufacturing Cell and Gene Therapies At Scale. BioProcess Int. 19(4) 2021: 10–13; https://bioprocessintl.com/manufacturing/cell-therapies/the-difficulties-of-manufacturing-cell-and-gene-therapies-at-scale-moving-to-flexible-facilities-and-closed-cell-processing-systems.

Matosevic S. Points to Consider for Cell Manufacturing Equipment and Components. Cell Gene Ther. Insights 3(10) 2017: 793–805; https://insights.bio/immuno-oncology-insights/journal/article/369/points-to-consider-for-cell-manufacturing-equipment-and-components.

Moutsatsou P, et al. Automation in Cell and Gene Therapy Manufacturing: From Past to Future. Biotechnol. Lett. 41, 2019: 1245–1253; https://doi.org/10.1007/s10529-019-02732-z.

Rafiq QA, et al. Developing an Automated Robotic Factory for Novel Stem Cell Therapy Production. Regen. Med. 11(4) 2016; https://doi.org/10.2217/rme-2016-0040.

Rios M. Cell and Gene Therapies: Optimization Strategies for Processing and Potency. BioProcess Int. 19(11e) 2021 (eBook); https://bioprocessintl.com/manufacturing/cell-therapies/ebook-cell-and-gene-therapy-development-optimization-strategies-for-processing-and-potency.

Peter Walters is director of advanced therapies at CRB Group; [email protected]. To read the Horizons: Life Sciences reports referenced in this article, please visit https://www.crbgroup.com/horizons-reports.

You May Also Like