Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

Biopharma 4.0 refers to applications of data and digital technologies to biotherapeutic manufacturing. Technological advances now enable the internet and its embedded systems to serve as a nucleus through which biomanufacturers can integrate production lines and processes across organizational boundaries, thereby forming a networked and agile value chain. Solutions under the industry 4.0 umbrella include

• platforms for “smart” manufacturing made possible by the internet of things (IoT)

• artificial intelligence (AI)

• systems for process automation

• technologies for remote operations

• systems for agile manufacturing.

However, a barrier to industry 4.0 adoption is emerging. The skills and expertise that are required to operate such technologies are misaligned with the available talent pool.

The Evolution of Biomanufacturing Talent

Rapid expansion in the biomanufacturing industry has become a key driver of the biopharma 4.0 paradigm. Transitioning to that approach requires a workforce that can succeed in complex, cross-functional teams. Hence, the industry requires personnel who have new skill sets that combine pharmaceutical and scientific expertise with hybrid information technology (IT) and mathematical capabilities. In addition to requiring deeper, alternative skills from operations staff, companies will need managers and leaders to be adept at working within biopharma 4.0 approaches.

By measuring the pace of adoption for specific technologies in the biomanufacturing sector, the requisite expertise can be predicted and compared against the skill sets represented in the available talent pool. Thus, skills gaps can be highlighted. In collaboration with the University of Dundee and University College London (UCL) in the United Kingdom, Evolution Search Partners is conducting an ongoing study to measure key talent dynamics and identify correlations with the rate of industry 4.0 adoption across all bioindustries (1, 2).

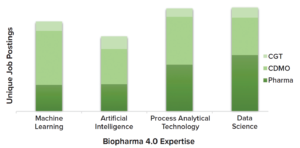

Figure 1: “Biopharma 4.0” talent demand across bioindustries in 2022; data are plotted by core competency, as outlined in unique job postings from cell and gene therapy developers (CGT), contract development and manufacturing organizations (CDMOs), and pharmaceutical developers (Pharma). Data shown here and in subsequent figures come from a 2022 study by Evolution Search Partner (1) and Emsi Data API reports (2).

For instance, Figure 1 demonstrates the current prioritized demand of biopharma 4.0 talent expertise, as indicated by unique job postings. Data are grouped according to areas of expertise that the industry has deemed to be vitally important to digitally efficient manufacturing companies.

Our research has uncovered evidence of increasing demand for expertise in fields such as data science, AI, and machine learning (ML) as both pharmaceutical companies and contract development and/or manufacturing organizations (CDMO/CMOs) focus on adoption of data platforms. Accompanied by digital-enterprise architecture, such platforms hold much promise for improving manufacturing outcomes.

AI and ML have advanced all aspects of biomanufacturing, including upstream cell culture, downstream biologic purification, process optimization, and associated digital technologies. From chemometrics to deep learning, advances in AI technologies have transformed bioprocess development significantly (3). Moreover, hybrid methods are applied increasingly to complement mechanistic biomanufacturing models with data-driven research into processes such as cell metabolism and adsorption (4, 5). Example applications of AI and data science in biomanufacturing include newly developed systems for

• digital conversion of operations

• cell-culture expansion and control

• process monitoring

• process automation

• data collection (industrial sensors)

• cell-line engineering

• product quality control

• multiplatform data analysis (3).

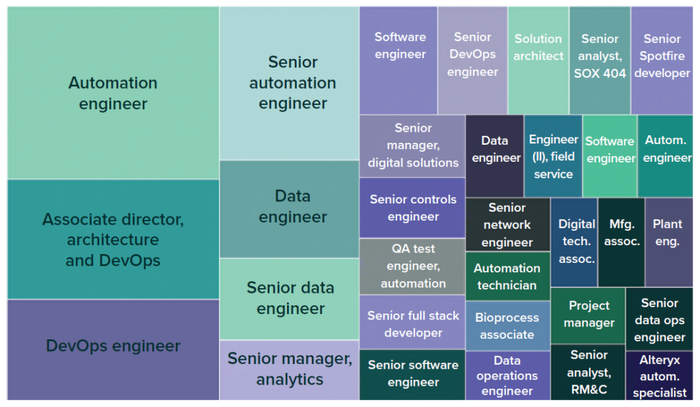

The Evolution study has monitored the increase in biopharma 4.0 talent demand since 2019. Figure 2 highlights which roles were prioritized in 2022 specific to digitalization and automation. Macrotrends in biopharma 4.0 adoption are generating major shifts in the operations workforce. Hence, companies and their employees may need to accept new ways of working. The unprecedented pace and scale of technological innovation are making impacts on many operations across the biomanufacturing industry as technologies are developed, automated and digitalized processes are introduced, and advanced data analytics are applied (6).

Figure 2: Biopharma 4.0 talent demand in 2022 by job role (1, 2); the larger the box, the higher the demand for that role. (autom. = automation, DevOps = software development and information-technology operations, eng. = engineer, mfg. = manufacturing, RM&C = resource monitoring and control, SOX 404 = Sarbanes–Oxley Act <404> compliance, QA = quality assurance).

New operational roles are emerging. Demand is increasing for automation engineers, data scientists, and data engineers. However, industry demand exceeds the available talent supply.

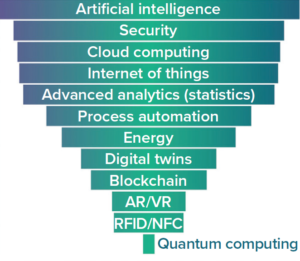

Figure 3: Perceived importance of technologies enabling biopharma 4.0 approaches, as evidenced by trends in talent demand (1, 2); AR/VR = augmented and/or virtual reality, RFID/NFC = tracking by radio frequency identification and/or near-field communication.

Talent Synergies

Figure 3 lists core business competencies that are required to implement biopharma 4.0 approaches. Results from another recent survey by Evolution Search, modeled on a previous study by the IBM Institute of Business Value (IBV) and Oxford Economics, demonstrate how executives from biomanufacturing companies perceived the importance of — and difficulty in implementing — digital technologies (7). AI was called out as the most critical technology that presents a challenge in biomanufacturing, partly because most drug makers have yet to implement AI at manufacturing scales.

Biopharma 4.0 and its accompanying technologies — AI, ML, the IoT, advanced sensors, automation systems, and capabilities for data mining and analytics — will require a more diverse workforce than what the industry currently has at its disposal. Of critical importance during the 4.0 transition are enhancements to quality control, business decision-making, and operations. However, digitalization is the integral pathway that the biomanufacturing industry must take forward (3, 8–10).

Biopharma 4.0 Adoption

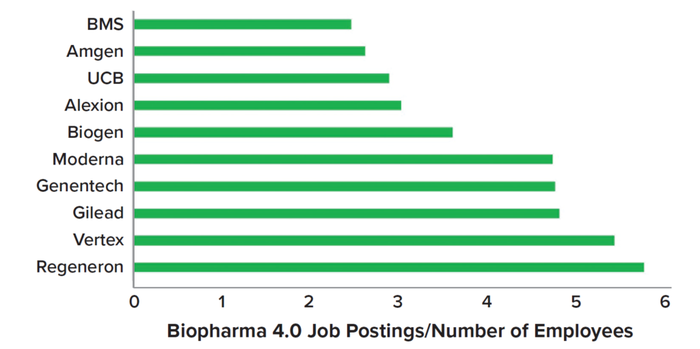

Despite difficulties associated with implementing biopharma 4.0, the approach could offer a significant competitive advantage to manufacturers, and for many companies, digital manufacturing is becoming a reality. Figure 4 presents data from an Evolution study identifying companies that placed the greatest numbers of advertisements for biopharma 4.0 roles in 2022, indicating elevated adoption of smart technologies. Adoption was measured algorithmically based on numbers of unique job postings containing a combination of search terms specific to biopharma 4.0: data analytics, ML, AI, process analytical technologies (PATs), digitalization, and automation (9).

Figure 4: Highest ratios of biopharma 4.0 adoption in 2022, as evidenced by talent demand per total numbers of employees (BMS = Bristol Myers Squibb) (1, 2).

The data show broad use of advanced technologies. Notable examples include Regeneron’s application of Databricks AI and ML platforms to drug development (8); implementation of automated systems for continuous biomanufacturing at Vertex Pharmaceuticals (11); and Moderna’s incorporation of process automation, digital systems, and AI into vaccine operations (12). In partnership with Carnegie Mellon University, Moderna also recently opened an academy to educate its employees about integrating AI and ML into operations (13).

GSK was an early adopter of innovative biopharma 4.0 technology. In 2019, before the emergence of SARS-CoV-2, the company partnered with Atos and Siemens to create a digital twin for vaccine development and manufacturing. The system can be used offline to simulate a given production process or applied online to monitor and control a vaccine process based on data from sensors. The companies worked to strike a balance in technological adoption that enabled process control without overwhelming operations and staff. The “Case Study” box above provides more detail about the project.

A Case Study in Digital-Twin Technology Digital twins now enable scientists to collect enough data to understand vaccine |

Industry Comparison

Uptake of smart manufacturing technologies has been significantly lower in the biopharmaceutical industry than in other sectors because of restrictive factors such as a lack of personnel with relevant skill sets. That result has come despite extensive financial investment. Initially, the biopharmaceutical industry was slow to adopt AI, the IoT, cloud-based platforms, and other digital technologies. However, as the SARS-CoV-2 pandemic emerged, companies were forced to prioritize investments in digital innovation and integrate such systems into every aspect of operations. Suddenly, digital transformation road maps that had spanned years were executed in months, sparking radical changes in operational behavior (6).

Many successful industries have established operating models in which dedicated digital-innovation resources are situated between business and IT units, often in “centers of excellence.” Smart factories require not only enabling technologies, but also infrastructural and cultural renovations within the adopting organization (14, 15).

In response to customer needs, the biopharmaceutical industry is experiencing a rapid increase in development activities for automated solutions. That trend provides opportunities to learn from other disciplines and to reform approaches to drug discovery and development. For example, the benefits of automation have been demonstrated clearly by the automobile industry, which incorporated such technology into production and assembly workflows more than a decade ago. That transition enabled significant gains in efficiency, quality control, and cost-effectiveness (10).

Data represent an essential component of today’s biomanufacturing industry. The goal of industry 4.0, broadly speaking, is efficient data collection, processing, and analysis. Mature industry 4.0 solutions providers are illuminating the future path of bio-industries and demonstrating the operational and productivity advantages that can be achieved by digitalization.

For instance, Bosch worked with an automotive company to establish factories with embedded sensors, which the manufacturer used to collect data about equipment conditions and cycle time (10). Bosch and its customer applied advanced analytics tools to process such data in real time, enabling identification of bottlenecks.

In the electronics industry, Siemens recently worked with a customer to use Simatic programmable logic controllers (PLCs) to automate control over factory processes and equipment. About 2,800 such devices were installed for that purpose. Now, 75% of the factory’s production is controlled by autonomous robots and machines (10).

Although biopharmaceutical companies have been slow to adopt industry 4.0 methods, evidence of change is apparent. Thus, biomanufacturers should be cognizant of lessons learned in other industries that are deemed to be industry 4.0 originators, especially the automotive, food and beverage, and semiconductor sectors, which use generally comparable manufacturing processes.

Attracting talent from other digitally mature manufacturing industries could be a solution to the impending biopharma 4.0 skills gap. Doing so would require a revision of pay scales to incentivize talent migration and achieve interindustry parity.

The Skills Gap

Before the SARS-CoV-2 pandemic, demand for new talent in the biomanufacturing industry increased by 26% from 2018 to 2020 (1). By the end of 2021, a further 32% elevation in demand was observed in the United States and Europe, as compared with a markedly slower 10% rise in the supply of expertise. However, that talent was not necessarily synergistic with industry needs for biopharma 4.0 implementation. Traditionally, the talent pool has consisted of biomanufacturing practitioners who have been trained in the fields of biology, biochemistry, and/or industrial engineering.

Considering the rise of data analytics, AI, and ML, biomanufacturers might face several key obstacles to matching talent demand and supply, predominantly due to the absence of industry 4.0 skills in biology-related postgraduate education and in available industry training. Thus, we anticipate a plethora of difficulties within the biopharmaceutical talent supply chain as adoption of biopharma 4.0 increases. Growing technological complexity and broad adoption of digital innovations are prompting changes to requirements for new employees, with biomanufacturers requiring increasingly more diverse, technical, and scientific skills. The transition to an automation- and digitalization-driven operating model, which is designed to increase connectivity and adaptivity over business operations, demands a new skill set in which new employees have expertise not solely in the science of biopharmaceutical development, but also in its driving technologies.

Potential Solutions

Talent demand in the biopharmaceutical industry already was substantially elevated before the SARS-CoV-2 pandemic, and now the need is even more palpable. Biopharma 4.0 is an impending market driver that will influence talent dynamics further. It is compelling biomanufacturers to prioritize digital innovation, incorporate such technology into every aspect of operations, and apply it to redevelop supply chains. The momentum of digital innovation shows no signs of slowing down; rather, digitalization is accelerating to become a pivotal element of competitive advantage for companies within the biopharmaceutical industry. Considering the potential biopharma 4.0 skills gap, both in talent supply and aligned expertise, companies must foster development of personnel with new skill sets and create trainings that are aligned to the required expertise. However, solutions indeed are available.

Training for Industry Prospects: To establish an effective workforce for the future, biomanufacturers must work to cultivate talent with the skill sets needed to support adoption of industry 4.0. Industry entrants must have expertise in data science, AI, ML, and/or mathematical modeling as initial core competencies. Northeastern University in Boston, MA, has put forth an impressive model for talent development with its “capstone design project,” which provides students in science, technology, engineering, and mathematics (STEM) with opportunities to train in subjects relevant to the biopharmaceutical industry (16). Driven by critical industry needs, the project is designed to foster skills such as experience with data analytics and integration, modeling of end-to-end production processes, AI, and ML.

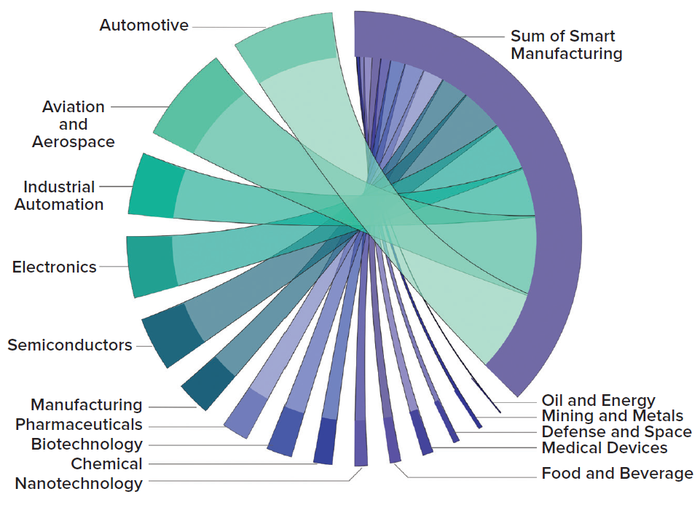

Talent Migration: Biomanufacturers could consider attracting talent from digitally mature manufacturing industries, such as the automotive and semiconductor sectors (Figure 5). This strategy would require a revision of pay scales to incentivize talent migration and achieve interindustry parity.

Figure 5: Demand for manufacturing 4.0 talent in 2022, broken down by industry; the solid purple arc to the right of the figure represents total demand. Each ribbon radiating from the arc depicts the indicated industry’s share of that total (1, 2).

Recruitment of Current Talent: Biopharmaceutical companies also should consider leveraging the skills of experienced, well-networked, and strategic recruiters who specialize in the industry and understands its needs and drivers. In addition to decreasing recruitment costs, organizations can get ahead of the growth of the supply and demand curve. A generic, nonspecialist solution to talent recruitment could be detrimental to future business growth.

References

1 Biopharma Talent Dynamics. Evolution Search Partners, 2023; https://evolutionexec.com/predictive-talent-dynamics.

2 Emsi Data API. Lightcast, 2023; https://www.economicmodelling.ca/apis.

3 Walsh I, et al. Harnessing the Potential of Machine Learning for Advancing “Quality By Design” in Biomanufacturing. mAbs 14(1) 2022: 2013593; https://doi.org/10.1080/19420862.2021.2013593.

4 Cova T, et al. Artificial Intelligence and Quantum Computing as the Next Pharma Disruptors. Artificial Intelligence in Drug Design. Heifetz A, Ed. Humana: New York, NY, 2022: 321–347; https://doi.org/10.1007/978-1-0716-1787-8.

5 Schmidt A, et al. Digital Twins for Continuous Biologics Manufacturing. Process Control, Intensification, and Digitalisation in Continuous Biomanufacturing. Subramanian G, Ed. Wiley: Hoboken, NJ, 2021: 265–350; https://doi.org/10.1002/9783527827343.ch9.

6 Grimes H, et al. PURE Biomanufacturing: Secure, Pandemic-Adaptive Biomanufacturing. IEEE Secur. Priv. 20(6) 2022: 53–65; https://doi.ieeecomputersociety.org/10.1109/MSEC.2022.3160465.

7 How Industry 4.0 Technologies Are Changing Manufacturing. IBM, 2023; https://www.ibm.com/topics/industry-4-0.

8 Customer Story: Discovering New Treatments with AI. Databricks, 2023; https://www.databricks.com/customers/regeneron.

9 Whitford B, Manzano T. The Promise of AI in Gene and Cell Therapy Operations. Gen. Eng. Biotechnol. News 42(2) 2022: 18–19; https://www.genengnews.com/magazine/volume-42/issue-no-2-february-2022.

10 Yahya M, et al. A Benchmark Dataset for Industry 4.0 Production Line and Generation of Knowledge Graphs. Semantic Web (under review), 2023; https://www.semantic-web-journal.net/content/benchmark-dataset-knowledge-graph-generation-industry-40-production-lines.

11 How Innovative Drug Manufacturer Vertex Is Achieving Continuous Manufacturing in Pharmaceutical Development and Production. Optimal Industrial Automation, 2022; https://optimal-ltd.co.uk/vertex-manufacturing.

12 Lydon B. Moderna Builds Native Digital Process Automation on Amazon Web Services. Automation.com, 9 February 2021; https://www.automation.com/en-us/articles/february-2021/moderna-native-digital-process-automation-aws.

13 Moderna Launches AI Academy in Partnership with CMU. Carnegie Mellon University: Pittsburgh, PA, 9 December 2021; https://www.cmu.edu/news/stories/archives/2021/december/moderna-ai-academy.html.

14 Macdonald GJ. Biopharma Is Going Digital . . . Bit by Bit. Gen. Eng. Biotechnol. News 42(6) 2022: 46–49; https://www.genengnews.com/topics/bioprocessing/biopharma-is-going-digital-bit-by-bit.

15 Markarian J. Automating Biopharma Manufacturing. Pharm. Technol. 46(7) 2022: 30–33; https://www.pharmtech.com/view/automating-biopharma-manufacturing.

16 Capstone Design — Bioengineering. Northeastern University: Boston, MA, 2023; https://bioe.northeastern.edu/academics/undergraduate-studies/capstone-design.

Corresponding author Jason Beckwith, PhD, ([email protected]), is managing director of the Evolution Search Group, 183 Bath Street, Glasgow, G2 4HU, UK; 44-0-141-248-2026; https://evolutionexec.com. Robbie Dool is a research analyst, Paul Rooney is head of new projects, and Manish Thilagar is a data analyst, all at Evolution Search Partners Ltd. Stephen Goldrick, PhD, is a lecturer in digital bioprocess engineering at University College London (UK). William Nixon, PhD, is emeritus professor, and Stavros Kourtzidis, PhD, is a lecturer, both at the University of Dundee (UK) School of Business.

You May Also Like