Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

October 28, 2019

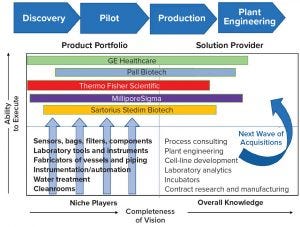

Figure 1: Supplier side capabilities over time; this chart represents major companies’ strategic intents; positions shown are relative, not scaled by market values, and vary by geography and technological capability.

Only a thin line now separates biopharmaceutical manufacturers and suppliers because the latter are increasingly becoming the process knowledge owners in the biopharmaceutical industry. As a result, suppliers are racing to become the most efficient “total solutions” provider.

In the 1990s, leading players in the industry such as Pall, Millipore, and Sartorius all supplied membrane filters for upstream and, to some extent, downstream processes with their crossflow and final filtration offerings. Pharmacia (which became GE Healthcare) was the major force in the final purification chromatography segment. A host of suppliers in the laboratory equipment segment occupied the discovery space, including Fisher Scientific (now Thermo Fisher Scientific) and VWR (now a subsidiary of Avantor).

Another segment of the industry consisted of bioreactor manufacturers with engineering competency, mainly from biomedical equipment backgrounds, but also from pure engineering groups or as part of laboratory supply companies. These included B. Braun Biotech International (BBI), an offshoot of Braun Medical with expertise in instrumentation and dialysis equipment manufacturing; New Brunswick Scientific (now Eppendorf), known for glass bioreactor designs; and Applikon Biotechnology, which originally had supplied only laboratory instruments, glass vessels, and shakers.

Apart from those companies, two major players in Switzerland dominated the bioreactor business. Chemap (now Infolabel) and Bioengineering Inc. offered pilot- and production-scale bioreactors that could be built and operated within a production facility rather than engineered onsite by engineering or fabrication companies.

In the United States, this market for pilot- and production-scale facilities was largely the creation of big engineering firms that designed and built stainless-steel fabricators. A similar trend followed worldwide when it came to biomanufacturing facilities.

Toward Consolidation

Bioprocessing knowledge had been fractured among research scientists, laboratory suppliers, filtration companies, bioreactor manufacturers, engineering companies, and process owners. Lack of coordination and the resulting wasted energy made focused knowledge streams difficult to achieve. This proved to be a serious impediment that delayed market entry for many biological products.

Case Study: As an entrepreneur, I partnered with Sartorius in the mid-1990s to set up a facility in India that manufactured filter housings because it was nearly impossible to import them from Europe or the States. Pall already had established manufacturing facilities for these components in India through its agent Pharma Lab, which used to make several kinds of pharmaceutical equipment. Millipore was on a similar platform with its joint venture partner in the pharmaceutical industry. But that world revolved around filters and nothing else.

The large amount of work we performed for Hindustan Antibiotics Limited (HAL) and other fermentation companies created a natural curiosity in the process chain. Thus, BBI considered Sartorius India an ally in securing business in that country. Apart from its core business in filter housings, the Sartorius India facility had capabilities only for building and installing addition vessels. But the partnership that developed between Sartorius and BBI can be understood as the beginning of consolidation in this industry.

With much effort and pain, Sartorius in India mastered the art of building working bioreactors, learned the ropes of validation and documentation, and became a success. The company did so by addressing its customers’ process chains instead of serving as a mere component supplier. None of the other players — in India or elsewhere — were taking this unique approach. Sartorius’s capabilities increased when the group saw the merit of addressing the process chain and went ahead with the acquisition of BBI in 2000.

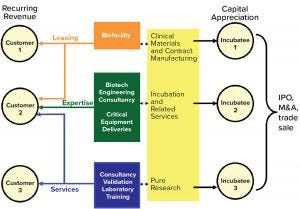

Figure 2: Fostering knowledge partnerships; a biofacility is the core of the biopharmaceutical ecosystem and the knowledge creation tool that facilitates services, incubation, and strategic alliances. Its influence creates a knowledge environment that generates substantial value for all players involved.

Meanwhile, the other bioreactor manufacturers were going bust in Europe. Most of them — Chemap, BBI, and several others — could not remain successful purely as systems manufacturers because they did not address the complete supply chain of their customers.

Dr. Utz Claassen, then chief executive officer of Sartorius, faced much criticism from those who knew only filters for the decision to acquire BBI. Despite initial resistance, some of those managers and executives became great supporters in driving the single-use concept. Sartorius Stedim Biotech ultimately grew by expanding that concept and consolidating its assets in India, Germany, and the United States.

By 2005, manufacturers realized the importance of addressing the process chain, and slowly the acquisition spree gained steam. Multiple companies with exciting technologies were now in play, including Wave Biotech and Xcellerex (both now part of GE Healthcare), HyClone Laboratories (now part of Thermo Fisher Scientific), and Stedim (now part of Sartorius Stedim).

The industry then moved into filling remaining gaps in the supply chain while shedding excess baggage in their portfolios. Thermo Fisher effectively combined its strong distribution muscle and financial strengths to incorporate HyClone and become an industry leader in single-use technologies. GE acquired Xcellerex and Wave Biotech; Sartorius acquired Stedim. Pall and Millipore pursued a different strategy by strengthening their internal competencies. But even they joined the consolidation craze in 2015 when they were acquired respectively by Danaher and Merck. Since then, Pall and MilliporeSigma have expanded their capabilities significantly.

The Total Solutions Paradigm

Since 2005, major manufacturers have seen unprecedented development. Addressing the complete process chain became a major engine of industry growth. The race was on to own and fulfill every gap in the system and to build global competencies and presence. Danaher’s in-progress acquisition of GE’s biopharmaceutical business is just the latest in that consolidation trend.

Because biopharmaceutical companies are racing to bring new products to market, climbing the knowledge curve and retaining talent are becoming difficult and time-consuming. Thus, suppliers are going one step beyond merely fulfilling needs in process chains to become full service providers. Supply companies are becoming increasingly informed about every bioprocess. By acquiring new competencies and fine-tuning their offerings, they serve as natural allies for an industry hungry for solutions and talent. All major players now are consolidating and becoming “process partners” by offering full-service process consultation to their customers — a tactic that cuts costs, reduces mistakes, and shortens time to market. The value generation from this trend can be enormous. The next wave of acquisitions is likely to be in the process and engineering consulting space.

Beyond Total Solutions

Figure 3: WE LAB model for the next level of strategic partnerships

The next natural step in this process is for total solutions providers to create a worldwide network of facilities — some starting as incubators and others as stand-alone sites — that help customers outsource production of clinical materials, conduct research, and scale up trials. Some companies are starting to pursue initiatives on the clinical materials front, even if that is only part of the work performed in their centers.

When entering those new segments, total solutions providers might adopt a WE LAB growth model (Figure 3). They could collaborate with universities, incubator facilities, and other end users to conduct research or produce clinical materials. Performing such services might generate intriguing startups — the costs and risks for which would be palatable to investors because the work would be performed within established knowledge environments. Incubation facilities could become a major engine of growth for suppliers, not only because of their services, but also because of the new partnerships they would bring.

Another offshoot of the consolidation process is arising in manufacturing cell lines. Some suppliers have moved into that space already. Intellectual property and confidentiality issues need to be addressed, but single-use technologies have made the difference. Companies can construct a single facility to service multiple clients, saving time and money.

The consolidation trend among suppliers is likely to encourage increasing numbers of biopharmaceutical startups to break entry barriers in terms of initial capital and facilities setup. That heightened capability could then position companies to solve many remaining puzzles in fighting diseases and alleviating human suffering.

Philip Cherian is former managing director of Sartorius India, past president of Sartorius BBI Systems, and cofounder of Biozeen. Currently he is principal strategy and operations consultant for Philip Melorr Inc., 11 Sovereign Drive, Flanders, NJ 07836; [email protected]; 1-610-703-0828.

To share this in PDF or professionally printed format, contact Jill Kaletha: jkaletha@mossbergco. com, 1-574-347-4211.

You May Also Like