Reinventing How Drugs Are Invented: Making a Case for Simplicity in Drug Development and Production

November 17, 2023

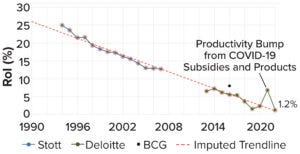

Figure 1: The current decline in biopharmaceutical research and development (R&D), as measured by dollar returns on investment (RoI); data points are from assessments of internal rate of return (IRR) by Stott (blue, 3), Deloitte (green, 4), and Boston Consulting Group (BCG) (black, 5). This figure is adapted from Stott.

The biopharmaceutical industry has entered into a creativity crisis. Despite billions in revenue, it has become a stagnant behemoth, struggling to deliver new therapies near the pace or price that the world needs. The industry’s institutional reputation is almost as low as it can get. And although “big-pharma” profits remain buoyant, research and development (R&D) productivity is declining steadily — an awkward fact for an industry that depends so greatly on innovation to maintain healthy margins (Figure 1).

At its core, our industry’s problem is cultural. We cling to a dogma eliding the important distinction between a scientific breakthrough and a new drug. To this day, we say that drugs are discovered, not developed as normal products are. We undertake drug discovery as if hoping for an Alexander-Fleming–like lucky break. But it is largely forgotten that his discovery, penicillin, remained a laboratory curiosity — not a drug at all — for more than 15 years (1). The product that we now know as penicillin was born only after the US Army invested significantly to figure out scalable manufacturing processes — the D in R&D (2).

Great science always will be essential to the biopharmaceutical industry, but the sector has lost its focus on core skills in product development and customer value creation. To reinvent itself, our industry should relearn some basic lessons from companies in industries that are good at launching new products.

Simplify products and processes. Complexity balloons costs and slows progress. Biologics manufacturing is one of the biopharmaceutical industry’s biggest expenses, often because of needless complexity in products and processes.

Obsess over composite customer value. Pharmaceutical companies sometimes forget that they must please patients, doctors, and payers. Failing to consider that trifecta stymies many launches.

Meet global customers where they are. Other industries efficiently tailor products to customers’ real-world needs. The pharmaceutical industry has nearly given up on that key strategy.

Without diminishing the nobility of science for its own sake, I submit that shifting the limelight a bit from basic researchers toward product developers and engineers is part of the cultural change needed to get the biopharmaceutical industry out of its current productivity rut. Below are some examples.

Complexity as a Tax on Progress

New-drug launches are expensive because of the high cost of development activities, not because individual doses are costly to manufacture. That fact is widely appreciated. But a paradox arises: Few executives appreciate that biomanufacturing complexity represents the largest single driver of new-drug development costs (6).

How can that unorthodox viewpoint be true? Consider monoclonal antibody (MAb) products. The largest budget line item for preclinical MAb development is the ~US$10 million needed for cell-line development and good manufacturing practice (GMP) process development (7). That figure is inexpensive compared with costs for conducting a late-stage clinical trial, but because fewer than 10% of candidate treatments survive development long enough to be tested for efficacy (most fail in nonhuman-primate toxicology testing and phase 1 studies), the true cost of those early activities is

>10-fold higher than it seems at first glance. Program failures act as a hidden multiplier of late-preclinical development costs. Given high drug-attrition rates, biopharmaceutical companies usually must run multiple programs to help ensure a single success. Losing programs must be paid for using profits from the few winners.

The problem gets worse. Those multiplied costs are inflated further by the “time-value of money” because they are, in effect, accumulating a high rate of interest that must be repaid out of the few drugs to receive approval. In this telling of the story, a straightforward solution presents itself: We must move more drugs — more “shots on goal” — into midstage clinical trials more quickly and cheaply but without sacrificing patient safety.

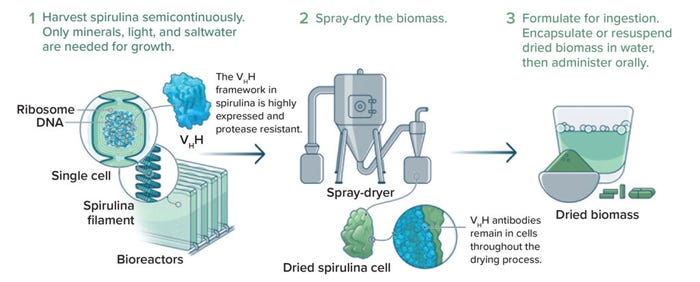

The idea of integrating supply-chain considerations into early product design is common in other industries. That kind of thinking is rare among biopharmaceutical developers — but it is certainly possible. An example from my company, Lumen Bioscience, is illustrative here. To scientists working with aseptically fermented bacteria, yeast, and mammalian cells, Lumen’s GMP platform might seem strange — scary, even. But the platform’s advantage lies in its simplicity. It leverages a simply engineered and edible species of cyanobacteria fermented in a simple growth medium to express nonsystemically bioavailable proteins. The approach uses inexpensive capital equipment that is easy to operate and does not require aseptic-processing methods (Figure 2). Late-preclinical development is vastly simpler and less expensive for a spirulina-based platform than for conventional systems expressing injected biologics (see the “Killing Complexity” box). The Lumen platform could have profound implications for R&D productivity (9).

Figure 2: Example process for straightforward, spirulina-based production and formulation of therapeutic proteins; VHH = antigen-binding fragments of heavy-chain–only camelid antibodies (IMAGE COURTESY OF LUMEN BIOSCIENCE).

Delivering Value to the (Composite) Customer

Innovation-driven industries excel at crafting products that generate customer delight. The biopharmaceutical industry usually does not generate similar buzz — the recent demand for Wegovy (semaglutide) notwithstanding (10). Many people are happy to spend >$1,200 for the latest iPhone model and even more for monthly add-on services. Generating iPhone levels of customer delight is more complex for drug developers because the “customer” is not a single individual.

With many normal products, a person chooses an item, pays for it, and consumes it. So the producer needs to deliver value to a single person. Even then, it is easy for results to go awry, sometimes spectacularly (11). But a drug’s customer is a composite of many actors. A patient ultimately receives the product, but an insurer usually pays (at least a portion) for it after a physician chooses it by writing a prescription. Sometimes other gatekeepers — e.g., pharmacy benefit managers (PBMs) and hospitals — can diminish patient access through formulary-listing processes. The economic interests of such actors often diverge, so aligning incentives to make a sale is more complex for drugs than for standard products. Because so many vetoes are built into the system, failure to satisfy one constituency can easily wreck a launch plan. Most new drug launches fail to reach their goals (12).

Reinventing drug development means rethinking such complexities. Rather than focusing on quality-adjusted life years (QALYs) alone, developers must embrace the realities of the pharmaceutical product life cycle. In practice, that has generally required prioritizing development programs that deliver easily perceptible value to all three main facets of the composite buyer — payers, patients, and physicians. But doing so can entail deemphasizing programs that might have difficulty catering to one or more of those groups, regardless of whether the program is scientifically tractable.

One example is the broader pharmaceutical industry’s well-documented propensity for “pipeline herding” (13). That tactic leads to crowded markets of follow-on drugs, few of which repay their cost of development (14). Antibiotics are another salient example. Most physicians and researchers would agree that patients and society would benefit from new classes of antibiotics, particularly for the many emerging drug-resistant strains of harmful bacteria. Yet bundled payments for hospital stays create incentives for healthcare administrators to avoid new, high-cost antibiotics, even if legacy drugs are mediocre for treating a given infection. Of course, it would be best if the American healthcare system’s flaws were fixed, and important efforts are underway in that area (15). But failure to be realistic about such constraints at the outset has led to catastrophe for some drug developers (16).

At Lumen Bio, we work hard to facilitate access to our platform technology for public-sector and charitable-research funders. In most cases, we’ve found that thoughtful consideration can yield a viable business plan where none yet exists — especially when the product can be produced scalably and development costs are affordable. A great example is our recent publication showing how reconceptualizing a treatment for Clostridium difficile infection turns what looks at first glance like a money-losing antibiotic into a preventive drug with true blockbuster potential (17).

Meeting Customers Where They Are

If large European countries were ranked alongside American states by per capita purchasing-power parity, such countries would fall in the bottom third of the data set. The United Kingdom’s per capita gross domestic product (GDP) ranks below that of Alabama (44th in the United States), Maine (45th), Arkansas (46th), and West Virginia (47th) — and below that of Mississippi (50th) if wealthy London is excluded (18). Regardless of whether it is fair to US taxpayers subsidizing R&D activities, other countries simply do not have the economic firepower to pay US prices for new products, pharmaceuticals included.

However, that wealth gap poses relatively few problems for healthy-innovation industries because they are adept at creating products that are affordable in regions with less disposable income. Teslas and smart phones are not obviously easier or less expensive to make and distribute than are many drug products, yet somehow the former kinds of products are globally ubiquitous. Meeting customers where they are was once part of the biopharmaceutical business strategy, too. Somehow we lost our way. Drug-price divergence began accelerating in the late 1990s (23).

It is possible to return to those early, healthy days of biopharmaceutical-industry innovation. Consider Pfizer’s positive experiences with the Comirnaty (mRNA vaccine) and Paxlovid (nirmatrelvir and ritonavir) products, both for COVID-19. Conventional wisdom holds that biopharmaceutical development costs can be recouped only with extremely high prices — and that the US pharmaceutical market is the only one that matters. Yet 2022 was Pfizer’s most profitable year to date because it defied such thinking. The vaccine and antiviral sold for $25 and ~$250 per dose, respectively, and together the products generated $57 billion in 2022 sales, a majority from outside the United States (24). Such stories are exceptional in today’s industry, but they need not be, and again, Lumen’s experience is pointing the way forward (25).

A Heavy Dose of Humility

Naysayers in our industry bemoan the impossibility of reversing R&D productivity decline (3). But no fundamental law of nature prevents us from turning R&D productivity around, particularly given the rapid pace of improvements in the laboratory and manufacturing tools that we use. Rather, industry culture keeps us referring to drug discovery, deferring uncritically to conventional wisdom and herding ourselves over and over again toward the same few targets and production methods.

The cure for bad culture begins with a heavy dose of humility. After recognizing that we have strayed from our goals, we must relearn the basics of product development from other industries with less-lofty callings. Reinventing drug discovery in that way can set the stage for our industry’s rebirth.

References

1 Gaynes R. The Discovery of Penicillin — New Insights After More Than 75 Years of Clinical Use. Emerg. Infect. Dis. 23(5) 2017: 849–853; https://doi.org/10.3201/eid2305.161556.

2 Monnet DL. Antibiotic Development and the Changing Role of the Pharmaceutical Industry. Int. J. Risk Safe. Med. 17(3) 2005: 133–145.

3 Stott K. Pharma’s Broken Business Model — Part 1: An Industry on the Brink of Terminal Decline. LinkedIn 17 November 2017; https://www.linkedin.com/pulse/pharmas-broken-business-model-industry-brink-terminal-kelvin-stott.

4 Seize the Digital Momentum: Measuring the Return from Pharmaceutical Innovation, 2022. Deloitte: London, UK, 2023; https://www2.deloitte.com/us/en/pages/life-sciences-and-health-care/articles/measuring-return-from-pharmaceutical-innovation.html.

5 Tollman P, et al. Unlocking Productivity in Biopharmaceutical R&D: The Key to Outperforming. Boston Consulting Group: Boston, MA, 2016; https://www.bcg.com/publications/2016/unlocking-productivity-in-biopharmaceutical-rd—the-key-to-outperforming.

6 Paul SM, et al. How To Improve R&D Productivity: The Pharmaceutical Industry’s Grand Challenge. Nature Rev. Drug Discov. 9, 2010: 203–214; https://doi.org/10.1038/nrd3078.

7 Li F, et al. Cell Culture Processes for Monoclonal Antibody Production. mAbs 2(5) 2010: 466–477; https://doi.org/10.4161/mabs.2.5.12720.

8 Saveria T, et al. Needle-Free, Spirulina-Produced Plasmodium falciparum Circumsporozoite Vaccination Provides Sterile Protection Against Pre-Erythrocytic Malaria in Mice. npj Vaccines 7(113) 2022; https://doi.org/10.1038/s41541-022-00534-5.

9 Finrow B, Engel A, Akkaraju S. Drug Developers Navigating “Biology’s Century” Need a Model. We Made One. STAT 15 March 2023; https://www.statnews.com/2023/03/15/biopharma-business-model-proposal.

10 Wingrove P. Obesity drug Wegovy’s Popularity Has US Employers Rethinking Insurance Coverage. Reuters 27 June 2023; https://www.reuters.com/business/healthcare-pharmaceuticals/obesity-drug-wegovys-popularity-has-us-employers-rethinking-insurance-coverage-2023-06-27.

11 Rubin BF, Cheng R. Fire Phone One Year Later: Why Amazon’s Smartphone Flamed Out. CNET 24 July 2015; https://www.cnet.com/tech/mobile/fire-phone-one-year-later-why-amazons-smartphone-flamed-out.

12 Rosenorn P, et al. Biopharma Launch Trends — Lessons Learned From LEK’s Launch Monitor. LEK Insights 22(87) 2020; https://www.lek.com/insights/ei/biopharma-launch-trends-lessons-learned-leks-launch-monitor.

13 Sharma P (@paras_biotech). Post: Pipeline Herding in Drug Development. X 29 April 2023; https://twitter.com/paras_biotech/status/1652502089040363521?s=20.

14 Lewin K. Impel Pharma Considers Bankruptcy, Asset Sales Despite Migraine Nasal Spray Quarterly Revenue Jump. Endpoints News 16 August 2023; https://endpts.com/impel-pharmaceuticals-considers-bankruptcy-asset-sales-despite-migraine-nasal-spray-quarterly-revenue-jump.

15 Gardner L, Mahr K. The War Against Superbugs Caught in Congressional Quagmire. Politico 2 October 2022; https://www.politico.com/news/2022/10/02/war-against-superbugs-congressional-quagmire-00059868.

16 Farrar J. We Ignore the Disaster in the Antibiotics Market at Our Peril. Wellcome 23 April 2019; https://wellcome.org/news/we-ignore-disaster-antibiotics-market-our-peril.

17 Finrow B. Preventive Drugs May Be the Best Solution to the Antibiotic Resistance Crisis. STAT 18 October 2023; https://www.statnews.com/2023/10/18/antibiotic-resistance-crisis-preventive-drugs.

18 Perry MJ. US GDP per Capita by State Versus European Countries and Japan, Korea, Mexico and China — and Some Lessons for The Donald. AEIdeas 6 March 2016; https://www.aei.org/carpe-diem/us-gdp-per-capita-by-state-vs-european-countries-and-japan-korea-mexico-and-china-and-some-lessons-for-the-donald.

19 Jester BW, et al. Development of Spirulina for the Manufacture and Oral Delivery of Protein Therapeutics. Nature Biotechnol. 40, 2022: 956–964; https://doi.org/10.1038/s41587-022-01249-7.

20 Hussack G, et al. Engineered Single-Domain Antibodies with High Protease Resistance and Thermal Stability. PLoS ONE 6, 2011: e28218; https://doi.org/10.1371/journal.pone.0028218.

21 NCT04098263. Safety and Pharmacokinetic Study of LMN-101 in Healthy Volunteers. US Clinical Trials Database, 2020; https://clinicaltrials.gov/study/NCT04098263#study-record-dates.

22 Tabahk H, et al. Protocol for the Transformation and Engineering of Edible Algae Arthrospira platensis To Generate Heterologous Protein-Expressing Strains. STAR Prot. 4, 2023: 102087; https://doi.org/10.1016/j.xpro.2023.102087.

23 Frakt A. Something Happened to US Drug Costs in the 1990s. New York Times 12 November 2018; https://www.nytimes.com/2018/11/12/upshot/why-prescription-drug-spending-higher-in-the-us.html.

24 2022 Annual Review: Financial Performance. Pfizer: New York, NY, 2023; https://www.pfizer.com/sites/default/files/investors/financial_reports/annual_reports/2022/performance.

25 Finrow B, Roberts J. High Impact Drugs at Dirt Cheap Cost. Medium 27 January 2021; https://finrow.medium.com/high-impact-drugs-at-dirt-cheap-cost-771a3667affe.

Brian Finrow is cofounder and chief executive officer of Lumen Bioscience, 1441 North 34th Street 300, Seattle, WA 98103; https://www.lumen.bio.

You May Also Like