CMC Development Platforms and Outsourcing to Reduce Timelines

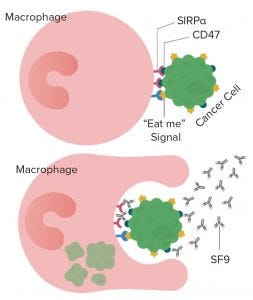

Figure 1: 5F9 (magrolimab) enables macrophages to phagocytize cancer cells by blocking the binding of the “don’t eat me” signal CD47 to its receptor SIRPα (1)

Forty Seven is a company developing novel therapies based on anti-CD47 and other immuno-oncologies. CD47 is called the “don’t eat me” signal that cancer cells give out to escape elimination by the body’s immune system. Qinghai Zhao, vice president of technical development and manufacturing, is one of the scientists working on the company’s magrolimab (5F9) monoclonal antibody that is designed to block the binding of the CD47 signal to the cell receptor SIRP-α while boosting the “eat me” signal that enables a patient’s own immune system to destroy the cancer cells (Figure 1).

At the 2019 BPI West conference in Santa Clara, CA, Zhao’s presentation focused on the importance of speed to investigational new drug (IND) application and the company’s process for selecting a platform and contract development and manufacturing organization (CDMO) for its magrolimab drug candidate. He highlighted the challenges in early stage chemistry, manufacturing, and controls (CMC) development, including the need for an aggressive timeline. After the conference, I spoke with him about the company’s strategies for meeting those timelines.

Speed to IND Is the First Step

Your presentation focused on working with a CDMO to address an aggressive timeline to investigational new drug (IND) application. Why is there a need to have such a short timeline? When we talk about speed to IND, I think that using a one-stop-shop CDMO combined with a platform approach is especially critical for small biotechnology companies. That doesn’t mean big pharmaceutical companies do not use this approach. But it’s more critical for small companies because they face significant financial constraints. So it is crucial for them to achieve the milestones set before the next fundraising round.

Do you think this is typical of other companies that have limited funding? Yes, it is typical. Most small biotech companies have 1–2.5 years of cash runway. I have worked at both big pharmaceutical companies and small biotechs. I would say that even a big pharmaceutical company would want speed to IND, although that has less to do with financial constraints. At an early stage of product development, the pressure is greater for small biotech companies than for large ones. In a big company, you may have 100 projects ongoing at the same time. So it is expected that some projects would be completed on time while others would be delayed. You always get some projects pushed to move as fast as possible. However, that pressure is different than at a small biotech company where achieving CMC milestones is critical to enable initiation of clinical studies as early as possible to generate meaningful results and attract investor interest.

Do those short timelines and other pressures carry on to later stages and even into commercialization? Speed to IND is the first step of speed to market. If you cannot achieve speed to IND, you risk being slow or late to launching your product. A biotech company certainly will be valued significantly more with a first-to-market drug candidate than other companies in a competitive market. The pressure to go fast inevitably carries on to later stages because there always will be a drive to be first to market.

The second major pressure is cost control, which carries on to later stages as well. Although every company needs to have strategies for meeting cost control requirements, it is especially vital for small biotechnology companies simply because of the constraints of their financial resources. A good cost-control strategy will increase the chance of success for a biotech company.

For example, your funding might support only three CMC programs. But depending on the cost efficiencies at a given CDMO, that level of funding might allow you to support four programs instead of three, thus representing a significant increase in your chances of success. Cost control is a challenge, but there are ways to deal with that challenge and create opportunities for your company as well.

The third part that carries on to later stages is the technology implemented in early stage development. I’ve seen some small companies that do not have sufficient resources and adequate knowledge during early stages of CMC development. That is a big challenge for a small biotech company because inappropriate early stage CMC development will carry significant pressure and risk on to later stages of product development. Because of their lack of experience and knowledge, these companies can end up spending more money and taking longer for late-stage CMC development, thereby compromising their ability to be first to market. For example, they might need to repeat cell line development if a nonmonoclonal and/or nonstable cell line is used for early stage development and clinical supply.

Technologies to Shorten Timelines

What technologies, strategies, and capabilities were important to meet your deadlines in working with your CDMO? The topic I talked about at BPI West in 2019 referred to monoclonal antibody production. For antibody production processes, you have three bioreactor choices in early stage GMP production: stainless steel bioreactors, disposable bioreactors, or perfusion systems. The stainless steel tank option has become less popular now for small-scale and early stage development because of the time required for changeover and potential cross-contamination risks. CDMOs have begun to retire small-scale their stainless steel tanks. Many disposable bioreactor options available to the bioprocess industry are now the industry trend. Most CDMOs offer choices of disposable systems, ranging from 200 L to 2,000 L in capacity. CDMOs love to use the disposable systems because of their well-known benefits in terms of easy changeover and lowered resource requirements at early stage GMP manufacturing when compared with the other two options.

Perfusion, or so-called continuous production, is a very interesting concept. I have spoken with a few CDMOs that are experienced with such systems and have been told that it is hard to get clients to commit to this technology at early stages. The biggest challenge is scale-up. After you complete phase 1 and phase 2 clinical supply production, you need to consider pivotal clinical study supply and commercial launch at larger scales. But when using perfusion technology, you may not have a real choice with CDMOs at larger scales. In the later stages, you might need to scale up to 10,000 L or 20,000 L to meet cost of goods (CoG).

Perfusion technology can be used at early stages. At later stages, however, you will still need to change to multiplex disposable or stainless bioreactors because finding a CDMO with such a large-scale perfusion facility can be difficult. That is a huge change that can lead to product profile differences, which you don’t want to see for late-stage CMC development. Changing from perfusion to one of the other two choices also can make comparability a big challenge, so some people push away from using perfusion. In fact, I don’t see it as a realistic choice in any program for which there is hope of ultimate commercialization, especially given the usual timeline constraints, although perfusion is appreciated for small-volume needs and will continue to evolve. Recently, I had a conversation with the CEO of a company specializing in perfusion technology. He said that his company tried it for a few years but found it difficult to convince clients to start with perfusion technology because everyone saw scale-up as a big challenge.

Does the technology a company selects need to change as it moves through IND and into commercialization? Yes, most likely you will need to change the technology to allow pivotal material manufactured at the scale that can meet the market demand and reduce CoG after drug approval. In this case, you must reinvent a process or reoptimize a process for later stages using different technologies. But when you move into phase 3 CMC development, you probably have received positive signals from clinical studies. Then you’ll be under pressure to proceed into phase 3 production as soon as possible. So reality does not give you much time for the transition between early stage and late stage. Again, perfusion is not a good option because of the potential product profile change and the significant time required to develop a new process for phase 3 production using disposable or stainless bioreactors.

Having said that, you can implement perfusion technology without needing to change at late stage if scale-up is not required for pivotal material and commercial production.

Is that the same case with new analytical techniques? Many biomanufacturers are thinking more about their analytical approaches, including implementation of PAT and generation of more data for FDA review. When a new analytical technology comes to market, your first questions should be, “Is it necessary? Do we need to implement this new technology for GMP testing?” If the FDA approves the use of an existing technology, you might be able to implement a new technology for information only. You don’t want to implement a method with limited knowledge and experience for GMP testing. And you don’t want to be a pioneer to implement a new technology without substantial experience regardless of whether it is a process-related or analytical technology.

However, biomanufacturers should be open-minded about exploring new analytical technologies that represent opportunities to improve their understanding of product profiles. A new analytical technology can and probably should be implemented as quality control (QC) release and stability testing when that technology is proven to be superior to existing ones and enough performance knowledge has been accumulated. In terms of generating more data for FDA review, methods for characterization can help a biomanufacturer obtain drug approval if the data present significant benefits in elucidating mechanism of action (MoA) and understanding product quality profiles compared with existing analytical technologies.

Platform and CDMO Selection

Your case study included timelines of some major CDMOs. What are some critical factors you used to find a CDMO? The case study I presented is about early stage CDMO selection to meet my company’s requirements, including reducing time to IND. When you select a CDMO, the first consideration is the quality of its performance. The company has to meet certain criteria and provide full confidence for you to introduce your product into its facilities. The second critical factor is the CDMO’s experience with the type of molecule you intend to develop and manufacture at the facility. The third factor is timeline alignment. For speed to IND, the timeline is an important criterion. You need to have a detailed discussion on timeline alignment. You also should be able to use platform technologies at the facility you select to reduce time to IND as much as possible. The last factor is cost, which is enormously important for small biotech companies but should never be the first thing to consider in CDMO selection.

Late-stage CDMO selection is a different process compared with selecting an early stage CDMO. You will need to pay particular attention to the CDMO’s biologics license application (BLA) and commercialization experience, FDA/EMA audit history and interactions with authorities, production slot and timeline commitments, and of course CoG. You want to launch a product that is viable on the market and that will be profitable for your company, so CoG assessment is a big part of evaluating a late-stage CDMO selection and outsourcing.

Your presentation highlighted different platforms and how they could be used to save time and costs. Could you briefly review how you approached those? The concept of using platform technologies for early stage CMC development, particularly for early stage monoclonal antibody programs, has been accepted widely in the industry. The benefit of platform technologies is that you know what they can cover, and you know their limitations that can be reduced at a later stage. A platform technology can provide you with confidence in understanding your process and the quality of your product. A big benefit of using a platform approach is that it will significantly reduce time, mitigate risk by minimizing unknowns, and help control costs.

Reference

1 Zhao Q. CDMO Selection for Speed to IND. BPI West, Santa Clara, CA, 11–14 March 2019.

Maribel Rios is managing editor at BioProcess International; [email protected]. Qinghai Zhao is vice president of technical development and manufacturing at FortySeven, Inc.

You May Also Like