July-August 2023

Sponsored Content

We at BPI had so much fun putting together our big anniversary retrospective issue last year that we decided to make it an annual tradition starting this year — albeit on a bit smaller scale. There’s a lot to say when you reflect on 20 years of progress, problems, and solutions. But what can you say after only a year? Well, it turns out that the answer to that question, as you’ll find in these pages, is “Plenty!”

The past 12 months have been characterized primarily by a biopharmaceutical industry emerging from the dizzying pace of the pandemic into some kind of “new normal” that’s only now beginning to establish itself. That’s the main theme of this issue, and I’ll let the authors and interviewees speak for themselves herein.

We’ve organized the main editorial contributions to this line-up in a general “top-down” approach, beginning with the big pictures of regulations and finance, then zooming into operations, manufacturing, and facilities, then finally landing on a personal career view. From another ang...

HTTPS://STOCK.ADOBE.COM

Biopharmaceutical researchers, manufacturers, and regulators converged on Washington, DC, in January 2023 to attend CASSS’s 26th annual Well-Characterized Biological Products (WCBP) meeting. Among the opening festivities at each such event is conferral of the prestigious William S. Hancock Award for Outstanding Achievements in Chemistry, Manufacturing, and Controls (CMC) Regulatory Science. The prize honors people who have spurred on significant advances in scientific principles, applied technologies, and science-based regulations for biomanufacturing process development, characterization, analysis, and quality assessment. The 2023 recipient of the prize is Kathryn Stein, who served as founding director of the Division of Monoclonal Antibodies (DMA) in the US Food and Drug Administration Center for Biologics Evaluation and Research (FDA CBER).

Stein joined CBER in 1980 and assumed leadership over the DMA in 1992. She received the CBER Outstanding Service Award in 2002 for spearhead...

HTTPS://STOCK.ADOBE.COM

The biopharmaceutical industry is, and always has been, rife with mergers and acquisitions (M&A) activity, with small biotechnology companies combining technology and platforms, mid-size organizations diversifying pipelines, and larger corporations replenishing products under the weight of expiring intellectual property (IP). And then come the multibillion-dollar megamergers: Glaxo Wellcome and SmithKline Beecham, Pfizer and Wyeth, and Merck and Schering-Plough, for example.

Few people expected 2022 to be an exception. According to a recent Ernst & Young (EY) report, the industry’s value stood at a record US$1.4 trillion, up 11% over 2021 (

1

). Meanwhile, a wave of patent expirations loomed, and biotechnology stock valuations were at their lowest in years. Despite those factors, the year saw the lowest amount of M&A activity in a decade. EY listed 71 deals over $100 million in value, all totaling $60 billion in 2022, which was down from $104 billion in such deals the previous year...

HTTPS://STOCK.ADOBE.COM

New competitors entering the bioprocessing industry during the COVID-19 pandemic gained access partly because of unprecedented demand and constrained supply of bioprocess materials, equipment, and consumables. During the pandemic, growth in supplier revenue increased dramatically, averaging >24% growth in 2022, with some segments of the industry showing even higher growth (

1

). The 20th annual report of biopharmaceutical production from BioPlan Associates also assessed price changes and competitive pressures resulting from the demand swings over the past few years. The bioprocess supplier landscape has changed significantly. Based on the annual report and on data from a recent BioPhorum white paper prepared by BioPlan Associates, we have quantified a number of competitive trends that are likely to persist as new competitors begin to influence the segment over the coming years (

2

).

Biopharmaceutical Supplier Growth

The pandemic brought significant revenue increases for many suppl...

HTTPS://STOCK.ADOBE.COM

Life-science companies must stay on top of new requirements, innovations, process improvements, and potential roadblocks to navigate complexities across the development, manufacturing, and regulatory life cycles of their products. Amid the increasing availability of cutting-edge technologies such as artificial intelligence (AI) and blockchain ledgers, organizations must establish best practices to support strategic decision-making, improve information collection and sharing with key stakeholders, and prioritize supply-chain management. Below, I share some insights from our team about emerging digital technologies and their implications for processes, operations, and regulations for the pharmaceutical and biotechnology industries.

AI and Big Data in the Biopharmaceutical Industry

The topic of natural language generation (NLG) has gathered momentum in 2023 with the evolution of tools such as OpenAI’s ChatGPT chatbot. Although such technology remains in an early (and error-prone) stat...

COURTESY OF TONI MANZANO AND AIZON;

HTTPS://AIZON.AI

A digital twin

(DT) is a theoretical representation or virtual simulation of an object or system composed of a computer model and real-time data (

1

). A DT model operates upon information received from sensors reporting about various aspects of the physical system and process, such as temperature, raw-materials levels, and product accumulation. From such data, the model can run simulations that enhance process development and optimization. It can predict specified outcomes, flag required actions, and even support closed-loop process control (

2

).

The biomanufacturing industry is familiar with dynamic mathematical models containing time-based derivative terms of relevant variables. Both these classical simulations and DTs are digital models that are replicating a system’s process, but DTs are distinctive in that they operate virtually in parallel with their real-world counterparts. And whereas a classical simulation typically reports about a particul...

Addressing sustainability can seem insurmountable for any business. Doing so requires endorsement from senior leadership and engagement from an entire organization. To ingrain sustainability into a company’s everyday activities, company leaders must enact strategies that are easy to implement, that produce results quickly, and that will promote long-term goals. Embracing a cycle of continuous improvement is crucial because today’s challenges and innovations can shape the norms of tomorrow, when new challenges inevitably will emerge.

Environmental and social governance lies at the core of our culture at Biogen. Our organization empowers its employees to adopt new ways of working in alignment with an increasing emphasis on sustainability. Biogen’s Product and Technology Development (PTD) team develops and delivers innovative devices, manufacturing processes, product packaging, and analytical solutions. In doing so, we help to provide safe and effective medicines to patients in ways that reduce environmental...

https//STOCK.ADOBE.COM

Cell and gene therapy (CGT) applications have increased rapidly over the past few years, with hundreds of candidate treatments entering the clinical pipeline annually. Although North America, Asia, and Europe are driving industry growth, drug sponsors in those areas will not want to limit product distribution to their respective regions; rather, they will want to maximize patient impact. Thus, companies must understand global regulatory differences and their implications for therapy production. However, advancements in the CGT industry often outpace adjustments to regulatory guidances.

When considering supply chains for allogeneic cell therapies, in particular, we find common obstacles to treating global or even regional patient populations. Some difficulties concern how to obtain healthy, adult-donor cellular starting material, including

• differences in donor eligibility requirements among countries

• the influence of donor welfare and compensation on global distribution of result...

HTTPS://CRBGROUP.COM

Driven by the urgency of the COVID-19 pandemic, the US government’s Operation Warp Speed (OWS) initiative gave biomanufacturing-facility design and construction teams an opportunity to unleash their creativity and put forth innovative solutions. Although the exigency for SARS-CoV-2 vaccines has declined, the life-science industry’s lightning-fast pandemic response has left a lasting impression among many companies. For instance, today’s biomanufacturers might wonder why facility construction should take four or five years when the industry has shown that it can be done in 18 months with the right tools and strategies. The pandemic took integrated project-delivery methods mainstream. It also enabled lean business principles and modularization to gain in popularity. But questions remain about how quickly the biomanufacturing industry will adopt such approaches moving forward.

Addressing Business Challenges

Lean project delivery

is a business philosophy that can alleviate constraints f...

HTTPS://STOCK.ADOBE.COM

It should come as no surprise that the pandemic instigated a boom in life-science facility construction around the world. Biotechnology facilities can be built from the ground up or converted from existing office, industrial, or older life-sciences sites. Choosing among those options is seldom straightforward.

Thanks to strong academic institutions and well-entrenched industrial hubs, the top three US markets for life-sciences real estate continue to be Boston in Massachusetts and San Francisco and San Diego in California.

Home to Harvard University and the Massachusetts Institute of Technology, the Boston area boasts the most square footage devoted to biotechnology real estate in the world, now totaling over 60 million ft

2

. From a broader perspective, that area is also home to the largest pharmaceutical cluster in the United States. The San Francisco Bay area has over 50 million ft

2

devoted to life sciences, extant or in development. Stanford University is there, along with se...

HTTPS://STOCK.ADOBE.COM

Women make up a significant percentage of the people who have established careers in the biopharmaceutical industry. However, the industry still needs to work toward creating equal representation in C-suite positions and helping women entrepreneurs start their companies. We also need to increase women’s overall representation among leading companies, with women sitting on boards of directors and making important decisions. We need to have more conversations about promoting women into leadership and positions of power.

It is hard to believe that the gender gap in science, technology, engineering, and mathematics (STEM) remains significant even in 2023, with women comprising only 28% of the STEM workforce (

1

). Researchers at the Massachusetts Institute of Technology (MIT) found that under 10% of 250 start-ups by MIT faculty were established by women, who make up 22% of the faculty. If men and women started companies at the same rate, then an estimated 40 more biotechnology companie...

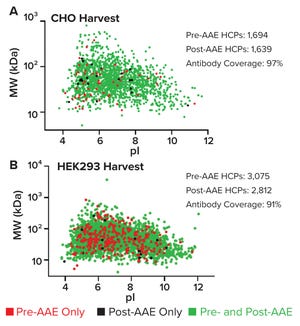

Host cell proteins (HCPs) can copurify with a biological drug substance (DS), posing potential risks for both patients and drug manufacturers. Although many HCPs are benign, some are immunogenic, others can interact with a DS and diminish its efficacy, and others can interfere with DS stability. Thus, the quantity and nature of residual HCPs in a DS generally are considered to be critical quality attributes (CQAs) that constitute a significant part of a drug developer’s overall risk-management strategy (

1–5

).

HCP identification and quantification by mass spectrometry (MS) is a powerful complementary method for demonstrating the suitability of an HCP enzyme-linked immunosorbent assay (ELISA). Herein, we present examples of how our company’s Antibody Affinity Extraction (AAE) technique followed by MS can be used to demonstrate an HCP ELISA suitability. We also show how the AAE-MS method can be used to identify HCPs in DS samples.

Antibody Coverage Analysis

AAE immunoaffinity chromatography is designed to ...

HTTPS://WWW.RICHTER-HELM.EU

In recent years, customer requirements for contract development and manufacturing organization (CDMO) services have changed. CDMOs have developed into partners, consultants, and providers of specific services, all preferably coming from a single source.

Richter-Helm is one driver of a transparent, flexible, guided, and solution-oriented way of partnership, offering its clients a full-service approach along the entire journey from gene to finished product. The company has a strong heritage and is known for providing best-in-class CDMO solutions including a unique knowledge base in process and analytical validation, process performance qualification (PPQ) procedures, and commercial production of therapeutic proteins and peptides, antibody-like scaffolds (e.g., variable-domain heavy-chain, VHH), bacterial vaccines, and plasmid DNA (pDNA) products. The global pharmaceutical industry expects and requests high-quality standards. Our services are verified regularly by national and int...

1,500-L bioreactor at Sino Biological.

Business analysts predict that the global market for monoclonal antibody (MAb) therapeutics — including human, humanized, chimeric, and murine antibodies — will expand at a compound annual growth rate (CAGR) of 14.1% from US$178.50 billion in 2021 to $451.89 billion in 2028. Strong demand for MAb products also is spurring on the global market for custom antibody manufacturing, which is projected to grow at a CAGR of 10.6% from $393 million in 2021 to $652 million by 2026 (

1

).

Driving much of that growth is the rapid rate at which new drug targets are being identified, particularly in the immunotherapy space. As new targets are uncovered, many companies are seeking out recombinant antibodies that can inhibit or activate them. The growing volume of gene-sequence and product-characterization data published openly online is helping researchers to accomplish that goal, which will boost further innovation in the biopharmaceutical industry.

Wide circulation of the initial...

Representatives from Tosoh Corporation and Tosoh Bioscience perform the traditional Japanese kagami-biraki ceremony to celebrate the opening of the company’s Ca

++

Pure-HA production facility in Grove City, OH.

The biopharmaceutical industry as we know it today dates back to the late 19th century. Emil von Behring and Paul Ehrlich, among other scientists, were pioneers in the industry. Their work on serum therapy laid a foundation for the development of vaccines and immunotherapies.

The modern biopharmaceuticals emerged in 1973 with the advent of recombinant DNA technology. That groundbreaking discovery opened doors to new frontiers, enabling scientists to manipulate an organism’s DNA for manufacturing novel biological products. The fruits of such revolutionary technology first were borne out with the production of biosynthetic insulin in 1978, which forever changed the landscape of the pharmaceutical industry.

Over the ensuing decades, combining an ever-growing understanding of biology with advances in b...

The mention of workplace safety conjures images of hard hats, steel-toe boots, and thick gloves. Add biomanufacturing and pharmaceutical facilities into the mix, and we may think of people covered from head-to-toe in hazmat suits. In reality, occupational safety for these industries falls between those two extremes.

The COVID-19 pandemic introduced new health considerations. At its onset, laboratory workers were exposed to an unstudied virus that brought with it an unknown hazard level. As knowledge advanced and scientists developed vaccines, new workplace safety concerns arose. The mRNA-vaccine technology developed by companies including Pfizer and Moderna depended on nonstandard transport conditions that required extremely low temperatures, introducing an industry-specific hazard for occupational safety.

In addition to the safety concerns inherent to laboratory work, biopharmaceutical companies face many of the same safety considerations that other workplaces must manage. Repetitive-strain injuries, wor...

In May 2023, the World Health Organization (WHO) declared an end to the COVID-19 pandemic (

1

). Despite that announcement, fallout from the pandemic continues to reverberate through global supply chains, exposing their opacity and fragility and catalyzing their transformation. Geopolitical issues, such as Russia’s invasion of Ukraine and rising tensions between the United States and China, have shaped supply-chain transformation, resulting in what I call a “supply-chain iron curtain” that is poised to complicate international trade (

2

).

But that does not mean the end of globalization. Rather, it reflects growing regionalization of global supply chains. Companies are deviating from a traditional, cost-driven approach to supply-chain management by making strategic and operational decisions increasingly in light of geopolitical considerations. A strategy known as “friend-shoring” has gained traction among many political and business leaders. Companies use that approach to develop supply-chain resilience b...