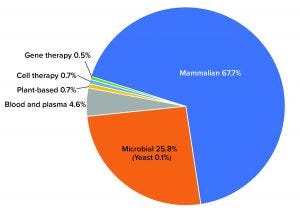

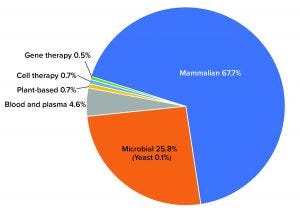

Figure 1: Percentage of total biomanufacturing capacity by platform or system

Since 2018, global bioprocessing capacity has grown from 16.5 million liters (1) to 17.4 million liters. Although output has continued to expand at around 12% overall, that rate represents a significant slowing in capacity growth as the industry moves toward greater productivity and efficiency. Trends that we have tracked in the BioPlan Associates annual report of biopharmaceutical manufacturing capacity and production (2) for over 17 years correlate with that finding. Titers are increasing; single-use technologies have reduced the need for large stainless-steel capacity; and the decline in approvals for large-volume, blockbuster biologics has diminished the need for super-size, “six-pack,” and multiple 10,000-L facilities worldwide. Optimizing capacity use will require planning for flexibility and peak-demand strategies. Further, the near-universal push toward greater productivity has led to commissioning of more facilities but with fewer liters of overall capacity.

Although COVID-19 bioprocessing certainly has added to overall global bioproduction, much of the pandemic-related demand for capacity is likely to be met by existing contract manufacturing capability and in-house capacity as the industry prioritizes and optimizes available capacity. Undoubtedly, that strategy will increase the overall capacity utilization rate this year.

BioPlan’s Top 1000 Global Biopharmaceutical Facilities Index Database has tracked global capacity since 2011. Over the past 10 years, our index has tracked and ranked what is now 1,643 bioprocessing facilities worldwide in terms of

known or estimated bioprocessing capacity (cumulative onsite bioreactor volume)

number of biological products manufactured at clinical scale

number of commercial scale biologics

number of bioprocessing-related staff.

By compiling key factors, including capacity, staffing, and number of biologics produced, we created a biomanufacturing “index” that can be aggregated to assess the concentration of bioprocessing in a given state, country, and region. Our indexing also accounts facility types (e.g., contracting manufacturing organization, CMO) and product classes handled, such as monoclonal antibodies (MAbs) and gene therapies.

Capacity Growth Over Time

Over the past 25 years, growth in sales and volumes of biologics has expanded consistently at 12–14% annually. More recently, however, growth in actual capacity and number of facilities tells the story of a maturing industry focused on improving productivity within existing infrastructure. For example, in our 2020 report (2), we saw expression titers for MAbs rise from an average of 1.95 g/L in 2008 to 3.5 g/L in 2020.

That rather constant, 12-year improvement in productivity (5.5% compound annual growth rate, CAGR) suggests that nearly half of the annual increase in demand would have been met through titer improvement alone. Other innovative technologies and process optimization steps are being introduced. For example, addition of perfusion bioreactors to improve seed-train performance can limit the need for additional capacity.

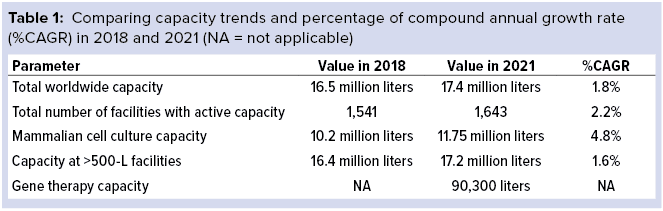

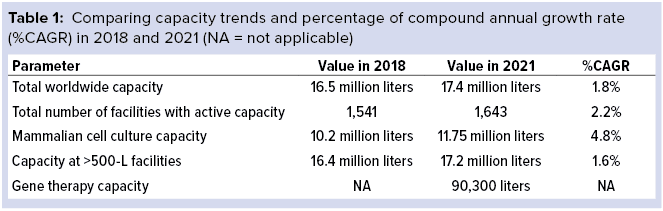

Table 1 shows that although more than 100 facilities have been added to the bioprocessing environment over the past few years, those additions have not made significant increases to total large-scale reactor capacity. That finding suggests that facilities are adopting smaller single-use platforms rather than making huge investments in fixed stainless-steel capacity, as would have been the case over 10 years ago.

Although advanced therapies such as cell and gene therapies are taking their place rapidly at the “biopharmaceutical table,” they still account for a small amount of total capacity. Gene therapies, for example, barely take up 0.5% total global capacity. By comparison, the dominant mammalian platforms make up more than two-thirds of the market (67.7%) (Figure 1).

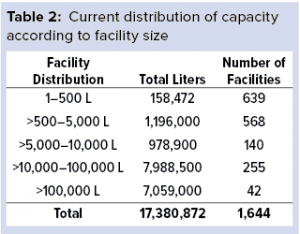

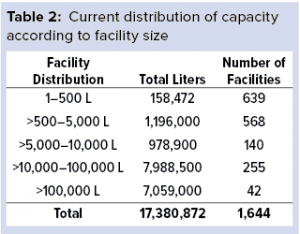

When evaluating the global industry by size, we find more than 1,000 facilities with >500-L capacity, which can be considered to be clinical-scale bioprocessing (Table 2). Although most of those facilities are producing for clinical supplies in developed markets, many are located in emerging regions — China and India, in particular.

When evaluating the global industry by size, we find more than 1,000 facilities with >500-L capacity, which can be considered to be clinical-scale bioprocessing (Table 2). Although most of those facilities are producing for clinical supplies in developed markets, many are located in emerging regions — China and India, in particular.

Global Comparisons

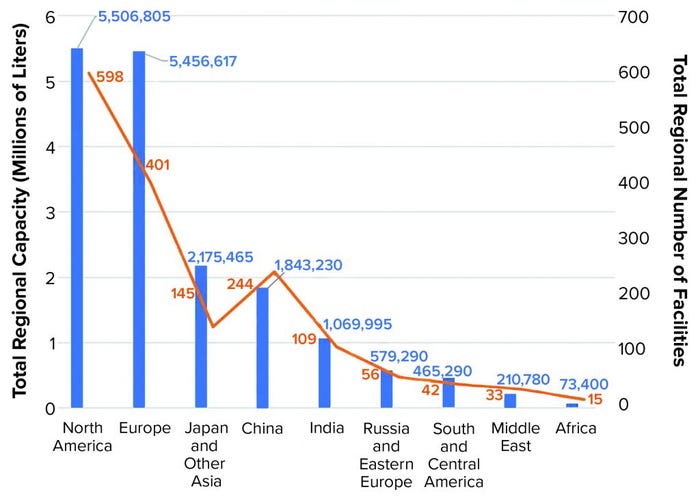

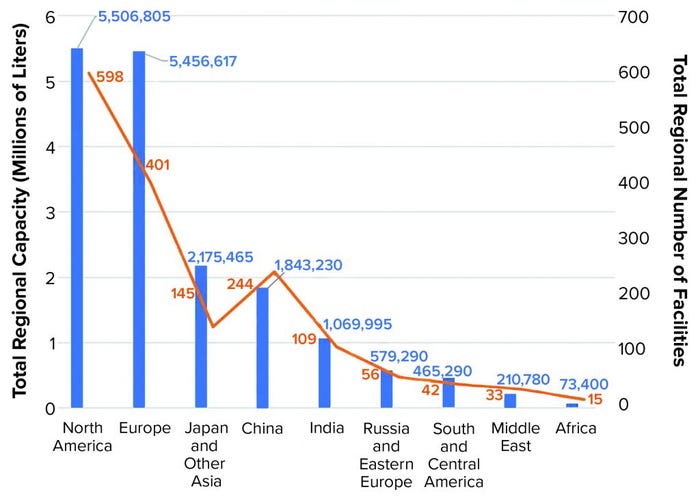

Of the 17.4 million liters that our database now tracks, 5.5 million liters (31.7%) reside in the United States and Canada, 5.46 million liters (31.4%) are in Western Europe, 2.2 million liters (12.5%) are in Japan and other Asia–Pacific regions, 1.8 million liters are in China (up from 870,000 L in 2018), and 1.1 million liters are in India (up from 941,000 L in 2018) (Figure 2).

Figure 2: Global biomanufacturing capacity according to region

Especially for emerging regions, our capacity figures are higher than some reported capacity data because we include all active global capacity, including facilities making human and veterinary vaccines and those making “biogenerics” — biologics that are not made according to good manufacturing practice (GMP) — used for therapeutics in lesser regulated markets. We include those non-GMP facilities because of the likelihood that regions such as China and India eventually will be producing biologics for Western markets (as they do with small-molecule drugs) and active pharmaceutical ingredients (APIs).

Although growth of biopharmaceutical manufacturing capacity in developed, major-market countries is continuing its slow and steady climb, developing regions often are reporting double-digit growth rates. Significant strategic implications come with such changes, especially in emerging and developing regions. As production of biologics becomes more globalized, APIs are produced in one region, fill–finish activities performed in another, and marketing and sales conducted in yet another. As more opportunities develop outside US and EU markets, biologics innovators and their suppliers are considering how such shifts in growth will influence predictive planning. Measuring regional capacity and using concentration indexes over time are important ways to gauge strategic relevance of regional segments.

After COVID-19 subsides, regional and domestic bioprocessing are likely to expand, and the importance of supply chain security for production of essential raw materials and equipment will increase. That will result in more facilities and more suppliers to help alleviate the bottlenecks and inventory shortages that were present even before the COVID-19 pandemic (for some raw materials and many single-use devices).

Biopharmaceutical CMO capacity continues to grow in China, especially since its regulations have changed to allow third parties to manufacture clinical and commercial biopharmaceutical products. The country continues to build capacity and adopt new technologies faster than India and thus will continue to pull ahead of it in biomanufacturing and related services. Those trends continue to translate to a significant influx of investment.

China has continued to build bioprocessing facilities and capacity over the past three years. It now has twice the number of facilities, although China’s average plant size continues to be around 25% smaller than that of India. Much of India’s well-established biomanufacturing expertise and capacity is in vaccine production, whereas China has continued its capacity build-out and intends to expand in a broader range of product platforms. We also observe that with the investment in China’s infrastructure and subsequent rapid expansion, the country’s overall capacity use is likely to be lower than elsewhere in the world. That overbuild has created idle capacity that could last for some years as the domestic Chinese market demand builds.

Non-GMP facilities currently do not sell biologics on regulated Western markets, but they are an increasingly important part of global capacity. Such emerging global facilities need their own biomanufacturing tools, technologies, and services. Non-GMP facilities are competing for global supply-chain resources. As their importance to their own local/regional drug markets increases, many of those facilities will be producing APIs, biosimilars, and innovative biologics for global markets. Tracking such regional growth is critical. Developing countries initially target their domestic markets, but that is changing as biomanufacturers achieve production quality goals and target developed-market export opportunities.

An Optimistic Future

Although biopharmaceutical manufacturing capacity expansions may be slowing, on-going expansions in demand for biologics continue unabated. The gap is being filled effectively as bioprocessing matures through innovation, process improvement, and improved facility use. Increasingly, the amount of capacity in liters is becoming less important than production and output. That trend continues to drive growth in supplies and services that continues to match pace with the 12–14% annual growth in biopharmaceutical revenues. Rapid expansions in emerging markets and demand for new technologies such as cell and gene therapies indicate that the market growth will continue. There is every reason to assume that biopharmaceutical manufacturing and the demand for raw materials, equipment, and services will continue to grow.

References

1 Top 1000 Global Biopharmaceutical Facilities Index Database. BioPlan Associates, Inc.: Rockville, MD; https://www.top1000bio.com.

2 Langer ES, et al. Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 17th ed. BioPlan Associates: Rockville, MD, April 2020; https://www.bioplanassociates.com/17th.

Corresponding author Eric S. Langer is president and managing partner, and Ronald A. Rader is the senior director of technical research at BioPlan Associates Inc., 2275 Research Boulevard, Suite 500, Rockville, MD 20850; 1-301-921-5979,

fax 1-301-926-2455; [email protected]; https://www.bioplanassociates.com.