CAR-T at the Crossroads: Is Allogeneic the Way to Go?

Artist’s conception of the moment a

CAR T cell identifies a cancer cell. (www.istockphoto.com)

As cell therapies move through the clinic toward commercialization, respondents to an Informa Connect industry survey are beginning to look to allogeneic — or off-the-shelf — products as “the next big thing.” Almost 200 people contributed to the Cell Therapy Analytics Report, revealing their current positions within the burgeoning cell and gene therapy space and offering their thoughts and predictions for the future.

Most survey respondents work within companies developing oncology products. Of those, the largest group (41%) said that they are developing chimeric antigen receptor (CAR) T-cell therapies specifically. This developmental divulgence reflects the regulatory successes of Novartis’s Kymriah (tisagenlecleucel) and Kite/Gilead’s Yescarta (axicabtagene ciloleucel), both of which shook the drug world when they received approvals in 2017.

Both those products are made using patients’ own cells, which are genetically engineered and then reintroduced. Such autologous cell therapies require intricate manufacturing processes and a complex logistics network — leading to a high cost of production and, naturally, a large price tag. The two therapies have been listed at US$373,000 and US$475,000, respectively.

When asked where the next big success and/or approval will arise in the cell and gene therapy industry, 47% of respondents ticked the “gene therapy” box. That may be slightly misleading considering that several gene therapies already have been commercialized, the latest being AveXis/Novartis’s Zolgensma (onasemnogene abeparvovec) priced at $2.1 million. Even so, the gene-therapy industry is far from mature.

Interview with Miguel Forte (former CEO, Zelluna Immunotherapy) |

|---|

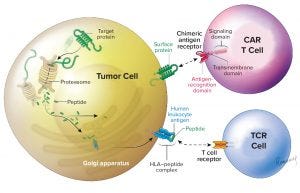

What are TCRs, and how do they differ from CAR T-cell therapies? They are different ways of targeting immune cells, both used mainly to guide T cells and natural killer (NK) cells against cancer cells. By gene editing (Figure 1), we can generate immune cells that express either an antibody-derived receptor — the chimeric antigen receptor (CAR) or a T-cell receptor (TCR) — that can recognize cancer cells and mediate their death. TCRs can recognize fragments from any type of antigen; CARs recognize only surface antigens, which is a small fraction (10–20%) of the total expressed genome. TCRs are nature’s way for some white blood cells to surveil diseased cells by migrating through tissues, and class 2 TCRs help mobilize the breadth of the immune system. So TCRs should have a better chance of penetrating solid cancers; CAR-T cells have demonstrated significant value primarily in blood cancers. Are there differences in their manufacturing and/or analytical approaches? The manufacturing is very similar, which is important so that new products can take advantage of previous experience and methods that have been developed already (including from those products already on the market). The main difference is that the inserted gene is specific for the different receptors. Gene modification of cells makes them express the receptors on their surface. That most frequently is done with a virus that does not harm the cells but can place the gene instruction for the receptor in their genomes. So CAR T-cell therapies don’t do as well against solid tumors. What does it really mean to say that a tumor is “solid” or not? Blood-cell cancers are frequently described as “liquid cancers” because they cirQculate suspended in blood. By contrast, cancer cells that aggregate to create a tumor mass are called “solid cancers.” This difference affects the accessibility of cancer cells to treatment with adoptive cell therapies. Penetration and action are more difficult for solid tumors. What companies are involved in TCR development, and can you point to some recent scientific milestones? Several companies are working to develop TCRs. The one with the most data and a product closest to market is Adaptimmune. Most of these companies use engineered class 1 TCRs that target a common range of antigens. Only Kite and Zelluna are developing class 2 TCRs derived from patients who have been vaccinated with cancer antigens, and only Zelluna has unique targets in the pipeline. What’s ahead for the near (and not so near) future? What the field can expect to see in the near future is emergence of more data supporting the use of adoptive cell therapies — both CAR and TCR — to benefit patients with both liquid and solid cancers. As we move further into the future, we will see optimization of manufacturing methods, delivery, and use of these products to deliver more efficacy, value, and comfort to patients. One aspect that will be important to all these adoptive approaches is the rapid availability of cost-effective and consistently manufactured cell therapy products. The vast majority of companies involved in developing such products are exploring ways to deliver them “off-the-shelf” to make them immediately available for patients in need. I am convinced that we will see developments on this front over the next few years. |

A quarter of respondents highlighted “solid-tumor treatments,” which makes sense with CAR T-cell therapies currently focusing on blood cancers. (See the “Interview” box on the right for more discussion. Note that interviewee Miguel Forte recently has moved to a position as chief executive officer of Bone Therapeutics, and his former company has appointed Namir Hassan to replace him.) Also interesting were written responses pointing to allogeneic immunotherapies as the next big thing in cell therapies.

Much talk has focused on reducing the cost of goods (CoG) for CAR-T therapies using automation and analytic technologies, but the prospect of an off-the-shelf CAR-T product would alter those concerns. Large-batch manufacturing would play into economies of scale, and by using technologies that are available and well-established in the antibody industry, allogeneic therapies could recalibrate the sector back to a CoG model that would be more appealing to patients and payers alike.

A number of companies have begun to focus on allogeneic CAR-T therapies: Gilead/Kite is expected to submit an investigational new drug (IND) request for an off-the-shelf product before the end of 2019, and Allogene (with Pfizer backing) already has begun constructing a manufacturing facility for its allogeneic pipeline. Find more details on the BioProcess Insider website — and for more insight, you can download the full Informa Connect report online.

More from Biotech Week Boston

Yescarta 2.0? How Kite Plans to Scale Out CAR-T Therapies: Representatives of CAR-T pioneer Kite Pharma say that scaling-out capabilities, digital technologies, and industry collaboration will be needed to bring cell therapies to maturity.

In 2017, Gilead company Kite Pharma became the second company to achieve US regulatory success for a chimeric antigen receptor (CAR) T-cell therapy. Although sales of Yescarta (axicabtagene ciloleucel) are rising two years on — Q2 2019 saw a 25% quarterly growth to $120 million — the sector itself has stalled somewhat, with just a couple of gene-therapy products joining it and Novartis’s Kymriah (tisagenlecleucel) on the market.

“We are still in the very early stages of the industry,” said Jian Irish (Kite’s senior vice president and global head of manufacturing) at the Cell and Gene Therapy Conference, part of Biotech Week Boston in September 2019.

Irish compared the cell-therapy sector with the well-established small-molecule industry and with the monoclonal antibody (MAb) sector, which has matured considerably over the past 15 years through standardized regulations and processes, productivity ramp-ups, and new technologies.

Figure 1: This illustration adapted from Zelluna Immunotherapy AS of Norway shows the difference between CAR-T and TCR cell therapies (https://www.zelluna.com/technology). Find more information on the company’s website.

“We are still at the bottom of the S-curve, and significant improvements will be required to advance technologies and build economies of scale.” However, she told delegates that increasing interest from developers and investors is moving cell therapies out of the inventing stage. Irish believes that rapid advancement in their performance is likely over the next five to 10 years.

To get there, the industry must comprehend that individualized cell therapies require an operating strategy for economies of scale that will be different from what works for traditional biologics. The manufacturing differences range from taking starting materials directly from patients and the uniqueness of each batch to the necessity of continuous processing (from apheresis to final product) and quality systems to cover the entire process from end to end. Information technology (IT) needs also to differ for cell therapies, which require a chain of custody throughout. Strict timing and scheduling are critical.

One challenge Kite faces is for Yescarta to be the lead cell therapy for hematologic malignancies. However, Irish said that another ambition is to develop cell therapies for solid tumors and establish an allogeneic platform. To do so, Kite is focusing on six areas for scale-up, and she recommended that other developers embrace these as well.

Enabling Patient Access: Kite’s Konnect technology platform was developed to enable commercial-scale logistics and scheduling. It connects IT solutions to track orders electronically across the whole process: from apheresis to manufacturing site and back to patients. The integrated information platform aids patients and physicians in a complex and time-sensitive supply chain.

Scaling Out Geographies and Capabilities: Kite has grown its manufacturing network rapidly since 2016, when it opened a 43,500-ft2 plant in El Segunda, CA. In May 2018, the company opened a 117,000-ft2 facility in Amsterdam, The Netherlands, to support production in Europe. In early 2019, Kite laid plans to construct a facility in Frederick County, MD, which is expected to begin commercial production by late 2021. Then in July, it announced that a 67,000-ft2 viral-vector facility would be built within its parent company Gilead’s site in Oceanside, CA.

Close Collaboration with Healthcare Providers (HCPs): “We actively collaborate to better understand patient needs,” said Irish. She explained that it is critical to ensuring fast turnaround for treating patients and making sure that providers understand the complexities of the cell products compared with more traditional therapies. She added that HCPs are keen to see the cell therapy landscape evolve and mature if that will decrease costs and prices.

Operational Efficiencies: Continuing improvements will provide scale and technology opportunities. Kite has been pushing for greater visibility with HCPs and simplified delivery of information while working to combine incremental improvements with new technologies for creating an Industry 4.0 foundation. Irish said that will require bringing together manufacturing process automation with digital workforce planning and operations visibility.

Digital and Industry 4.0 Capabilities: Automation and closed systems are key, she continued, addressing many challenges in manufacturing and reducing the potential for human error. Kite also is working on “tangible opportunities to connect with real-time data to synchronize end-to-end activities.”

Industry Collaborations: Kite cannot do all that itself, and Irish said that a cell therapy “ecosystem” is needed to speed up advances in the sector. Companies can work together to set up educational and training institutions, create standards, and develop technologies. “We must make wise decisions and invest in technology to move up the S-curve,” said Irish. “It will require the entire industry to come up with solutions and establish regulatory standards.”

Based in Montpellier, France, Dan Stanton is editor of BioProcess Insider. Contact him at [email protected], or follow him on Twitter: @Dan5tanton. This article combines two pieces that originally appeared online at https://bioprocessintl.com/category/bioprocess-insider in the fall of 2019.

You May Also Like