Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

March 14, 2019

The “biopharmaceutical ecosystem” is a multibillion-dollar industry that encompasses large and small drug companies; ancillary providers of services, technologies, equipment, and infrastructure support; and tertiary groups that provide policy direction, regulatory standards, incubator space, and more. This ecosystem is vast and dynamic, evolving constantly as new ideas take hold to push the industry in new directions and present new opportunities for innovation and commercialization.

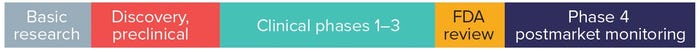

Figure 1: The biopharmaceutical development pipeline

However, many companies operating within this ecosystem struggle to understand their development and commercialization strategies, and many are developing “me-too” or “follow-on” products that lack differentiation and competitive advantage. On the other hand, some organizations possess breakthrough products or technologies but struggle to make themselves heard and differentiate their offerings among thousands of other vendors and suppliers in the marketplace. Here, I offer an overview of business opportunities within the ecosystem along with frameworks that should be useful for building commercialization strategies.

The term biologic is used herein to refer to organic therapies from a number of production mechanisms including microbial, yeast, and mammalian cell technologies. Classical “small-molecule” pharmaceutical products have a distinct chemical composition and are manufactured using chemical raw-materials. Over the past decade or so, the term biopharma has emerged to describe the results of industry consolidations in which large pharmaceutical organizations have either acquired or merged with biotechnology companies.

Biologic Development Pipeline

The complete biologic development pipeline (Figure 1) starts with basic research and terminates with approved and commercialized biologics that undergo postmarket monitoring. This pipeline spans 10–15 years, and development of a successful candidate can cost an average of US$1.4 billion (1). Many companies consider the pipeline to begin with preclinical or phase 1 clinical trials. However, it starts with basic research: the process of learning more about the world and filling in gaps in our knowledge related to diseases and treatments. Thanks to the US Food and Drug Administration (FDA) — the agency that reviews and approves biologic license applications (BLAs) — we have clear definitions of the subsequent phases in the pipeline.

Drug Discovery: Basic biologic discovery is the process of narrowing thousands of potential targets to a handful of prospective therapeutic targets of interest that could help reverse or stop progression of disease. Researchers generate insights that help them identify new technologies or new uses for existing technologies.

Preclinical Research: As research progresses, scientists work to further narrow the list of potential target molecules. Critical parameters they must consider are dosage requirements and toxicity. Note that the latter is less a concern for biologics than for classical synthetic drugs.

Preclinical Development: As promising molecules progress through the pipeline, more information is required to understand their mechanics. Those include how a molecule is absorbed, distributed, metabolized, and excreted (ADME); its benefits and mechanisms of action (MoA); appropriate dosages and administration methods; and affects, interactions, and effectiveness relative to other drugs.

Clinical Trials (Phases 1–3): To help a developer understand the effects of a given biologic on humans, the drug candidate will enter clinical trials with a small population (typically 20–100 volunteers for a phase 1 study) and progress to testing in several hundred (phase 2) and finally several thousand people (phase 3).

Regulatory Review: The process of reviewing clinical data and chemistry, manufacturing, and controls information submitted to regulatory bodies takes time.

Postmarket Approval Safety Monitoring (Phase 4):Once a molecule has been approved for commercialization, it requires ongoing monitoring to ensure safety and efficacy across a growing user-group population.

Biopharmaceutical Industry Overview

The time and money required for a biologic candidate to progress from drug discovery to approval provides a wealth of opportunities for suppliers of technology, equipment, consumables, and services. This fact has been documented in several economic-impact studies. For example, a 2016 PhRMA report indicates that the US biopharma sector represents 4.8 million jobs— but that only 803,000 workers are directly while another 3.9 million workers are indirectly employed by drug companies (2). That gives the sector a jobs multiplier of 1:5. And there are no indications of the biopharmaceutical industry slowing down. More than 200 biologics have been approved — and another 7,000 targets are currently in clinical development. Additionally, the pipeline is expected to remain strong as investments in global R&D funding continue to grow at 3.8% yearly (almost a third of which is spent on supplies and consumables) according to one report (3).

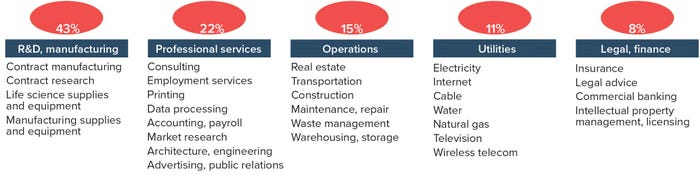

Figure 2: “BioPharma-adjacent” aspects of the biopharmaceutical ecosystem

Biopharmaceutical Ecosystem

As exemplified by the jobs figures quoted above, the biopharmaceutical industry does not operate in a vacuum — far from it. It is an interdependent web of partnerships and suppliers that operate within an “ecosystem.” As companies such as Novartis, Amgen, and Sanofi pull the industry forward with their latest discoveries and/or therapeutics, they rely on suppliers providing equipment, consumables, services, and technology. Based on the 2016 PhRMA results (2), at least 30 major sectors contribute indirectly to the biologics pipeline. These “biopharma-adjacent” industries have been categorized into five groups: R&D and manufacturing, professional services, operations, utilities, and legal/finance (Figure 2).

The R&D and manufacturing category includes contract research and manufacturing organizations (CROs, CMOs) as well as companies selling equipment and consumables for manufacturing, research, and development processes. Professional services include firms that provide consulting, advertising, public relations, accounting, employment services, and so on. Operational companies serving the biopharmaceutical industry provide real-estate support, transportation/shipping, construction, waste management, and warehouse/storage support. Utilities include electricity, water, Internet, cable, wireless telecommunications, and television services. Finally, the legal/finance group includes insurance, commercial banking, and intellectual property (IP) management and licensing services.

In addition to those biopharma adjacent companies selling goods and services that support the biologics pipeline, a tertiary level of “biopharma influencers” creates the policy framework for job creation, physical infrastructure, opportunities for collaboration, and innovation funding. Examples of such groups — whether public or private entities — include the following:

Countries that compete to attract economic dollars and jobs

States that compete for economic dollars and jobs

Incubators that compete for occupants

Biotechnology clusters that see the inherent benefit of collocating to drive innovation and fuel ideas

Universities that seek to attract top talent to enhance their reputation and drive attendance

Member organizations and consortia that lobby and advocate on behalf of their members, helping to drive policy initiatives.

Together, the biopharmaceutical companies, biopharma-adjacent industries, and biopharma influencers all combine to create the biopharmaceutical ecosystem.

HTTP://STOCK.ADOBE.COM

Opportunities in the Biopharmaceutical Ecosystem

Tremendous opportunities exist within this ecosystem. However, to understand what those might be, it is important first to describe the dynamic state of the ecosystem itself. It does not exist in a “two-dimensional” static environment at one point in time, but rather in a four-dimensional plane propelled forward in time as it constantly evolves, grows, and transforms.

To better visualize that, consider the biopharma ecosystem in terms of cosmology’s Big Bang theory. The first biologic emerged from a nebulous cloud of ideas, inspiration, innovation, and energy. When the spark was lit, it created an explosion that began to propel the industry outward in all directions. Ideas and resources from that initial nebula began to condense into organizations that then grew large enough to generate speed and momentum to propel them ever faster outward. Regulatory bodies took a lead role in helping to define policy frameworks to guide those trajectories while suppliers and companies in adjacent markets arose in response to the needs of biopharmaceutical companies.

However, other ideas were slower to reach amalgamation. They stayed closer to the point of ignition and may have gravitated toward one another, merging/consolidating the mass required to gain speed and momentum of their own. To support this process, other influencers took shape: e.g., consortia, clusters, and incubators. All the while, new entities continued to come into existence or merge within this ecosystem in response to changing market conditions and the opportunities they present.

Over time, the ecosystem changes shape and direction as entities on the frontier push boundaries and move into adjacent areas to explore new possibilities, setting the tone for the rest of the industry to follow. On the interior, meanwhile, companies have a long view of the ecosystem. Those “ankle biters” (as they can be known by those on the frontier) are astute at identifying opportunities to go farther. Their efforts also can disrupt the ebb and flow of the ecosystem as a whole, causing it to change speed or direction from within.

This ecosystem would not exist without the visionaries, accidental inventors, and opportunists who help to drive it forward through exploration of new technologies, ideas, and discoveries. Therefore, opportunities abound for companies seeking to operate within the biopharma ecosystem.

Frameworks to Leverage for Technology Commercialization

No prescriptive solution for navigating this dynamic ecosystem exists, but certain frameworks can propel commercial ideas forward and, with correctly timed actions, help accelerate their growth. No matter where a company resides within the ecosystem, nor what product or service it offers, at least three concepts or frameworks can be immensely valuable if understood and applied correctly within the context of the biopharmaceutical ecosystem: technology readiness level (TRL), manufacturing readiness level (MRL), and commercialization.

Technology Readiness Level: During the 1960s, the US National Aeronautics and Space Administration (NASA) developed a novel framework for what is now called the technology readiness level (TRL) benchmark of technologies used for space applications against a standardized scale understood by all people involved in the space program (from engineers to administrators). It was born from a desire to incorporate the latest technologies into space missions while minimizing potential risks that doing so could bring. Since its creation, the TRL concept has been adopted widely by a number of organizations to streamline technology development programs at the European Space Agency, the US Department of Defense, the US Department of Energy, the European Commission, and the oil and gas industry.

Figure 3: Technology readiness levels

The TRL is a nine-point scale (Figure 3) of product development that starts with an idea and progresses through experimentation and environmental testing to successful mission operations. It provides an indication of the maturity level of a given technology (not an indication of the quality) as a standardized approach to assessing new technologies for incorporation into current systems. The progression of technology evaluation from TRL level 5 to level 7 has been termed the “Valley of Death,” when the cost to test a technology in a “relevant environment” (especially for space equipment) proves challenging.

Figure 4: Technology readiness level (TRL) and manufacturing readiness level (MRL) scales in parallel

Other concepts relevant to the TRL scale include systems readiness levels (SRL) and integration readiness levels (IRL) benchmarks. The former measures system-wide readiness, whereas the latter is a measure of a system’s ability to accept and integrate the new technologies (4).

Manufacturing Readiness Level: Building on those concepts, the manufacturing readiness level (MRL) scale measures risk in manufacturing new technologies and moves in parallel with the TRL (5). The 10 MRL levels measure shortfalls in manufacturing as technology progresses across the TRL scale. MRL measurements can enhance an organization’s capabilities to respond to the manufacturing needs of a technology under development.

Commercialization: Although the TRL has received widespread attention and adoption as a scale for innovation, many organizations struggle to bridge the gap between a viable technology and a commercialization strategy that will make that technology successful. Some experts have applied the “valley of death” term (historically the failure to advance product development from a laboratory proof of concept to a working prototype in the field) to that inability to commercialize products or technologies. Others have expanded on the concept of TRL to create a widely interpreted measure of commercial readiness: the commercial readiness level (CRL) scale.

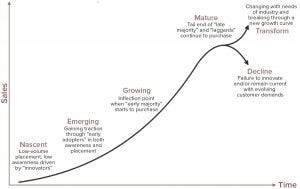

Figure 5: Product/technology growth curve

A “valley of death” does exist in commercial terms, but it may be an inappropriate term to represent those challenges. A company’s inability to accelerate its viable product through widespread adoption is more akin to the “inability to ramp up” the growth curve. Another concept popularized by Geoffrey Moore in the early 1990s (6) was the inability to “cross the chasm.” Both concepts provide a better representation of an organization’s inability to take a technology that has been scored successfully and progressed through the TRL model into buyers’ hands.

The growth curve (Figure 5) often is used to describe the maturity levels of industries, companies, technologies, and products. In this context, companies begin at the bottom left of the curve and, as sales begin to grow, start to gain traction from “emerging” status to the high-growth phase. This curve is useful for assessing rates of growth.

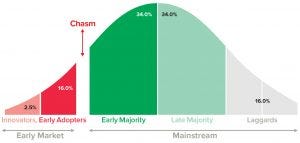

Figure 6: Technology/product adoption and diffusion growth curve

The “crossing the chasm” concept provides a different perspective to the growth curve by offering insights into the customer-adoption process for new and innovative technologies based on consumer buying behaviors. The “chasm” is a precipitous drop-off that occurs when a company fails to capitalize on early wins that have created the momentum that would have allowed it to ramp up further along the growth curve. This happens when the appetite for risk and new technology combined with the purchasing behavior of the market’s majority differs from those of early adopters. The early market (Figure 6) values access to the newest technologies over and above tested/proven technology. By contrast, the majority want to see and hear performance results before making purchasing decisions. They are slightly less risk averse than early adopters are, but most buyers will be willing to adopt a new technology if they see testimonials or positive reviews from others.

Although many business principles, growth charts, matrices, and frameworks exist, I believe that such concepts taken together can provide significant information on an organization’s potential for growth. And when taken together, those described above can provide significant information on each organization’s potential for growth relative to itself. However, commercializing a technology or product requires more than a couple of charts. It requires an ability to detect the changing winds and navigate turbulent waters to capitalize on potential momentum (while avoiding potential headwinds) — and the fortitude to make a decision. For many businesses, following a prescriptive approach to commercialization rarely works. Thus, although a CRL makes sense in principle, it fails to take into account the intellectual computing power, appetite for risk, and wayward decision-making of different business owners and leaders. The analogy of “building the engine while flying the plane” applies to many small businesses, with many of their owners/leaders having the vision to take a risk before all boxes have been checked. A successful commercialization strategy then comes not in having done everything that needs to be done, but rather in knowing what needs to be done in time.

Nonetheless, as I’ve learned from working with many large and small organizations, several factors set apart those companies on the left side of the growth curve relative to those on the right. I view the appetite for risk and ability to move fast as critical strengths of small businesses, but the systems and approaches to commercialization at large businesses also have inherent value. The question becomes how best to balance the strengths of both to propel your company forward.

Rather than building out another form of the CRL, MKA Insights proposes the following framework as a starting point for helping organizations build an organizational strategy for commercialization. As spelled out in the “Commercial Framework” box, this takes into consideration both the cultural elements of smaller businesses and the process approaches of larger organizations.

A Commercial Framework |

Product/Technology Roadmap and Pipeline: What current products are ready for commercialization; what can be modified with little development effort; and what requires more development effort but could generate significant returns? Do you have focus and direction? Can you be led by customers enough to know which direction would be of most value rather than responding to every change suggested? |

Pricing Strategy: What is the cost to develop your product/technology (including fixed and variable costs)? Depending on where you are on the adoption curve, could you offer at-cost or low-cost pricing to drive adoption before changing the pricing strategy with an increase in demand? |

Promotion and Differentiation: What efforts are you engaged in for driving market awareness? What is your content generation strategy? Why should customers care? With so much “noise” in the industry, how do you differentiate yourself relative to competitors? |

Fundraising: Do you have an investor deck? Have you shared succinctly the customer challenge that you are trying to solve? How do investors know about you, and why should they care? Have you used their buy-in to promote to customers? |

Sales: How do you segment the broader market into manageable target categories? Have you identified opportunities for highdollar sales? Could alternative strategies such as distributors, original equipment manufacturers (OEMs, which make things from components provided by other organizations), or other partnerships accelerate your company’s growth? |

Structure As Strategy: What resources — and what divide-and-conquer strategy — are in place to ensure diffusion of effort across your organization? |

Competitive Awareness: Are you aware of your company’s perceptions relative to its peers when it comes to performance, customer service, and technological superiority? How does your pricing compare? Are competitors acquiring/consolidating; launching new products; or aggressively investing in sales, marketing, and/or R&D? How do you remain competitive in a shifting competitive landscape? Has a competitor outpaced your development efforts and beat you to market, and if so, how should you respond? |

Perspective: Perhaps the most important consideration for both small and large businesses is the introduction of an unbiased perspective to help ground their owners/leaders in the reality of the competitive landscape and organizational capabilities. This can help them correct their course as early as possible in the business journey. |

Decision-Making Ability: The ability to make decisions quickly — and at all (that is, to take a chance and accept risk) — are key differentiators between large and small organizations. Nimbleness and urgency at the top driving decision-making and propelling the organization are critical to keeping organizations competitive and innovative. |

Some Examples of High-Impact Approaches

Because the pace of innovation and discovery within the biopharmaceutical ecosystem remains strong, it is nearly impossible to describe all unique and creative opportunities or solutions currently in development. However, certain innovative ideas could make a big impact on this ecosystem.

Research: Bioz, Inc. (Los Altos, CA) is an emerging life-science software company that has developed a proprietary artificial intelligence (AI) platform to search, aggregate, and analyze usage information relative to scientific products, reagents, and services used by academic and biopharmaceutical researchers worldwide. The company generates realtime research insights from 27 million PubMed articles, aggregating on its own website life-science experimentation recommendations for 50,000 vendors and 300 million stock-keeping units (SKUs) as of 19 October 2018. Bioz reports that more than a million lifescience researchers are using its searchengine platform.

Enhancing that platform, the company has developed a proprietary scoring mechanism (“Bioz Stars”) based on an algorithm that reviews several criteria to generate a confidence score from one to 100. Some criteria include product mentions, recency, efficacy, search frequency, and views. The search engine collects real-time user behavior from its website and updates product scoring accordingly. The Bioz Stars have become a trusted rating system used by life-science researchers in making purchasing decisions for tools, equipment, and reagents used in research, development, and manufacturing.

Capitalizing on the momentum and adoption by researchers, the company began to implement its “Bioz Stars” partner program onto vendor websites in 2018. This program places objective scores and supporting data onto vendor and manufacturer websites in the form of a badge. The badges are dynamically generated widgets that vendors add to their own websites, each badge providing a summary snapshot of a given product’s mentions in published scientific articles along with its Bioz Stars score. Currently, 50 companies have integrated these badges onto their websites, with a backlog of vendors requesting such integration. Some adopters include MilliporeSigma, Qiagen, Sciex, and Thermo Fisher Scientific.

A small badge could have a significant impact on the way researchers search for and procure equipment, reagents, consumables, and technologies within the biopharma ecosystem — effectively providing access to information that will allow them to make better decisions, reduce costs and time, and flatten the procurement timeline. Imagine what could happen if Bioz were integrated into procurement systems to help researchers find objective, evidencebased product information within their procurement workflows?

Training: Thomas Jefferson University (Philadelphia, PA) has partnered with Ireland’s National Institute for Biotechnology Research and Training (NIBRT) in Dublin to gain exclusive North American rights to NIBRT’s training curriculum. The Institute is the result of a collaboration among four academic institutions: University College of Dublin, Trinity College Dublin, Dublin City University, and the Institute of Technology–Sligo. Established in 2012, NIBRT’s mission is to provide training and research solutions for biopharmaceutical manufacturing in Ireland (7). It has executed successful partnerships with GE Healthcare, Lilly, Merck, Pfizer, Regeneron, and Thermo Fisher — and it completed just over 19,000 training days for more than 4,000 trainees in 2017.

Similar to NIBRT, Jefferson recognized the need for a more formal training program for bioprocessing professionals after discussions with its close neighbors in the industry. As a result, the university invested in establishing its own Jefferson Institute of Bioprocessing (JIB), which is a 20,000-ft2 training center that will open in May 2019. Initial advisors and partners for this new training center include Bristol-Myers Squibb, Bucks County Community College, GlaxoSmithKline, Janssen, Merck, Montgomery County Community College, NIBRT, the National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL), Shire, West Pharmaceutical, and WuXi.

Through its JIB collaboration, facility, and curriculum, Jefferson is ideally positioned to address one of the largest supply-chain risks to the biopharmaceutical ecosystem — a shortage of trained bioprocessing engineers and technicians in biomanufacturing facilities — and should help speed up the ecosystem’s forward progress.

Insights

It seems like a century ago that Amgen and Genentech developed the first recombinant human erythropoietin. Today we have cancer vaccines, and companies such as Novartis and Kite Pharma (now part of Gilead Sciences) are pushing the boundaries even further by targeting disease on a genetic level. The biopharmaceutical industry is rife with opportunities for large and small companies, for those providing ancillary services, and for those helping to define the policy frameworks and provide educational, infrastructure, and human resources. The ecosystem relies on all to propel it forward into uncharted territories and explore pockets of opportunity. There is much yet to be discovered that presents opportunities for technology exploration and commercial advancement.

Organizations such as Bioz and Jefferson represent just a couple of the ideas and innovations currently taking hold in the industry. Neither ideas nor bright minds are in short supply — but the brilliant minds dreaming up the near-impossible or creatively solving difficult business challenges might need support in understanding the processes or frameworks that can help accelerate discovery and development or commercialize and market the resulting products and solutions. For these individuals venturing into the unknown, a plethora of information and resources is readily available if you know just where to look.

References

1 Briefing: Cost of Developing a New Drug. Tufts Center for the Study of Drug Development: Boston, MA, 18 November 2014; https://csdd.tufts.edu/s/Tufts_CSDD_briefing_on_RD_cost_study_-_Nov_18_2014.pdf.

2 The Biopharmaceutical Industry’s Role in Fueling the Economy and Global Competitiveness. Pharmaceutical Research and Manufacturers of America: Washington, DC, 2018; http://phrma-docs.phrma.org/industryprofile/2018/pdfs/2018_IndustryProfile_BioFuelingEconomy.pdf.

3 2018 Global R&D Funding Forecast. R&D Mag. Winter 2018; https://www.rdmag.com/article/2018/03/2018-global-r-d-funding-forecast-snapshot.

4 Sauser B, et al. A Systems Approach to Expanding the Technology Readiness Level Within Defense Acquisition. Int. J. Defense Acquis. Mgmt. 20 March 2009: 48.

5 OSD Manufacturing Technology Program, Joint Service/Industry MRL Working Group. Manufacturing Readiness Level Deskbook, Version 2.0. US Department of Defense: Arlington, VA, May 2011; http://www.dodmrl.com/MRL_Deskbook_V2.pdf.

6 Moore G. Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers. HarperCollins: New York, NY, 1991.

7 About NIBRT. National Institute for Bioprocessing Research and Training: Dublin, Ireland, accessed 5 February 2019; https://www.nibrt.ie/about.

Kiran Chin, MBA, MSc, is managing partner and chief executive officer at MKA Insights (New York, NY), a strategy consulting firm that works with companies in the biopharma ecosystem to help accelerate growth. She has held strategic leadership roles in bioprocessing and life science organizations and has graduate degrees in business and finance as well as an undergraduate degree in economics. Contact her at [email protected], https://mkainsights.com, or www.linkedin.com/in/kiranchin.

Further Reading |

On technology readiness levels (TRLs) https://mkainsights.com/insights/trl |

On commercialization frameworks https://mkainsights.com/insights/commercialization-frameworks |

On the biopharmaceutical ecosystem https://mkainsights.com/insights/biopharma-ecosystem |

You May Also Like