Content Spotlight

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

According to a report, almost half (44%) of mammalian biomanufacturing capacity will be controlled by contract manufacturers or hybrid firms by 2025, a jump from 32% in 2020.

The paper entitled ‘Supply and Demand Trends: Mammalian Biomanufacturing Industry Overview,’ produced by BioProcess Technology Group BDO, forms part of the CPhI Pharma Annual Report, published ahead of next week’s event in Milan, Italy.

Image by Nick Youngson CC BY-SA 3.0 Alpha Stock Images

The authors Dawn Ecker and Patricia Seymour claim that the projected kilogram quantities of product needed to meet annual commercial and clinical demand for all products produced using mammalian production systems will jump from just over 32 metric tons in 2020 to nearly 64 metric tons in 2025, as more products move through the development process and receive commercial approval. (This figure does not include COVID-19-related products, which the authors say follow a different algorithm).

Industry is gearing up to cater for this with BDO estimating global mammalian biomanufacturing capacity to reach close to 7,500 kL by 2025 – a jump of 30% on 2020’s estimated capacity of 5,200 kL.

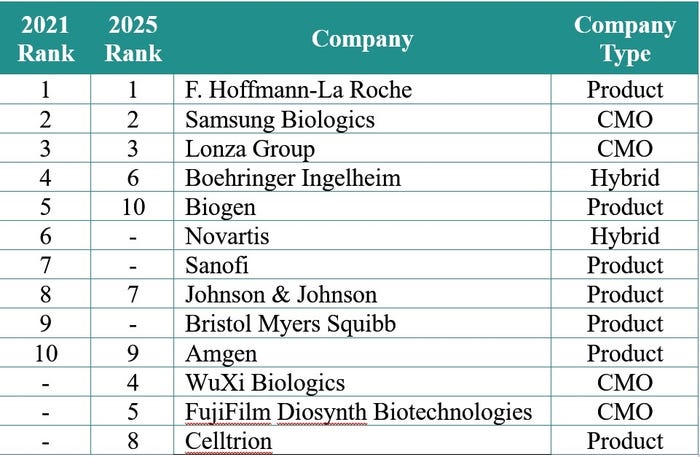

Capacity has never been equitably available to industry as historically product developers have invested in inhouse capabilities to service their own pipelines. Outsourcing is a normalized strategy in the industry but still the likes of Roche, Novartis, Sanofi and Biogen – along with hybrid sponsor-CMO firms like Boehringer Ingelheim – have held the bulk of the global manufacturing capacity.

“Currently, nearly 60% of the capacity is controlled by ten companies,” say Ecker and Seymour. Furthermore, sponsors control nearly 70% of the installed mammalian cell culture capacity.

But while the top 10 will not change dramatically by 2025, substantial capacity investments from contract development and manufacturing organizations (CDMOs) WuXi Biologics (see here) and FujiFilm Diosynth Biotechnologies (see here) will shift the dynamic, pushing the distribution of capacity for product companies down to 56% in 2025.

By 2025 the amount of mammalian capacity available will be sufficient to feed the demand for products according to BDO’s modeling, based on the most probable scenarios and including estimations for therapies being developed for certain large patient population indications such as Alzheimer’s disease.

However, “should several of these large-demand products obtain regulatory approval and adequate reimbursement by healthcare oversight organizations or become part of a managed entry agreement between a company and public payer of a social or national health insurance system, a significant increase in demand for manufacturing capacity could occur potentially leading to a capacity shortage,” the authors warn.

“Conversely, there are other manufacturing trends which could result in a decrease in demand for some biopharmaceutical manufacturing capacity. Among these are the industry’s increased focus on orphan indications, a shift from full length naked antibodies to alternative antibody formats and more potent products (e.g., antibody drug conjugates (ADCs) or bispecific antibodies) which would require lower doses and therefore less manufacturing capacity.”

You May Also Like