Content Spotlight

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

CAR-T pioneer Kite Pharma says scaling out capabilities, embracing digital technologies, and industry collaboration are among the efforts needed to bring cell therapies to maturity.

In 2017, Gilead company Kite Pharma became the second company to achieve US regulatory success for a chimeric antigen receptor (CAR) T-cell therapy. Two years on, and while sales of the product Yescarta (axicabtagene ciloleucel) are rising – Q2 2019 saw a 25% quarterly growth to $120 million –the sector itself has somewhat stalled with just a couple of gene therapy products joining Yescarta and Novartis’s Kymriah (tisagenlecleucel) within the cell and gene therapy space.

“We are still in the very early stages of the industry,” Jian Irish, SVP and global head of manufacturing at Kite said at the Cell and Gene Therapy Conference, part of Biotech Week Boston.

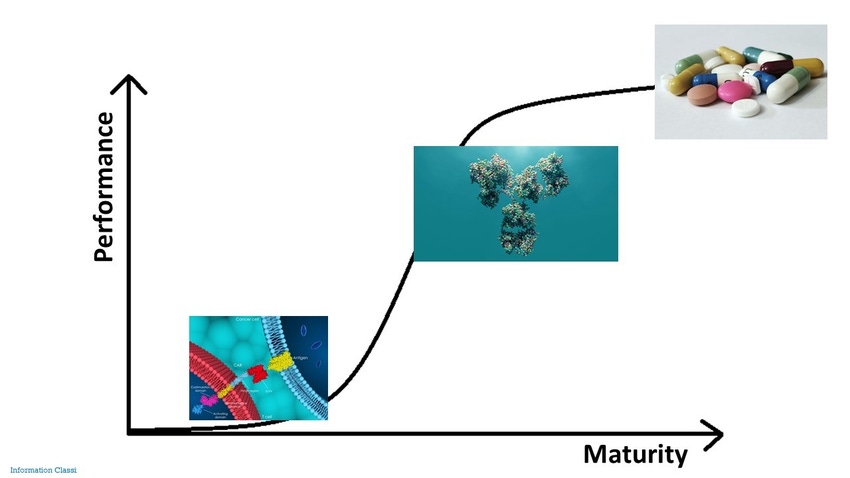

Can CAR-T move up the S-curve to maturity?

She compared the cell therapy sector with the well-established small molecule space and the monoclonal antibody space, which has considerably matured over the past 15 years through standardized regulations and processes, productivity ramp-ups, and new technologies.

“We are still at the bottom of the S-curve and significant improvements will be required to advance technologies and build economies of scale.”

However, Irish told delegates with increasing interest from developers and investors cell therapies are moving out of the inventing stage and it is likely there will be rapid advancement in their performance over the next five to 10 years.

But to do this, industry must comprehend that individualized cell therapies require a different operating strategy for economies of scale than traditional biologics.

The manufacturing difference range from taking the starting material direct from the patient and the uniqueness of each batch, to the necessity for continuous processing from apheresis to final product and quality systems to cover the entire end-to-end process. Meanwhile information flow needs differ for cell therapies as they require a chain of custody throughout the process, and timing and scheduling are critical for the supply chain.

One of the challenges Kite is rising to is for Yescarta to be the lead cell therapy for hematologic malignancies. However, Kite’s ambition also looks to developing cell therapies for solid tumors and establishing an allogeneic, off-the-shelf, platform, Irish said.

To do this, Kite has highlighted six areas it is focusing on for scale-up, which Irish said others in the space should embrace:

Enabling patient access: Kite’s Konnect technology platform has been developed to enable commercial-scale logistics and scheduling, connecting IT solutions to track orders electronically across the whole process, from apheresis to the manufacturing site, and back to the patient again. The integrated information platform aids patients and physicians in what is a complex and time sensitive supply chain.

Scaling out geographies and capabilities: Kite has rapidly grown its manufacturing network since opening its 43,500 square-foot plant in El Segunda, Santa Monica (California) in 2016. In May 2018, the firm opened a 117,000 square-foot facility in Amsterdam, The Netherlands to support production in Europe. And so far this year, Kite has laid plans to construct a facility in Frederick County, Maryland expected to begin commercial production by late 2021, while in July it was announced a 67,000 square-foot facility will be built within Gilead’s site in Oceanside, California to supply viral vectors.

Close collaboration with healthcare providers (HCPs): “We actively collaborate with healthcare providers to better understand patient needs,” said Irish, explaining that it is critical to ensure a fast turnaround to treat patients and to make sure providers understand the complexities of the products compared with more traditional therapies. She added HCPs are also keen to evolve the cell therapy landscape as once it has matured the costs and prices will decrease.

Operational efficiencies: Continued improvements will enable scale and technology opportunities. From an information flow, Kite has been pushing for greater visibility with HCPs and simplified delivery, while operationally the firm has been working on combining incremental improvements with new technologies to create an Industry 4.0 foundation. This, Irish explained, will involve bringing together manufacturing process automation with digital workforce planning and operations visibility.

Digital and Industry 4.0 capabilities: Automation and closed systems are key, she continued, addressing many challenges in manufacturing and reducing the potential for human error. Kite is also working on “tangible opportunities to connect with real-time data to synchronize end-to-end activities,” she said.

Industry collaboration: Finally, Kite cannot do all this itself, and Irish said the cell therapy “ecosystem” will have to collaborate to speed up advances in the space. This will involve setting up educational and training institutions, creating standards, and partnering on technologies. “We must make wise decisions in investing in technology to move up the S-curve. It will require, however, the entire industry to come up with solutions and establish regulatory standards.”

You May Also Like