China's New Five-Year Plan

June 1, 2011

In October 2010, the Communist Party of China’s Central Committee approved its 12th Five-Year Plan for National Economic and Social Development (FYP) (2011–2015), which it ratified on 14 March 2011. During those five years, China will continue to focus on government-guided economic development, industry, and technology. The FYP outlines the government’s commitment toward reforming its economy and increasing its domestic consumption to decrease its dependence on exports for future growth of its gross domestic product (GDP). Other initiatives include closing the income gap by increasing minimum wages, protecting the environment, and changing its cost structure through tax increase, all likely to significantly affect its current biopharmaceutical industry (1).

State of the Industry

Although China’s economy is the second largest in the world, its biologics industry is only 20 years old and occupies only a small fraction of the international market. Nonetheless, its rapid growth is undeniable. The National Development and Reform Commission of the People’s Republic of China (NDRC) has predicted that the total output value of China’s pharmaceutical and medical industry will reach about $236 billion in 2011, which is an increase of 24% over the value in 2010 (2).

According to one report, China’s pharmaceutical industry overall will grow at an annual rate of more than 20% during the 2011–2015 FYP, and by 2015 the top 100 pharmaceutical (small-molecule drugs and biologics) companies in China are expected to make up >40% of the industry’s total. As of the time of printing, NDRC plans to detail its new policy on biopharmaceutical development before June 2011 (3).

Figure 1: ()

China holds a large market for biosimilars and biobetters, but every drug must undergo clinical trials and registration. Scott Wheelwright is president of WZE Management Consulting Company. His firm helps companies in China with project management and comply with good manufacturing practice (GMP). Wheelwright says domestic growth of the Chinese pharmaceutical industry last year was 25%, and both the national and local governments as well as private sources are investing in support.

INNOVATION SCORECARD

Scientific American recently ranked the countries of the world according to several factors for their capacity to support biotechnology innovation. The author ranked each country on a scale of 1–10 for several criteria. By comparison, the top final score(s) were 37 for the United States; 29 for Canada; 28 for Sweden; 27 for Denmark, Finland, and Israel; 26 for France, Iceland, The Netherlands, and Switzerland; and 25 for Belgium, Ireland, the United Kingdom.

Intellectual Property Protection: 6.39

Intensity of Biotech Activity: 0.14

Enterprise Support: 3.95

Education/Workforce: 0.42

Foundations for Biotech Innovation: 3.56

Final Score: 14

SOURCE: FRIEDMAN Y. AGLOBAL BIOTECHNOLOGYSURVEY — WORLDVIEWSCORECARD. SCIENTIFIC AMERICAN WORLDVIEW 2011; WWW.SAWORLDVIEW.COM/WORLDVIEW-SCORECARD.

Although Chinese companies (both international and domestic) are active in all stages of biologics development, most R&D is conducted on contract to international firms. “Chinese pharmaceutical companies have not been successful at developing new pharmaceuticals,” says Wheelwright. Strengthening basic research in R&D and innovation (shifting from a “made in China” platform to a “designed in China” position) is a key objective for the new FYP (4).

The biologics industry in the Asia–Pacific regions is expanding, but “the real growth is in China and India, with the growth in China probably triple the growth in India,” says Ames Gross, president of Pacific Bridge Medical. Contract research organization (CRO) businesses will grow because the number of clinical trials in China is expected to increase as more global trials include patients from India and China. Major drug companies are setting up R&D work in China, and people are demanding better medical products and better care as technologies in China become more advanced.

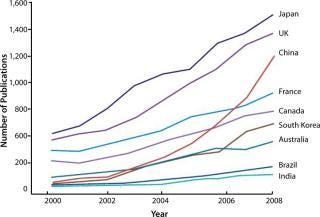

A skilled workforce and strong government support in application-oriented research have helped raise China’s activity in regenerative medicine: stem cells, gene therapy, and tissue engineering. The country approved the world’s first two gene therapies (although questions regarding their efficacy remain), and it is the world’s fifth largest publisher of stem-cell articles (Figure 1). China continues to build capacity for these therapies but struggles in addressing international criticism about their lack of scientific evidence for safety and efficacy and concerns over regulatory issues. Besides regenerative medicine, other targeted areas in the new FYP include technologies in functional genomics, proteins, stem cells and therapeutic cloning, genetic engineering drugs, vaccines and gene therapy, and nano-biotechnology and nanodrugs (5).

Figure 1: Adapted from Reference 5, with permission from DS McMahon. ()

FYP Challenges

Problems delaying economic growth include lack of a national development strategy, generally small enterprise scales, low R&D commercialization rate, poor financing, small state investment in R&D, and poor protection of intellectual property (IP) (6). During the new FYP period, China’s biomedical industry will need to focus on improving its market accessibility, quality control management, GMP compliance, and IP protection.

QUICK FACTS

Population: ~1.3 billion (global ranking: 1st)

Major Cities: Shanghai, Beijing (capital), Chongqing, Shenzhen, Guangzhou

Languages: Standard Chinese, Mandarin, Yue, Wu, Minbei, Minnan, Xiang, Gan, Hakka dialects, Mongolian, Uighur, Tibetan

Literacy: 92%

Doctoral Students: ~43,000 (in 2008)

Natural Hazards: Typhoons, floods, tsunamis, earthquakes, droughts, volcanoes

Business

Labor Force: 780 million (global ranking: 1st); 9.6% agriculture, 46.8% industry, 43.6% services

r>Major Industries: agriculture, mining and ore processing, textile, chemicals, consumer goods, telecommunications

Exports: $1.5 trillion; 20% United States, 12% Hong Kong, 8.3% Japan, 4.5% South Korea, 4.3% Germany

Imports: $1.3 trillion; 12.3% Japan, 10% Hong Kong, 9% South Korea, 7.7% United States; 6.8% Taiwan, 5.5% Germany

Internet: 15.251 million hosts (global rank: 6th); 389 million users (global rank: 1st)

Biotechnology

R&D Tax Subsidies: ~14¢/US$ spent

Biopharmaceutical Sales Revenue: ~US$13 billion (2009)

Approved Biotech Drugs: recombinant cytokines, therapeutic antibodies, recombinant vaccines, gene therapy, H5N1 vaccines (domestic market only)

Industry Organizations:

Chinese Biopharmaceutical Association USA, PO Box 61362, Potomac, MD 20859-1362

China Medicinal Biotech Association, 010-62115986, fax 010-62115976; www.cmba.org.cn; [email protected]

Related Government Agencies:

State Food and Drug Administration, 26 Xuanwumen Xidajie, Beijing, 100053, P.R. China, fax 86-010-68310909, [email protected]; www.sfda.gov.cn

Ministry of Health, No.1 Xizhimenwai Nanlu, Xicheng District, Beijing, China 100044; 86-10 6879-4049; fax 86-10 6831-3669; [email protected]; www.moh.gov.cn/ (no English version)

SOURCE: CIAWORLD FACT BOOK; SCIENTIFIC AMERICAN WORLD VIEW 2011

Entering the market. For the most part, Chinese pharmaceutical distribution is local. Part of the FYP goals are to restructure and rebalance the economy to allow for growth. Still, there have been tense instances with international trade partners. For example, in March 2011 a delegation from several pharmaceutical companies in India visited Beijing to “express their eagerness” in getting into the Chinese market. However, they voiced concerns over the time-consuming and “arduous” process. Avik Pharmaceutical managing director Anant Thakore said it would take up to three years for an Indian medicine to be approved in China, even with appropriate documentation on file. In addition, companies would still need to conduct clinical trials even if previous trials were approved by US and European regulators. The high costs for such filings would be a great disincentive for companies (7).

Quality Control: Chinese biopharmaceutical companies can expect to benefit from tighter standards for quality control. The State Food and Drug Administration (SFDA), China’s regulatory agency, plans to release a draft outlining quality standards that should eliminate unqualified manufacturers. Liu Zhenxian, managing director of the nonprofit, R&D-focused Pharmaceutical Association Committee, said industry development in China has been hindered by companies choosing lower prices over better quality, resulting in quality management systems falling short of international standards. As Liu told the Global Times, “By 2012, there will be $1.39 trillion worth of medicines that have lost patent protection. This could be a great opportunity for Chinese generic drug producers. However, we should first produce quality generic drugs and then put more into research and development for new drugs” (8).

GMP Compliance: SFDA this year raised GMP standards and plans to eventually raise them to meet international levels. “This is a real challenge for many of the older pharmaceutical companies in China, which as a consequence will probably go out of business,” says Wheelwright. He says that although currently no plants in China that manufacture finished pharmaceuticals for export to the United States have been inspected by and approved by the United States, plans are in the works. “No CMOs have GMP plants in China at this time, because they have not been built yet. It’s just a matter of time, and several are under construction. A number of biopharmaceutical companies in China are developing novel products for the international market and are building CGMP manufacturing companies to meet SFDA, US FDA, and EMA standards.”

IP Protection: Both international and domestic companies in China are hoping the 2011–2015 FYP will address concerns with IP laws. China is a member of World Trade Organization, which means the government has a commitment to uphold IP rights — and some infringements of Chinese patents have resulted in company shutdowns. “But that is the key,” says Wheelwright, “It’s a Chinese patent, and the patent laws in China are somewhat different than in the United States. So patents that have stood up in the US or in Europe have sometimes not stood up as well in China. That said, there are several contract organizations that are capable of doing full GLP studies that meet US and European standards, and those companies have very good records and very good IP protection for their clients.”

Business Strategies

Most of the business in China stays in its domestic market. “The domestic growth of the industry is so fast that China has not had the capacity to focus on exports,” says Wheelwright. Growth has been driven by an increased standard of living among the Chinese, who pay for the drugs themselves — even expensive imported oncology drugs. One disincentive for companies to set up business in China is the government’s pressure to reduce prices because for the most part it administers and pays for healthcare. The government is developing plan to try to cover everyone’s healthcare needs, but also to restrict price increases and the prices paid for pharmaceuticals.

According to Wheelwright, the first and the real difference between China and other countries is that the government, especially local administrations, is always a partner in every business. “I collect business cards everywhere I go. As for business cards in China, half of them are government personnel. Nowhere else in the world is that the case. So it’s important to have good relationships with the government. The government offers many incentives, so you should never come to China without investigating the alternative government incentives and working with someone who can negotiate the best incentive for your company.”

About the Author

Author Details

Maribel Rios is managing editor of BioProcess International; [email protected]

REFERENCES

1.) 2010.China’s 12th Five-Year Plan: How It Actually Works and What’s in Store for the Next Five Years, Apco Worldwide, Beijing.

2.) 2011.China’s Pharmaceutical and Medical Industry to Reach 1.55 Trillion Yuan of Total Output Value in 2011 Global Times.

3.) 2011.China Weighs New Policy on Pharmaceutical Industry Asia Today.

4.) 2011.Biopharmceutical R&D Becomes Future Orientation of Pharmaceutical EnterprisesUptoday China Market News.

5.) McMahon, DS. 2010. Cultivating Regenerative Medicine Innovation in China. Regen. Med. 5:35-44.

6.) 2010. China’s 12th Five-Year Plan: Prospects on Major Industries.

7.) Feig, L.

2011.Indian Companies Look At Chinese PharmaGlobal Times.

8.) Fei, L. 2010.Quality to Be Focus of Pharma Global Times.

You May Also Like