Biomanufacturing capacity: 45% growth but new blockbusters could leave shortageBiomanufacturing capacity: 45% growth but new blockbusters could leave shortage

Biomanufacturing volumes are set to increase by 45% to 6,400 kL over five years. But the potential arrival of MAbs could lead to a shortage in capacity.

Biomanufacturing volumes are set to increase by 45% to 6,400 kL over five years. But with demand growing at over 10% per year and the potential arrival of Alzheimer’s MAbs, there may still be a shortage in capacity.

In a report published in conjunction with the CPhI Worldwide meeting in Frankfurt, Germany this week, Dawn Ecker, director of bioTRAK Database Services, BioProcess Technology Group, BDO, spoke of the current capacity availability within the biologics industry and potential restraints in the next few years.

According to her research, capacity for mammalian cell culture supply stood at 4,400,000 L in 2018 but is predicted to grow to around 6,400,000 L by 2023, representing a difference of 45%, or an annual growth rate of 8%.

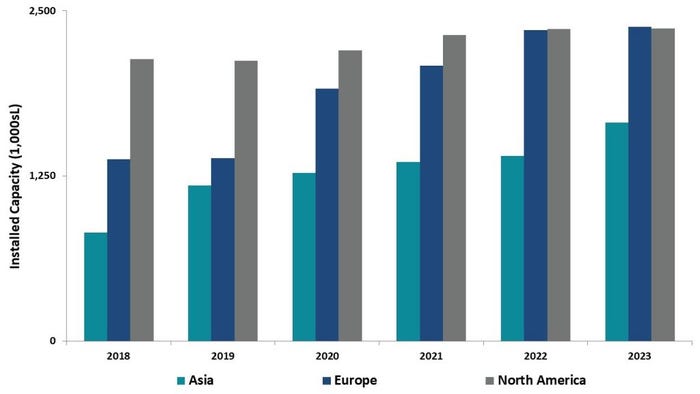

North America currently holds the majority of manufacturing capabilities – roughly half the world’s bioreactor capacity – but over the next five years the region is set to stagnate in terms of growth while Europe and Asia catch up.

According to Ecker, Europe and Asia are seeing surges in new capacity installation (think WuXi, Celltrion, Lonza investments).

“By 2023, with significant growth rates projected in Asia (~9%) and Europe (nearly 15%), North America and Europe will have equivalent capacity,” Ecker says. “The capacity growth in these areas, particularly in Korea and Singapore as well as Ireland, are likely due to government incentives and tax advantages, among other factors.”

Geographic Distribution of Capacity. Graph c/o Dawn Ecker, BDO.

Demand and supply

Under current estimates, such levels of capacity inhouse and available to the industry from contract development and manufacturing organizations (CDMOs) should satisfy industry’s volume demands, she added.

“In 2018, the annual volumetric requirements were just over 2,500 kL, while in 2023, the volumetric requirement is projected to be just over 4,200 kL, a 5-year growth rate of 11%.”

However, these estimates are based on “the mostly probable scenarios,” Ecker says. If there are significant developments in biologics for indications such as Alzheimer’s disease or broad cancer treatments like PDL/PDL-1 checkpoint inhibitors, this could all change. The approval of these types of products could spark a new spate of ‘blockbuster’ drugs that would require much higher levels of manufacturing capacity.

If several “large-demand products obtain regulatory approval and adequate reimbursement by healthcare oversight organizations or become part of a managed entry agreement between a company and public payer of a social or national health insurance system, a significant increase in demand for manufacturing capacity could occur potentially leading to a serious capacity shortage,” Ecker states.

Approved biologics for diseases such as Alzheimer’s Disease, Parkinson’s Disease, Diabetes, and some coronary heart disease or atherosclerosis products, are projected to require volumes of over 750 kg per year, she adds.

While the validity of approval and demand prophecies lie in the hand of regulatory bodies and healthcare systems, Biogen recently stepped closer to bringing a potential Alzheimer’s disease monoclonal antibody to fruition.

The firm announced plans last month to seek US Food and Drug Administration (FDA) approval for its previously ‘discontinued’ Alzhemier’s disease drug aducanumab. The MAb targets a protein called beta-amyloid that is thought – by some – to play a role in Alzheimer’s disease progression.

Bioprocess Insider editor Dan Stanton will be talking about Ecker’s predictions along with reports on China’s biologics boom and developments in the cell and gene therapy space as part of a media panel at CPhI on Tuesday.

About the Author

You May Also Like

schedl_b_and_w.jpg?width=100&auto=webp&quality=80&disable=upscale)

schedl_b_and_w.jpg?width=400&auto=webp&quality=80&disable=upscale)