September 2017 Featured Report

Rearchers are working on next-generation therapies to achieve targets not possible with traditional biologics. (WWW.IMMUNOGEN.COM)

According to a 2017 industry report, 74% of biopharmaceuticals currently in development (phase 1–3) are possible first-in-class medicines (those that use a unique mechanism of action), thus representing a potential new pharmacological class of treatment (

1

). They include regenerative medicines, conjugated monoclonal antibodies (MAbs), and DNA and RNA therapeutics. Some emerging therapies — such as antibody–drug conjugates (ADCs) and biobetters — have been more at the forefront of discussions than others, but all are poised to bring exciting changes to patient care. Authors and experts in this report discuss how meeting and optimizing specific process needs for those products will be imperative to keep pace with innovation.

Manufacturing processes for traditional biologics such as traditional (full-length) antibodies and vaccines are well established in most cases, but emergi...

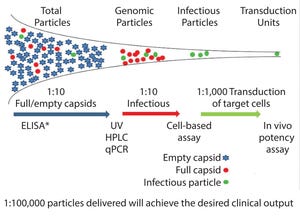

Figure 1: Vector heterogeneity * ELISA determines total particles. qPCR determines empty particles.

After many years of development, gene therapy is beginning to deliver on its promises in the clinic, in some cases with spectacular outputs. Those clinical successes also have led to an influx of funding and engagement from large pharmaceutical companies, thereby bringing the required financial support and expertise for late-stage clinical developments and product commercialization. Although many initial studies were confined to small patient groups and focused on a range of rare monogenetic diseases, new approaches to gene editing have significantly broadened potential use of adenoassociated virus (AAV) mediated gene therapy to a broader range of therapeutic applications, specifically in immunotherapy.

Consequently, process development groups and manufacturers now are faced with the transition of such products into licensed clinical products that are available, safe, and affordable to broader patients grou...

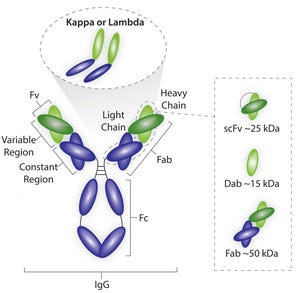

Figure 1: Average sizes of fragment antigen-binding (Fab), single-doman antibody (dAb), and single-chain FV (scFV) antibody fragments

Although the number of bispecific antibodies approved so far (two) and antibody fragments either approved or with an investigational new drug (IND) filed (∼20, both antigen-binding and variable) are far below the number of approved and candidate monoclonal antibodies (MAbs), research in both fragments and bispecifics continues to look promising. And as Jonathan Royce, business leader for chromatography resins at GE Healthcare, discusses here, both offer specific therapeutic advantages over MAbs. But manufacturers should be aware that their diverse structures will require specific processing strategies.

(Editor’s note: The statements made here are solely the thoughts and opinions of Jonathan Royce and may not necessarily be those of GE Healthcare.)

Research and Technologies

BPI:

Antibody fragment therapies have been a part of the industry for a while, yet there not a lot of...

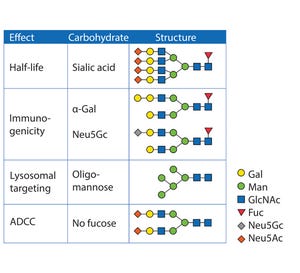

Figure 1: Innovator products and their biosimilar and biobetter variants

The pipelines of pharmaceutical companies are full of biological drugs. Many of them are innovative therapeutic proteins, but a growing number represent biosimilars and biobetters (Figure 1) (

1

). Biobetters typically are defined as being “based on innovative biologics but with improved properties” (

2

). Their development benefits from known therapeutic approaches and mechanisms of action resulting in low risk, fast paths to the clinic and thus lower costs. Superiority is achieved through extended half-life (

t

1/2

), improved efficacy, and reduced immunogenicity or toxicity (

3

). Some desirable improvements such as enhanced pharmacokinetics can be obtained by genetically connecting additional domains to the protein of interest (

4

). For instance, several half-life improved fusion proteins recently have received market approval as biobetters for coagulation factor IX (FIX) or glucagon-like peptide 1 (GLP-1) (Table 1).

Table 1: Ap...

photo WWW.IMMUNOGEN.COM

As a major class of emerging therapies, antibody-drug conjugates (ADCs) already have gained the attention of biopharmaceutical researchers and manufacturers because they combine both the precision of monoclonal antibodies and the potency of highly potent drug compounds. A few ADCs already have entered the market, but many more candidates are progressing through industry pipelines. Platform processes are not yet universal (and it remains to be seen whether they ever will be), but major ADC developers are establishing their own with significant success. I spoke with Thomas Ryll, head of technical operations at ImmunoGen, to discuss his company’s current work in ADCs, its approach to harnessing innovation to develop products, the progress of ADCs in the industry, and his perspective of their future potential with immuno-oncology.

Current Work

BPI:

Would you review ImmunoGen’s work on ADCs?

Thomas Ryll, head of technical operations at ImmunoGen

Ryll:

ADCs came to the forefront in the...