Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

September 30, 2021

Sponsored by Corning

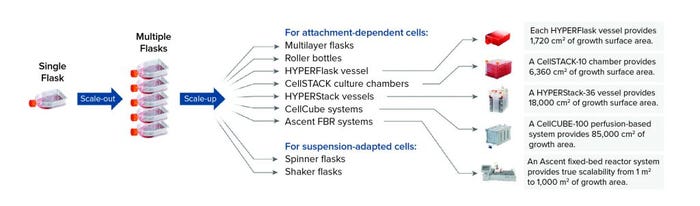

When considering strategies for expanding the number of cells being grown to support cell therapy development, companies often focus on decisions regarding scale-up and scale-out: increasing capacity either by using larger vessels to increase production volume or by implementing more units of the same vessel, respectively. Complete workflows often involve both. Figure 1 shows an example of scaling out from one to multiple cell culture flasks of the same dimension before transitioning to a larger format.

Figure 1: Scale-out of flask-based cell culture operations adds more of the same type of flask into a production workflow, whereas scale-up involves transitioning to a larger culture-vessel format such as a Corning HYPERFlask, CellSTACK, HYPERStack, CellCUBE, or Ascent FBR system or to spinner and shaker flasks depending on cell type.

Scale-out can be straightforward because the production unit remains the same; scaling up can be more complex and require more planning. Considerations include the time needed to optimize cell culture expansion, harvest, and quality testing during process development through pilot-scale production and finally to large-scale manufacturing. Investing time at the process development stage helps to identify potential challenges that complicate transfer of a process to manufacturing scale. Because cell functionality is paramount to cell therapy efficacy and quality, scaling strategies for such products require significant validation to ensure that cells retain the same phenotype and quality at each process stage.

Timely and effective planning around the following factors helps to facilitate a successful transition to increased production capabilities.

Special Considerations

Cell Type: Many commercially available adoptive cell therapies target primary cell types such as cytotoxic T cells to generate chimeric antigen receptor (CAR) T-cell therapies. Such cells are nonadherent and can be cultured in suspension systems. But scaling up suspension-cultured cells to larger vessels requires careful agitation to ensure sufficient gas and nutrient exchange while minimizing cell damage caused by shear stress. Culture flow dynamics should be evaluated based on equipment specifications (e.g., number of impellers, sparging strategies, stir speeds, and mixing strategies) to determine potential effects on cells. Those factors can present unique challenges because scale-out processes often introduce different vessel designs. Resolving inconsistencies helps to maintain product quality. Additionally, process analytical technologies (PATs) that are commonplace in large-scale protein production can optimize manufacturing by providing critical information about a culture’s health and behavior.

As interest grows for allogeneic cell therapy approaches such as CAR-T, biopharmaceutical companies increasingly are sourcing T cells from induced pluripotent stem cells (iPSCs), which can be expanded and differentiated in vitro to meet cell number and dosage requirements for cell therapy products (1). Typically, iPSC expansion is performed in two-dimensional (2D) adherent conditions using feeder-dependent systems with embryonic fibroblasts or feeder-free systems with purified matrices. Robust, large-scale iPSC production remains a major challenge because such cells are prone to spontaneous differentiation and cell death in suspension cultures.

Intermediary microcarrier-based culture formats can accommodate iPSC attachment requirements. They also enable process scale-up to stirred-tank suspension bioreactors that are compatible with PATs that facilitate real-time monitoring. However, adapting to a new microcarrier system from a static, 2D culture can require significant process development time because conditions must be validated for each vessel being considered for inclusion in a scale-up strategy.

Timelines: Speed to market is an important consideration. In the race to be first to market, cell therapy developers might decide to keep attachment-dependent cell therapies in adherent manufacturing systems rather than spend time adapting to suspension cell culture systems. Alternatively, depending on product demand and anticipated life-cycle requirements, companies might transition to suspension-based systems. Regardless, developers should ensure that supply chains for critical components can support product duration and demand to mitigate potential delays.

Facility Space and Labor: Real estate is scarce and expensive in many biotechnology hubs. Availability of appropriate facilities can factor heavily into adoption of cell culture platforms. Some systems are relatively compact, whereas others require additional equipment and/or skilled personnel. In some cases, staff training might be necessary to implement new production technologies.

Capital Considerations: Budgetary constraints greatly influence many factors involved in devising a scaling approach to cell therapy manufacturing. How much capital investment can be put toward scaling processes? Facility space, equipment, personnel, product demand, time available for process development and validation, and all the costs associated with those factors must be weighed against potential return on investment before a decision can be made.

Navigating Technology Transfer

Many cell therapy developers choose a contract manufacturing organization (CMO) or contract development and manufacturing organization (CDMO) to help meet production goals and timelines. The ensuing knowledge transfer often includes validation of good manufacturing practice (GMP) process development and manufacturing methods, implementation of a quality control (QC) strategy, and collaboration to secure supplier agreement plans and scheduling. Developers must select CMO/CDMO partners with extensive experience in large-scale manufacturing, knowledge of regulatory requirements, and a commitment to collaboration. Corning’s application scientists frequently facilitate successful technology transfer from customers to their chosen CMOs/CDMOs. Such experience has helped us to identify the following considerations for that transition.

Know Your Process and Product: Cell therapy developers must understand their products’ critical quality attributes (CQAs) at small scale. Implementing analytical methods to characterize attributes such as product identity, potency, purity, and functionality can facilitate technology transfer. Those parameters help companies establish QC metrics against which the effects of process changes can be measured during scaling operations. Early in that process, it is important to communicate a product’s projected demand to determine whether a manufacturing partner has enough capacity to meet production requirements in an allotted timeframe. Ultimately, understanding a product’s CQAs and timeline to market will inform CMO/CDMO selection.

Find Commonality with Contract Manufacturers and Technology Providers: Differences in equipment and operating procedures between a sponsor company and a manufacturing partner can pose difficulties during technology transfer. Problems can arise if a CMO/CDMO is unfamiliar with a customer’s technology platform, necessitating time- and resource-intensive adoption of new processes. Identifying commonalities with a manufacturer such as applications of similar cell culture surfaces (e.g., tissue-culture–treated vessels such as the Corning CellBIND system) and consistent cell culture platforms can mitigate technology-transfer risks.

Technology transfer is not a one-way street. It requires a dedicated team as well as continuous communication and collaboration. Working with technology providers such as Corning can add significant value to the relationship between a cell therapy developer and a manufacturing partner. The Corning team strives to connect both parties to help ensure technology transfer success. That includes training of technicians at both sites to ensure process consistency and working with manufacturing organizations to identify economies across their different culture platforms to increase process flexibility, decrease production costs, and streamline supply chain concerns.

Ultimately, developing a thorough understanding of a cell therapy product and leveraging the expertise of technology providers and contract manufacturers can streamline scaling strategies and facilitate the transition from laboratory- to commercial-scale manufacturing.

Reference

1 Nianias A, Themeli M. Induced Pluripotent Stem Cell (iPSC)-Derived Lymphocytes for Adoptive Cell Immunotherapy: Recent Advances and Challenges. Curr. Hematol. Malig. Rep. 14(4) 2019: 261–268; https://doi.org/10.1007/s11899-019-00528-6.

Chris Suarez is field applications manager at Corning Life Sciences, 836 North Street, Tewksbury, MA 01876; [email protected]; 1-800-492-1110. For more information, visit https://www.corning.com/celltherapy.

CellCUBE, CellBIND, CellSTACK, HYPERFlask, and HYPERStack, are registered trademarks of Corning Incorporated. Ascent is a trademark of Corning Incorporated.

You May Also Like