October 1, 2019

Demand for viral vectors has emerged as a major M&A driver in the gene therapy CDMO space says an industry expert.

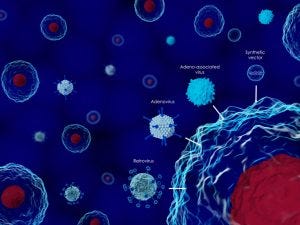

Viral vectors are hollow viruses developers can fill with genetic material. When one of these vectors ‘infects’ a cell the genes inside are inserted and expressed as proteins.

Vectors are vital for the production of gene therapies, including new products like Spark Therapeutics’ Luxturna (voretigene neparvovec-rzy) and AveXis’ Zolgensma (onasemnogene abeparvovec-xioi).

Image: iStock/Meletios Verras

The problem is that, for the past few years, viral vectors have been in short supply. Primarily this is because they are technically challenging, time consuming and expensive to produce.

One recent study said the major difficulty is that adherent culture systems – the technology with which most vectors are made – are difficult to scale-up for commercial manufacture.

In addition, according to the Alliance of Advanced Biomedical Engineering, very few CDMOs have the manufacturing capabilities need to make vectors.

As a result, contractors that are able to make vectors have significant backlogs the article says.

Gene therapy concerns

The viral vectors shortage is so acute it has been reported by the mainstream media. In 2017, for example, the New York Times raised concerns it could delay development of lifesaving therapies.

And such concerns persist according to Fiona Barry, Associate Editor at GlobalData’s PharmSource.

“There is a pressing shortage of viral vector manufacturing capacity for cell and gene therapies.

“According to the forthcoming report Gene Therapy Market Opportunity for CMOs – 2019 Edition, there are 24 gene therapies alone in Phase III development currently, so it’s a real concern whether viral vector manufacturing will be able to keep up with demand when these therapies reach the market.”

She added that, “CDMOs with viral vector capacity will have a huge advantage as the clinical pipeline for these advanced therapies gets approved.”

Contagious M&A

The vector opportunity has not gone unnoticed. In recent months both Catalent and Thermo Fisher announced billion dollar takeovers citing a desire to add viral vector capacity as key.

Private equity firms have also shown interest in contractors with viral vector capacity. In May Ampersand Capital Partners announced it was buying German vector specialist Vibalogics GmbH.

At the time Ampersand general partner David Anderson said, “Given the exciting developments within the complex virus market this is an excellent time for an investor with deep experience in the viral vector contract manufacturing sector to partner with the company.”

About the Author

You May Also Like