May 2016 Supplement

World Vaccine Congress Names “Best CMO”

At its annual meeting in Washington, DC, this past March, the World Vaccine Congress named Paragon Bioservices, Inc., as the “Best Contract Manufacturing Organization” (CMO) for 2016. The annual Vaccine Industry Excellence (ViE) Awards honor the industry’s most outstanding achievements in vaccine development around the world. This award is based on the service range in niche and core therapeutic areas, methods of performance improvement, attention to and quality of relationships with clients, reaching milestones and outcomes, and building and maintaining long-term partnerships.

Paragon’s focus is development and manufacturing of biopharmaceuticals — including production and purification of recombinant proteins, viral vectors, and vaccines. The company provides research services, process development, and current good manufacturing practice (CGMP) manufacturing. The company’s CGMP facility includes microbial and mammalian cell culture and downstream processing suites,...

When I began recruiting contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) to join the Pharma & Biopharma Outsourcing Association two years ago, some of the biologics-focused companies were concerned about being in a trade association alongside small-molecule–focused providers. It wasn’t quite “Upstairs, Downstairs,” much less a Sharks vs. Jets rivalry, but they weren’t sure whether my big-tent approach was viable. (For you millennials in the audience, please replace those references with “Downton Abbey” and “Batman v. Superman.”)

But the bio-CMOs learned quickly that there are more areas of overlap than there are differences between them and others, at least in some key business areas. After the first meeting of our board of trustees (during BIO 2014), we had a trustee dinner where our members could talk casually and learn what one another’s companies do and how they operate in the larger outsourcing sector. Both large- and small-molecule CMOs and...

byGil Roth

WWW.GRAPHICSTOCK.COM

Biopharmaceutical contract manufacturing organizations (CMOs) were initially enabled when the requirement for a company to file for both an establishment license application and a product licensing application transitioned to the current format of a biologics license application (BLA) submission for biological products (

1

). The initial focus of such CMOs was to provide large-scale, commercial manufacturing for companies that had already developed and validated bio manufacturing processes. Consequently, CMOs were generally formed as stand-alone service providers that “rented” manufacturing capacity to their customers. Some of the earliest biopharmaceutical CMOs originated as spin-offs of product companies that had built excess capacity. Other CMOs remained within pharmaceutical companies as divisions that offered third-party contract manufacturing services using their excess biologics manufacturing capacity. The CMO landscape has evolved over the past three decades so that the collec...

WWW.GRAPHICSTOCK.COM REPRINT WITH PERMISSION

A strategic technology transfer plan is the touchstone of global biomanufacturing enterprise, especially for contract service providers that must meet the needs of customers located across several continents. Like their clients, contract development and manufacturing organizations (CDMOs) are facing shortened timelines and cost pressures. They are turning to their process engineers and technology transfer teams to ensure communication with sponsor companies and streamline the transfer of information and critical activities between process development (PD) and manufacturing.

In his presentation at the 2016 BioProcess International West conference, Paul C. Jorjorian, director of global technology transfer at Patheon, highlighted the company’s approach for technology transfer across its global network of manufacturing and development sites. Here, he shares the key points of that presentation, including the company’s best practices and lessons learned.

Background

W...

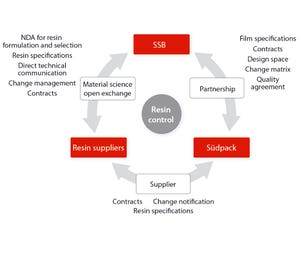

Single-use technologies have transformed biopharmaceutical manufacturing by providing tremendous and proven opportunities to reduce costs, improve flexibility, and shorten cycle times. The expansion of such technologies into commercial production has naturally raised new challenges for both end users and suppliers, thus driving the need for a critical look at risks associated with their use. End users now face a new challenge: how to assess their own supply chains for robust assurance of supply. What is the suppliers’ responsibility in addressing such concerns? End users must rely on their single-use suppliers as the provider of their process train components. How should users ensure process safety and efficiency when such aspects are transferred to a single-use supplier?

The risk of relying on suppliers has long been a topic of discussion when end users considered the “single-use decision.” Many risk assessments so far have led to incomplete strategies. The first step is a different and more comprehensiv...

WWW.GRAPHICSTOCK.COM REPRINT WITH PERMISSION

Biosimilars are a relatively new subset of biopharmaceuticals, with the biotechnology industry finally maturing such that off-patent generic-type products increasingly will be entering major markets (

1

–

3

). So far, more than 20 biosimilars for a limited number of reference products have been approved in major markets, primarily the European Union. Only two products have been formally approved as biosimilars in the United States.

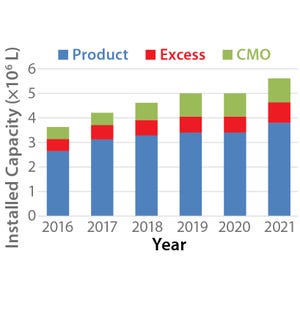

For this rapidly growing industry sector, little consensus or authoritative information is available yet regarding how and where biosimilar products will be produced. The future of their manufacturing is still up in the air. Much discussion among experts has focused on a dramatic up-tick in contract manufacturing organizations (CMOs) involvement with process development projects and clinical-scale manufacturing for biosimilars. None have really set up commercial-scale projects (yet), however. Many such companies are publicly discussi...

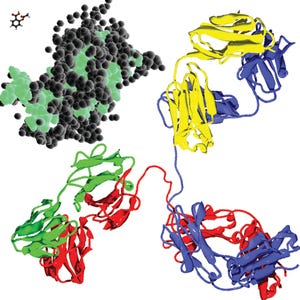

VISUAL SCIENCE (WWW.VISUAL-SCIENCE.COM)

A rapid increase in the number of companies working on development and registration of biosimilars has created a significant market for contract testing and manufacturing organizations (CTOs and CMOs) providing outsourced services specific to these products. Biosimilar developers turn to contract organizations when they lack either the internal capability or capacity for conducting certain work as well as when they require additional resources to bring products to market rapidly. A wide range of contract services are available, and each particular activity offers advantages and disadvantages to biosimilar manufacturers.

Figure 1: Biosimilarity regulatory process; IND = investigational new drug; GMP/GCP/GLP = good manufacturing/clinical/laboratory practice; SA = safety assessment; BLA = biologics license application; CMO = contract manufacturing organization; CRO = contract research organization

Figure 1 depicts the regulatory process for development and licensing of...

In perspective: aspirin (upper left, front), somatropin (middle molecule), and an antibody (lower right, back) — to approximate scale — molecular models from Wikicommons

Over recent decades, protein-based therapeutics have emerged as key drivers of growth in the pharmaceutical industry. Drug development pipelines have filled with biologics, and a handful of monoclonal antibody (MAb) products have become some of the best-selling drugs around the world. Production of biotherapeutics is often challenging because of the inherent instability of these large, complex molecules. Their fragile nature has forced manufacturers to change how bulk drug substances (BDSs) are handled and final drug product is formulated, sterile filtered, and filled. Ajinomoto Althea was established in 1998 as a contract manufacturer that primarily focused on one class of therapeutics: large-molecule biologics. Here we share some learnings from over 17 years of experience in biomanufacturing and outline special considerations necessary ...

WWW.MASTHERCELL.COM

The work of developing advanced medical products is spreading around the globe, and with it comes specialized contract services. Far from a “one size fits all” approach to development, and with few platform technologies yet available, contract service providers in the advanced therapeutics space must focus on helping to move promising science into good manufacturing practice (GMP) environments, but with regulatory pathways and eventual harmonization still under development.

One company that formed to address the specific needs of cell therapy developers is MaSTherCell (based in Gosselies, Belgium), which was acquired in 2015 by Maryland-based Orgenesis Inc. I spoke with MaSTherCell’s Eric Mathieu (chief operating officer) and Thibault Jonckheere (chief business officer) about their reasons for this therapeutic focus.

BPI:

Some contract providers choose to specialize in specific therapy types such as cell therapies, antibody–drug conjugates (ADCs), and biosimilars. Can you begin by int...