The Difficulties of Manufacturing Cell and Gene Therapies At ScaleThe Difficulties of Manufacturing Cell and Gene Therapies At Scale

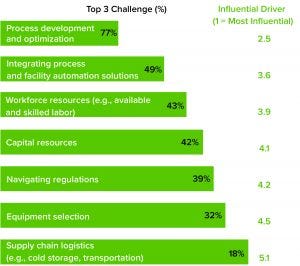

Figure 1: Average commercial manufacturing challenge

From large-scale manufacturing of one-size-fits-all blockbusters to small-scale processing of personalized therapies, the biopharmaceutical industry has undergone a revolution over the past decade. Among the standout milestones is the development of advanced therapy medicinal products (ATMPs). More than 1,000 of these research-intensive therapies are progressing through clinical trials toward potential commercial manufacturing. Cell and gene therapies (autologous and allogeneic) are targeted for many incurable diseases and conditions, including autoimmune disorders and cancers. Despite the excitement about ATMP potential, developers and manufacturers are facing sizable difficulties, according to survey data collected by CRB for its Horizons: Cell and Gene Therapy report (https://go.crbusa.com/2020-horizons-atmp) (Figure 1). Our study finds

a lack of commercial good manufacturing practice (GMP) manufacturing capacity to meet current and future demand

the need to automate and optimize processes

the struggle to scale open and manual operations to automated and closed processing required for commercial production

the need to transition from adherent cell culture to suspension cell culture to maximize scalability

a lack of skilled and available expertise to manage and operate new process equipment.

Our study data were collected from nearly 150 industry leaders and reflect the need for manufacturers to design and construct flexible facilities that can adapt to future process improvement and technologies that continue to change every two to five years. That evolving optimization will enable biomanufacturers to prepare for scale-up or scale-out to GMP commercial manufacturing to meet future demand.

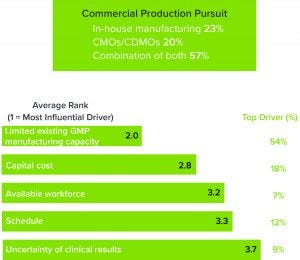

Figure 2: (top) Percentage of respondents who are pursuing in-house manufacturing, outsourcing, or a combination thereof; (bottom) respondents who are pursuing contract manufacturing organizations (CMOs) or contract development and manufacturing organizations (CDMOs) indicated the drivers for doing so.

Greater Commercial GMP Manufacturing Capacity Is Needed

It is unsurprising that nearly three-quarters of respondents are partnering with contract manufacturing organizations (CMOs) or contract development and manufacturing organizations (CDMOs) to overcome those obstacles, citing a lack of GMP manufacturing capacity as their main reason to outsource (Figure 2). That is not a cut-and-dried solution, however. CMOs are experiencing the same capacity crunch that is affecting the rest of the industry, resulting in wait times that can stretch as long as two years. To meet growing demand, CMOs/CDMOs also need to consider flexibility as they invest in new facilities.

Our study found that a lack of a skilled and available workforce was another significant factor, which is understandable given the highly technical developments in the ATMP sector over the past decade. We have seen this phenomenon repeat during the birth of every high-technology industry over the past 60 years, including that for recombinant DNA technology in the 1970s and 1980s. The early entrants in a new industry skew toward hiring doctorate-level staff, which is occurring with ATMPs as companies try to translate benchtop techniques to robust commercial environments. Getting products off benches and into cleanrooms takes highly skilled, highly trained people. CDMOs can provide that expertise, but they also are faced with the task of building a skilled workforce.

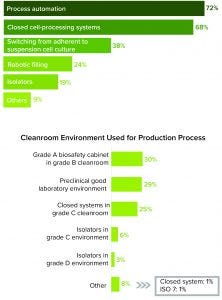

Figure 3: (top) Process automation and closed cell-processing systems are indicated to be the technology advances most influencing respondents. (bottom) A grade A biosafety cabinet in a grade B environment is the most commonly used cleanroom system.

Potential Effects of Process Automation and Closed Cell-Processing Systems

A need for aseptic manufacturing is driving the most impactful technology advancements, according to survey respondents. Most of them listed process automation (72%) and closed cell-processing systems (68%) as the most significant technological advancements that will affect their decisions about manufacturing (Figure 3).

Process automation is a key consideration for respondents because whole-cell processing and gene modification are technique-sensitive processes with a high risk of failure. Because cell therapies are introduced intravenously and cannot be terminally sterilized, the whole-cell processing that they require during manufacturing must be performed under aseptic conditions to prevent cross-contamination between products and culture contaminations from manufacturing environments. Any slight process alteration or human error can jeopardize a batch.

Equally important to respondents was the adoption of closed cell-processing systems, which offer numerous advantages. Reducing touchpoints in a process can minimize or eliminate risks of contamination. It also leads to a potential reduction in cleanroom requirements. Although closed cell-processing systems in grade C cleanrooms now account for 25% of cleanroom environments, we anticipate that number to increase to nearly 75% within a few years. Closing and automating processes improve speed, quality control, design flexibility, and the path to regulatory approval.

Designing flexible ATMP facilities also can be problematic, depending on the type of therapy to be made. For example, facilities for autologous therapies must be designed with chain of custody and identity in mind because such products are vein-to-vein treatments for individual patients. For such cases, quality control laboratories occupy more floor space than for other types of therapies because each batch must be tested even though lots are small. When production of autologous cell therapies must be increased, a process must be scaled out, not scaled up, to add more processing units. By contrast, batches of allogeneic treatments require less quality-testing space and can be scaled up by volume because they contain many doses and are used to treat a large number of patients. Flexible designs will account for automation and future technological developments, so biomanufacturers can eliminate the need for costly retrofits or expanded facility footprints.

We expect that bioprocessing also will undergo changes as manufacturers switch from adherent to suspension cultures (Figure 3). This is an important consideration given the limited production options and manual manipulations of anchorage-dependent cell cultures. Suspension cultures allow automation early in a process and can eliminate adherent-culture–volume limitations. Such platforms are desirable for allogeneic cell therapies, and they help increase production of those products.

By contrast with current manual filling techniques, robotic filling is anticipated to facilitate scale-up, according to study participants (Figure 3 top). The use of isolators also can help reduce square footage of highly classified spaces to a box within a room. Isolators are an aseptic processing alternative if a completely closed system is not possible, and they can eliminate the use of grade A biosafety cabinets, decreasing operational costs when accommodated by lower-grade room classification. ATMP isolators are different those traditionally used in large-scale filling operations. The more compact, tailored versions fit the ultimate objective of having a closed process. However, ATMP isolators represent a heavy capital investment and can be more expensive than some custom designs.

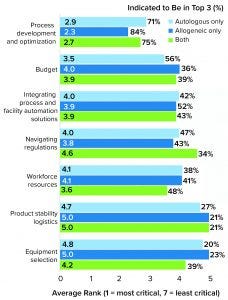

Figure 4: Study participants were asked to rank their biggest challenges in progressing toward commercial manufacturing (1 = most critical, 7 = least critical). By far, the highest-ranked factor was process development and optimization.

Process Development and Optimization Are the Biggest Challenges

Technology in the journey from clinical to commercial manufacturing has been advancing rapidly within the past 10 years. It is easy to understand why process development and optimization was the biggest concern among respondents (Figure 4).

Cell processing equipment used for small-scale production for research and clinical trials is likely to have open connections requiring a grade A environment with grade B background heating, ventilation, and air conditioning (HVAC) classification for protection. That approach does not lend itself to processing thousands of doses per year, which stresses the importance of transitioning to closed cell-processing systems that can operate in a grade C or lower environments. The speed of change in this sector gives biomanufacturers only a couple of years to learn and adopt current innovations. To scale up or scale out from open, manual processes for clinical production to commercial manufacturing would require a substantial increase in headcount and floor space at prohibitive costs.

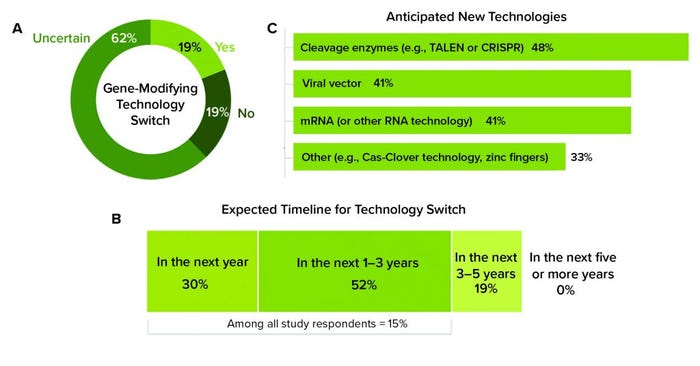

Study participants indicated that attracting skilled and available labor was a significant difficulty when shifting to commercial manufacturing. Adopting new techniques requires an influx of expertise and equipment that biomanufacturers still are trying to understand and perfect. For example, out of the available gene-modifying platforms, manufacturers of both autologous and allogeneic genetically modified cell therapies primarily rely on viral vectors (79% and 74%, respectively). Those first-generation vehicles that deliver altered genetic material to cells are more popular than more recent developments, including messenger RNA (mRNA) (35%) and gene-editing technologies such as clustered regularly interspaced short palindromic repeats (CRISPR) (28%). Although respondents reported a high level of uncertainty about whether they will switch to another ATMP platform, 19% anticipated switching, and 15% said that this will happen within the next three years (Figure 5). Despite strong experience with viral vectors (for which there will always be a place), more recently introduced platforms require employees with different skills and use different processes that take time to develop and apply rigorously and faithfully to obtain consistent results.

For this report, CRB’s subject matter experts dug deep into an array of important issues confronting the ATMP space, finding an industry brimming with optimism for the future but contending with the twin pain points of resource and risk ever present. Below are some issues we explored.

Figure 5: (a) Study participants reported whether they anticipate switching to another gene-modifying technology in the future. (b) Those who answered “yes” indicated how soon they anticipate to switch and (c) to which technology. (TALEN is transcription activator-like effector nucleases; CRISPR is clustered regularly interspaced short palindromic repeats; mRNA is messenger RNA; Cas-Clover is a Demeetra AgBio trademark.)

Multiple Modalities: Both biomanufacturers and CMOs face the same need for flexibility to nimbly address shifting needs in the marketplace. CMOs must respond to evolving client needs. Biomanufacturers who are bringing their ATMP production activities in house have complex product pipelines and need the flexibility to develop different modalities in parallel. More than half of our survey respondents say that they expect to adopt a multimodal solution within the next two years, indicating that flexibility, scalability, operational efficiency, and speed to market are the top drivers.

Facility Optimization: Nearly 80% of survey respondents ranked process development and optimization among their top three commercial manufacturing challenges across both cell and gene therapy platforms (Figure 4). Most respondents also cited variability or uncertainty in their processes and regulatory considerations among primary operational concerns. More than a third of respondents said that they are concerned or anxious about their facility’s achievable throughput.

Project Delivery: Two-thirds of respondents would consider a turn-key or end-to-end approach to project delivery that moves projects from design to operation. But when asked about barriers to adopting a turn-key approach to project delivery, nearly a third of respondents cited a lack of organizational awareness of end-to-end offerings in the marketplace. Other inhibitors include constrained procurement processes and widespread belief that single-source solutions create excessive risk.

Planning for Flexibility in Process and Facility Design

Given the challenges that respondents faced when considering in-house manufacturing at commercial scale, it is imperative to focus on closed, automated, and adaptive design. Flexibility in site and facility layout is essential to account for emerging equipment innovations and to make room for tomorrow’s ATMP products.

Ideally, such a forward-thinking approach to commercial design will allow biomanufacturers to adopt breakthrough technologies and new automation solutions strategically. Thus, developers would have both the control and flexibility needed to shape the future of cell and gene therapies.

Corresponding author Allan Bream ([email protected]) is a bioprocess specialist, and Brita Salzmann ([email protected]) is an ATMP process specialist at CRB.

You May Also Like