BioPhorum Operations Group Technology Roadmapping, Part 2: Efficiency, Modularity, and Flexibility As Hallmarks for Future Key TechnologiesBioPhorum Operations Group Technology Roadmapping, Part 2: Efficiency, Modularity, and Flexibility As Hallmarks for Future Key Technologies

February 13, 2017

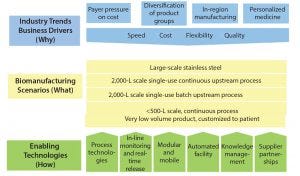

Figure 1: Roadmap development and structure

For a complex biopharmaceutical industry, setting out to forecast future technologies must involve considering how such technologies will be used. In the first article (1), I discussed why there was a need to develop a technology roadmap for the biopharmaceutical industry and the trends shaping its future: namely, the introduction of new product classes, the continued growth of the biopharmaceutical market, pressure to reduce costs, and uncertainty in approval and sales of new products. Herein I discuss the technology roadmap’s objective, the approach taken to develop it, business driver metrics, and (most important) the scenarios that consider how technology might be used in the future. I will also introduce the six teams looking at key technologies and enablers.

Background and Objective

Over 150 individuals participated in designing and constructing the technology roadmap. They include representatives from more than 17 biopharmaceutical manufacturers, 12 suppliers to the biopharmaceutical industry, eight academic or government institutions involved in biotechnology research and/or training activities, and four engineering consultancy firms.

The overarching objective of the technology roadmapping team is ultimately to streamline delivery of drug products to patients. Setting the direction to achieve that requires establishing a common set of assumptions to frame business drivers and industry needs. The intention is to serve as a guide for the biomanufacturing industry by projecting 10-year targets, assessing technology needs and challenges to be resolved to meet those targets, and recommending potential solutions and areas of innovation that the industry can implement.

The goal of the first edition of the roadmap is to reach an audience far wider than that represented by just the original member companies. That will allow more people to comment, review, and update subsequent editions as well as contribute to implementation planning. The roadmap is designed to be a starting point for future discussions and activities. It acts as a guide, so it is up to individual manufacturers, suppliers, regulators, and others to make their own resource investment and implementation decisions.

Choosing a subset of biological therapies to focus on in terms of developing the view of future technology was an important decision. Because of their current and short-term future dominance, monoclonal antibodies (MAbs) produced by mammalian cell cultivation are the key focus. Because recombinant proteins represent the largest class of biological drugs by far today for both therapeutics and vaccines, the roadmap emphasizes opportunities for improvement of such important products — and MAbs in particular.

Roadmapping Methodology

Having established the framework for the collaboration, the team next created the process for developing the roadmap. According to Rajesh Beri (technical director at Lonza and a member of the steering committee), “Projecting the enabling technologies of the next 10 years is not an easy or a simple task — not in an industry as complex as biopharma. Luckily, other complex industries already have pioneered technology roadmapping with great success, yielding case studies and best practices.”

To create a method for developing the roadmap, the team chose a process that had been pioneered at the University of Cambridge (Figure 1). This method started with identifying industry trends and business drivers (the why) and progressed through to the next stage of identifying the commercial biomanufacturing scenarios (the what). That provided a clear vision for six enabling-technology teams cataloging the required capabilities and enablers (the how).

Business Drivers and Metrics

Understanding the connection between market demands and a company’s business reality will be key to its success by providing direction in decision making and ability to respond to changes. A quantitative understanding of these drivers and of their related metrics is particularly important because they help manufacturers determine the relative value of technology options and solutions. The roadmapping team identified four major business drivers: flexibility, speed, quality, and cost. The relative importance of those drivers depends on the business model and circumstances of an enterprise.

Based on the market trends and business needs, targets were set for each metric’s five- and 10-year horizons. For instance, a key flexibility metric is the titer range in upstream processes, which are directly accommodated by downstream facility fit. A key speed metric is the time to release product (end-to-end speed). A key cost metric is reducing the total cost to supply by 50%. In a few cases, targets were set considering only MAbs. Those metrics aligned with demands of identified trends and drivers that require significant innovation to leap forward and supplement existing focus on incremental improvements to support current operations.

Visualizing Future Biomanufacturing Facilities

The technology roadmap steering committee reviewed numerous scenarios for biomanufacturing that could exist in 10 years. Selection was based on the realization that there will be very different facility requirements depending on product portfolio, volumes required, emerging market requirements, and need to fully use existing capacity.

Given the complexity of the biopharmaceutical industry and an increasing diversity in drug products and companies, the committee selected five high-level scenarios to cover a full spectrum of process and facility types. Each scenario or facility type is associated with a representative set of business conditions that reflect a typical mix of key drivers. Each business scenario was selected with a distinct set of business dimensions, including capacity requirements and business drivers (e.g., facility flexibility, speed to clinic and to market, quality, and cost of manufacturing).

Paul McCormac (director in Pfizer’s Biomanufacturing Sciences Group) has a unique understanding of the biomanufacturing landscape and played an integral role in identifying the roadmap’s future manufacturing scenarios. “The scenarios are a vision of what the multiple manufacturing footprints will look like in the future to support biotech products in development. Essentially, there won’t be one scenario that fits all the demands. Some probably will be very large in scale, some will be 2,000-L disposable with continuous operations. Other scenarios will be very small scale for newer, exciting therapies.”

Table 1: Main facility-type scenarios with typical associated product types and business drivers

The range of those potential requirements has proved to be quite considerable. Production outputs can vary from metric tons of a recombinant protein (as has been the case for some blockbuster MAbs) to very small quantities of a drug or preparation intended for a single patient.

Table 1 summarizes the five main scenarios. It includes a list of typical products and facility features that are characteristic of each scenario and describes the general facility type and manufacturing process.

Figure 2: Expert teams delivering roadmaps for the six key enabling technologies

Projections on Innovation Efforts

Six expert teams projected where the industry will be investing its innovation efforts over the coming decade.

Process technology, including advanced automation, concentrated reactants, and continuous processing, which would evolve from current standards and manufacturing processes

In-line monitoring and real-time release, including quality control technologies for eliminating lag time between manufacturing and distribution-enabling businesses to be more agile and reduce cost of holding inventory

Modular and mobile manufacturing systems that are quick to configure and assemble using plug-and-play, standard design

Automated facilities and improving automation and equipment to make the transition from development to manufacturing more seamless

Supply partner management such that suppliers become technology development partners for industry, collaborating to solve problems

Knowledge management, including integrating the knowledge of product and process technology across development, manufacturing, and commercial value streams.

The six teams created individual roadmaps for their areas, describing the vision for the future and the benefits that would accrue to the industry. The combination portrays a future landscape describing where the bioindustry will be investing resources over the next decade. Subject-matter experts were engaged for each team to visually roadmap details of needs, challenges, and potential solutions.

Strategy Development

The technology roadmapping process started at a macro level by defining market and industry trends. Such trends include reducing costs, meeting the demands of smaller populations of patients, and improving the speed of products to clinics. At a lower level, such needs are translated into business drivers (cost, speed, flexibility, and quality) and then broken down into further granularity (e.g., describing how in 10 years time there will be a 10-fold reduction in the cost of a classic MAb product).

The committee has created scenarios for the future of manufacturing and the types of facilities that will be needed. By doing so, experts can step into the actual manufacturing value stream to work out how the future bioindustry wants to operate and the technologies required to achieve those targets.

The final article in this series will be timed to coincide with the launch of the technology roadmap. It will provide highlights and conclusions from the report, including discussions on where innovation is necessary to achieve the 10-year vision of the future. It will feature who has been involved in the creation of the roadmap, the cross industry input, and how that will shape the future. Part 3 also will present approaches to roadmap implementation for accelerating innovation and describe how the BPOG team is working closely with stakeholders in the industry to communicate the content.

Reference

1 BioPhorum Operations Group Technology Roadmap, Part 1: Four Trends Shaping the Future of the Industry. BioProcess Int. 14(11) 2016: 20–21.

Steve Jones is director of the BioPhorum Operations Group (BPOG); [email protected]; www.biophorum.com/category/resourcestechnology roadmapping-resources/introduction/.

You May Also Like