When Is a Virtual Business Model Suitable for Biopharmaceutical Companies?When Is a Virtual Business Model Suitable for Biopharmaceutical Companies?

April 14, 2015

https://bioprocessintl.com/wp-content/uploads/2015/04/032015_Jain.mp3

WWW.GRAPHICSTOCK.COM

Virtual companies are based on the model that all activities are outsourced. Such companies have no (or few) employees, occupy no laboratory space, and use contract service organizations for all activities. Over the past decade, several virtual biopharmaceutical companies have formed (1–4). They are primarily start-up ventures that use contract research organizations (CROs) for R&D and contract manufacturing organizations (CMOs) for product manufacturing. By contrast, a fully integrated biopharmaceutical company is based on the model that all activities are internal to the company. Such companies discover, develop, manufacture, and commercialize their products using internal resources.

Many biopharmaceutical companies follow a hybrid model: Most of their activities are internal, but they may in-license or purchase drug candidates from other companies and/or use a CMO for manufacturing. The hybrid model allows companies to leverage internal capabilities while providing flexibility to procure expertise and resources that are not available internally to the company.

A virtual company model provides biopharmaceutical companies with the following advantages over a fully integrated model, although these advantages may incur higher operating costs (5–7):

Elimination of capital expense and time of building R&D and manufacturing facilities

Access to diverse expertise and resources not available internally

Ability to undertake risky projects without investment in significant resources.

Cost Analysis

SMC performed a conceptual analysis to identify conditions that favor the virtual company model over the fully integrated company model. For this analysis, we assumed that both models have identical innovation and productivity. Further, revenue per product is assumed to be driven completely by market forces and independent of business model and company size.

Costs: Companies must increase operational efficiency and reduce costs to maximize return on investment (ROI) defined as revenue/cost (8). Cost has a fixed component (e.g., administrative, facility depreciation, rent/lease, and facility maintenance) and a variable component (e.g, utilities, raw materials, and labor). Variable costs for a company depend on the number of activities (or equivalently, the number of products in the R&D stage and the total volume of commercial products). Although fixed costs are constant in the short-term, they increase with R&D and manufacturing capacity in the long-term. Although fixed costs are constant in the short term, they increase with R&D and manufacturing capacity in the long term because, as a company grows, it invests in equipment, facilities, and infrastructure (9). Thus, in our analysis, we treated fixed cost as a function of capacity.

Equations:

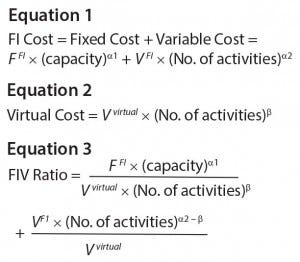

Because of economy of scale and experience curve, cost increases with the number of activities at a less-than- linear rate. Equation 1 shows fully integrated cost (FI cost). In Equation 1, FFI is the average insourced fixed cost per unit capacity, VFI is the average insourced variable cost per activity, and a1 and a2 (0 < a1, a2 ≤ 1) are factors accounting for economy of scale/experience curve. Applying Equation 1 for high facility use (number of activities ≈ capacity) results in the relationship between cost and the number of activities, as previously discussed (8).

In a virtual model, a contract organization charges its clients per activity. Virtual cost incorporates a contract organization’s fixed cost, variable cost, and profit factor. As outsourced volume (economy of scale) increases, a client may negotiate lower cost per activity, as shown in Equation 2. In that equation, Vvirtual is the average outsourced variable cost per activity, and b (0 < b ≤ 1) is a factor accounting for economy of scale and experience curve.

The ratio of FI cost and virtual cost (denoted as FIV ratio) can be used to determine whether a virtual model is more cost effective. FIV > 1 favors a virtual model because of lower costs (Equation 3).

Benefits: Despite the profit factor, a virtual business model can offer financial benefits over a fully integrated model, for following scenarios.

Higher Facility Use: Facility and equipment increase typically occurs in steps. Activities less than the capacity can result in underuse of facilities for fully integrated companies. In Equation 3, the fixed-cost portion of the FIV ratio increases with capacity and decreases with the number of activities. So low facility use can lead to a high FIV ratio. By contrast, contract organizations combine projects from all clients to attain high facility use.

Higher Economy of Scale: As Equation 3 shows, higher economy of scale corresponds to lower a1,2 and b. Contract organizations can achieve significantly higher economy of scale (b << a1,2) than fully integrated companies because of their expertise, efficiencies, and scale, resulting in a high FIV ratio. SMC believes that b >> a1,2 is less likely because of the expertise and scale of contract organizations.

Lower Average Variable Cost per Activity: Companies can have lower average outsourced variable cost per activity (Vvirtual in Equation 3) because of lower costs for utilities, raw materials, and labor through operations in low-cost regions (10). Lower V virtual will increase FIV ratio. Large, global contract organizations are better equipped to operate in low-cost regions than small, domestic fully-integrated companies.

The scenarios above are especially applicable to small product portfolios in development (e.g., early-stage companies) and low-volume commercial products (e.g., orphan drugs). Thus biopharmaceutical companies should evaluate the option of fully (outsourcing both R&D and manufacturing) or partially (outsourcing either R&D or manufacturing) virtual business models before investing in a fully integrated model. That evaluation should be comprehensive, taking into account cost, time, and need for specialized resources. A virtual business model may be favorable despite higher costs due to access to specialized resources.

Considerations Before Implementing a Virtual Model

A virtual business model can save time and costs and provide access to R&D and manufacturing resources and expertise not otherwise available. But before adopting this model, a company should take the following considerations into account (5–7).

Intellectual Property Protection: Ensure that sufficient confidentiality and intellectual property protection measures are in place before outsourcing activities.

Ease of Communications and Activity Coordination: Ensure that communications and activity coordination are not complex. If a contract organization is in a distant location, then include overhead costs for activity coordination in the analysis.

Financial Stability of Contract Organization: A contract organization must be financially stable to ensure no disruption of R&D and manufacturing activities.

Quality Systems of Contract Organization: Ensure that a contract organization has quality systems that meet good laboratory practice (GLP) and good manufacturing practice (GMP) requirements of multiple regulatory agencies globally. Perform periodic audits of the contract organization to review its quality systems.

Evaluation Is Key

A biopharmaceutical company implementing a virtual business model outsources all activities and eliminates cost, time, and resources required for setting-up R&D and manufacturing facilities. That enables early proof-of- concept demonstration and speed to market and focuses on core competencies. Companies having small product portfolios in development and/ or low-volume commercial products should consider a virtual model before investing into dedicated facilities. Moreover, all biopharmaceutical companies should evaluate their product portfolios periodically to identify suitable business model for optimization of operations and maximization of return on investment.

References

1 Garde D. Biotech Boom or No, Many Startups are Staying Virtual. 4 June 2014; www. fiercebiotech.com/story/biotech-boom-or-no- many-startups-are-staying-virtual/2014-06-04.

2 Phillips T. What Is a Virtual Business? http://biotech.about.com/od/ businessadminstration/f/virtualcompany.htm.

3 Whalen J. Virtual Biotech: No Lab Space, Few Employees. The Wall Street Journal 4 June 2014.

4 Ledford H. Biotechnology: Virtual Reality. Nature 498, 2013: 127–129.

5 TCP Innovations. To Be or Not to Be: The Pros and Cons of the Virtual Biotech Company. Drug Baron 6 November 2009.

6 Cohn C. Lessons Learned the Hard Way about Running a Virtual Company. Forbes 11 August 2014.

7 Broderson H. Virtual Reality: The Promise and Pitfalls of Going Virtual. Nature 26 September 2005.

8 Jain S. Revenue per FTE and Cost per FTE as Metrics of Operational Efficiency and Performance of Biopharmaceutical Companies. BioProcess Int. 12(11) 2014.

9 Elliott R, Payne K. Essentials of Economic Evaluation in Healthcare. Pharmaceutical Press: London, UK, 2005.

10 Jain S.A Case for Biopharmaceutical Operations in Low-Cost Countries to Maximize Return on Investment. BioProcess Int. 13(2) 2015: 16–21.

Siddhartha Jain is a managing partner at SMC Consulting Group LLC, 404 Brunswick Drive, Troy, NY 12180; sid.jain@smcstrategy. com; www.smcstrategy.com.

You May Also Like