Addressing the Challenges of Developing Biopharmaceutical DrugsAddressing the Challenges of Developing Biopharmaceutical Drugs

September 28, 2016

Stefan Schlack (Photo by Connect Upstream)

The biopharmaceutical industry is enjoying considerable success. Its products account for about a fifth of world pharmaceutical revenues, which are growing at twice the pace of those generated by most traditional chemically synthesized drugs. Biopharmaceuticals populate the list of best-selling drugs, and a number have achieved blockbuster status. Biotechnology stocks have outperformed the general market as investment has flowed into the industry.

As with other highly profitable markets, the market for biopharmaceuticals has become increasingly competitive. Reflecting this fact, in September 2015 Sandoz launched Zarxio (filgrastim-sndz), the first biosimilar product approved by the US Food and Drug Administration for use in the United States (1). Competition from a tide of biosimilar products is on the way, forcing biomanufacturers to consider how best to optimize their operations for maximum efficiency and lowest cost. The following figures show analysis of 2016 data from Evaluate Pharma (www.evaluategroup.com).

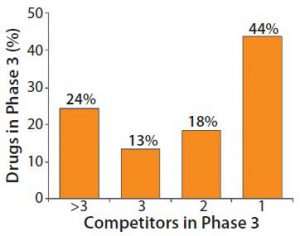

Figure 1: Heavy competition in phase 3 pharmaceutical development

Figure 1 indicates the degree of competition within the pharmaceutical industry today. More than half of drugs in phase 3 development must compete with at least one rival product. The industry expects that about one in four products at this phase of clinical development will compete for market share against more than three other drugs. Developers must have high-titer, optimized bioprocesses to succeed in this increasingly competitive environment.

The need for greater manufacturing efficiency exacerbates an existing challenge that biomanufacturers must address. Critically, they must beat their competitors in the race to identify a target molecule, protect their intellectual property, and launch a product onto the market so that patients can benefit. Failure to win that race has an enormous impact on the financial success of a drug development project. Developing optimized bioprocesses in this context further compounds the challenge.

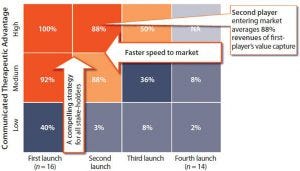

Figure 2: Value captured as a function of time (market entry) and therapeutic advantage; limited value is captured beyond first/best-in-class launch order.

Companies whose biologic products reach the market first, with the greatest therapeutic advantage, capture the most value (Figure 2). They need a compelling strategy for their products that addresses the requirements of all stakeholders. The second player to enter a market achieves an average 88% of the revenues of a first mover. A third player can expect just 50% of the value captured by the first company to market.

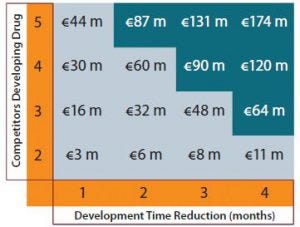

Figure 3: Additional revenues (in millions of euros) over commercial lifespan through earlier commercialization.

Figure 3 shows the additional revenue that a company can capture over a product’s life cycle if it can launch candidates earlier. That does not include revenues gained through additional months of sales, but it constitutes the commercial benefit obtained for the total product lifespan. Under the most competitive scenario with five companies competing, shortening development time by a single month yields an additional €44 million of revenues. A four-month reduction in biologic development time gives additional revenues of €174 million.

To address the need to increase speed to clinic, biopharmaceutical companies probably will have to adapt their approaches to drug commercialization. They are likely to outsource services that external providers can perform more efficiently and effectively than they can, thereby expediting biologics through early and late-stage development. Biomanufacturers no longer need to automatically perform cell line or analytical development in-house. By outsourcing to companies that provide “off the shelf” services, they can accelerate development without increasing headcount. Applying platform production methods for biologics of the same family reduces process development time. High-throughput screening tools are already widely adopted to help companies understand optimum platform process operating parameters. That can save weeks of development time.

The industry will benefit from applying quality by design (QbD) principles and focusing on process robustness to ensure good product quality and operational excellence. In my view, however, robust and well-characterized processes are more likely to scale up on the first attempt without needing rework that can delay projects by months. Intense efforts to define process design spaces will facilitate the transfer of biologic products across global manufacturing networks. Such networks must be flexible and agile to make a range of products and cope with peaks and troughs in demand.

Fortunately, successful operation of robust and highly controlled commercial-scale bioprocesses no longer depends on capital-intensive stainless steel plants with associated utilities infrastructure. Single-use technology has matured to enable widespread implementation of disposable yet robust commercial processes. Applying such technologies shortens timelines and significantly reduces the cost required to design, build, and commission biomanufacturing facilities. Lower-cost facilities risks less capital should a product fail on clinical or commercial grounds because a competitor reached the market first.

On the other hand, disposables allow companies to build direct-replica facilities in global locations, enabling rapid process transfer and capacity expansion if demand becomes greater than projected. That can be the case when companies identify additional indications against which a drug will work or receive market approval in other countries. In the past, when companies relied on dedicated, stainless steel facilities, such events could easily lead to production bottlenecks.

The introduction of robust yet flexible production platforms is timely. My company’s industry analysis in recent years predicts that adaptive global biomanufacturing capacity will be strategically important for biopharmaceutical leaders. The specificity of biologics and increasing intensity of competition are reducing estimated peak sales for new products. Sponsors are finding it difficult to identify and commercialize biotech blockbusters.

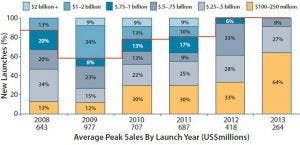

Figure 4: Estimated peak sales of drugs launched 2008–2013 (by launch year)

Figure 4 illustrates a trend toward products with lower estimated peak sales between 2008 and 2013. The time it takes to reach peak sales is increasing as companies pursue a strategy of serially expanding the number of target indications throughout a product lifespan. To sustain their growth trajectories, sponsors must have rich candidate pipelines and manage them effectively. Those pipelines are becoming increasingly diverse, adding complexity. By designing flexibility into their global production footprint, bioexecutives can manage uncertainties and guard against risks associated with pipelines of diverse drug candidates for niche patient populations.

Flexible manufacturing capacity allows biopharmaceutical companies to adapt operations as they gather data on the clinical performance of pipeline products. This allows them to make varying numbers of products in different annual quantities depending on data generated from clinic trials.

That newfound flexibility is facilitating operations managers’ decisions to expand their companies’ global manufacturing footprints and access rapidly growing markets in territories all over the world. Governments can demand localized manufacturing as a precondition for approval of market licenses or provide disincentives to overseas production through high import taxes. Local biomanufacturing is often beneficial for drug producers because it simplifies supply chains.

Figure 5: Trends toward localized production by major biopharmaceutical companies (select examples*)

Figure 5 suggests the extent to which the biopharmaceutical industry has expanded capacity and extended its geographic reach over recent years. Transferring processes effectively through global manufacturing networks will be a core competency that companies must master. Fortunately, as more digitization benefits other industries, so too will it revolutionize bioprocessing. Advanced process analytical tools will help process engineers construct digital fingerprints of bioprocesses operating in one location and compare them with those at new sites. They can thus make interventions to transferred processes that ensure matching product quality attributes for all sites.

The biopharmaceutical industry is responding to escalated competition through improved operational efficiencies and shortened product development timelines. To implement their growth strategies, companies will need agile and flexible global operations that allow them to respond to uncertainties in market demand. I expect that they will face increasingly complex global supply chains. Those must respond to changing market dynamics through focus on quality and robustness of technologies, providing long-term assurance of supply, and improving product delivery performance. Suppliers must be fully capable of delivering products/services and supporting customers all over the world. Innovations in all these areas will help the industry continue to grow even as it matures.

References

1 Peters RC. Framing Biopharma Success in 2016: Corporate Restructuring, Regulatory Initiatives, and Biosimilars Will Shape Biopharma Development in 2016. BioPharm Int. 29(1) 2016: 8–11.

Stefan Schlack is senior vice president of marketing and product management at Sartorius Stedim Biotech, August-Spindler-Straße 11, 37079 Göttingen, Germany; +49 551 3080; [email protected].

You May Also Like