Modern Technology Transfer Strategies for Biopharmaceutical CompaniesModern Technology Transfer Strategies for Biopharmaceutical Companies

March 10, 2015

https://bioprocessintl.com/wp-content/uploads/2015/03/032015_Dennett_1.mp3

Application of industrial biotechnology has changed dramatically over the past decade. Stainless steel process equipment has largely given way to disposable systems, facilitating easier and quicker process configurations and up-scaling. Suppliers generally made incremental advances in the quality of raw materials and consumables to ensure that those could more readily comply, “off the shelf,” with regulatory expectations. Once out-of-reach analytical equipment such as mass spectrometers and cell analyzers are becoming more common place in development laboratories, which better enables biopharmaceutical companies to characterize products and processes and confirm that specifications are being met. Advances in process and analytical technologies thus have raised the bar of what is possible in-house. Technology transfer continues to play an important role in this modern scenario, whether manufacturing and analytical testing are outsourced or retained and transitioned in-house.

Application of industrial biotechnology has changed dramatically over the past decade. Stainless steel process equipment has largely given way to disposable systems, facilitating easier and quicker process configurations and up-scaling. Suppliers generally made incremental advances in the quality of raw materials and consumables to ensure that those could more readily comply, “off the shelf,” with regulatory expectations. Once out-of-reach analytical equipment such as mass spectrometers and cell analyzers are becoming more common place in development laboratories, which better enables biopharmaceutical companies to characterize products and processes and confirm that specifications are being met. Advances in process and analytical technologies thus have raised the bar of what is possible in-house. Technology transfer continues to play an important role in this modern scenario, whether manufacturing and analytical testing are outsourced or retained and transitioned in-house.

In its attempts to find the next medical blockbusters, the industry is throughputting new product candidates at an accelerated rate and outsourcing process and analytical activities more than ever before. The latter may result from a lack of sufficient internal capacity, a common reason for outsourcing in the past. It also may come from decision makers grasping the positive fact that outsource partners (if chosen correctly) tend to be specialized at what they do and therefore can reduce overall program risk. Technology transfer during product development, whether internal or outsourced, must perform flawlessly the first time, meet expectations, and ensure appropriate comparability of product. Regulatory requirements for demonstrating a life- cycle development approach are ever paramount. Therefore, technology transfer is just as important as (if not more so than) it has ever been.

Demographics |

|---|

Who are the biotechnology players in technology transfer and outsourcing? Here are the outsourcing requirements for different types of company. |

Emerging Biotech: Majority of key development stages and CGMP clinical manufacturing |

Established Biotech: Can keep most of a process/product life cycle in house; may choose outsourcing to access partner’s expertise, reduce risk, and/or to run multiple product pipelines (which is increasingly becoming the case) is likely to mix in house and outsourcing |

Virtual Biotech: Needs to outsource everything |

A Critical Consideration

Some bioprocess developers might wonder why technology transfer is so critical. “Surely we just hand over the process, analytical methods, and a bill of materials,” they might say. “How hard can it be?” In fact, if you ask a typical university start-up company how long technology transfer is likely to take, the answer may be, “a couple of weeks.” For a well-versed biotechnology company, however, the (more realistic) answer probably will be “six to nine months.”

The International Conference on Harmonisation of Technical Requirements for the Registration of Pharmaceuticals for Human Use provides a very powerful statement on the importance of technology transfer (1): “The goal of technology transfer activities is to transfer product and process knowledge between development and manufacturing, and within or between manufacturing sites to achieve product realization. This knowledge forms the basis for the manufacturing process, control strategy, process validation approach and ongoing continual improvement.”

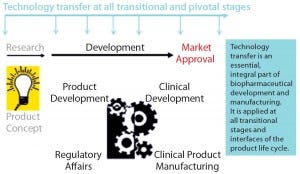

Figure 1: Technology transfer across the product development life cycle

Although it is an essential part of product development (Figure 1), in some instances technology transfer can be erroneously underrated and too little effort put in too late. During a product’s life-cycle, process change is inevitable and unavoidable: Process modifications, product refinements such as posttranslational awareness and impurity profiles, up-scaling, and

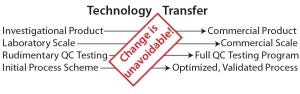

increasing compliance with current good manufacturing practices (CGMPs) each involve related technology transfers (Figure 2). A failed transfer can easily lead to several months of effort in recovery and high expenditure in putting things right — not to mention making a big dent in investor trust (or even a complete breakdown of investor confidence. So although the cost of development never gets any cheaper, seamless technology transfer is essential for “right first time” results. Comparability of process and product equivalence at every significant step change or pivotal-trial materials change is also a fundamental regulatory requirement that is usually underpinned by technology transfer data.

Figure 2: The necessity of technology transfer as a consequence of change

Formulating an Action Plan

The precise nature and application of technology transfer first depends on your company type (see the “Demographics” box), what can be done internally, and what needs to be outsourced. Technology transfer doesn’t have to be difficult, but diligent planning, close project management, and full company buy-in are an absolute requisite.

When Is Technology Transfer Needed? First consider what is being transferred. Examples include

a product’s transition from early development to CGMP

a pivotal change from producing phase 1 material to producing phase 2 material incorporating process scale-up

in-house, site-to-site transfer

scale-up to commercial manufacturing

process/analytics transfer to an outsourcing partner.

Such transfers don’t happen on their own; we need to resolutely project-manage them with a sufficiently detailed and accurate plan and protocol. We also need to document each transfer properly, typically with a technology transfer report. And we first need to define acceptance criteria for a transfer, which will enable us to determine whether a transfer has been successful. This process should incorporate a multidisciplinary team — top management and a project manager with personnel from development, analytical, CGMP, quality, and engineering groups, for instance). If a project is being outsourced, team members should be involved from both the client and service provider.

Breaking It Down

Whether a transfer is internal or external, many aspects remain the same. Consider a process manufacturing a biologic product with supporting analytical methodology. Let’s take as an example scenario, transfer of product from early development into CGMP for manufacture of phase 1 clinical material with transfer to an outsourcing partner.

Fundamental Information: What is our process, what is our product, and how do we intend to test it? How much product do you need to make (consider clinical requirements, testing materials, and retains)? Is the associated technology preexisting/in-house or is it envisioned to come from an outsource partner?

Outsource partnering could be initiated through meeting at an industry event, from an online search, or by recommendation. Do your homework. Make a list and ask around, then narrow it down to a short list. Be clear about what you want and ask for an indicative quote. Visit contract manufacturing organizations (CMOs), and if possible, take along someone with previous insight and expertise. Costs can vary dramatically, so when comparing quotes you need to ensure a high-quality output (e.g., regulatory-aligned documentation).

Make sure the CMO has a good, proven track record or can readily adapt to your process and product. Remember you are buying into a partnership, and it has to feel right. CMOs will need to coordinate timeslots with other projects, so your project campaign may be scheduled for several months down the line.

Do not hide anything from your CMO. This is critical. Do your process and analytical methods work well? Is the characterization of your product sufficient, or do issues remain to be resolved (e.g., posttranslational modifications, impurities, productivity)? Be honest up front, or the CMO will ultimately uncover problems, leading to delays and costs in putting things right. If development work such as characterization and optimization will be required, then such needs will need to be identified and planned.

Make sure the CMO can adequately reconfigure its facility and equipment to accommodate your process without having to inappropriately adapt your process instead. This is not so essential earlier on, but it will be a more significant criterion at more advanced stages of process realization.

Once a clear CMO is shortlisted, it will be important to establish formal quality and technical agreements (they may be one and the same). They define the technology transfer scope and related deliverables, payment stages, and who will be accountable for what and when. Read these agreements carefully — especially the small print — because they are contractual and legally binding. Because setting up agreements can take time, it may be possible to begin “at risk” by commencing transfer of a bill of materials or procuring an essential item of equipment, which can involve the longest lead time within a program.

For an internal transfer (e.g., from an early development group to CGMP manufacturing), the general philosophy is essentially similar to that of outsourcing described above, but the interplay of information should be more accessible and immediate. Do not overlook the importance of cohesive meetings including everyone to ensure a common understanding. The “Initiation” box provides a starting- point checklist.

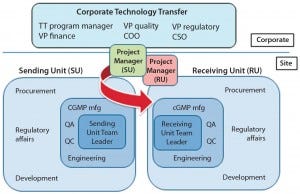

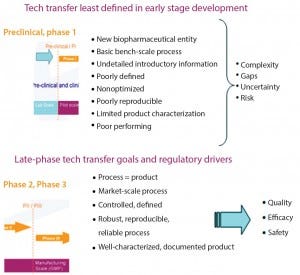

Component Parts: Figure 3 lists key aspects of technology transfer. Early and late-stage transfers have different considerations and acceptance criteria (summarized in Figure 4). Those are the basic criteria, and they may seem easy at first: The basics of transferring materials, methods, process, equipment, and knowledge include showing that those are appropriately prequalified and ultimately meet final acceptance criteria. However, any and all aspects of this process are capable of going wrong Technology transfer is the sum of its parts, in which one mistake can ruin the –results. Most often, that thing is the one you haven’t planned for.

Figure 3: Coordinated technology transfer team of sending and receiving units

Figure 4: Early (top) and late-stage (bottom) technology transfer goals

Preventing Failure: Considered planning and protocols – the key to getting it right — includes project management, a technology transfer plan, risk assessment (audit of facility, equipment, materials, and so on), and a protocol.

They are interrelated. Finally, a technology transfer serves as the cornerstone of this exercise.

Initiation of Technology Transfer

A Technology Transfer Plan: The objective is to transfer expertise, technical information (e.g. concerning raw materials and specifications), and technologies. A technology transfer plan (which often takes the form of a GANTT chart, as in Figure 5) should include the sequence of all transfer activities. It should describe the timing and dependencies for each transfer activity and expected milestones for meeting the acceptance criteria of achieving valid technology transfer. In addition, regulatory expectations and responsibilities should be stated, along with the regulatory milestones and outputs that may be linked to the technology transfer effort.

Figure 5: Technology transfer plan (e.g., Gantt chart)

A technology transfer protocol should list the proposed stages of the technology transfer: key personnel and responsibilities; materials, methods, and equipment; documentation that each stage has been suitably completed before the next initiates; applicable critical controls; experimental design and acceptance criteria for analytical methods; supporting information on development, production batches, qualification batches, and process validation; change control procedures for process deviations; evaluation of end products and associated acceptance criteria; provisions for keeping retention samples, intermediates, and finished products; and a conclusion with lines for signed approvals.

Technology Transfer Report

Documented evidence that transfer of technology is considered to be successful should be formally captured in a technology transfer report. It should describe the scope of the technology transfer and cross- reference the technology transfer protocol. The report should also list associated critical parameters and show how acceptance criteria were met, along with discussion and conclusions. List all discrepancies and applicable corrective actions.

This report may be requested by a competent authority for approval of a site transfer or as part of a preapproval or normal GMP inspection. A technology transfer report also may constitute (or should directly correlate with) a required comparability report.

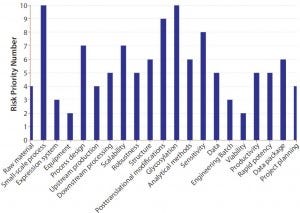

It is essential to have a scientifically passionate and coordinated technology transfer team (from both sides in an outsourcing relationship) with accurately planned, agreed upon, and timely communications. Perform a risk analysis to determine what can go wrong. Tools such as fishbone diagrams and failure modes analysis (Figure 6) can highlight the weak points here. Even the seemingly simple, every-day technology transfer for making a cup of coffee could fail on several fronts: milk (full, skimmed, or none at all); additives (sugar, other sweeteners, flavorings, a combination, or none of the above); volume, strength, temperature, and quality of coffee (instant, decaffeinated, regular); cup type and size; and the time of day to make and drink it.

Figure 6: Technology transfer risk evaluation

The technology transfer process may sound futile to the uninitiated, but its importance is paramount from both a technical and regulatory perspective, so it should never be overlooked. It may look straightforward from a high level, but in reality, for biotech products and processes it is actually very complex. This activity can cost a significant amount of effort, time, and money, which is a major reason to get it right. Failure can easily cost six months to a year of work to put things right. From my own experience, good and adherent planning is essential and can make the difference between failure and success.

Absolutely consider conducting a preliminary engineering batch before formal technology transfer of CGMP manufacturing. This can demonstrate that the process runs as expected. Remember that effective training is not always factored in.

Acceptance criteria need to be objectively defined. Analytical qualification/validation also is necessary and can be an overlooked time constraint. Be sure to take into account the latest regulatory requirements. They are liable to change and need to be properly interpreted, especially (for example) in transfer of a legacy product.

Take-Home Messages

In a process/product development life cycle, change is unavoidable. Companies must ensure that pivotal-stage clinical materials are the same from one trial to the next. Technology transfer therefore must ensure the management of such changes. Technology transfer is closely linked to comparability. Whether in house or outsourced, technology transfer efforts are much the same.

Secure buy-in from laboratory personnel up to senior management is essential. Technology transfer can and should involve development, CGMP, quality, and engineering groups. Do not rush things, which is by far the most common failing. Diligent planning and project management are key. Procurement of materials can take several weeks; method and process transfer also can take a long time to qualify (or validate as necessary), particularly with biopharmaceuticals that take a long time to manufacture.

CMOs are involved in many projects, so a timeslot probably will not be available immediately for your manufacturing campaigns but could open up several months in the future. Do not outsource anything that has a hidden problem, which will escalate inevitably. Ensure that quality outputs meet regulatory expectations. Ask for up-front examples, and try to speak with previous clients of your short- listed CMO.

Remember, in outsourcing you are buying into a scientific partnership of developing and manufacturing part of your product’s development life cycle. It is important to maintain a strong rapport. If you encounter a problem (development often can hold hidden surprises, even if in house), quick assimilation and decision making will be needed. Above all, the “people” aspect of technology transfer needs to work — especially for knowledge transfer and continual communication. Plan frequent teleconferences and meetings to maintain active working relationships.

Finally, keep the objective challenge in focus: The product development goal is to create a robust and reproducible process and a safe and consistent product. That is what technology transfer ultimately aims to underpin and establish.

Acknowledgment

The author greatly thanks Romain Le Deun, MSc, for valuable scientific input.

Reference

1 ICH Q10 Pharmaceutical Quality System. US Fed. Reg. 74(66) 2009: 15990– 15991; www.ich.org/fileadmin/Public_Web_ Site/ICH_Products/Guidelines/Quality/Q10/ Step4/Q10_Guideline.pdf.

Further Reading

WHO Technical Report Series No. 961, 2011. WHO Guidelines on Transfer of Technology in Pharmaceutical Manufacturing. World Health Organization: Geneva, Switzerland, 2011; http://apps.who.int/prequal/info_general/ documents/TRS961/TRS961_Annex7.pdf.

USP <1224> Transfer of Analytical Procedures. USP 37–NF 30 May 2012.

Richard Dennett, PhD, is a director of Voisin Consulting Life Sciences at its global head office in Paris, France; 33-2-9968-7110; [email protected], http://voisinconsulting.com. He has been actively involved in commercial development and CGMP manufacture of many process types and product classes, including direct and interim management of technology transfer.

You May Also Like