BioPhorum Operations Group Technology Roadmapping, Part 3: Enabling Technologies and CapabilitiesBioPhorum Operations Group Technology Roadmapping, Part 3: Enabling Technologies and Capabilities

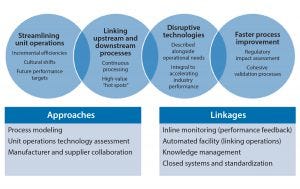

Figure 1: Process technologies — key themes

Although great strides have been made over the past 20 years to increase the productivity and robustness of manufacturing processes for biopharmaceuticals, the cost and complexity of their development and manufacturing remain high, especially in comparison with those of small-molecule pharmaceuticals. Process improvements are required to increase patient access while maintaining the viability of an R&D-driven biopharmaceutical industry. Facility productivity, cost of goods (CoG), and capital investment all have significant margins for improvement. Such goals can be achieved not only through process technologies available to the industry, but also through enhancements to the way in which those technologies are implemented. Automation, analytics, modularity, and knowledge management all have key roles to play in this transformation. In part 3 of this series, we discuss how those factors will shape the industry’s future.

Thirty-one member companies contributed to this first edition of the roadmap, with additional input from academics and agencies. More than 170 people (both biopharmaceutical manufacturers and suppliers) are now actively involved in the roadmapping process.

Process Technologies: the Backbone of the Roadmap

Developments in process technologies are set to increase the productivity and robustness of biomanufacturing. Better technological solutions in manufacturing plants ultimately will lead to safer and more cost-effective drug products.

The impact of future process technologies is likely to affect every business driver: cost, quality, speed, and flexibility. Thus the Technology Roadmap expert team has arranged the document as if it were a process map rather than focusing on each business driver or technology type individually.

The analysis focused on the most common production scenarios in the industry from an upstream perspective: 2,000-L disposable and 10,000-L stainless steel bioreactor capacities for the commercial production of monoclonal antibodies (MAbs). The process map of a bioprocessing operation includes each unit operation and its drivers, needs, and challenges described in detail. Priorities for each process operation will vary. As an example, for bioreactor design, the team suggests that the biggest driver should be speed to reduce the time for cell growth. For the harvesting and distillation step, the biggest driver will be cost.

A focused development effort on a select number of technologies (Figure 1) could have a broad and significant impact in our industry, including

process intensification to improve titers, thus reducing volumes and the number of unit operations, increasing the number of streamlined ways of working, and lowering capital cost of facilities

richer chemically defined media, feeds, and supplements that enable higher cell densities and titers, simplified media make-up, and longer media stability

robust, scalable harvest technologies and cell retention devices that minimize large capital investments and handle increasing cell densities

standardized modular claims for robust viral clearance approaches that provide streamlined regulatory processes and ease process development

buffer management approaches that reduce operational constraints and space requirements for buffer preparation and hold as well as cost-efficient inline dilution solutions

high-capacity chromatography resins with extended lifetimes to reduce costs

single-use technologies to increase flexibility and improve closed systems, decreasing capital cost and total cost of goods over product lifetime.

Challenges in Reaching for Increased Process Efficiency

The bioprocessing industry faces many challenges in reaching its goals of increased process efficiency and improved economics. Among them are variations in product potency, market requirements, and manufacturing productivity that necessitate a broad range of facility designs. To have maximum impact, new process solutions must be adaptable across a broad range of scales and facility types.

As mentioned in a previous article (1), we used data modeling to evaluate the four most common production scenarios and distill the most useful strategies from the huge amount of data. Among our findings were both small or and large changes to individual unit operations. Although such changes made quite integral differences in small areas of a process, they didn’t make huge differences to overall process speed, cost, and capacity. Our conclusion was that the high value and breakthrough improvements will come only from truly disruptive technology that affects a process from end to end and links upstream and downstream.

Among the valuable input from supply partner members of the Technology Roadmapping team was the feedback that a lot of the needed technology is already available. But it is not already being used because the first company to implement it will have to bear the brunt of costs associated with validation and regulatory compliance. That company also will have to determine what the validation process would include and what would have to be demonstrated to regulators.

It is at this point that the benefits of a collaborative industry approach reap rewards, negating the need for anybody to be the first guinea pig. Regulators also will be able to evaluate new technologies in an open environment, speeding up the approval process.

Benefits of Implementing Modular and Mobile Processing

Biopharmaceuticals and cell and gene therapies currently are produced in fixed facilities that require significant upfront, at-risk capital investment. Modular and mobile concepts offer an opportunity to shift this paradigm away from large, fixed assets toward networks of smaller, standardized manufacturing facilities. They can be built in less than half the time and in a way that defers cost until there is greater certainty about market demand and probability of success. Such manufacturing platform standardization provides an opportunity to accelerate the delivery of therapies to the market, improve supply-chain responsiveness and regulatory review for new products, and simplify the process of adding capacity.

One of the greatest challenges to this approach is a need for standardization. Biomanufacturers understand that being able to buy standard parts from multiple suppliers would make the market cheaper and more dynamic. When manufacturers launch their products and write their facility and kit plans, many tend to overcomplicate them. By the time those plans reach a supplier, the kit has become customized and tailored to a manufacturer’s specific use. Of course, the supplier is willing to accommodate the customer’s needs. A complete culture shift in the industry is required to move toward standardization that manufacturers can use, suppliers will buy into, and regulators will accept.

Another challenge to implementing the modular and mobile approach is regulatory validation. Currently validation takes a three-stage approach: First, equipment coming into a factory is validated, then the operation that will be performed using that equipment is validated, and finally the product coming out of that operation is validated. This process can be simplified down to only one episode of validation. For example, if the same standard components are used in the same arrangement in a facility and under the same conditions, then there should be no need to revalidate.

Again this is a seismic shift in thinking for the industry that would involve changing the way regulators authorize the production of new products and the change-management processes involved. Eliminating nonvalue activity for both manufacturers and regulators could speed up time to market of new products by 50–80%.

The third challenge in implementing a modular and mobile approach is flexibility. In theory, scaling up/down a manufacturing facility should be very easy if it must be moved to a new location. This scenario would be very useful in times of emergency, such as during a pandemic outbreak, when a vaccine production facility could be located where it is most needed and removed when the outbreak is over. In that scenario, production is being moved to the patient population. That reach brings with it a globalization issue: different regulatory standards and approaches in different regions. Global standards would be required so that those facilities could be moved around quickly and easily.

In summary, to realize the benefits of a modular and mobile strategy, the industry will need to make progress with the following recommendations. First, develop standard, simple, fit-for-purpose design of facilities and processes packaged in a modular format. Such modules could be fabricated, tested, and delivered much more quickly and at a lower cost than traditional facilities. They could be added or removed as needed without interrupting operations and could be repurposed, allowing for alignment of capacity with demand.

Second, industry consensus on standards will be required to define the capabilities and interconnection of a facility, room, process, equipment, automation, and single-use systems (SUS) with a key need to focus on interconnection. That would require collaboration between pharmaceutical manufacturers and suppliers.

Third, collaboration with regulators will be required to enable a new regulatory strategy in which the facilities are treated as equipment for purposes of validation and qualification. This would allow faster regulatory licensure of follow-on capacity additions or new products.

Fourth, operational robustness, operator safety, product quality, and ultimately patient safety will be improved through standardization and continuous improvement. Robust supply and performance of disposables will need to be supported through improved supply chains.

Finally, efficiencies in drug-product operations and supply-chain inventory of drug substances will be improved through design and colocation of drug-substance and drug-product facilities.

Drug manufacturers can use the above strategies to successfully respond to the market trends and business drivers.

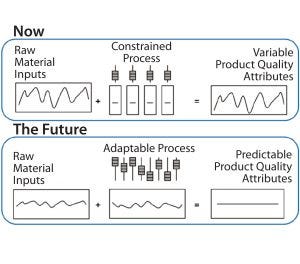

Figure 2: In-line monitoring and real-time release

Making Real-Time Release Possible with In-Line Monitoring

Using innovative measurement systems such as in-line monitoring will speed up manufacturing to quickly release biopharmaceutical products (Figure 2). In-line monitoring has multiple benefits not only in terms of lead times, but also product quality because in-line monitoring improves measurement systems and because of the knock-on effect on supply chains and capacity. For manufacturers, it provides a cost positive benefit, including drastic reductions in the costs of holding large inventories.

The real step change achieved through this approach is in lead times for drug-product release — moving from over 20 days to under five days. A manufacturer can decide the fate of a batch in real time rather than having to wait a month for analytical results.

Implementing in-line real-time monitoring for bioprocesses brings unique challenges. They include the complexity and variability of raw materials (especially living organisms), the difficulties with moving from stainless-steel to single-use equipment, and the potential shift from batch to continuous processing. One key challenge to achieving real-time release is ensuring that high-level technology demands and systems are met. The industry’s future needs will revolve around the development of innovative in-line monitoring systems, associated probes and sensors, and appropriate analytics to make sense of data and give a control point later in each process. The only way that such scientific and technical challenges can be overcome is if the bioprocessing industry has close relationships both with academics (in terms of developing the analytics and using prediction models) and suppliers (to specify equipment that will be needed for real-time monitoring of processes).

The industry will need to work collaboratively to ensure that regulators accept and understand these new approaches and that suppliers are brought into processes early to develop a set of common standards for equipment and specifications. In the Technology Roadmapping team, companies and supply partners already are talking together about the needs, the difficulties, and the solutions to be developed and implemented. Part of the collaboration is connecting with regulators and academics and keeping them well briefed on the progress being made as well as being transparent about challenges and options we have for the future.

Automated Facilities of the Future

Future biopharmaceutical facilities will be fully automated. They will include a critically enabling set of standardized and interoperable technologies and capabilities that will decrease capital and operating costs, reduce time to build and commission facilities, and speed up drug-product launch to market. They will be integrated from development to final drug product, and they will be able to handle variable processes, variable batch sizes, and variable geographies. To meet different market demands, future facilities will be able to quickly ramp capacity up or down and do so with minimal staff, minimal time to change over, maximum safety, and minimum regulatory observations. Benefits provided by an automated facility include

full integration across all systems such as manufacturing execution systems (MES), personal communication systems (PCS), and laboratory information management systems (LIMS)

full integration for quicker and cheaper build times; access to all the data generated with full context; and decreased variation such that full integration will lower operating costs and improve quality

standardization of underlying processes and unit operations that allows for quick and easy configuration (instead of custom programming)

data management, with the extraction and visualization of information out of the data

highly available automation systems

reduction of manual labor through the use of robotic systems and mechanization (currently, labor costs for biopharmaceutical facilities are among the highest of any industry)

new and converging technologies that eliminate errors through paperless operation and guide maintenance and support activities; reduce cost through the use of smart scheduling techniques to maximize use; and enable the move to cloud and virtualized technologies

disruptive concepts and technologies such as the convergence of platform technologies to provide a new model for operation, with capability and intelligence distributed at much lower levels in the plant architecture (plug-and-play modules); and the use of large amounts of data and adaptive machine learning to provide decision support and help eliminate delay and errors.

Important challenges must be overcome to fully implement an automated facility. The first of these is variation in volumes and batch sizes involved in manufacturing processes and the diverse geographical locations. Attaining the ability to ramp capacity up and down will speed up commercialization. The sooner that is done, the faster the build costs can be met and a company can get into profitability. Achieving standardization across the industry is a huge paradigm shift for achieving best practices as well as standardization of equipment and protocols.

Figure 3: Process technologies — key themes

Adapting to change and a willingness to collaborate will be the hallmarks of leading companies, both for end users and suppliers. Some people may see that as a battle to determine “winners” and “losers” in terms of automation providers, but that type of focus will serve only to delay change and lead to adoption of less technology in the near term while bioprocess companies wait to see what evolves. Suppliers will need to ensure that their supply chains are on board and should realize that it is possible to work within standards and still remain competitive (Figure 3).

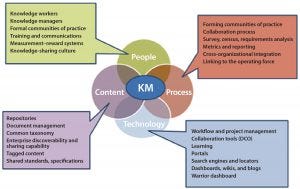

Knowledge Management: The Heart of a Manufacturing Process

Knowledge management as a process of capturing, developing, sharing, and effectively using data is important to drive business by providing patient, product, and process information. Including dimensions of people, processes, content, and technology (PPCT), it is both a multidisciplinary and cross-functional approach to innovation and continuous improvement. A robust and reliable knowledge management platform integrates product and process information across development, manufacturing, and commercial value streams. It provides near–real-time access to information and cross-product learning.

Figure 4: Knowledge management diagram for people, process, content, and technology (PPCT)

As the industry advances in its maturity and capabilities, the need for knowledge and knowledge-enabled processes becomes essential. The Technology Roadmapping Team’s vision of knowledge management for the future is of an organization in which people have access to all knowledge in seconds or minutes (Figure 4). This capability would enable and speed up many tasks:

Technology transfer would be efficient and done right the first time.

Knowledge would be readily available for risk assessment and development of process designs and control strategies.

Investigations would find root causes quickly.

Second-generation products and analytical methods would be developed using a foundation of deep and growing institutional knowledge.

Lessons learned would be built seamlessly back into routine operations.

Many organizations have experienced difficulties associated with poor knowledge management not helped by the proliferation of knowledge management solutions that do not deliver on their intended use. Especially within biomanufacturing, content management systems are neither institutionalized nor strongly adopted nor routinely used.

A geographically dispersed and mobile workforce presents challenges in knowledge management collaboration. Unclear knowledge management strategies that are not introduced with a business focus will have difficulties attracting attention and gaining momentum. Another major barrier to knowledge management can come from a lack of a systemic approach and no cultural readiness: Although the right technology is important, it is insufficient unless it is incorporates the right “people” processes.

Implementing a knowledge management system requires both a paradigm shift and a cultural transformation that begins from the top of an organization. The bioprocess industry understands that this knowledge management revolution is on its way. Manufacturers must make sure they can not only manage the volume of information, but also ensure that it is understood and that best practices are in place.

Data privacy is another issue that the industry must address. Doing so will allow manufacturers to share knowledge and store it in the cloud, while making sure that there is privacy for both manufacturers and suppliers.

The technology roadmap outlines the industry’s needs for knowledge management. Understanding the value in achieving those targets (set for 10 years out) is critical and and can be achieved through collaboration and partnership. The competitive and precompetitive spaces offer many opportunities to look at best practices for early adoption of knowledge management systems.

Supply Partnership Management: The Key Ingredient

The Technology Roadmapping team recognizes that supply partnerships are an important area of the roadmap. The Supply Partnership Management team focused on its own future goals and on becoming an important element and contributor to all of the other teams. Supply partnerships are a developing way for companies to work, bringing more value to the supply-and-demand side of the industry and accelerating the pace of innovation. The goal is to influence the direction and decision-making of the industry as companies develop new future technologies.

The Roadmap’s Supply Partnerships team had a different slant than the other teams. It focused specifically on the relationship of biopharmaceutical companies and their supply base rather than just one technology. The team envisions a future biopharmaceutical industry characterized by a few fundamental elements:

creating a series of standards for materials, components, specifications, documentation, and more

creating new value propositions that focus on delivery and performance in addition to the traditional focus on innovative technology; this allows customers to reward great manufacturers that sustain business and not just the great innovators that get selected early in a development cycle

creating more flexibility, agility, and interchangeability that will lead to greater opportunity for suppliers of new and additional applications as well as improve supply chain continuity

creating lean and efficient supply chains driven by “super” integration of business systems between customers and suppliers.

Five key enablers that will deliver the industry’s vision are openness and trust, standardization, built-in quality, electronic data exchange, and forecasting and demand planning. The main drivers for moving toward this vision are cost, speed, and flexibility. Total cost to supply should be driven down by volume use, improvements in supply chains, and upfront build costs being reduced by implementing more flexible designs.

Quality is a key challenge. Companies need to keep raw-material variability low and product availability high. Quality needs to be built in, which means minimizing through automation any opportunities for errors to occur in a design process (e.g., using robots). When it comes to forecasting and inventory planning, the onus is on integration with suppliers and biopharmaceutical manufacturers to work together, sharing information on material use and replenishment timing.

Is it possible to achieve real-time, just-in-time resupply as the automotive industry enjoys? The answer possibly lies in built-in quality, supply chain management, and the use of new technology such as blockchain databases. Removing duplication of effort through standardized testing would elminate the need for end users to test raw materials again, and only a frank discussion between manufacturers and suppliers can resolve why such practices exist.

Agreeing on how best to operate electronic data exchange and supplier integration to understand appropriate platforms and languages presents an opportunity to standardize equipment so that it is plug-and-play without bespoke couplings. But that presents legal challenges such as intellectual property expectations regarding ownership, right-to-use, and the length of commitment from both sides. Manufacturers and suppliers will need to collaborate to make the regulatory process more efficient and streamlined. As regulatory expectations evolve, they often require increased levels of involvement from the supply base.

To encourage innovation, the biopharmaceutical industry must work on the following areas with suppliers:

developing ways of working and collaborating a culture of trust

developing electronic data exchange as a process with standard applications across the industry

engaging regulators to reduce duplication of requirements and on accepting development of standard practices

assessing technologies from the automation concept called Industry 4.0, including how they apply to the bioprocessing industry and their potential for affecting inbound supply chains

deeply assessing the capacity to meet the growth needs of the industry in key areas such as supply of critical raw materials (e.g., cell culture media components and specialist plastics for single-use systems) and services (e.g., sterilization and lyophilization) with considerations to forecasting and demand planning cross-industry to support the roadmap

taking into account supply chain mapping, transportation, and logistics of materials in future editions of the roadmap as future biologics production becomes even more global; supply chains to support the industry will continue to be distributed worldwide and finished products also distributed globally.

The key to achieving the above objectives is collaboration between customers and suppliers, requiring that each look at the relationship in a different way and challenge the previous limitations of data sharing and openness. That collaboration can take many forms, ranging from a visit to a manufacturer’s facility (to fully understand a process) to assignments at each other’s facilities. Developing a high level of trust will bring optimal results, so each partner can achieve what neither company could have done on its own.

Recommendations from the First Technology Roadmap

Collaboration has been the overriding theme in the first edition of the Technology Roadmap. The high participation levels in its development demonstrate that the industry will openly share technology strategies. It also shows that manufacturers are moving in the same direction with the same challenges to overcome and a willingness to develop solutions that will benefit all stakeholders — and ultimately, patients.

The first edition kick-starts the roadmap initiative and has imbued a sense of momentum to evolve to the next level of maturity and to implement the roadmap into industrial operations. The steering committee recommends several steps that the industry can take to move forward. Industry is identified as inclusive of all stakeholders (e.g., end users, suppliers, regulators). Those steps are

Build awareness of the Technology Roadmap and encourage engagement through proactive communication activities with industry public events and networks as well as within member organizations.

Engage with key industry organizations and gather feedback from the industry to form responses to the roadmap, align efforts, and consider funding routes.

Identify collaboration opportunities in response to roadmap needs to accelerate innovation initiatives and roadmap “quick wins.”

Develop and track industry analytics to understand market trends and progress of innovation.

Widen the participation to engage key stakeholders (including regulators) to implement the roadmap vision.

Broaden the scope of roadmap efforts with new areas of focus and continued future editions.

Nominate and recruit subject matter expertise for future roadmap activities such as industry benchmarking and tracking, trend analytics, collaborative projects, communications, regulatory interactions, and input for the secondedition process.

This technology roadmapping effort is an evolving, dynamic, and open process. We welcome comments from all industry stakeholders and look forward to continued growth in membership, further accelerating and broadening industry impact. Please go to the BPOG website below to sign up for the first edition of the Technology Roadmap and learn how to become part of this worldwide effort for the biopharmaceutical industry.

Reference

1 Biophorum Operations Group Technology Roadmapping, Part 2: Efficiency, Modularity, and Flexibility As Hallmarks for Future Key Technologies. BioProcess Int. 15(2) 2017: 14–19.

Bob Brooks, Jonathan Dakin, Clare Simpson, and Linda Wilson are facilitators at the BioPhorum Operations Group. For more information, contact [email protected]; www.biophorum.com/category/resources/technology-roadmapping-resources/introduction.

You May Also Like