- Sponsored Content

Pfizer Collaborates to Accelerate Approval of Biosimilar MAbs in ChinaPfizer Collaborates to Accelerate Approval of Biosimilar MAbs in China

November 22, 2017

Sponsored Content

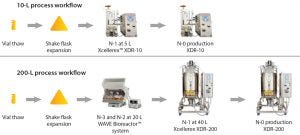

Figure 1: Process flows for 10-L and 200-L upstream processes using single-use bioreactors from GE

In their pursuit of developing therapeutics, biopharmaceutical companies face many challenges, including pressure to meet aggressive timelines, reduce risk and cost, and increase speed to market. Addressing these challenges is especially critical for biosimilar manufacturers, who face fierce competition and an expanding footprint in emerging markets (1). The global biosimilars market is growing rapidly and is expected to exceed more than US$6 billion by 2020 (2).

This case study describes how Pfizer is collaborating with GE Healthcare to achieve regulatory approval of biosimilars in China by streamlining process transfer strategies and implementing both single-use technologies and flexible, deployable manufacturing solutions.

Customer Needs and Concerns

Pfizer was interested in collaborating with a service provider to reduce risk and increase the speed to market of two biosimilar monoclonal antibodies (MAbs) while working under aggressive timelines. Assistance was needed in designing the scope of work for converting the existing stainless steel processes to single-use technologies while ensuring product titers and analytical comparability of the two target molecules. Fast deployment of a global, flexible, scalable, cost-effective biosimilar manufacturing solution was required to facilitate the goal of being first to market in an emerging region. Furthermore, once the decision was made to purchase a biomanufacturing facility, process transfer and start-up support at the new facility were desired.

Both the conversion to single-use and the process transfer needed to be completed in less than 6 months for both MAbs. Importantly, the molecules had to be confirmed as biosimilar products according to their critical quality attributes (CQA). Intellectual property (IP) protection was a concern at the start of the project, so initially GE’s Fast Trak team did not know the culture media and feed formulation, several process solutions, or the analytical comparability analytics. There were some initial concerns regarding whether the process would require modification or if GE’s equipment would have to be modified to accommodate the process. Other concerns centered around communication with and alignment of global teams. Specifically, Pfizer wondered whether GE’s team was flexible enough to handle real-time scope and process changes as the definition phase progressed.

Customer Outcomes

Project Scope of Work: The initial scope of work consisted of two 10-L process transfer runs for each of two MAbs, known as Product A and Product B, for a total of 4 × 10-L runs in GE’s single-use bioreactors.

One of those runs would be followed by a downstream run-through. After each run, the process could be optimized if necessary to meet customer targets. All 10-L protocols, solution records, and bills of material would be generated. Another 10-L run, both upstream and downstream, would be performed for each MAb for process confirmation.

Two proof-of-concept scale-up runs at 200-L scale would be performed for each MAb, for a total of 4 × 200-L runs, including both upstream and downstream processing. All 200-L batch records, solution records, and bills of material would be generated.

Fast Trak scientists in the United States would follow GE’s standard operating procedure (SOP) for process transfer. It defines the steps, roles and responsibilities, and templated documents required for process transfer. In addition to following the SOP, Fast Trak scientists would use cross-functional teams with process development, pilot plant, and manufacturing staff. All GE team members are trained in current good manufacturing practice (cGMP) and work closely with GE’s quality assurance (QA) teams.

Conversion to Single-Use Technology and Process Transfer

Upstream Single-Use Process: The critical process parameters (CPP) for upstream unit operations were identified for process transfer. Some of these parameters included seed train, agitation rates according to power input, pH, dissolved oxygen (DO), sparge pore size, feed, gassing, and bioreactor control strategies. Pfizer’s 12,000-L stainless steel process was scaled down and adapted to GE’s single-use bioreactors at a 10-L scale (Figure 1). After the 10-L process was worked out for each MAb, a 10-L process confirmation run was performed. The process was then scaled up to 200 L (Figure 1).

Pfizer staff worked on site and in plant with the Fast Trak scientists and engineers for all

upstream operations. They were also present for all real-time process or equipment changes.

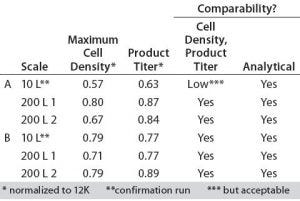

Table 1: Upstream process results for products A and B

The cell densities and product titers were determined by GE. The analytical comparability testing was performed by Pfizer after purifying the MAbs using their standard process. The results are summarized in Table 1. The maximum cell density and product titer were normalized to data from their 12,000-L (12K) stainless steel process.

The upstream process results met Pfizer’s expectations for cell density, product titer, and analytical comparability.

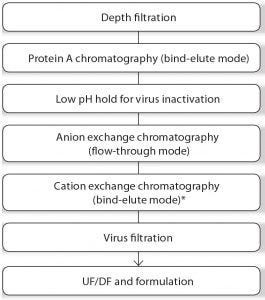

Figure 2: Downstream process workflow for MAb products A and B; UF/DF was performed using TFF (UF = ultrafiltration, DF = diafiltration) *Product B only.

Downstream Single-Use Process: The downstream process workflow is shown in Figure 2. The original downstream MAb process used large stainless steel centrifuges, tangential-flow filtration (TFF) systems, chromatography systems, and buffer tanks. The CPP for downstream process transfer were identified, including linear velocities, loading and binding capacities, collection criteria, flux rates, temperatures, pressures, pH, conductivity, hold times, and storage conditions. The stainless steel downstream process was scaled down and adapted to GE’s single-use TFF systems, depth-filtration systems, chromatography columns, buffer systems, bags, tubing sets, and sensors.

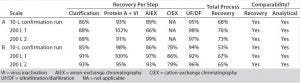

Table 2: Downstream process results for products A and B

The recovery at each step and the total process recovery were calculated. Analytical comparability testing was performed by Pfizer. The results are summarized in Table 2. The downstream process met Pfizer’s expectations for recovery and analytical comparability.

Process Transfer: The upstream and downstream processes were successfully converted from conventional stainless steel to single-use technology and scaled up from 10 L to 200 L. The project was finished in 5 months, including completion of 6 × 10-L batches and 4 × 200-L batches, as well as generation of more than 50 process documents and four complete bills of material. An estimated 6–12 months were saved based on Pfizer’s original timeline for a similar scope of work. Pfizer’s expectations were met for both upstream and downstream results, including analytical comparability.

Based on the successful outcome of the first phase of the project, Pfizer decided to purchase one of GE’s flexible manufacturing solutions, which would be located at a future manufacturing site in Hangzhou, China.

Choice of Flexible Manufacturing Technology: The FlexFactory™ biomanufacturing platform is a cGMP-compliant option that provides a complete production train, from cell culture to drug formulation, that can be installed in 12 months. GE’s KUBio biomanufacturing facility is a prefabricated cGMP-compliant facility for biosimilar MAb production. It can be built, assembled, qualified, and ready-to-run within 18–24 months. FlexFactory single-use platforms are included in KUBio facilities. After considering the options, the decision was made to move forward with a KUBio facility. GE’s Fast Trak and Enterprise Solutions teams worked with Pfizer to ensure appropriate selection of equipment and consumables.

Figure 3: Fast Trak Bridge Manufacturing Services offer access to process experts and enabling technologies in single-use, and provides additional manufacturing capacity while a facility is being built. Upon completion, GE transplants the process back to the customer with complete transparency and training.

Process Training: While the KUBio is being built, it is critical for Pfizer to maintain the clinical timeline for both MAbs. Therefore, Pfizer is continuing to work with GE’s Fast Trak teams for Bridge Manufacturing Services and other support until the process can be transplanted to their new KUBio facility in China (Figure 3).

After the initial phase of work, the single-use upstream and downstream processes for both MAbs were transferred to GE’s Fast Trak China team, which is generating material in country for preclinical studies, again working together with Pfizer on site and in plant.

In addition to providing manufacturing and training support, GE is providing support for other needs in the region where the KUBio is being built. For example, GE is helping with sourcing appropriate and compliant raw materials in the emerging region. GE’s Fast Trak team, along with GE Global Operations (GGO), supported customer meetings with local government and regulatory officials. Another service provided by GE is single-point project management throughout the project.

When Pfizer’s KUBio manufacturing facility is ready, The Fast Trak team will support process transfer, equipment training, and facility start-up activities at the new site. This not only ensures your process timeline continuity but also facilitates speed to market.

Conclusion

By working closely with GE’s Fast Trak team, Pfizer converted stainless steel upstream and downstream processes to single-use technologies up to 200-L scale. Notably, both MAbs in the study met Pfizer’s expectations for analytical comparability. Process transfer, including process documents and bills of material, was completed in five months, saving an estimated 6–12 months compared with internal timelines. This outcome led to Pfizer deciding to also invest in a GE KUBio facility, which will be deployed on a site in China.

While the KUBio is being built, assembled, and validated, GE’s Fast Trak China team will prepare material for preclinical studies with Pfizer staff on-site. With ongoing support from GE’s Fast Trak team and from other GE functions, Pfizer hopes to obtain regulatory approval in China for these two biosimilars.

Acknowledgment

We thank Pfizer Inc., for kindly providing us with permission to use this body of work as a demonstration of our Fast Trak Services.

“When tasked with the challenge of building a biologics plant in China, Pfizer Inc. sought a solution that would ensure speed to market and also be capable of manufacturing complex mammalian cell culture processes. Traditional stainless steel, stick-built projects generally have significantly long completion times, making them unattractive for emerging markets. GE Healthcare’s KUBio provides an elegant solution to this challenge by leveraging GE’s single use technology and prefabricated KUBio modules, creating a drug substance facility that can be seamlessly integrated with a more traditional CUB and warehouse facilities. Ensuring comparable results of a process in different facilities is paramount. A change in technology from stainless steel to single-use bioreactors presented a challenge to the project. Should Pfizer invest in a new technology without any prior experience of running the mammalian processes in the XDR single-use system? Working closely with GE Healthcare, a small cross-company team of scientists and engineers worked with lightning speed to transfer two processes to the GE Marlborough facility for proof-of-concept runs, first at 10-L scale and then at 200 L. The data produced helped forge an informed decision to proceed with a single-use biologics facility in China. The partnership with GE Healthcare continues with supporting runs in their GE Shanghai facility.”

—John Coyne (Pfizer Bioprocess R&D, Senior Manager Pilot Plant, Andover, MA)

References

1 Otto R, et al. Rapid Growth in Biopharma: Challenges and Opportunities. McKinsey & Company 2014; www.mckinsey.com/industries/pharmaceuticals- and-medical-products/our-insights/rapid-growth-in-biopharma.

2 Biosimilars Market: Global Forecast to 2020. Marketsandmarkets.com 2015; www.marketsandmarkets.com/Market-Reports/biosimilars-40.html?gclid=CNa_37uAu88CFQ-raQodCk0O6w.

You May Also Like