- Sponsored Content

Post-COVID Supply-Chain Challenges Are Easing, Part 2: Impact of Increased Vendor Competition on PricingPost-COVID Supply-Chain Challenges Are Easing, Part 2: Impact of Increased Vendor Competition on Pricing

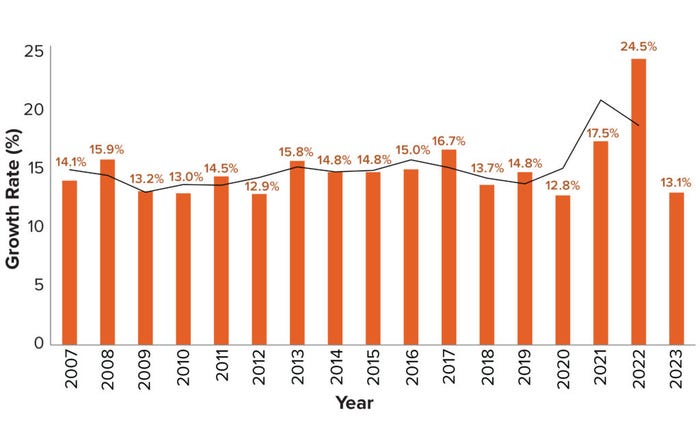

New competitors entering the bioprocessing industry during the COVID-19 pandemic gained access partly because of unprecedented demand and constrained supply of bioprocess materials, equipment, and consumables. During the pandemic, growth in supplier revenue increased dramatically, averaging >24% growth in 2022, with some segments of the industry showing even higher growth (1). The 20th annual report of biopharmaceutical production from BioPlan Associates also assessed price changes and competitive pressures resulting from the demand swings over the past few years. The bioprocess supplier landscape has changed significantly. Based on the annual report and on data from a recent BioPhorum white paper prepared by BioPlan Associates, we have quantified a number of competitive trends that are likely to persist as new competitors begin to influence the segment over the coming years (2).

Biopharmaceutical Supplier Growth

The pandemic brought significant revenue increases for many suppliers. However, some are now experiencing relative declines in both revenues and profitability, with some companies indicating steep drop-offs in future ordering. Some industry experts have attributed this decline to inventory draw-downs and conservative purchasing. In our research, however, those factors have had a relatively minor impact when averaged across the industry.

Multiple factors could be contributing to the current downturn:

• corporate belt-tightening in response to economic worries

• continued drawdown of safety stocks and inventory

• recent entry of new competitors to the market

• suppliers returning to standard discounting practices

• increased confidence in the supply chains

• inventory from large suppliers only now being used by their regional affiliates

• political instability around the world.

Although the overall biopharmaceutical ecosystem has generally weathered the pandemic and stabilized supplies of equipment and materials, concerns continue regarding when the bioprocess industry will return to the healthy growth patterns exhibited through the past 20 years. The 20th annual survey has measured supplier growth for 17 of those years. Until the pandemic, the industry had demonstrated remarkable stability, with a steady 12–15% annual growth rate in revenue that continued through both recessions and boom times. Then, average revenues in the supplier segment grew 17.5% in 2021 and 24.5% in 2022. Now, supplier revenue growth is returning to the levels of those earlier years, standing at 13.1% as of this writing (June 2023).

That transition from the exceptional growth experienced during the COVID‑19 pandemic realigns the industry with its average growth rates from previous years (Figure 1). Note that the potential influence of inflation could lessen overgrowth for 2023 compared with that before the pandemic. Respondents to the annual survey in the “Equipment and Instrumentation” category reported a current average annual growth rate of 14.0%, down significantly from 23.8% in 2022. The “Raw Materials and Consumables” category also experienced a substantial decrease from similarly historic highs in 2022.

Figure 1: Average annual vendor sales growth rate, 2007–2023 (2).

Some observers have identified industry segments such as single-use devices experiencing 20% increases in prices over the COVID period. That alone could have contributed much of the revenue growth among those suppliers. From a volume perspective, however, volume growth would not have shown such a significant spike aside from increases attributable to stockpiling and purchasing of inventory for pipeline vaccines that did not make it to market. Some large suppliers reportedly produced inventory of bioprocess supplies for their regional affiliates, subsidiaries, and distributors, thus increasing volume sales during the pandemic. Anecdotally, that could be reducing forward orders now — at least until those in-country affiliates’ inventories are used up or pass their expiration dates.

Single-Use Consumables Segment

Demand has shifted for most bioprocess equipment and consumables segments during the pandemic, most significantly single-use systems (SUS). To determine when members of this segment believe that it will “bottom out” of the downward trend in ordering, we conducted a short survey at the BioProcess Systems Alliance (BPSA) annual summit in Washington, DC, on 11 July 2023. Forty-four manufacturers participated in our anonymous analysis.

Most large and mid-scale SUS manufacturers feel that the industry still is up to six months away from flattening out the decline in ordering volume. Most large manufacturers (60.0%) expect that “growth will remain flat for up to six months.” Only 11% of respondents indicated that “growth has already returned to this segment.” So it is likely that the segment will continue to stagnate at least through 2023.

Averaging the change in SUS volume (not revenue) that each respondent company stated that it was experiencing today (year-on-year), we found that SUS manufacturers are experiencing an average drop of 17.3%. Large and medium manufacturers had significant decreases of 20.6% and 23.7% respectively; small manufacturers indicated a decline of only 7.5% in volume. It seems that the adverse effects of current ordering reductions are hitting larger SUS manufacturers harder. Multiple issues are creating a confluence of problem factors here: e.g, inventory draw-down, increased competition, and inaccuracy in inventory management systems’ predictions of required stock levels.

Factors Affecting Revenue-Growth Slowdown

In our September 2022 white paper, we identified several factors contributing to the overall drop in revenue growth (1). They include increased competition from new and smaller suppliers entering the market as well as a return to price discounting as supply chain and availability problems have eased. Although warehousing drawdown is a minor factor, it contributed to the overall decrease. In our research at the time, we found that many suppliers were not fully aware of the effects of new competition on their markets.

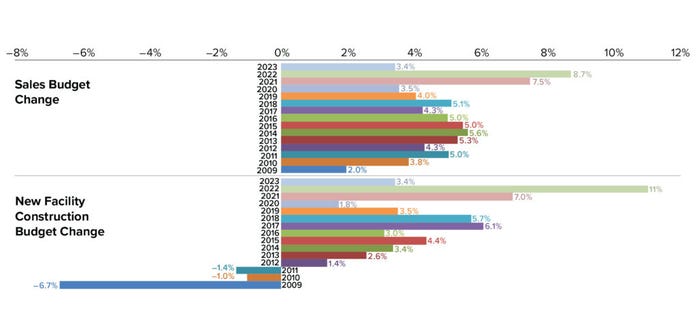

When we examined some budget changes among suppliers during the pandemic for the annual report, we found strong increases in sales budgets as well as in new supplier facility construction (2). For example, suppliers’ budgets related to sales increased nearly 9% in 2022 but only 3.4% in 2023, which is below their historical trend lines (Figure 2). Note that during the perceived post-COVID retrenchment among industry suppliers, sales budgets normally might have been expected to increase to counter the revenue decreases. In some cases, however, it is possible that such numbers reflect staff reductions.

Figure 2: Summary of selected results for vendors’ average budget changes, 2009–2023 (2).

Competition Affecting Revenue Declines: To some extent, the reduction in orders currently experienced by major suppliers can be attributed to the market entry of secondary and tertiary competitors taking partial orders. New entrants gained market access during the pandemic as end users sought to manage their supply and lead-time problems. Many drug developers explored alternative sourcing options, and the result is a landscape with more (albeit smaller) qualified industry suppliers.

Pricing for Bioprocess Supplies and Consumables: As the industry normalizes after the pandemic, the influence of those new, smaller suppliers on pricing probably has not been felt yet. However, suppliers acknowledge the market changes and competitive challenges that lie ahead, and price competition is a logical expectation.

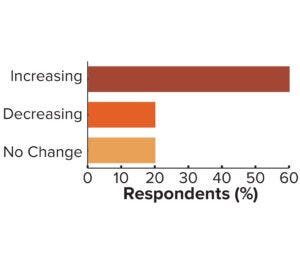

Figure 3: Forecast for competition

(supplier perspective) (2).

Most suppliers (60%) are aware of the emerging competitive situation; however, 40% anticipate either no changes in competition or decreasing competition (2). That might indicate a disconnect between what the latter group of suppliers is experiencing (less competition), and what end users are predicting (Figure 3).

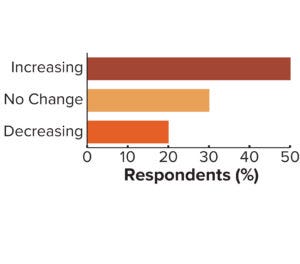

Increased Competition Affects Discounting and Price Reductions: The effects of competition are not being felt fully by all suppliers yet. Only 20% have found that prices are decreasing — which is probably the case because price pressures have not come to bear (2). Fully half of our survey respondents felt that prices are increasing.

Figure 4: Effects of competition on

pricing (supplier perspective) (2).

Price reductions, however, may be slow in coming. In the bioprocess segment, they can take the form of volume discounts and/or bundled-purchase discounts. But we expect that actual product price decreases will be unlikely for the time being. Timing will be difficult to predict for what discounting does occur. However, as the pandemic abates, and as availability and lead times improve, competitors probably will begin to reintroduce strategic pricing initiatives (Figure 4).

Although some suppliers are experiencing a return to healthy demand, many are encountering new competitors entering the industry. New suppliers are taking some market share from established and concentrated key players. Some have noted more competition in the bioprocess space with historic barriers to entry — such as building trust, resources, and labor — becoming less critical.

New Biotherapeutic Market Entrants: COVID-induced supply-chain disruptions paved the way for smaller suppliers of bioprocessing products and services to seize unique opportunities. With big-pharma buyers qualifying new suppliers to mitigate supply-chain risks, many newcomers have experienced substantial growth. The challenges ahead for those new players lie in sustaining that growth as pandemic disruptions subside.

Such competition generally is expected and probably welcomed by managers of many bioprocess facilities. In our white paper research, >71% of end-user respondents noted that they expect increased competition to continue and that it should lead to reduced prices (1). The additional competition has the potential to reduce prices over the long term.

International growth in the biopharmaceutical industry persists, with a notable and understandable focus on investments in vaccines and COVID-related therapeutics over the past few years. Consequently, the industry has witnessed a notable surge in the number of drug developers and biomanufacturing facilities worldwide.

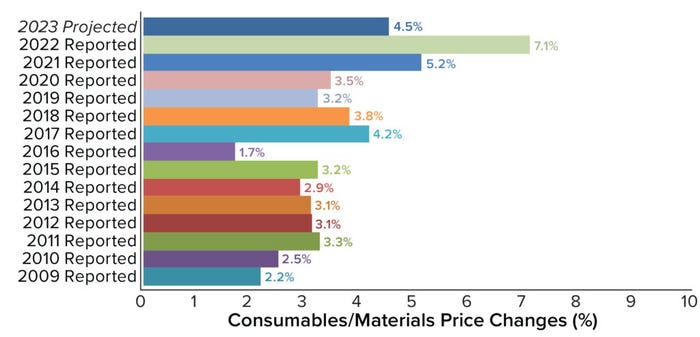

Vendors’ Average Pricing Changes: Initial fears of serious price gouging for consumables during the pandemic generally did not materialize in the bioprocess segment. Most of the increased prices — and the increased revenues that resulted — appear to be attributable to products being in short supply and thus sold at list price (effectively eliminating all discounting). According to our annual report, vendors reported an average pricing change of about 7.0% in 2023 for all products and services related to biopharmaceutical manufacturing, up from about 5.0% in 2022 (2). In previous years, typical prices in most subcategories did not increase much more than 2–3% annually. All five market segments we measured experienced higher average price increases in 2022, but those all subsided in 2023 (while remaining above prepandemic levels).

Considering average pricing changes among vendors from 2009 through 2022, projected changes for 2023 have decreased (Figure 5). The most significant change would be in disposable, single-use devices, with a projected average price up 4.5% for 2023. It was up 7.1% in 2022. CMO services also had slightly less average pricing increase of 3.3% this year (2).

Figure 5: Vendors’ average price changes for selected categories, 2009–2022 and projected for 2023 (2).

End-User Perspectives on Ordering Consumables

In our white paper research, 90% of end users either increased orders or did not change ordering volumes during 2022, and that trend is likely to continue through 2023 (1). It represents a significant difference from what many suppliers are experiencing. However, there is evidence that some portion of that gap probably comes from orders changing to alternative suppliers rather than canceling entirely due to reduced end-user demand. Orders are being split among suppliers, too, when some can offer relatively short lead times, improved availability, and/or better post-COVID prices.

Respondents suggested that it’s all about stronger competition, which “allows new suppliers to take share away from concentrated key players.” End users are multisourcing and turning to new suppliers “to avoid raw materials bottlenecks”. Some claim that these developments ultimately are the fault of suppliers, who “have massively delayed orders; we customers haven’t canceled anything.”

Future Perspectives

Overall demand for bioprocess supplies remains strong. With new therapeutics on the horizon, growth is anticipated in both established and emerging segments. Even as end users report a significant increase in orders, some large suppliers are experiencing nearly the same level of orders decreasing. The question for some of those companies is when demand will stabilize for consumables orders.

The pandemic has posed challenges for both end users and suppliers in terms of supply chain logistics, materials availability, and lead times. Research shows that secondary and even tertiary suppliers, who typically would take years to establish themselves, now have entered the market successfully. That increased competition — including from new entrants in China and India — could lower prices eventually and is likely to create near-term competitive pressures. Over 71% of end users anticipate ongoing competition and subsequent price reductions.

As the pandemic abates, and as availability and lead times improve, competitors are likely to begin reintroducing strategic pricing initiatives. One respondent noted, “Competitors have been increasing capacity, [and] more cost-sensitive customers have more sourcing options” (2). Supply-chain resilience could come into play here as well — as second sourcing becomes a requirement for some biomanufacturers. That might not decrease the overall volume of consumables required by the industry (it actually could increase overall volumes required slightly), but the demanded volumes for individual suppliers might change as the total volume is split across more suppliers.

Increasing demand factors for consumables include increasing numbers of batches run and new products launched (including emerging technologies such as cell/gene therapies), new facilities and expansions, and a rise in product approvals for biologics. During 2022, end users’ order volumes increased by an average of 18% while their values increased by 16% (2). When asked to project for the future, the great majority of end users (87.5%) indicated that they expect to increase volume requirements and expenditures on bioprocessing consumables. The next question is when and how end users will share demand forecasts with their suppliers so that they can match production to demand.

The future for most suppliers to the biopharmaceutical industry remains rosy. In fact, most suppliers are quite positive about the future, despite projections for increased competition. When asked for our annual report to indicate their financial revenue outlook for 2023–2024, a slim majority (53%) of suppliers expects to do even better post-COVID than they were doing before it (2).

References

1 Langer ES, et al. Impact of COVID-19 on Bioprocessing Supply Chain Hiring, and Inventory: A Collaborative Industry Analysis. BioPlan Associates, Inc.: Rockville, MD, September 2022; https://www.bioplanassociates.com/reports-studies.

2 Langer ES, et al. 20th Annual Report and Survey of Biopharmaceutical Capacity and Production. BioPlan Associates: Rockville, MD, April 2023; https://www.bioplanassociates.com/20th.

With over 25 years of experience in biopharmaceutical and life-science market analysis and strategy, Eric S Langer is managing partner of BioPlan Associates, Inc., One Research Court, Suite 450, Rockville, MD 20850; 1-301-921-5979; [email protected]. Robert (Bob) Brooks is a BioPhorum supply partner with over 25 years of experience working in quality assurance, production, supply chain, logistics, and procurement in the pharmaceutical and healthcare industries. BioPlan Associates, Inc., and BioPhorum have worked together to prepare this analysis to support BioPhorum’s members’ and clients’ decision-making.

You May Also Like