Access the Chinese Market with a Localization StrategyAccess the Chinese Market with a Localization Strategy

The biopharmaceutical market in China has been growing rapidly due to increasing healthcare needs, government support, and investments in research and development (R&D). The market size is expected to grow from about US$48 billion in 2020 to $112 billion in 2025, a 135% increase in five years, with a compound annual growth rate (CAGR) of over 18% (1). Such growth makes China an increasingly important player in the global biopharmaceutical industry, offering potential market opportunities to both domestic and international companies.

Accordingly, the evolving biopharmaceutical landscape in China has attracted global attention. In March 2024, leading pharmaceutical chief executive officers (CEOs) gathered in Beijing and demonstrated their commitment to expanding operations within the country (2). That high-profile assembly highlighted China’s importance as a key market for biopharmaceuticals — driven by its large population, increasing healthcare needs, and progressive regulatory reforms. As China modernizes its healthcare system, demand is growing there for innovative therapies and biologics, making the Chinese market attractive for many biopharmaceutical companies around the world.

Several factors contribute to the expanding market. China’s aging population and a rising incidence of chronic diseases both have increased demand for innovative medical treatments. The country’s National Bureau of Statistics reported in 2021 that about 18.7% of the population was age 60 and above, then predicted that percentage to rise to 34.9% by 2050, indicating a substantial market for age-related healthcare solutions (3). Additionally, the Chinese government’s “Healthy China 2030” plan for improving healthcare access and quality has spurred investments further in the biopharmaceutical sector.

Regulatory Reforms Drive Market Growth: The Chinese government has implemented regulatory reforms to promote development and manufacture of biopharmaceuticals within the country. China’s regulatory body for drugs and medical devices, the National Medical Products Administration (NMPA), has played a crucial role in this transformation.

One of the most significant reforms was the 2019 revision of the country’s Drug Administration Law, which streamlined drug approvals and improved alignment with international standards (4). The law prioritizes reviewing and approving innovative products and encourages domestic manufacturing and development of new drugs for rare diseases in line with the Healthy China 2030 strategy.

Localization Regulations

The NMPA published in June 2024 its guidelines detailing requirements for submission of dossiers for domestic production of biologics that were originally approved and marketed overseas (5). This guideline is meant to encourage localization of manufacturing for biopharmaceuticals that already are marketed in China through importation. The primary goals are to improve the nation’s supply chain resiliency, reduce dependency on drug imports, and ensure availability of critical medicines despite global disruptions.

Local Manufacturing: The guidelines encourage foreign biopharmaceutical companies to establish local manufacturing capabilities, particularly for high-demand and essential drugs, to reduce costs and lead times and to improve market access.

Incentives and Benefits: The NMPA offers incentives including accelerated regulatory approvals for locally produced drugs as well as tax benefits and potential subsidies to make localization attractive for companies seeking to expand in China. New drug applications (NDAs) for localized products enter a nine-month expedited approval process.

Technology Transfer and Local Partnerships: The guidelines promote technology transfers and partnerships between foreign companies and local biomanufacturers.

Reducing Supply-Chain Vulnerabilities: Localization helps Chinese companies mitigate risks associated with global supply chain disruptions — as the world experienced during the COVID-19 pandemic — to ensure that critical medications remain available to Chinese patients. Additionally, biologics produced locally need not undergo batch-release testing by the NMPA, which otherwise can add about two months to the release process for imported drugs.

The localization regulations require the marketing-authorization holder (MAH) of a given product to be a registered business entity in China. The guidelines recommend that companies maintain the same manufacturing process during localization to obviate the need for additional studies, which can complicate review processes and delay approvals. To confirm the NDA package requirements, a consultation meeting with the NMPA might be necessary once process performance qualification (PPQ) data are available.

Strategic Pathways

To localize manufacturing in China, biopharmaceutical companies can choose between two general pathways: constructing and operating an owned biomanufacturing facility or partnering with a Chinese contract development and manufacturing organization (CDMO). Each option presents distinct business and technical considerations that can influence time to market, capital expenditure, operational flexibility, and regulatory compliance.

Building a wholly owned manufacturing facility provides a biopharmaceutical company with maximum control over its own production processes, quality standards, and intellectual property. This approach allows for design and construction of a facility design that is tailored to a given product’s specific requirements. An owned site also offers the potential for long-term cost savings once it is fully operational and optimized. However, it also requires significant upfront investment and involves lengthy construction, regulatory approval, and commissioning timelines. Additionally, managing a facility demands specialized expertise and ongoing operational oversight, which can increase both complexity and risk.

By contrast, partnering with a Chinese CDMO offers a relatively fast and cost-effective pathway to localization. This option reduces capital expenditure by taking advantage of existing infrastructure, ultimately accelerating time to market. CDMOs also offer scalability, allowing companies to adjust production capacity based on demand and thus minimize the risk of facility underutilization. Furthermore, established local CDMOs are experienced and familiar with NMPA regulations, ensuring compliance and smoothing market entry.

However, partnering with a CDMO can diminish a sponsor’s direct control over its biomanufacturing and quality processes. Dependency on CDMO’s capacity and scheduling is another factor to consider, particularly during high-demand periods. To address those concerns, companies can choose a CDMO with ample production capacity and a proven manufacturing track record. Figure 1 highlights key considerations for choosing a CDMO in China.

Figure 1: Essential considerations for selecting a contract development and manufacturing organization (CDMO) in China; apart from critical technical attributes, a candidate must be aligned with key values, such as patient focus, commitment to sustainability, and intellectual-property protection.

Geopolitical dynamics can play a role in decision making when considering the localization strategy. For example, following the introduction of the US Biosecure Act, biopharmaceutical companies will need to monitor and assess carefully its potential effects if they currently have or might enter into contracts with US federal “executive agencies” and also acquire “biotechnology equipment or services” from listed Chinese “biotechnology companies of concern” (6). For now, uncertainty remains regarding whether the act will be finalized and enacted into law.

Understanding Localization Registration Pathways

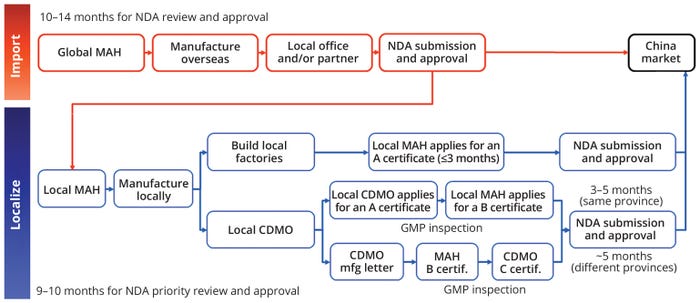

The registration process for localizing biopharmaceutical manufacturing in China follows a structured pathway governed by the NMPA (Figure 2). The process involves obtaining specific certificates — type A, B, or C — depending on the pathway chosen by the MAH. A type A drug-manufacturing certificate is issued to an MAH that operates its own manufacturing facility in China, certifying that the facility has passed necessary inspections and complies with Chinese good manufacturing practices (GMPs). A type B certificate is granted to an MAH that outsources production to a local CDMO instead of having its own manufacturing facility in China. Certificate B ensures that an MAH has proper oversight and that the corresponding CDMO complies with required standards. Finally, a type C certificate is issued to the CDMO itself, confirming that its facility meets all Chinese GMP standards and thus is authorized to manufacture pharmaceuticals on behalf of an MAH.

Figure 2: The two registration pathways for localization are based on whether a market-authorization holder (MAH) decides to build its own facilities or use a contract development and manufacturing organization (CDMO); GMP = good manufacturing practice, NDA = new drug application.

Those certificates are critical components of the registration and localization process to ensure compliance with Chinese GMPs and NMPA regulatory standards. For MAHs operating their own facilities, a Certificate A is issued after the site has been inspected and deemed GMP compliant, a process that can take two to three months. Timelines can vary depending on the complexity of manufacturing processes and whether a facility is new or existing.

When both a CDMO and MAH are located in the same province, the certification process is relatively streamlined. First, the CDMO must obtain a Certificate C confirming its compliance with Chinese GMPs. When that certificate has been issued, the MAH then can apply for its Certificate B. This entire process typically takes three to five months and can require GMP inspections at both the MAH and CDMO sites, depending on risk levels as evaluated by the provincial regulatory authority.

If the MAH and CDMO are located in different provinces, the certification procedure requires additional steps to ensure proper coordination between the respective provincial regulatory authorities. In such a case, a CDMO must obtain a formal “Manufacturing Letter” document confirming its capability and commitment to manufacturing the product for a given MAH — before that MAH can apply for its Certificate B. The letter is issued by a provincial NMPA office in the CDMO’s province. Following that, the MAH can submit its application for a Certificate B to its own provincial regulatory authority, including the acknowledged Manufacturing Letter within the dossier. This entire process can take about five months and also can require GMP inspections for both the MAH and the CDMO, again depending on the evaluated risk levels.

After A, B, and C certificates are obtained, the final step is filing an NDA with the NMPA. The submission must be comprehensive, demonstrating that the localized manufacturing processes and facilities meet Chinese market standards. For biopharmaceuticals that meet specific criteria, the NMPA offers a priority review pathway designed for localized products. Under that expedited review process, the timeline is typically nine to 10 months, which allows for a faster market entry than the standard review procedures can provide (typically taking 10–14 months).

Segmented Manufacturing

Except in special cases (e.g., when urgent medical needs must be met) that receive prior approval from the NMPA, China’s regulatory framework for biopharmaceuticals generally prohibits segmented manufacturing for commercial products (7). The entire biomanufacturing process — from drug- substance production to final packaging — must be conducted within NMPA-approved facilities run by a single manufacturer, and all located within a specified province. The NMPA’s goals in centralizing all manufacturing stages are to minimize risks associated with quality differences across different sites, reduce the potential for contamination, and ensure that consistent production standards are met. Although this regulatory approach constrains the flexibility that segmented manufacturing may offer, it underscores the importance of selecting the best strategy for localizing production. Sponsors must evaluate whether to establish their own manufacturing facilities in China or engage a CDMO to meet all NMPA requirements. Given the current regulatory environment, ensuring that a chosen facility can handle the full scope of production is crucial for successful market entry.

In October 2024, the NMPA announced a pilot program that permits companies to explore segmented setups (8). The pilot program is limited to specific provinces where the biopharmaceutical industry is well established with extensive regulatory oversight experience. Applicants first must receive approval from a provincial agency before submitting their proposals to the NMPA. This initiative represents a step toward enhancing production efficiencies while aligning with regulatory objectives for quality and safety, and it offers significant benefits for drug developers. Organizations that are interested in partnering with local service providers under this framework must select a CDMO with a proven track record in GMP manufacturing and quality management.

As the regulations surrounding segmented manufacturing in China continue to evolve, it will be crucial for any company seeking to enter the Chinese market to remain updated on all the changes made. Such regulations remain a critical factor in shaping strategies and decisions related to localization.

A Roadmap for Success

The NMPA’s localization guidelines represent a strategic shift in China’s approach to the biopharmaceutical industry. By promoting localization, the country has created an environment where multinational companies can invest in local manufacturing. The new approach should strengthen China’s domestic capabilities while ensuring that Chinese patients can access the latest biopharmaceutical innovations.

This development presents opportunities and challenges for companies operating in or entering the Chinese market. Strategic localization can pave the way for market leadership in one of the world’s most dynamic and rapidly growing regions. However, embarking upon such endeavors requires a thorough understanding of the regulatory landscape. Partnering with reputable CDMOs with end-to-end capabilities to provide integrated solutions would be an attractive approach to ensuring success.

References

1 Zhang W. Market Size of Biopharmaceuticals in China 2013–2025. Statista 4 September 2024; https://www.statista.com/statistics/999117/china-market-size-of-biopharmaceuticals.

2 Liu A. Big Pharma CEOs Gather in Beijing To Show Continued Interest in China, Offer Policy Advice. Fierce Pharma 26 March 2024; https://www.fiercepharma.com/pharma/big-pharma-ceos-gather-beijing-continued-interest-china-policy-advice-local-drug-industry.

3 Jizhe N. Main Data of the Seventh National Population Census. National Bureau of Statistics: Beijing, China, 11 May 2021; https://www.stats.gov.cn/english/PressRelease/202105/t20210510_1817185.html.

4 Wang Y, Chen D, He J. A Brief Introduction to China’s New Drug Administration Law and Its Impact on Medications for Rare Diseases. Intractable Rare Dis. Res. 8(4) 2019: 226–230; https://doi.org/10.5582/irdr.2019.01133.

5 Center for Drug Evaluation (CDE). Requirements for Submission Dossiers for Approved and Marketed by Overseas-Produced Drug Products Transferred to Domestic Production (for Therapeutic Biologics) [translated]. National Medical Products Administration: Beijing, China, 7 June 2024; https://www.cde.org.cn/main/news/viewInfoCommon/f37332951c50ea97f7b642b2cf42b3a4.

6 Gallagher M, et al. HR7085 — 118th Congress (2023-2024). US House of Representatives: Washington, DC, 25 January 2024; https://www.congress.gov/bill/118th-congress/house-bill/7085/text.

7 Regulations on the Implementation of the Drug Administration Law of the People’s Republic of China (Revised Draft for Comments) [translated]. National Medical Products Administration: Beijing, China, 9 May 2022; https://www.nmpa.gov.cn/xxgk/zhqyj/zhqyjyp/20220509222233134.html.

8 Notice of the National Medical Products Administration on the Issuance of a Pilot Program for the Segmented Production of Biological Products [translated]. National Medical Products Administration: Beijing, China, 21 October 2024; https://www.nmpa.gov.cn/xxgk/fgwj/gzwj/gzwjyp/20241022112249149.html.

Corresponding author Sun Chau Siu, PhD, MBA ([email protected]) is head of global regulatory affairs; Yiyun Chen, PhD, is global regulatory lead; Zheng Zhou is head of global quality systems and compliance; and corresponding author Joon Chang ([email protected]) is head of global business development and marketing — all at Altruist Biologics in Suzhou, China; https://www.altruistbio.com.

You May Also Like