China Can Be Ignored No Longer: Long-Term Biopharmaceutical Opportunities Based on Near-Term Demonstrated GrowthChina Can Be Ignored No Longer: Long-Term Biopharmaceutical Opportunities Based on Near-Term Demonstrated Growth

WWW.ISTOCKPHOTO.COM

China has long served as “the world’s factory,” but many experts in the biopharmaceutical industry have assumed that making consumer electronics, clothing, and toys for a global consumer base does not translate well to making complex biologics on the global stage. However, according to a newly released report, the biopharmaceutical market in China reached a value over US$9 billion in 2018, with the domestic monoclonal antibody (MAb) market there making up a very large percentage of that (1).

Much of those domestic sales are made by the 180 biologics manufacturers currently operating in the country. But our research suggests that this is only the beginning for biologics in China. In fact, biologics account for just 10.4% of sales of all drugs sold there (1). So a substantial domestic clinical need remains. But whether and how this growth can be translated effectively into success for China as a player on the global biopharmaceutical stage still is in question.

China has become “the world’s factory” for good reasons: a business-oriented environment, currency control, and lower wages and compliance barriers relative to the rest of the advanced world.

Lower Wages: China has 1.42 billion people, so the laws of supply and demand give it a good supply of workers who are low-wage but highly skilled (relative to other countries at the same wage levels). Until recently, most Chinese people were rural and either poor or lower middle class. Internal migration has created industrial cities where workers are (for now, at least) willing to accept low wages.

Minimum wages have increased dramatically: In Shanghai, for example, they are pushing $3/hour. And the large labor pool in China ensures a consistent population of workers. In the biopharmaceutical industry, finding skilled workers has become a challenge over the past 10 years, with those increasing wages and a perceived lack of trained staff, so many Chinese companies continue to recruit from overseas.

Business-Oriented Environment: The network of raw-materials suppliers, manufacturers, distributors, and investors in China has evolved dramatically over the past 30 years. For example, Shenzhen (near Hong Kong) has become a world hub for electronics manufacturing. Success is driven by the region’s supply chain, manufacturing base, and low-cost technical workforce.

In bioprocessing, similar bases are emerging, and the Chinese government has included investment in biopharmaceutical manufacturing and biotechnology as part of each five-year plan/guidance for over 25 years. With a high-level focus and investment in biologics, China is likely to continue on its path toward the global stage in this industry.

Environmental Compliance: Chinese factories seldom follow environmental laws and guidelines, which allows them to keep their waste-management costs low. China is home to most of the world’s top-20 most polluted cities.

In the biopharmaceutical industry, however, a lack of compliance will not get Chinese biomanufacturers onto the world stage. And most bioprocessing professionals in the country recognize this clearly. With over 85% of Chinese biomanufacturers seeking to become global exporters (according to our 2017 research surveys), it follows that achieving good manufacturing practice (GMP) production is a goal in China. The only questions related to that now are how and when it will happen.

Currency Control: China often has been accused of depressing artificially the value of its renminbi (RMB) currency as a way to give its exports an edge. But in recent years, the RMB has increased steadily in value against the US dollar. China keeps the rate in check by buying dollars, which has swelled its foreign-exchange reserves to about US$4 trillion (2). The attractiveness of the biopharmaceutical market — including biosimilars — makes it a particularly important area for Chinese investors holding those trillions in currency reserves. The question remains whether China can evolve from “the world’s factory” for toys, consumer electronics, steel, and other commodities into a realm as technologically complex as biologics development and manufacturing.

However, the bigger question may be whether China can afford not to make advances in this strategically important healthcare segment. The country makes up nearly a fifth of the world’s population, with a middle-class that will account for 30% of its population in 10 years. Put in context, the middle class alone will be 30% larger than the entire population of the United States. And the domestic need for biologics among that increasingly affluent segment is likely to accelerate Chinese biomanufacturing growth (3). So it’s a logical conclusion that, even if China weren’t already “the world factory,” growth of its biologics industry probably is inevitable. It remains to be seen how the rest of the developed world’s global biologics manufacturers, suppliers, distributors, and regulators will participate in that inevitable growth.

Some Background

Since the reform and open-door policy initiated in the 1980s, and China’s admittance into the World Trade Organization (WTO) in 2002, the country has become a manufacturing giant whose exports flood global markets. China also has been an important producer of chemical active pharmaceutical ingredients (APIs) for some time. But the country’s domestic biopharmaceutical industry has lagged since its birth in 1989 with the launch of the first Chinese recombinant protein therapeutics (interferon alpha-1b) in Shenzhen. In fact, the country has yet to export biologics to regulated markets, and only a few therapeutic MAbs have been innovated by domestic Chinese companies.

However, China has been making rapid and significant progress in recent years. Its biologics market grew 21% annually from 2010 to 2013, reaching a value of RMB 25 billion (vaccine and blood products excluded) (4). From 2010 to 2014, annual growth in sales revenue among Chinese biopharmaceutical manufacturers topped 23% (1). The market is estimated to continue growing at such a rate, far surpassing growth in regulated markets at a pace significantly faster than that of small-molecule drugs in China. However, it equals <10% of the sales of biopharmaceuticals in Western markets (1).

Why the Growth

Robust growth of China’s biopharmaceutical industry can be attributed to several major factors. First, the country is getting richer as it becomes a manufacturing giant, its economy surpassing Japan’s and Europe’s. China now has become the world’s second largest economy in terms of gross domestic product (GDP). Second, the country has been expanding its national healthcare insurance program to facilitate access to healthcare and pharmaceuticals for more than one billion Chinese citizens. According to the Ministry of Human Resources and Social Security in 2015, basic medical insurance and cooperative medical systems now cover essentially everyone in China. As a result, total healthcare expenditure has increased from about $150 billion to $4.8 trillion over the past decade, during which the country’s percentage of total GDP has risen from 4.5% to 6.2%.

Double-digit annual growth in healthcare expenditure lays a solid foundation for the future of the Chinese biological therapeutics industry, the prices of which used to be completely prohibitive for the vast majority of the country’s patients. Its population also is growing old relatively quickly, with statistics showing that people 60 and older make up over 17% of the total population. Chinese seniors could number >300 million by 2025.

By the Numbers | |

|---|---|

The Chinese pharmaceutical market has a compound annual growth rate (CAGR) of >15%. In more developed countries, it’s <4%. | From 1997 to 2016, highly-cited journal articles from China rose from 1% to 20% . |

By 2018, the Chinese biopharmaceutical market had reached US$9.32 billion in value. | In the next five to seven years, Chinese biopharmaceutical facilities are expected to expand by ~$20 billion. |

Monoclonal antibodies (MAbs) account for only ~6% of the Chinese drug market. | Most multinational companies have facilities in one or more of 22 life sciences parks in China. |

Chinese MAb production will be worth $4 billion by 2020 (15–25% CAGR). | Chinese inventors filed more than a million patents in 2015, almost twice the number filed by US inventors. |

27 MAbs have been approved in China: 18 are imported, nine are manufactured locally. | China surpassed the United States in patent filings in 2011. |

The $122.6-billion (including small molecules) Chinese pharmaceutical market was the world’s second largest by 2017. | Total Chinese healthcare expenses have grown to $480 billion (5.88% of GDP). |

The population over the age of 65 in China will reach 170 million by 2020. | Of more than a million biomedical R&D staff in China, 30% are returnees with knowledge and experience gained abroad. |

In 2016, 41% of people in China were covered by insurance programs. | China boasts 180 biopharmaceutical manufacturing facilities and >850,000 L total biomanufacturing capacity, more than India. |

More than 400 MAbs are in development currently in China. | Biopharmaceuticals represent ~5% of the Chinese domestic drug market (compared with >25% in the United States). |

Which Sectors Will Be Affected

Most subsectors of China’s biopharmaceutical industry are growing rapidly, including recombinant products, biosimilars, growth factors, and vaccines. We see long-term opportunity especially in three sectors: therapeutic antibodies, contract biomanufacturing, and clinical trial contract research.

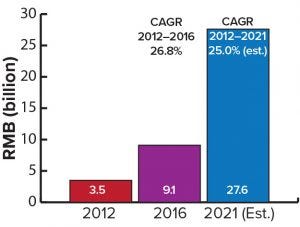

Figure 1: Sales of MAb therapeutics; RMB = renminbi (Chinese currency)

MAb Therapeutics, Especially Biosimilars: Our study identifies major gaps between China and the rest of the world in the use of therapeutic MAbs. Such products make up a large percentage of biologics globally but only 7% of the Chinese biologics market. In terms of sales for individual MAbs, the difference is even more striking. At present, only 12 of about 70 MAb therapeutics that have been approved in the United States have been approved by the Chinese Food and Drug Administration (CFDA) and made available to the country’s market. China started developing therapeutic MAbs relatively late, with Yisaipu the first locally made MAb launched in 2006. Currently, few less-expensive biosimilar MAbs of quality are available from domestic drug makers. Regulatory hurdles for therapeutic MAbs from multinational companies have inhibited imports into the Chinese market.

Despite a relatively late start, the Chinese therapeutic antibody market is catching up quickly (Figure 1). We expect that by 2021 the country’s total market for MAb therapeutics will exceed RMB 27.6 billion ($4.1 billion) with broader coverage by the national healthcare insurance system and launching of biosimilar MAbs by domestic drug-makers (1).

Drug Approvals: The Chinese Food and Drug Administration (CFDA) has granted 1,653 approvals for biologics manufacturing, >95% of which have brought therapeutic biologics to the country’s market. That agency has accepted 7,060 regulatory applications for biologics, of which about 6% are for therapeutic antibodies. As of early 2018, 288 of the 401 pipeline antibodies in China were in active development. Among those, 77 had been initiated abroad and 211 by domestic Chinese companies. Of note, 18 antibody therapeutics are under codevelopment by overseas and domestic companies, 11 of which originated from Chinese companies. So the Chinese antibody market is becoming increasingly integrated with markets in the rest of the world. Our study shows that among the >400 MAb therapeutics under clinical development in China, the hottest candidates include CD20, HER2, EGFR, VEGF, TNF-alpha, and PD-1/PD-L1.

Ambitious Chinese companies already are conducting clinical trials in regulated markets. For example, Genor Biopharma has started a phase 1 clinical study of its anti-Her2 MAb in Australia; and Teruisi, an antibody therapeutics company founded by returnee scientists, filed an investigational new drug application (IND) with the US Food and Drug Administration (FDA) for one of its projects in 2018.

It is widely accepted that biosimilar/biobetter drugs from domestic Chinese makers are more likely than from elsewhere to be put on the National Reimbursement Drug List (NRDL) and made more affordable for Chinese patients. That indicates strong potential for growth in the coming decade. Although we expect quite a few domestic drug-makers to launch biosimilar MAbs, recent regulatory reforms also should make it easier for multinational pharmaceutical companies with innovative pipelines to enter the Chinese market.

Contract Manufacturing Organizations (CMOs): Although China started late in mammalian bioprocessing, its industry is making progress with substantial investments in bioprocessing. The country’s bioprocessing capabilities have grown quickly over the past decade, with expansion plans and new facility construction news coming out almost weekly, to reach a total biomanufacturing capacity of >85,000 L (6). Many facilities under expansion will incorporate the most advanced technologies, including single-use technologies (SUTs) and modular strategies. For example, both Pfizer China and JHL Biotech have used the KUBio modular factory from GE Healthcare to build their facilities in China.

Investment in biologic contract manufacturing organizations (CMOs) is reasonable because even some Chinese leaders are proposing that outsourcing of bioprocessing should be considered there. For many Chinese companies, biomanufacturing is not a core competency, making CMOs a rational alternative. They provide indispensable services to small and medium sized biotechnology companies that might not have the finances to construct their own GMP facilities.

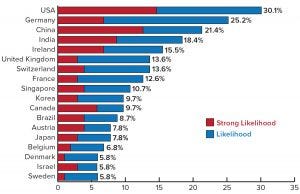

Figure 2: Country selections for international outsourcing of biomanufacturing

Some industry leaders in China also believe strongly that the future will be in companies from other countries outsourcing production there. Among them is Li Zhiliang, chief executive officer of Autekbio, the country’s first biological CMO. He predicts that outsourcing of bioprocessing to Chinese CMOs will become a mainstream activity. That is supported by our 15th annual report (Figure 2), which indicates that 21.4% of global biomanufacturers (outside China) see the country as a likely or possible outsourcing destination by 2023 (5).

At present, Chinese domestic biological pipelines are driving local demand for contract manufacturing. The Yangtze Delta Region is home to hundreds of start-up companies developing innovative biologics. According to our recent research, more than 50 domestic companies among the top 90 biopharmaceutical companies in China have begun MAb development projects (6). Although more established companies tend to build their own facilities, many newer biotechnology companies in China will need external manufacturing partners.

With both global and domestic demands on the rise, Chinese regulatory authorities made a move in 2016 to start a pilot program, under which holders of a CFDA biologics approval number are required to market their therapeutic products and take responsibility for them but have the option either to manufacture the drugs on their own or use contract manufacturers instead. This market authorization holder (MAH) program was a very significant breakthrough. It first started as a pilot run in 10 provinces and municipalities, was completed in 2018, and is expected to expand to the whole country.

MAH reform already is boosting China’s CMO industry. According to statistics in 2017, a total of 381 MAH applications were filed, with Shanghai alone home to 16 applicants for 24 drug projects with 18 contract manufacturing partners (7).

Boehringer Ingelheim’s contract manufacturing facility in Shanghai is the first multinational biologics CMO in China. It had lobbied for the MAH reforms and announced that, even before it officially started operations in 2017, demands for services had been booked through 2019. Several domestic pharmaceutical companies, including North China Pharma and Tasly Pharma, also stated that they have idle capacity available for contract manufacturing. Currently, China has an estimated >50% idle capacity in biomanufacturing, the percentage of which is below 30% in both the United States and Europe. MAH implementation is expected to decrease idle capacity significantly, leading to cost reductions and increased productivities.

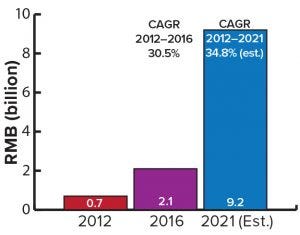

Figure 3: China’s biopharmaceutical service market 2012–2021 (estimated)

According to WuXi Biologics, China’s biopharmaceutical service sector (including CMOs) has been growing at nearly 30% annually over the past several years. It is projected to reach a value of USD $1.4 billion by 2021 (Figure 3). WuXi has the largest biomanufacturing facility in China and has just gone through a successful initial public offering (IPO) on the Hong Kong stock exchange. The largest singleuse bioprocessing facility in the world, it boasts an existing capacity of >37,000 L. Expansion plans call for >180,000 L in the near future. New CMOs have started operations since 2016, but China’s biopharmaceutical contract manufacturing is likely to be dominated by several key players that already have built solid reputations on product quality and safety in the industry.

As regulatory hurdles are resolved, the Chinese contract manufacturing segment is expected to keep on demonstrating growth though domestic developers. Major concerns still exist for global manufacturers: e.g., quality issues/loss of control, a lack of reliable CMOs, no commercial insurance for risk sharing, and little experience in managing manufacturing partnerships or auditing.

WWW.ISTOCKPHOTO.COM

Clinical Trials: We also see clinical contract research organizations (CROs) as a long-term opportunity in China. Conducting clinical trials in China comes with unique benefits and limitations. The country is home to world’s largest patient pool for many common diseases. Its high rate of recruitment and retention of trial subjects is valuable because patient enrollment and retention of adequate sample sizes often is the most time-consuming part of clinical research and a leading cause of missed trial deadlines. According to our firm’s Advances in Biopharmaceuticals China study, >80% of trials did not meet their enrollment schedule (1), and that 90% of missed deadlines were the result of sluggish patient recruitment.

High recruitment rates thus offer a major opportunity to drive the progression of clinical trials and shorten time to market. Many patients come from rural areas to seek medical care at tertiary hospitals in the big cities of China, leading to huge medical-service volumes and possibly faster recruitment rates than elsewhere. The follow-up risk is relatively low because Chinese patients tend to comply with their doctors’ orders. Compared with more those of developed countries, China’s relatively insufficient healthcare opportunities might offer more treatment-naïve patients.

Everything considered, it is estimated that choosing a study site in China at the drug discovery stage costs about a third to half less than doing so in the United States. Cost savings seem to be even more obvious at the clinical trial stage. The cost per patient, per visit for all therapeutic areas and phases could be up to three times less in China. These cost savings result from both direct and indirect means: e.g., investigator and site fees, the cost of trial-related medication(s), laboratory tests and hospital stays, financial compensation for the patients, CRO service fees, and other supporting fees. All are less expensive in China than elsewhere. In addition, fast patient enrollment and high retention rates indirectly reduce infrastructure and personnel costs.

China also has weaknesses that cannot be dismissed. These include a lack of qualified investigators/expertise in clinical research, limited funding to support such research, less than ideal adherence to good clinical practices (GCPs), and regulatory hurdles. Overall, however, the opportunities outweigh the challenges. With strong regulatory reform taking place in China and the country’s 2017 ascension into the International Council on Harmonisation of Technical Requirements for the Registration of Pharmaceuticals for Human Use (ICH), some of the major negative issues are being addressed. For example, regulatory authorities are demanding self-examination of clinical data by drug makers, quite a few of whom have withdrawn applications after the process. It is expected that higher clinical-trial data standards will improve the reputation of Chinese CROs. Meanwhile, streamlining IND application processes and the new rules that allow phase 1 clinical trials in China to be initiated by multinational companies are good news to local clinical trial CROs, as is the acceptance of data originated from overseas in applications for approval in China. Thus, the country could become a highly favorable clinical trial hub in the near future.

A Biological Evolution

Given the current Chinese domestic population and the country’s economic growth, investment climate, and focus on biotechnology, it is not a question of whether China can move on from its status as “the world’s factory” for clothing and consumer electronics. How it will advance its domestic healthcare segment and then move to meet other global biopharmaceutical needs remains to be seen. As China’s increasingly affluent middle class grows, a domestic need for biologics is an engine accelerating domestic biomanufacturing growth. Based on our research into the Chinese biopharmaceutical market over the past 16 years, we conclude that growth of the country’s biologics industry is inevitable. Opportunities abound for the rest of the developed world’s biologics developers, manufacturers, suppliers, distributors, and regulators to participate in the growth of China’s biologics industry.

References

1 Qing V, Ed. Advances in Biopharmaceutical Technology in China, 2nd Edition. BioPlan Associates, Inc.: Rockville, MD, November 2018; www.bioplanassociates.com/china.

2 Picardo E. Why China’s Currency Tangos with the USD. Investopedia 12 February 2014; www.investopedia.com/articles/forex/09/chinas-peg-to-the-dollar.asp.

3 Zuo M. China’s middle class to rise to more than third of population by 2030, research firm says. S. China Morning Post 3 November 2016; www.scmp.com/news/china/money-wealth/article/2042441/chinas-middle-class-rise-more-third-population-2030-research.

4 CPA-McKinsey China Hospital Pharmaceuticals Report: An In-Depth Perspective. McKinsey and Company: Beijing, China, 2014.

5 Langer ES, et al. 15th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity. BioPlan Associates, Inc.: Rockville, MD, April 2018.

6 Database: Top 60 Biopharmaceutical Facilities in China Directory. BioPlan Associates, Inc.: Rockville, MD, February 2017, updated December 2018; www.top1000bio.com/top60china.

7 Du Chenwei. Spring Comes to Innovative Drug Developers As Contract manufacturing Starts in Zhangjiang. Liberation Daily 10 October 2017.

Vicky (Qing) Xia is senior project director, and corresponding author Eric S. Langer is president and managing partner at BioPlan Associates, Inc., 2275 Research Boulevard, Suite 500, Rockville, MD 20850; 1-301-921-5979, fax 1-301-926-2455; [email protected], www.bioplanassociates.com.

You May Also Like