Biosimilars in DevelopmentBiosimilars in Development

October 1, 2011

The 2009 Biologics Price Competition and Innovation Act (BPCIA) provided the bioprocessing industry with the legislative pathway toward approval of biosimilars. US Food and Drug Administration information regarding how it will translate that legislation, however, had been limited until an August 2011 article finally provided some insight on how those guidances might actually play out (1). As expected, the agency appears to be implementing a science-driven approach, with sponsor companies needing to apply complementary orthogonal analytical methods to present a “totality of evidence” required to verify “sufficient similarity.”

Even before BPCIA, the industry had some ideas of the manufacturing requirements and analytical specifications that might pertain to biosimilars development. The European Union developed a general guidance in 2005 (under revision) and has since released other guidances for specific biologic types. Likewise, the International Conference on Harmonization (ICH) published its Q6b quality guidelines describing test procedures and acceptance criteria for biologics. Still, current perspectives on biosimilars manufacture, process development, testing, and emerging markets continue to be hot topics of discussion—discussions that undoubtedly will continue as regulators and industry work toward bringing biosimilars into to a changing market.

The Manufacturing Difference

Potential opportunities in biosimilars have attracted generics manufacturers, pharmaceutical companies collaborating with start-up biotechnology companies, and small biotechnology organizations that can make biosimilars but license them at a later stage. Some small pharmaceutical companies making small-molecule generics — underestimating the differences in developing large proteins — have run into difficulties when entering the biosimilars market. “Although the forms to be completed and the information to be provided are the same [as for small-molecule generics], the way in which you can obtain that information and the level of assurance you can obtain on a biologic is very different,” says Sheila Magil, principal consultant at BioProcess Technology Consulting.

Biosimilars manufacturing offers both advantages and challenges when compared with the manufacture of an innovator biologic. From a process development standpoint, the end point and certain quality attributes about the reference product are known. The final dosage is known because it was defined by the originator company. In addition, the cell line (typically Chinese hamster ovary, CHO, cells) is known, although a biosimilars company must clone its own cell line. Manufacturing control details, however, are not public, and innovators will argue that biosimilar companies do not know what they know about a product. “If you develop an originator molecule, you can define your product by your own standards, says Martin Schiestl, scientific and regulatory advisor at Sandoz Biopharmaceuticals (Austria) “When you make a biosimilar, you have to match the reference product very closely. That means you need to optimize the manufacturing process steps to meet a much tighter development target than when you develop an originator molecule.”

Genzyme learned that the hard way. In 2008, the FDA ruled that the company’s Myozyme (alglucosidase alfa) treatment for Pompe disease produced at its facility in Allston, MA, was actually a different product than its Myozyme product already registered and produced at its facility in Framingham, MA. The agency determined that because of “differences in the biological signature of the active molecule” and concerns about how the protein is glycosylated, the same drug produced in two facilities within the same company were in fact not “similar.”

Some original biologics may have been developed using older technologies and expression systems. Modern techniques may be able to generate higher titers and improved purity. Because many attributes of a molecule are determined upstream, consistency is critical. Even with the correct control mechanisms in place, changes in CHO consistency and glycosylation may occur. “Knowing the molecule and its history, experienced people can come up with equivalent processes for a drug,” says Adriana Manzi, founder and head of the product development consulting practice at Atheln, Inc., a firm currently working on a biosimilars projects in Europe. “They still need to have the controls in place to ensure that the process they are using is not introducing risk or changes in the molecule that would affect the safety or efficacy.”

Determining the amount of capacity to dedicate to a biosimilar product is also a complex issue. In 2006, Sandoz launched its first biosimilar, a recombinant human growth hormone, in the European market, after nearly 10 years of development. The company faced several hurdles, not only scientific and technical, but also regulatory. At this time, the whole idea of biosimilarity was just starting to evolve, no products were approved and consequently no regulatory guidances were in place. Schiestl says the company met with the European Medicines Agency (EMA) for presubmission meetings to discuss its approach and maintained open communication with the agency.

The type of the cell line used by the originator was public information, and Sandoz designed its own cell line by preparing and selecting cell line candidates suitable for developing a biosimilar product. “At the beginning, we characterized the reference product very thoroughly so that we understood its identity and purity profiles. We then designed the cell line capable to produce a product that matches exactly this profile of the reference,” says Schiestl. The same approach was used to also optimize other manufacturing process steps, including fermentation, protein purification, and drug product development. Sandoz was in the unique position of actually having biologics manufacturing capacity, so it didn’t have to build from scratch. “It was more a question of how do we dedicate existing capacity as opposed to what capital investments do we need to make over the next few years,” says Schiestl.

Similarity (Un)Defined

Although more than a dozen biosimilars have already been approved in the european Union, what exactly constitutes similarity is still open to interpretation. scientific literature and even regulatory agencies have used biosimilar, biogeneric, and follow-on biologic interchangeably. (Nonetheless, the definition of a biobetter as a new entity in the market based on another biologic is clear.) “there is an emerging understanding about which terms should be used and in which case,” says Morrey Atkinson, Ceo at Cook pharmica. “Biosimilar seems to be the term of choice at this point, but i don’t believe it is necessarily understood by everyone who is working in this sector.” Fewer are favoring biogeneric, however, because such products are not interchangeable in the same way as are small-molecule generics.

perhaps adding to that confusion is that the Biologics price Competition and innovation Act (BpCiA) discusses both biosimilarity and interchangeability. pharmacists, for example, are allowed to replace prescribed brand-name products with those deemed interchangeable. eMA does not recognize interchangeability (yet). interchangeability requires comparability testing, which has been a familiar methodology for many years.

Comparability protocols are used after manufacturing changes are made. there are clear guidances in developing comparability strategies, including analytical tests and in vitro/in vivo tests, depending on the extent of the change.

Without a clear guidance from the FDA as to what the agency is using as its criteria to establish degree of similarity, it is “very difficult” to figure out which term is to

be used appropriately, says Atkinson. Well-known comparability protocols have made it clear what needs to be done or at least the logic that a sponsor has to go through to demonstrate comparability. “But similarity is a much less defined term. it’s not currently being used in describing the degree of differences between compounds.”

EMA has taken a case-by-case approach for each biosimilar approval filing. Although FDA’s guidance on biosimilars has not yet been released, recently the agency has hinted that it will be taking the same approach. Acknowledging the “complex nature” of biologics, the FDA says it is unlikely to develop a “one size fits all” assessment of biosimilarity. Rather, agency scientists will take into account different types of information in their assessments (2).

When Sandoz started in Europe, the EMA had no guidances for biosimilars. Existing guidances applied to the development of new biological products, and those methods were already known. However, scientists from industry and agencies discussed the principles of comparability exercises that are conducted following manufacturing changes. “Those procedures were discussed when we started with biosimilars, and they served as the starting point to design the comparability exercise for biosimilars,” says Schiestl. “What we were seeing in Europe was that the guidelines quite nicely followed the science in this field. So we were not too surprised when the guidelines were released, because they were pretty much what science tells us.”

Investing equipment and capacity for biosimilars can become a major issue, especially for smaller biotech companies. The situation has opened new doors for contract manufacturers that may have the flexibility to deal with market demands. Contract services companies have found that they can take different approaches to biosimilar manufacturing: either completely comply to what the originator did (with respect to cell line and yields) or apply as many potential new technologies that are available to increase flexibility. The second option allows a manufacturer to be cost competitive without relying on the large scale that the originator had due to low yields generated. Enhancing an upstream process with new technologies means smaller-scale commercial manufacture. One CMO has developed a technology to intensify the upstream process five- to 15-fold, so it can downsize commercial manufacturing from 10,000-L to ~500 L.

Testing Similarity

Some experts find similarity easy to define analytically. “From my perspective, showing similarity is showing that a product conforms to quality standards and known established reference standards,” says Bruce Compton, research associate professor at Barnett Institute, Northeastern University. “Quality standards are legally binding agreements between a company and a regulatory authority, and as long as the product passes those standards, then, I would consider the product to be similar by definition.”

In Europe, a number of companies have the experience analytically demonstrating similarity (by EU standards). In the United States, even without an FDA biosimilars guidance, several published studies have built a body of evidence. One analytical approach is, wherever possible, to use sensitive, orthogonal methods that are complementary to help elucidate a single product parameter and determine critical product quality attributes.

Analytical assays used to compare physicochemical and biological properties between production batches of a potentially similar biopharmaceutical and in comparison with a reference product can be also be used. Analysts stress the importance of recognizing the limits of those assays to accurately interpret for market approval (2). As do innovator products, biosimilars must undergo testing for safety and efficacy. “If you look at the monographs in EP and USP, they are quite simple in terms of the analytics for some biologics (e.g., insulin, human growth hormone). But the main issue with biosimilars is that the complexity of the problem follows the complexity of the molecule,” says Compton. For example, insulin has a relatively low molecular weight that can be fully characterized, not only its primary sequence, but also all its posttranslational modifications. The task becomes more difficult with complex molecules such EPO, tPA, and factor VIII.

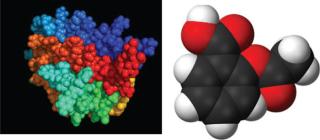

Figure 1. Comparing complexity and molecular weight of biologics such as erythropoietin (LEFT) with small-molecule drugs such as aspirin (RIGHT) (not to scale) ()

A biosimilar needs to have some identical quality attributes of an innovator product (e.g., primary sequence, higher order structure, biological functions). For other quality attributes, differences are acceptable if they are not relevant with regard to the clinical outcome. The question then becomes whether those subtle differences have any effect on clinical results. Some variations in the profile may have no impact on the activity or safety, whereas others could affect those characteristics. For any analytical testing, the answer depends on the questions asked. “The analytical comparability of the biosimilar and innovator drugs should be established first, followed by appropriate preclinical and clinical testing to define the impact of any variations observed,” says Manzi.

ICH Q6B details standards according to primary, secondary, and higher-order structure as well as activity and posttranslational modification. In addition, companies develop their specifications differently from one another. Specifications such as those for purity, for example, are “multilayerd” — established on international and regional levels (e.g., WHO, EU monographs, specifications within a country, and specifications within a company). “The default is to meet global standards,” says Compton, “going through the same process as when you develop a drug, characterizing it, and ensuring that it conforms to certain quality standards.”

He says the best way to do that is to make sure that biosimilar quality standards are the same as those of the innovator’s company, although it may not be under any legal obligation to disclose what those specif ications are. “In that case, you can try to obtain multiple lots of the innovator drug product and test them, thus allowing you to develop your own specif ications and justify them.” However, it is important to understand that you are testing drug product, not drug substance and you need to understand anticipate the impact on drug substance of conversion to drug product by, for instance, lyophilization. As he observes, Q6B includes two important sentences: One says that specif ications have to be justif ied, and the other says that characterization test methods do not have to be validated. “When you are working with these molecules and you have limited experience, there is no point in trying to validate a method. What you should do is emphasize the science and the advanced technology you have, and demonstrate that characterization is done under well documented and controlled conditions on qualif ied instruments by qualif ied personnel” h

e says

Barnett has developed advanced technology for analysis of glycoproteins. Using both HPLC and CE, for example, provides gives highly complementary data and helps to assure the carbohydrate characterization is correct. Additionally, there are other chemistry based methods that can be used to look at secondary and higher-order structure with regard to disulfide bonding. Another powerful and sensitive technique for assessing higher order structure is hydrogen-deuterium exchange (HDX), which allows researchers to map a significant number of the exchangeable protons on the surface of a protein. Studies have been able to show the tertiary structure of an antibody and how a change of one carbohydrate moiety will cause an allosteric shift in the whole structure.

The carbohydrate structure is important because it can impact not only ADME, but also the efficacy of some products. “In some products, variant glycoforms are thought to have the potential to impart immunogenicity,” says Compton. “There is a major concern with being able to really define to a very low level the fine structures of the carbohydrates. Within the past couple of years, we’ve started looking at low levels of varying forms of glycans that we didn’t think occurred in cell culture production.”

Another area of interest is deamidation, by which asparagine loses ammonia and results in an isoamide bond form because of a shift in a peptide bond. “We are now starting to realize that it has potential immunogenicity,” says Compton. Immune response in patients has also been linked to subvisible particles, usually at low levels. “It’s usually not compromising to product efficacy safety,” says Compton, “but the products are immunogenic to some extent. The current thought is that they are immunogenic because of the way we manufacture them, using chromatography to purify proteins. Concentrations of product can be very high a chromatographic band, inducing precipitation, and when the material is eluted off, to a certain extent it goes back into a solution but results in some denatured precipitates.” This is one of the areas of current investigation in the biotech industry and may result in the industry investigating alternative methods to chromatography to purify protein based products.

Effector functions of antibodies are carried in one molecular region. So a modification in that region for one antibody may be quite important to its biological activity, but in another antibody it may not matter at all in terms of safety and efficacy. “You have to know and understand intrinsically the structure–function relationship of a compound and the degree to which any modification would affect the safety and efficacy and biological activity,” says Morrey Atkinson, CEO of Cook Pharmica.

In addition, biosimilars need to match profiles that may or may not have changed over time. “For a biosimilar, you have to understand the variability in the manufacturing process that you are trying to match and understand how your compound matches that. There is no hard and fast rule,” says Atkinson. “There are things that are understood to be important, such as aggregation level and chemical stability.” Glycosylation also may be important. A current debate is whether an analysis of glycosylations is necessary — whether specifications should be based on that or whether a characterization of glycosylation pattern is suff icient. “That has been a real challenge because glycosylated molecules are very heterogeneous, and the degree to which you can either match or show consistency with an innovator compound is going to be a challenge.”

Commercialization opportunities

Biosimilar manufacturers work under different time pressures than innovator companies. Biosimilars need be ready for the market by the time patents expire and be ready to face unknown competition with other biosimilars (as well as with an innovator drug). Even if a biosimilar is approved, it doesn’t mean that the market will adopt it. Biosimilar manufacturers still must develop a market infrastructure relationship with prescribers.

Intellectual property issues also may hinder market launch. “Unlike small molecules for which there is a patent on the molecule, biologics have a lot of patents. The primary patent on a molecule may expire, but there are other patents around it that may be more complicated because many biologics are not simply patented as a molecule. For a biosimilar developer, determining its IP strategy is going to be critical,” says Atkinson.

Another challenge is determining the percentage of the market that a company expects its biosimilar to capture, which affects projections of capacity demands. “Highly successful innovator compounds typically are produced at a very large scale because they have 100% of the market,” says Atkinson. “But when you start fragmenting that market, then that scale can be very interesting.” Moreover, modern production systems have much higher titers and productivity, so a compound that was launched 10–15 years ago may have a titer of 0.5 g/L or even 1 g/L, but now titers are reaching much higher. “So you may be able to just intrinsically run it at smaller scale because of the productivity gains and expressions and downstream yields.”

Make room at the top

Monoclonal antibodies (MAbs) are expected to be the next big class of biosimilars, with unique challenges stemming from their size (~150,000 Da, compared with existing biosimilars at <40,000 Da), complexity, and diverse biological functions. They are subject to posttranslational modifications, so biosimilar manufacturers will need to analyze them to greater detail. MAbs are quite mature as a product class, however, so many technologies for their characterization are available and have increased in sensitivity over time.

In the clinic, MAbs are often used for cancer indications or immunological conditions. In that case, the pathway can be more complex because developers potentially have to deal with changes in how cancer or immune disorders are treated now as opposed to when the originator protein was developed perhaps 15 years ago. “The background treatment in many cancers was different than what it is now. So you can’t actually run the clinical studies the way they were done at the time, because you wouldn’t f ind any patients to go into this,” says Hans-Peter Guler, MD, senior vice president of clinical development at INC Research. And because patient populations may be fairly sick, different end points would have to be chosen than for originator proteins. “For example, the originator has to show survival as the primary outcome parameter. But survival is something that takes some time to achieve, so it may also not be ethical to do survival trials when you conduct comparative trials with a biosimilars against an originator,” says Guler.

The abbreviated pathway not taken

EMA has issued specific guidances for particular types of biosimilars such as products containing erythropoietin or growth hormone. By developing guidances according to various types of biologics, “EMA has acknowledged that there are different concerns for different biologics,” says Magil. Industry debates continue about whether the EMA’s “abbreviated pathway” will serve as such. “EMA’s ‘abbreviated pathway’ is not really abbreviated,” says Magil. “It specifically says there will be animal testing and clinical testing. The agency may not require human phase 1 studies because it accepts that a given physical chemical moiety is safe and there is no need to conduct dose ranging, but it will still look for efficacy studies.”

The FDA’s upcoming guideline on biosimilars is likely to take a similar approach as in Q6b and the European monographs: prove an understanding of the primary, secondary, and higher-order structure of a molecule an

d define and control posttranslational modif ications. “If manufacturers truly want an abbreviated approval process, they will have to begin working with the FDA much earlier in the process,” says Magil. “It will not be a scenario of conducting all the assays tests you think are appropriate, right up to your submission, send it to the FDA, and only then does the agency respond. You will have to include the FDA in manufacturing and development discussions as well.”

Expectations in the industry are that biosimilar companies will need considerable analytical, physical, and clinical evidence to demonstrate similarity. The general consensus is that currently all biosimilars must go through clinical (animal and human) and analytical testing. According to Magil, many of the presentations at FDA’s November 2010 open meeting on biosimilars were from a companies and patient groups that clearly were not comfortable with a regulatory approval pathway that didn’t have human trials. “It is possible that the pathway will be abbreviated by removing the need to perform animal trials if you can show that there are no differences at all in terms of excipients and the active substance, but that is not for sure.”

Many fundamental objectives such as product quality and short development timelines are the same for both biosimilars and brand products. However, the overall objective for biosimilar development may be to reduce the number of complementary nonclinical animal studies and clinical studies by performing more analytical studies. “We are seeing more sponsors applying high-end analytical characterization very early on in development, whereas perhaps in the past for a brand product you wouldn’t start characterizing into that detail until later,” says Phil Ball, US technical director at Eden Biodesign, a former private CMO and process development company, now conducting internal biologics and biosimilars projects for Watson

Pharmaceuticals (Parsippany, NJ). “So there are some unique developmental challenges, but the primary objectives are often the same, which is to have a high-quality product produced by an efficient manufacturing platform.”

The needs of the industry are clear: “They want to know what’s in the FDA’s head. It’s an issue of reducing risk and understanding the regulatory viewpoint,” says Magil. “If the glycosylation is slightly different, for example, how different is not different at all? The FDA needs to address that question soon because it relates to MAbs and comparability for scaling up,” says Magil.

Whether any company will actually take advantage of an abbreviated pathway is uncertain. “Because of the data exclusivity issue, there’s some discussion on whether companies are even going to use an abbreviated pathway. Whether they will file an aBLA or a standard BLA is unknown,” says Atkinson. “It’s a strategic question, but based on the way people are interpreting the legislation and data exclusivity part, it may be just as advantageous for them to file BLAs.” Manzi agrees. “The FDA pathway for biosimilars has so many legal issues that at this point some biosimilar manufacturers are doubting they will use the biosimilar pathway and will most likely use the traditional pathway for filing in the United States.”

“No one is expecting bioidenticals. We expect differences, and we have the tools and techniques to explore and understand those differences,” says Roger Lias, president and group commercial director at Eden Biodesign. “How will it translate to FDA guidance and approval of these products? We shall see.”

About the Author

Author Details

Maribel Rios is managing editor of Bioprocess international.

REFERENCES

1.) Kozlowski, S.. 2011. Developing the Nation’s Biosimilars Program. N. Engl. J. Med 365:385-388.

2.) Locatelli, F, and S. Roger. 2006. Comparative Testing and Pharmacovigilance of Biosimilars. Nephrol. Dial. Transplant 21:v13-v16.

You May Also Like