December Spotlight December 2016December Spotlight December 2016

December 13, 2016

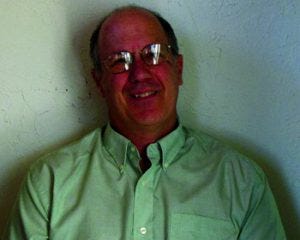

BPI Advisor Will Be Missed

Thomas J. Pritchett, PhD (1950– 2016), was a member of the BioProcess International advisor board since its founding. He also was founder, publisher, and editor of the BioQuality Newsletter and provided decades of analytical and quality control training to many people in the biopharmaceutical industry, both on the industrial and regulatory sides. Pritchett always provided insightful, well–thoughtout approaches to implementing current good manufacturing practices (CGMPs) under all conditions, ranging from virtual to global companies. He helped to train emerging regulatory systems in the Middle East. His focus was always on patient safety and good science. Tom will be dearly missed by those of us who had the pleasure of working with him.

Thomas J. Pritchett, PhD (1950– 2016), was a member of the BioProcess International advisor board since its founding. He also was founder, publisher, and editor of the BioQuality Newsletter and provided decades of analytical and quality control training to many people in the biopharmaceutical industry, both on the industrial and regulatory sides. Pritchett always provided insightful, well–thoughtout approaches to implementing current good manufacturing practices (CGMPs) under all conditions, ranging from virtual to global companies. He helped to train emerging regulatory systems in the Middle East. His focus was always on patient safety and good science. Tom will be dearly missed by those of us who had the pleasure of working with him.

Pritchett committed suicide after many years of struggling with bipolar disorder. It is his family’s request that those of us in the biopharmaceutical industry lead the way to understanding that mental diseases are illnesses that need our innovative scientific insights — and that we become part of a social change to put an end to blaming patients and seek treatments and cures for such diseases. They respectfully request that you do this in his memory.

Letter to the Editor: Sterile Filtration

I read this paper with interest and thank the authors for their efforts: “Best Practices for Critical Sterile Filter Operation: A Case Study,” by Yanglin Mok, Lise Besnard, Terri Love, Guillaume Lesage, and Priyabrata Pattnaik (BioProcess Interational May 2016). We must give credit to the hydrophobic–hydrophilic filter combination, which represents a possible preuse/poststerilization integrity test design and a choice of different engineering possibilities. The authors description of the multiple purposes of the barrier filter are beneficial.

Having said this, I would not necessarily call the described activities as “best practices.” Described activities promote use of a preuse/poststerilization integrity test, representing an elevation of risk according to risk assessments mentioned in several papers, presentations, and a September–October 2012 PDA position paper. Best practices commonly reduce risks, especially in critical processing steps.

Furthermore, some questions arise and clarifications are needed. For example, the authors state that a preuse test will confirm that the filter is properly installed and was not damaged during transport, and that testing after sterilization limits risk. They suggest that none of these activities were properly validated and that personnel training is lacking. In addition, is a preuse/poststerilization test performed on the barrier filter? All listed risk criteria also apply to the barrier filter (?).

The authors suggest performing a barrier-filter integrity test after the product filter passed the preuse/poststerilization test. Such a barrier-filter test would be performed off-line, so a valve is closed and now represents a barrier to the “sterile” filtrate side. An important question: How long does a user leave the filtration process idle to test that barrier filter? The time interval to perform that test and leave the filtration process idle must be validated because a downstream manipulation has happened. Users must prove that no microbial proliferation happens on the upstream side of the tested product filter, which could influence its retentivity. Filter process validations need to take that time interval into consideration, which increases their complexity.

Drying a sterilizing-grade filter — described in the paper as “typical” — requires users to push it past its bubble point and run the drying cycle for a prolonged period at elevated differential-pressure conditions (>50 psi for a 0.2-μm PVDF filter). How can we be assured that such high differential pressure blow-down does not cause damage? Do users have to integrity test it again? The authors mention time and pressure examples but not the necessary validation process to make sure that a product filter will withstand the described conditions.

The authors describe an engineering solution that can be used in a process with a commercial risk that is too high not to use a preuse/poststerilization integrity test. However, that engineering opportunity itself is as much subject to a robust risk assessment as a filtration process without the use of a preuse/poststerilization integrity test.

—Maik Jornitz, principal consultant, BioProcess Resources LLC

The authors agree that the decision to implement or not implement preuse poststerilization integrity testing (PUPSIT) should be based on a risk assessment (see the risks highlighted above). However, note that risks are also associated with not implementing a preuse test: e.g., regulatory compliance and product loss from processing with damaged filters. In many cases, those risks outweigh those associated with implementation. When implementation is chosen, best practices as described in the paper can reduce greatly or eliminate risks of downstream contamination. In fact, when deciding whether to implement PUPSIT, it’s important to consider that a well-designed and -operated process can reduce greatly or eliminate the risk of downstream ingress.

Typically, testing a barrier filter before product filtration might take 30 minutes or less. In any event, feed bioburden must be assessed before product filtration. Because filter PUPSIT typically uses purified water or water for injection (WFI) and clean dry air, microbial contamination introduced during the process should be minimal. If fluids used for the PUPSIT introduces bioburden that exceeds validated limits, this may suggest a much bigger problem than the time it takes to test the barrier filter.

Regarding filter drying after the integrity test, the drying method we described is an effective means of maximizing product yield that is commonly practiced in the industry. It is routine in many validated processes. For a properly designed, manufactured, and operated filter system, air pressure up to the filter manufacturer’s specification creates no risk to filter integrity.

—Yanglin Mok, manager of manufacturing sciences and technology (Singapore), Merck KGaA

BPI Welcomes New Advisors

Yuan Chang is a biopharmaceutical drug substance and drug product development leader with over 16 years of experience in process and product development and CMC leadership. As a process scientist and group leader, his work has included purification process development, optimization, characterization, technology transfer, and manufacturing support at Genentech, FibroGen, Biogen IDEC, and MedImmune/AstraZeneca. In his most recent role as CMC team leader and project manager in biopharmaceutical development at MedImmune, Chang was engaged in developing upstream and downstream processes, formulations, analytical methods, drug product presentations, and drug product fill–finish and lyophilization processes. He also was involved in technology transfer, good manufactruing practice (GMP) manufacturing and quality assurance, contract manufacturing and research organization (CMO, CRO) selection and management, regulatory submissions, and clinical supply chain and logistics decision-making. Chang’s experience spans from lead-molecule selection to process performance qualification and authoring biologics license applications (BLAs).

Yuan Chang is a biopharmaceutical drug substance and drug product development leader with over 16 years of experience in process and product development and CMC leadership. As a process scientist and group leader, his work has included purification process development, optimization, characterization, technology transfer, and manufacturing support at Genentech, FibroGen, Biogen IDEC, and MedImmune/AstraZeneca. In his most recent role as CMC team leader and project manager in biopharmaceutical development at MedImmune, Chang was engaged in developing upstream and downstream processes, formulations, analytical methods, drug product presentations, and drug product fill–finish and lyophilization processes. He also was involved in technology transfer, good manufactruing practice (GMP) manufacturing and quality assurance, contract manufacturing and research organization (CMO, CRO) selection and management, regulatory submissions, and clinical supply chain and logistics decision-making. Chang’s experience spans from lead-molecule selection to process performance qualification and authoring biologics license applications (BLAs).

Chang holds bachelor’s degree in pharmacy and a master’s degree in medicinal biochemistry from Lanzhou Medical College (Lanzhou, Gansu Province, China) and a PhD in biochemistry focusing on PEGylation of protein therapeutics from Shanghai Institute of Biochemistry (Shanghai, China).

Returning editorial advisor Alois Jungbauer is a professor in the department of biotechnology at the University of Natural Resources and Life Sciences in Vienna, Austria. He also serves as head of the bioprocess engineering research field for the Austrian Centre for Industrial Biotechnology (ACIB). Since receiving his PhD in food technology and biotechnology from the University of Natural Resources and Life Sciences (Vienna, Austria) in 1986, Jungbauer has taught protein technology, downstream processing, and biochemical engineering at the same university.

Returning editorial advisor Alois Jungbauer is a professor in the department of biotechnology at the University of Natural Resources and Life Sciences in Vienna, Austria. He also serves as head of the bioprocess engineering research field for the Austrian Centre for Industrial Biotechnology (ACIB). Since receiving his PhD in food technology and biotechnology from the University of Natural Resources and Life Sciences (Vienna, Austria) in 1986, Jungbauer has taught protein technology, downstream processing, and biochemical engineering at the same university.

Head of the protein technology and downstream processing laboratory and the Christian Doppler Laboratory of Receptor Biotechnology, Jungbauer is currently working on the bioengineering of proteins, plasmids, and viruses with special focus on expression, downstream processing, and characterization of large biomolecules. He has more than 200 publications on recombinant protein production and bioseparation, holds 15 patents, and has written 12 book contributions — most recently, a monograph titled Protein Chromatography, Process Development, and Scale Up. He is also executive editor and cofounder of the Biotechnology Journal and a member of several editorial boards in biochemical engineering. Currently Jungbauer is the president of European Society of Biochemical Engineering Science (ESBES), a section of the European Federation of Biotechnology.

Drug Companies Still Want to Innovate High-Risk, First-in-Class Products

To maximize revenues and stay ahead of competition, pharmaceutical companies are increasingly developing first-in-class treatments. A recent GBI Research report (Innovation Tracking Factbook 2016: An Assessment of the Pharmaceutical Pipeline) suggests that growth in drug R&D cost stems from increased clinical failure rates and emphasis on proving superiority over comparator drugs in technology assessments. It costs an estimated US$2.6 billion to bring a single novel drug to market. Meanwhile, payers exhibit an increasing level of sophistication in assessing the cost-effectiveness of drugs.

GBI managing analyst Dominic Trewartha points to “the inherently limited lifecycle of a patented drug and growing costs as a percentage of net sales” for why the drug industry has such high R&D costs. So it is imperative for companies to reduce product development costs, maximize annual product revenues, and optimize drug lifecycles. “Together, these factors favor the inclusion of first-in-class pipeline products within a balanced pipeline portfolio.”

Traditionally, “me-too” drugs have been successful both clinically and commercially. Such products provide well-established pathways for promising product development because of lower risk profiles based on “safer” and more cost-effective incremental innovation. Higher-risk programs for innovative first-in-class products remain attractive, however. The 4,964 first-in-class drugs currently in development represent 37.9% of pipeline products with disclosed molecular targets.

Among Trewartha says, “Some of the most successful products in the past 10 years have been first-in-class therapies: Avastin (bevacizumab), Rituxan (rituximab), Herceptin (trastuzumab), and Gleevec (imatinib).” Note that three of those are monoclonal antibodies (MAbs). In analyzing 2015 US Food and Drug Administration (FDA) approvals, GBI Research found that first-in-class products have far higher average projected sales than other drugs, suggesting a trend that will continue. Trewartha concludes, “Despite the high risks involved in developing first-in-class products, pharmaceutical companies stand to earn high rewards through innovative development strategies.”

2015 Licensing Deals Hit US$46.2 Billion

Licensing agreement values in the pharmaceutical industry rose from $33.7 billion in 2014 to $46.2 billion in 2015 (up 37.1%). That growth was driven primarily by Sanofi, which struck three major deals totaling nearly $9 billion, according to GlobalData.

In a white paper published earlier this year (Pharmaceutical Sector Brief – Pharma Licensing Values Soar to New Levels), GlobalData analyst Gianfranco Zeppetelli elaborates: “Sanofi inked two key partnerships for metabolic indications, the first of which was a $4.3 billion partnership with South Korea’s Hanmi Pharma. Sanofi gained exclusive worldwide license to develop and commercialize three pipeline products for the treatment of type 2 diabetes. The company also made a $1.7 billion agreement with Lexicon Pharma to manufacture and sell an investigational oral dual inhibitor of SGLT-1 and SGLT-2 that is currently in phase 3 development.”

The white paper highlights a surge of investment in immuno-oncology over the past five years as immunotherapies have advanced significantly and become the new pillar of cancer treatment. In that space, Sanofi signed a $2.7 billion deal to codevelop Regeneron’s REGN-2810, an inhibitor of programmed cell death protein 1 (PD-1) currently in phase 1 testing.

Another important partnership was Pfizer’s $2.9 billion agreement with Merck KGaA to develop and commercialize avelumab, an investigational anti-PD-L1 MAb in phase 2 development as a potential treatment for multiple metastatic and advanced solid tumors, (e.g., breast and prostate cancer). Under the terms of that agreement, Merck KGaA receives an upfront payment of $850 million and is eligible to receive regulatory and commercial milestone payments totaling up to $2 billion.

“Companies are adapting to current market dynamics and positioning themselves for growth through portfolio transformation, targeted deal-making, cost-cutting measures, and sharpening focus on high-performing therapeutic areas, and geographic markets,” Zeppetelli concludes.

Regenerative Medicine Groups Collaborate

The International Society for Cellular Therapy (ISCT) and the Alliance for Regenerative Medicine (ARM) announced in April 2016 their growing collaboration. ISCT is a global society of clinicians, researchers, regulators, technologists, and industry partners dedicated to the translation of cellular therapy into safe and effective therapies to improve patients’ lives. ARM is an international organization representing the regenerative medicine sector, including gene and cellular therapies. Signed by ISCT president Massimo Dominici and ARM managing director Morrie Ruffin, this agreement enables the two organizations to work together increasingly. Since ARM’s establishment in 2009, they have collaborated on a series of projects, including cowritten white papers. Some members have held leadership roles in both organizations. Now a joint committee will monitor and plan broader activities and projects more consistently than before.

Joint activities will begin with proposed projects on standards. These include formulating and managing an international coordinating body alongside other activities to improve ISO standards for cell therapy and other regenerative medicines. The groups also will collaborate on one another’s conference programs, communications, and education initiatives specifically related to cell therapy.

“In recent years, cellular therapies have expanded exponentially,” Dominici said. “This is in terms of scientific discoveries, clinical results, and investment, all of which generate enormous opportunities for patients and the industry.”

ISCT seeks consensus among key stakeholders and hopes to balance the interests of industry, academia, and regulators by implementing changes in its global executive committee. CEO Dan Weiss is joined by Miguel Forte as chief commercialization officer and Karen Nichols as chief regulatory officer. This will provide organizational focus on the key areas required to successfully deliver new cell therapies to patients.

Forte stated that collaboration between ISCT and ARM will enable academia, regulators, and industry to work more closely together than ever before. “The cell therapy field continues to require ongoing development and intellectual and financial investment globally, especially regarding process development, manufacturing strategies, and market access. Opportunities created by this agreement have never been stronger.”

“ARM and ISCT are united by a common goal of advancing innovative cell therapies,” Ruffin said. “Our further collaboration on various projects streamlines efforts to bring potentially life-saving treatments to patients with current unmet medical needs.”

World Biosimilars Market Could Explode

Allied Market Research predicts that the biosimilars market contributed global revenue of $2.55 billion in 2014 and predicts it to generate some $26.55 billion by 2020, growing at a compound annual growth rate (CAGR) of 49.1% in five years. Key driving factors fostering such market growth are low pricing of biosimilars, relative ease of developing them, and reliable and timely regulations with quick approvals of drugs.

The market for follow-on biologics originated primarily from the expiration of patent protection for many biological medicines, including blockbuster biopharmaceuticals with high annual revenues. Such drugs are highly priced, which coupled with rising healthcare costs around the world, has led to an increased demand for biosimilars. To gain approval from the European Medicines Agency (EMA), the FDA, and the World Health Organization (WHO), biosimilars must either be interchangeable in efficacy/function with referenced biologics or demonstrate no meaningful clinical difference from the originals. Favorable regulatory environments with pathways for biosimilar approval across major regions could persuade more developers and companies to invest in the market.

The US market for biosimilars gained momentum after the September 2015 launch of Novartis’s Zarxio (filgrastim-sndz), the first biosimilar to be approved there. Developed by Sandoz (Novartis’s biosimilars division), the drug is a follow-on to Amgen’s Neupogen (filgrastim). Sandoz claims that the launch has eroded that product’s US market share by 13%. In March 2016, the FDA approved a second biosimilar: Celltrion’s Inflectra (infliximab-dyyb), a comparator to Janssen Biotech’s Remicade (infliximab). Already approved for marketing in Canada, Mexico, Australia, and much of Europe, it is the first biosimilar MAb to get US approval.

Similar developments would unlock new opportunities for pharmaceutical companies and drug developers on the global market. Many European countries have commissioned studies that focus on biosimilar Remsina, which is considered to be another potential replacement for the Remicade product. It’s approval could foster biosimilar market growth across Europe. The current biosimilar is sold in many Nordic countries at a huge discount — around 75% — further boosting its adoption.

Erythropoietin and MAbs are glycosylated proteins that together accounted for about a third of the total global biosimilar market revenue in 2014. Among leading segments of the market, blood disorders and oncology combined accounted for about 61% in 2014. Interferon is the fastest growing biosimilar product, estimated by GlobalData to grow at a CAGR of 51.1% during the forecast period.

Emerging trends suggest that Europe is attracting major investors interested in the biosimilars industry. Growth prospects there are driven by streamlined regulatory guidelines and high biosimilar adoption rates by physicians, payers, and patients. Read more online: www.alliedmarketresearch.com/global-biosimilars-market.

Incentives for Physicians to Prescribe Biosimilars Would Improve Affordability

Incentives for physicians to prescribe biosimilars could increase their adoption and further reduce their costs, according to a report (Payor Strategies to Promote Biosimilar Utilization) from Matrix Global Advisors (MGA) released by the Pharmaceutical Care Management Association (PCMA). Biologics represent a large share of US drug spending. Increased use of biosimilars could benefit both patients and the healthcare system as a whole.

The report notes that in addition to improving physician education about biosimilars, policymakers and payers could encourage physicians to use biosimilars by rewarding them for doing so. Report author Alex Brill (CEO of MGA) says, “Biosimilars offer the potential to improve the cost-effectiveness of medicines by driving competition. But to facilitate a robust biosimilars marketplace in the United States, additional tools may be necessary for payors to consider.”

According to a recent IMS Health report, the amount of drug spending expected to be subject to biosimilar competition between 2016 and 2020 is $182 billion. “Each day that providers delay prescribing FDA-approved biosimilars means higher costs and fewer options for patients,” said PCMA president and CEO Mark Merritt.

The report concludes that because higher use of biosimilars will drive competition, incentivizing their adoption would increase the robustness of the biosimilars market overall. That could further benefit US patients and the health care system overall.

AMA Adopts New Policies

The American Medical Association (AMA) adopted several new policies at its annual meeting in June 2016 that touch on a diverse array of public policy issues. Two new policies are of particular interest to drug developers.

Creating a Program to Dispose of Unwanted Medications: The AMA called for the pharmaceutical industry to fund a program for disposing of unwanted medications as hazardous waste. Estimates indicate that 30–80% of patients do not finish common prescriptions, including pain medications. Many drugs are simply discarded at home. The US Geological Survey has found found that as many as eight out of 10 sampled rivers and streams show traces of drugs, hormones, steroids, and personal-care products in their water.

“Many unused medications are diverted and used by someone other than the patient,” said AMA presidentelect David Barbe. “Manufacturers should be stewards of their products throughout their lifecycle and provide this critical service to patients and our environment.”

Warnings Urged for Legal Ads Targeting Medications: The AMA recommended that advertisements warning about the dangers of pharmaceuticals include warnings that patients should consult with their doctors before discontinuing medications.

“The onslaught of attorney ads has the potential to frighten patients and place fear between them and their doctors,” said Russell Kridel (AMA board of trustees member). By emphasizing side effects while ignoring benefits and FDA approvals, he said, “such ads jeopardize patient care. For many patients, stopping a prescribed medication is far more dangerous, and we need to be looking out for them.”

You May Also Like