Top Trends in BiomanufacturingTop Trends in Biomanufacturing

February 4, 2021

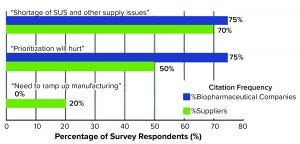

Figure 1: Top-level near-term concerns brought about by the COVID-19 pandemic (2)

Facing an ongoing pandemic, growing pipelines, and a possible capacity crunch, the bioprocess industry is striving to balance its priorities. Those are some of the key issues to watch according to the 17th annual report and survey of biopharmaceutical manufacturing capacity and production from BioPlan Associates. It includes survey responses from 130 decision-makers (from 33 countries) at both bioprocessing organizations and contract manufacturing organizations (CMOs) and responses from 150 bioprocess industry suppliers (1). Top trends from this report are highlighted below.

Industry Growth Continues

The biopharmaceutical industry and its bioprocessing sector are healthy and continue to expand in revenue, breadth, importance, and diversity. Worldwide sales of biopharmaceuticals are approaching US$300 million and increasing globally at ~12% annually, with supporting growth in bioprocessing markets (supplies and services) at comparable annual rates. Budgets for new capital investments in bioprocessing equipment are growing at 8.7% on average.

The survey projects a positive future for some key areas. The outlook for biological products is improving. Each product area often includes smaller markets such as orphan and personalized products. Bioprocessing facilities for major markets worldwide (Asia in particular) are expanding. This area now includes an upcoming wave of facilities coming on-line for COVID-19 and other pandemic and biodefense products in addition to expansions in the cellular and gene therapies areas.

Survey respondents also expect to see an uptick in cell and gene therapy facilities and products, including commercial manufacturing. Implementation of single-use systems (SUS) should increase because fewer new commercial-scale facilities based on stainless-steel equipment are expected. An increasing number of modular-constructed facilities and cleanrooms are expected. The number of good manufacturing practice (GMP) facilities is expected to increase.

Biosimilars, biobetters, and biogenerics will capture growing market shares. Adoption of continuous processing, including upstream perfusion and continuous chromatography, should increase for commercial manufacturing in coming years. The number of diverse and novel products that are both in development and marketed should increase. Such products include cell and gene therapies, antibody–drug conjugates, and live microbe therapeutics. Automated and digital systems will continue to be implemented and built into process equipment. These include process automation, monitoring, and control; data recording and processing; and process analytical technology (PAT). Finally, expression systems and advanced genetic engineering will improve, especially as more companies use tools such as clustered regularly interspaced short palindromic repeats (CRISPR).

Industry Adapting to Address the Pandemic

A BioPlan Associates white paper (2) reviews how the bioprocessing sector and biopharmaceutical industry have adapted to the ongoing pandemic. Adjustments include making necessary staff and operational changes and paying greater attention to ensuring robust supply chains. Key activities such as R&D and manufacturing also have increased to address needs during the pandemic. Business is continuing as always without major disruptions or changes, with many facilities adding R&D and/or manufacturing activities.

Figure 1 shows survey results of the most commonly cited concerns brought about by the COVID-19 pandemic. The top is “shortage of SUS and other supply issues,” which includes the inability to obtain single-use supplies when needed. “Prioritization will hurt” is the second most-cited concern. That means nearly all suppliers and many developers are prioritizing their orders and activities and pushing pandemic- and biodefense-related activities to the front. Such prioritizations and expected worsening of ongoing shortages (including high-purity polymers) will result in many facilities having longer wait times for suppliers to fill orders, particularly for single-use supplies.

Long-Term Changes

Major long-term changes will come as the biopharmaceutical industry does its part to resolve the COVID-19 pandemic. The main response will be an expansion of biopharmaceutical R&D and manufacturing activities worldwide. That includes an unprecedented ramping up of pandemic- and biodefense-related vaccines as well as therapeutics R&D and manufacturing to provide billions of doses of COVID-19 vaccines per year. Emphasis on those new activities means that biomanufacturers are likely to displace existing bioprocessing work to other facilities. For example, smaller CMOs that are not involved in pandemic-related work are facing increased future demand as pandemic and biodefense projects are undertaken by other CMOs.

Developer and supplier company executive interviewees provided their top-10 list of major long-term effects of the pandemic on the bioprocessing sector. The list includes expectations for long-term, future effects such as

more outsourcing (cited by 70% of developer interviewees)

changes in supply chains (cited by 60% of developer interviewees), including concerns over relationships with suppliers and securing second sources

more regionalization (cited by 50% of developers and 45% of suppliers), which refers to an increase in manufacturing facilities (both for developers and suppliers) being located in more countries — for example, a US plant would supply the US market whereas plants in China and India would support their own regional markets

a supply crunch for SUS (cited by 50% of developers and 35% of suppliers), which includes a worsening of current single-use equipment shortages

expansion in SUS manufacturing capacity (cited by 64% of suppliers and 30% of developers)

increased funding (64% of suppliers and 20% of developers).

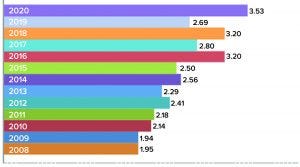

Figure 2: Average titers (g/L) for monoclonal antibodies at commercial scales (2)

Increasing Productivity

Biomanufacturing productivity, particularly in terms of upstream titers and downstream yields (to a much lesser extent) continue to increase incrementally. Figure 2 shows reported average monoclonal antibody (MAb) titers at large scales at the facilities of survey respondents over the past several years. Keep in mind that titers in the late 1980s to early 1990s were usually in the few 100s of mg/L or <10% of current average titers.

Related survey findings this year include the following:

The average titer for new commercial-scale MAb upstream bioprocessing is 3.53 g/L and 3.96 g/L for new clinical-scale MAb upstream bioprocessing.

“Improving production titer” was cited by 56.5% as a key factor having “the greatest impact on reducing your cost of goods for biotherapeutic products.”

Fewer, Smaller Stainless-Steel Bioreactors

BioPlan Associates projects that fewer new stainless-steel bioreactors will be installed as more single-use facilities come on-line. The volume of stainless- steel bioreactors installed and in operation also is smaller. Their average onsite size was 3,502 L, compared with 3,694 L reported in 2018.

The percentage of respondents reporting that their facilities have bioreactors >2,000 L has been declining. Essentially, all bioreactors >2,000 L can be assumed to be stainless steel. Despite all the needed infrastructure and capital investment costs, stainless-steel bioprocessing remains more cost-effective compared with SUS for long-term repeated or nonstop commercial manufacturing.

Follow-Ons Bring More Products and Players

Development of biosimilars (and biogenerics in lesser-regulated and nonregulated international markets) are resulting in new products, stakeholders, and facilities entering the biopharmaceutical industry. The Biosimilars/Biobetters Pipeline Directory (3) reports 1,099 biosimilars (including biogenerics) in development or marketed worldwide, with 588 in clinical trials or marketed in one or more countries. More than 560 biobetters are in development or marketed worldwide, with 296 in clinical trials or marketed. More than 800 companies worldwide are involved in follow-on products, including many new entrants in both developed and developing regions. As the number of competing similar biopharmaceuticals entering world markets increases, marketing will become more competitive (including on the basis of product costs). That is forcing developers to adopt optimally efficient and flexible bioprocessing technologies and facilities.

“Capacity Crunch” for Cell and Gene Therapies

Distribution of advanced-therapy capacity is insufficient, according to survey respondents whose facilities perform cell and gene therapy bioprocessing. BioPlan has projected a worsening cell and gene therapies “capacity crunch” similar to the crunch in mainstream bioprocessing that was feared but prevented in early 2000s. The current capacity shortfall for cell and gene therapies is estimated at 5× or 500%. So, 5× current capacity would be in use if such capacity were available. That shortfall will increase significantly over the next five years. Despite many new cell and gene therapy facilities and expansions, future shortages will continue. Most developers, including leading CMOs, are working to catch up with early and midphase clinical capacity needs, and few developers have scaled up capacity for commercial and GMP manufacturing.

Continuous Bioprocessing Optimism and Skepticism

When asked what bioprocessing innovations are most needed, respondents most frequently cited aspects of continuous bioprocessing. “Upstream continuous processing and perfusion” was cited by 44.2% of survey participants. Forty percent of respondents indicated that they expect “downstream: continuous purification/chromatography” to be evaluated or tested by their facility in 2021. BioPlan expects most bioprocessing facilities to evaluate at least some part of continuous processing this year.

Nearly two-thirds of respondents expect that there will be fully continuous commercial manufacturing facilities (rather than one or a few parts being continuous) within five years. Nearly 60% expect that perfusion eventually will be adopted by most bioprocessing facilities.

Respondents are skeptical about continuous bioprocessing overall, however. Over 60% of them cited that many years of development will be needed to achieve truly continuous bioprocessing. When asked to rate concerns regarding perfusion, 71.8% of respondents cited “process operational complexity” as the top concern, reflecting that perfusion adds considerable mechanical, technical, and regulatory complexities to bioprocessing. Adoption and implementation of continuous processing remain low. A few facilities have implemented continuous operations for at best one or a few unit processes both up- and downstream as continuous, mostly perfusion. Those sites include newer facilities and a few facilities that have been using perfusion for decades for commercial manufacturing of a few products. BioPlan studies have shown that only 5% to <10% of bioreactors over desktop size use perfusion. Most of those systems use feeder (not production) bioreactors.

SUS Implementation Increasing

SUS continue to advance into biopharmaceutical manufacturing and currently dominate at precommercial scales (e.g., clinical and preclinical). Well over 80% of respondents reported considerable use of single-use bioprocessing equipment, and 84.3% reported use of single-use bioreactors. Implementation of those SUS indicates much wider applications of single-use equipment as part of the same processing lines. BioPlan estimates that ≥85% of precommercial (R&D and clinical) product manufacturing involves substantial SUS-based manufacturing. SUS capacity and use will increase further as products are developed using SUS to progress toward clinical-scale and current good manufacturing (CGMP) manufacturing.

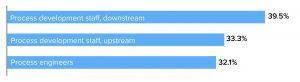

Figure 3: Areas where hiring difficulties exist in biopharmaceutical operations with percentage of survey respondents

Hiring Challenges Creating Significant Bottlenecks

As the bioprocess industry expands, some facilities will face major hiring problems, especially for expanding industry sectors such as regenerative medicine. We asked respondents to indicate job positions that currently are difficult to fill (Figure 3). Out of 25 options, downstream process development staff was cited as the most difficult to fill (39.5% of respondents, slightly down from 45.1% in 2019). The next most cited were process development staff (upstream) and process engineers. The apparent decrease of hiring problems in other areas might be because some companies have been successful in streamlining their processes, making them more efficient, more automated, faster, and less expensive. That can reduce pressure on already minimized staff. Such companies are doing more, with fewer or the same resources. Survey results showed decreasing percentages (compared with 2019 results) of hiring difficulties in some areas, especially in process development engineering and operations.

Overall, steady growth of the biopharmaceutical market will be suppressed by demand for staff. The need for trained bioprocessing staff expertise has remained, year after year. That problem is likely to worsen as experienced staff retire, demands increase for new therapies such as pandemic vaccines, and markets in regions such as China continue to grow. As a result, BioPlan Associates expects a lot of mobility among skilled employees, including “poaching” from one company to another, with impacts on every company.

References

1 Langer ES, et al. Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 17th Annual Edition. BioPlan Associates: Rockville, MD, April 2020; https://www.bioplanassociates.com/article/biopharma-manufacturing-trends-2020.

2 Rader RA, Langer ES, Jhamb K. COVID-19 Impact on Bioprocessing: Accelerating Trends and Long-Term Impact of Novel Coronavirus-19 on Biomanufacturing and Bioprocess Supply Chain. BioPlan Associates: Rockville, MD, June 2020; https://bioplanassociates.com/wp-content/uploads/2020/07/Covid-19-Impact-on-Bioprocessing-White-Paper-BioPlan-20200605.pdf.

3 Rader RA. Biosimilars/Biobetters Pipeline Directory. BioPlan Associates: Rockville, MD; https://www.biosimilarspipeline.com.

Ronald A. Rader is the senior director of technical research at BioPlan Associates; 1-301-921-5979; [email protected]; www.bioplanassociates.com.

You May Also Like