The Talent Enigma in Digital BiomanufacturingThe Talent Enigma in Digital Biomanufacturing

Demand for talent in the biopharmaceutical industry already had been climbing before the COVID-19 pandemic, showing an increase of 26% from 2018 to 2020. By the end of 2021, a further 32% surge was observed in the United States and Europe, against a 10% rise in the supply of expertise. Bolstered at first by the need to manufacture SARS-CoV-2 vaccines and therapeutics and now by the threat of new pandemics, current market drivers include increases in investment, initial public offerings (IPOs), and commercialization of cell and gene therapies — modalities that call for a distinct set of skills.

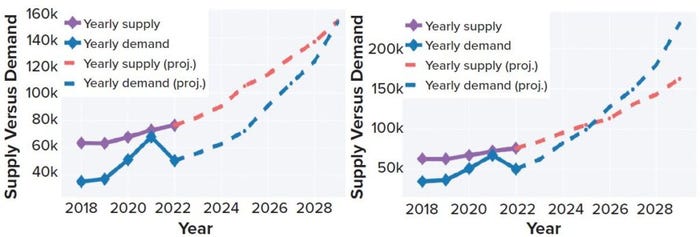

With researchers from the University of Dundee (UD) and University College London (UCL) in the United Kingdom, Evolution Search Partners has begun analyzing and modeling what we term “biomanufacturing talent dynamics.” Such evaluation helps to project the critical equilibrium point at which demand exceeds supply in relation to shifts in market growth. The models presented in Figure 1 illustrates our supply-versus-demand market growth assumptions.

Figure 1: Comparing talent supply and demand for US biomanufacturing under different market growth conditions; supply is expected to grow by 10%, based on a 12-year median. Demand growth is projected at 10% (left) and 20% (right). The equilibrium points illustrate where talent demand exceeds supply. Supply refers to numbers of graduates and postgraduates entering the industry, with demand specific to biomanufacturing job vacancies. Data are from a 2022 study by Evolution Search Partners.

Emerging Challenges

Cytiva president and chief executive officer (CEO) Emmanuel Ligner has noted, “The difficulty in accessing talent has been a topic in the industry for a long, long time. It is not only on the R&D side, but [also] on the manufacturing side and the technician side.” He added, “It is difficult to find the right talent. It takes time to hire [qualified people]; and then, once you have hired them, you have to train them” (1). Ligner predicted that “as we come out of the [COVID-19] pandemic, the demand for talent is not going to ease.’’

“Biopharma 4.0” – Amplification of a Talent Crisis: Several other challenges to the biopharmaceutical-talent supply chain are imminent given increasing adoption of Biopharma 4.0 principles. New levels of manufacturing complexity, combined with implementation of contemporary technologies, are spurring on changes to requirements for new hires, with drug makers asking applicants to demonstrate diverse technical and scientific skills. The transition to digitalization, a model designed to enhance operational connectivity and adaptivity, demands different expertise (2, 3). New hires must be skilled not solely in the science of biopharmaceutical manufacturing, but also in the technologies driving it.

Biopharma 4.0 refers to technological advances by which the internet and embedded systems serve as a nucleus in which to integrate production lines and processes across organizational boundaries (4). The goal of the approach is to form a networked and agile value chain. Thus, personnel must be able to succeed in complex, cross-functional teams, and they must have skills that combine pharmaceutical and scientific expertise with information technology (IT) and mathematical capability. As with on-the-ground staff, Biopharma 4.0 also will require broader skill sets from managers and leaders.

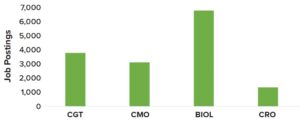

Figure 2: 2022 talent demand across biomanufacturing sectors, based on job postings specific to digitalization and automation (data from Evolution, 2022) (CGT = cell/gene therapy, CMO = contract manufacturing organization, BIOL = traditional biologics, CRO = contract research organization)

Our study, which began in 2019 and remains ongoing, attempts to measure the talent dynamics surrounding Biopharma 4.0 across biotechnological industries. Figure 2 illustrates the shift in talent demand in 2022 as exemplified by an increase in unique job postings specific to digitalization and automation, both of which are integral features of Biopharma 4.0.

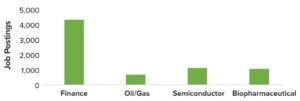

Automation and digitalization could be key disruptive forces facing biopharmaceutical companies. Those that invest and perform well in these areas in the short term are thought to be better prepared for the future business landscape because of increases in operational efficiency and decreases in costs (3, 5). Biopharma 4.0 adoption will require technology and experienced staff. Unfortunately, companies might struggle to hire workers who can use and integrate digital technologies within a manufacturing setting. The misfortune stems from the fact that workers from sectors in which digital manufacturing is more common — e.g., the automotive, finance, semiconductor, oil/gas, and food industries — tend not to transfer into biomanufacturing positions due to compensation parity. As a result, opportunities for biopharmaceutical companies to recruit workers from that talent pool are limited.

Figure 3: Demand for digital manufacturing talent across the biopharmaceutical, semiconductor, finance, and oil/gas industries in July 2022, based on job postings specific to digitalization and automation (Evolution, 2022)

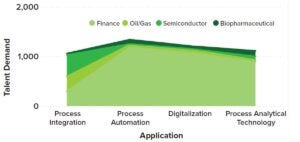

The biopharmaceutical industry might reach a breakpoint for redefinition of workforce roles and development of new skill sets. Such changes would be vital to supporting successful adoption of Biopharma 4.0. Biopharmaceutical companies also would benefit from promoting learning as a continuous process by providing training opportunities that would help to create a multiskilled and interdisciplinary workforce. Figures 3 and 4 compare demand for digital manufacturing talent across industries and applications, respectively.

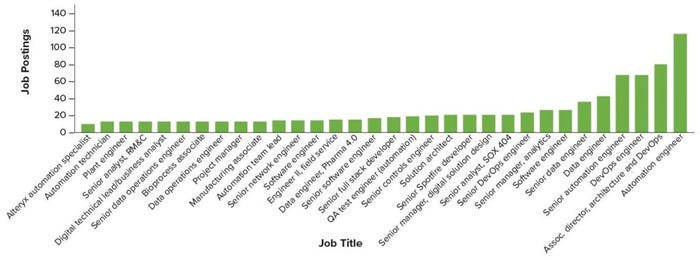

Biopharma 4.0 and the accompanying technological advances — e.g., in sensors, automation, artificial intelligence (AI) and machine learning (ML), the internet of things (IoT), and data mining and analytics — require a more diverse workforce than what the biopharmaceutical industry currently has available. Such tools are of critical importance for enhancing quality control (QC), business decision-making, and operations; however, digitalization is the integral pathway that the industry must take. Digitalization could help companies to stay relevant and increase operational efficiency by mitigating human errors, enhancing system and modular connectivity, and understanding trends. Figure 4 illustrates priority roles in 2022 specific to digitization and automation.

Figure 4: Demand for digital manufacturing talent across the biopharmaceutical, semiconductor, finance, and oil and gas industries in July 2022 across Industry 4.0 applications (Evolution, 2022)

The biopharmaceutical industry traditionally has been slow to incorporate AI, cloud computing, the IoT, and other innovative digital tools into their operations. Factors have included a lack of expertise and relevant skill sets despite high investment in them. However, as the COVID-19 pandemic emerged, companies were forced to prioritize investments in digital innovation and implement new technologies into every aspect of operation. Digital transformation road maps that spanned years suddenly were executed in months, sparking radical changes in operational behavior.

Many successful organizations have established operating models in which dedicated digital innovation resources are situated between business and IT functions, often in centers of excellence. These “smart factories” require not only enabling digital innovations, but also transformations in manufacturing infrastructure and company culture (4).

Figure 5: Biopharma 4.0 talent demand in 2022, by job role (Evolution, 2022) (RM&C = resource monitoring and control, SOX 404 = Sarbanes–Oxley Act <404> compliance, DevOps = software development and information-technology operations)

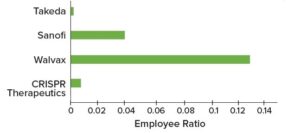

GlaxoSmithKline (GSK) recently collaborated with Siemens and Atos, two leaders in digital transformation, to create a smart, future-facing vaccine manufacturing facility that leverages a digital twin. Despite the difficulty of implementing Biopharma 4.0, the model could provide manufacturers with significant competitive advantages. For GSK, digital manufacturing is becoming a reality. Figure 6 illustrates additional examples of digital manufacturing sites, with associated talent growth in 2022.

Figure 6: Biopharma 4.0 talent demand in 2022 across selected biopharmaceutical companies with “smart facilities”; employee ratios represent hiring growth per number of employees.

As Martin Meeson (CEO of Fujifilm Diosynth Biotechnologies) has explained, a key factor in biopharmaceutical talent dynamics is that the industry is “no longer competing for talent with just other biopharmaceutical companies. We are competing at a worldwide level” (1). For instance, the IT sector tries “to pull in five times the number of people that we are trying to pull in, and the two industries are seeking overlapping skills.”

The Advent of Digital Biomanufacturing

Walvax and Honeywell (China): The Walvax Biotechnology facility in Yuxi, China, is the country’s first industrial site for mRNA vaccine production. The facility leverages Honeywell’s “intelligent plant” solutions and automation control systems to optimize manufacturing quality, operations, and regulatory compliance. Walvax’s long-term goal is to enable complete and sustainable life-cycle management for its vaccine products.

Walvax is working with Honeywell to install systems for batch process control, building management (BMS), and energy management (EMS). The solutions are designed not only to promote manufacturing quality and consistency, but also to optimize production and accelerate time to market. Technologies such as digital twins and dynamic modeling tools have been implemented to enable monitoring, visualization, and management of assets and processes (6–8). Ultimately, the Walvax–Honeywell collaboration is poised to promote digital manufacturing at the Yuxi site and, more broadly, digitalization of the vaccine industry.

Sanofi (United States): In October 2019, Sanofi opened its first digitally enabled facility for biopharmaceutical production, located in Framingham, MA. The site will support manufacture of next-generation biologics for the company’s “specialty care” portfolio, and it is among the first facilities in the world to use technologies for fully continuous biologics production. Provisioned for end-to-end manufacturing, the facility gathers information from millions of data sources to optimize processes continually. According to Sanofi, enhanced digital integration and improved data use are helping to optimize manufacturing processes and increase process efficiency (9). The cutting-edge technologies will promote commercialization of important new medicines.

Takeda (Germany): Takeda has established a new facility in Singen, Germany, to manufacture vaccines against dengue viruses. The site’s IT systems are based completely on open-platform communications unified architecture (OPC UA), and Takeda has planned for future machine-to-machine communication using a message broker/data gateway. The company is an industry leader in these respects. Opened in 2019, the facility is a state-of-the-art sterile manufacturing plant that combines a high degree of automation with the most advanced digital and data-driven technologies.

Getting Ahead of a Potential Skills Gap

The COVID-19 pandemic forced biopharmaceutical companies to prioritize digital innovation, infusing it into every aspect of operations and using it to renovate disrupted supply chains. However, the momentum and importance of digital innovation are not slowing down as the public-health emergency abates; rather, digital transformation is accelerating and becoming a vital element of competitive advantage for companies within the biopharmaceutical industry. Considering the potential for an industry-wide “skills gap,” in terms of both talent supply and aligned expertise, opportunities for staff to develop skill sets specific to Biopharma 4.0 have become business-critical.

Several strategies could help to solve the digital-biomanufacturing talent enigma. Drug makers can promote learning as a continuous process and provide current employees with training that creates a multiskilled and interdisciplinary workforce. Ireland’s National Institute for Bioprocessing Research and Training (NIBRT) leverages collaborations across industry, academia, and government agencies to develop such learning opportunities (10). UCL provides online courses through its Modular Training for the Bioprocess Industries (MBI) program (11).

Biopharmaceutical companies might consider working with industry-specific recruiters to tap into current talent supply chains. In addition to saving costs, organizations using that strategy might get ahead of growth in the supply-and-demand curve. To shore up the workforce of the future, industry and academia must help new recruits to develop new skill sets that support successful adoption of Biopharma 4.0 principles and technologies. One example is Lonza’s “Attach and Train” initiative, which aims to build a pipeline of skilled workers for Singapore’s biologics manufacturing industry in anticipation of hiring demand (12). More broadly, the biopharmaceutical industry will need to redefine workforce roles in accordance with digital manufacturing development.

References

1 The Global Talent Challenge in Biopharma: Expert Panel Q&A. Cytiva, 1 June 2021; https://www.cytivalifesciences.com/en/us/news-center/global-talent-challenge-in-biopharma-expert-panel-qa-10001.

2 Hole G, Hole AS, McFalone-Shaw I. Digitalization in Pharmaceutical Industry: What To Focus On Under the Digital Implementation Process? Int. J. Pharm. 619, 2021: 100095; https://doi.org/10.1016/j.ijpx.2021.100095.

3 Kudumala A, et al. Biopharma Digital Transformation: Gain an Edge with Leapfrog Digital Innovation. Deloitte Insights, 8 December 2021; https://www2.deloitte.com/us/en/insights/industry/life-sciences/biopharma-digital-transformation.html.

4 Arden NS, et al. Industry 4.0 for Pharmaceutical Manufacturing: Preparing for the Smart Factories of the Future. Int. J. Pharm. 602, 2021: 120554; https://doi.org/10.1016/j.ijpharm.2021.120554.

5 Markarian J. Automating Biopharma Manufacturing. Pharm. Technol. 46(07) 2022: 30–33; https://www.pharmtech.com/view/automating-biopharma-manufacturing.

6 Canzani E, Timmer S. Beyond Building Predictive Models: TwinOps in Biomanufacturing. TechRxiv, 2 September 2021; https://www.techrxiv.org/articles/preprint/Beyond_building_predictive_models_

TwinOps_in_biomanufacturing/16478856/files/30567753.pdf.

7 Destro F, Barolo M. A Review on the Modernization of Pharmaceutical Development and Manufacturing — Trends, Perspectives, and the Role of Mathematical Modeling. Int. J. Pharm. 620, 2022: 121715; https://doi.org/10.1016/j.ijpharm.2022.121715.

8 Hole G, Hole AS, McFalone-Shaw I. Digitalization in Pharmaceutical Industry: What To Focus On Under the Digital Implementation Process? Int. J. Pharm. 619, 2021: 100095; https://doi.org/10.1016/j.ijpx.2021.100095.

9 Belhamel C. The New Challenges in the Pharmaceutical Industry — What Strategy To Face Them? Sanofi Experience. Milev J. Res. Studies 5(2) 2019 437–449; https://www.asjp.cerist.dz/en/downArticlepdf/89/5/2/106099.

10 Training Courses. National Institute for Bioprocessing Research and Training: Dublin, Ireland, 2022; https://www.nibrt.ie/training-and-education/training-courses.

11 MBI Modules. University College London, Department of Biochemical Engineering: London, UK, 2022; https://www.ucl.ac.uk/biochemical-engineering/study/industrial-training/mbi-modules.

12 Yee GW. Overview of the Singapore PharmBio Sector. PharmBioSingapore, 2018; https://www.pharmbiosingapore.com/articles/industry-articles/overview-of-the-singapore-pharmbio-sector.

Corresponding author Jason Beckwith, PhD, ([email protected]), is managing director of the Evolution Search Group, 183 Bath Street, Glasgow, G2 4HU, UK; 44-0-141-248-2026; https://evolutionexec.com. Paul Rooney is head of new projects, Manish Thilagar is a data analyst, and Robbie Dool is a research analyst, all at Evolution Search Partners Ltd. Stephen Goldrick, PhD, is a lecturer in digital bioprocess engineering at University College London (UK). William Nixon, PhD, is emeritus professor, and Stavros Kourtzidis, PhD, is a lecturer, both at the University of Dundee (UK) School of Business.

You May Also Like