Bioprinting Capabilities and FuturesBioprinting Capabilities and Futures

Figure 1: Major hurdles facing the bioprinting field; findings based on primary and secondary research by Charles River Associates (CRA).

Bioprinting has advanced rapidly through engineering step changes in the use of three-dimensional (3D) printing. With these developments, living cells can be positioned layer by layer to produce functional tissue structures. Key attributes of this emerging technology are its high scalability and modularity, which enable automated and repeatable manufacture of a wide variety of tissues. These high-throughput biofabrication capabilities equip companies with tools to develop 3D-printed tissues for broad applications, from in vitro drug testing models to therapeutic tissue implants, to whole organ transplants.

Promising Developments

According to Jay Hoying, chief scientist at Advanced Solutions Life Sciences, “The regenerative medicine field is seeing an explosion of novel tissue and tissue-model fabrication strategies, with bioprinting as a mainstay approach. Translating these strategies into an automated manufacturing workflow is an active area of technology development and will be necessary to realize fully the promise of these regenerative solutions.”

The bioprinting market is young, but it is close to producing engineered tissue products with high commercial potential. Several companies (e.g., Organovo, Regenovo, BioDan, Prellis Biologics, and Aspect Biosystems) have had success developing and marketing 3D bioprinted tissue products for drug testing and pharmaceutical studies.

The use of 3D tissue models in drug development, paired with the potential to create living tissue replacements and a rapidly advancing technological platform, has led the bioprinting sector to be valued at a forecasted US$4.7 billion by 2025 (1). Yousef Hesuani, cofounder of 3DBio, notes that pharmaceutical companies interested in 3D tissues “want to pick up bioprinting technologies. I know of 10 to 15 companies closely watching this field.”

The bioprinting field may be close to creating tissue products with high commercial and therapeutic value, but the ultimate vision of engineering organs is still far in the future. As the only publicly traded bioprinting company, Organovo currently leads the 3D in vitro model market with its ExVive kidney and liver products. The purpose of those products is to offer researchers alternative methods for testing drugs in nonanimal models. They have yet to show broad real-world applicability, but in 2017 Organovo generated US$4.2 million in revenue from contracts with drug developers who are optimistic about using the products in their research pipeline. Organovo also is working to develop a liver tissue patch that is bioprinted using a patient’s own cells, then implanted to help increase liver functionality.

Regulatory Responses

These developments are promising, but like many other bioprinting developers, Organovo is faced with a novel and untested regulatory pathway. Lack of clear oversight makes it difficult to translate novel bioprinting technologies to commercial applications. Organovo will be working closely with regulatory agencies as it scales up its technology to ensure that its products are validated for commercial use at every step in the development process.

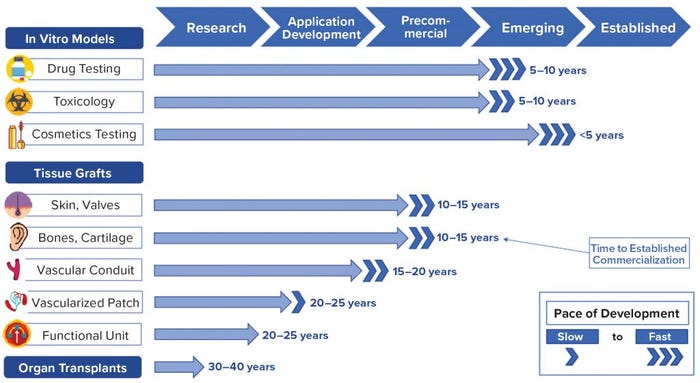

Figure 2: Product commercialization timeline; findings based on primary and secondary research by Charles River Associates (CRA)

Because of these rapid developments, commercial adoption of bioprinted products is likely to occur for in vitro tissue models within five to 10 years. Simple skin and bone grafts will arrive within 10–15 years, followed by vascularized patches and functional organ regeneration implants in 20–25 years, and finally organ transplants in 30–40 years (Figure 2). Inspired by recent developments, early investors already are engaging the bioprinting market. Large pharmaceutical entities are moving bioprinting companies in house, dozens of new players are entering the field, and stakeholders are collaborating at every level of development.

At the federal level, agencies such as the US Department of Defense (DoD) and National Aeronautics and Space Administration (NASA), as well as the European Medicines Agency (EMA), are expediting clinical trials or investing directly in the biological and manufacturing infrastructure that is required to support the advancement of these technologies. The US National Science Foundation (NSF) awarded multiple grants in September 2018, valued at US$20 million each, to institutions dedicated to studying and developing biomaterials specifically for use in bioprinting applications. In addition, the DoD recently awarded a US$80 million grant to the Advanced Regenerative Manufacturing Institute (ARMI) in Manchester, NH. The organization’s mission, according to its founder Dean Kamen, is to “make practical the large-scale manufacturing of engineered tissues and organs, and to develop a trained and ready workforce necessary for that manufacturing” (2). Regulatory agencies that include the US Food and Drug Administration (FDA) are similarly preparing for the imminent impact of bioprinted products.

Collaborative Foundations

The current bioprinting industry strongly resembles that of biologic therapies in the 1990s. To advance biologic therapies from early high-risk stages of commercial readiness to the level of wide-scale adoption seen today, biologic developers first needed to establish proof of concept. Bioprinted products now are moving through that same developmental stage with the help of large healthcare companies such as AstraZeneca (AZ) and Johnson & Johnson (J&J). Although such collaborations are exciting, investors still are working to understand the best way to provide bioprinting stakeholders with the support they need to grow and evolve their products through the risk-riddled stages of commercial development.

To that end, AZ has established the BioVentureHub, which provides biotechnology companies with laboratory space and access to world-class technical and scientific professionals. The goal of the hub is to bring together a wide range of biotechnology companies that can research and collaborate together while contending no claim on the products or intellectual property (IP) produced therein. CellInk, a bioprinting company, already has moved four researchers into the BioVentureHub laboratory space. Those experts are working to produce kidney, heart, liver, and lung tissue models for pharmaceutical development.

Likewise, in 2018, J&J announced the creation of a bioprinting research laboratory. The company will collaborate with the Advanced Materials and BioEngineering Research institute (AMBER) in Ireland at the J&J 3D Printing Center of Excellence in Dublin, in an arrangement that will provide space for bioprinting research.

Hurdles Ahead

The bioprinting field is gaining traction at the commercial and technological level, but three key development hurdles are impeding the progress of transforming basic demonstrative technologies through higher levels of technical readiness (Figure 1).

First, regulators must establish clear guidelines for bioprinted products. The FDA is leading the charge among federal agencies by establishing close collaborations with bioprinting manufacturers and requesting specific proof-of-effectiveness data. But the agency has yet to define clear safety guidelines for these products. Moreover, although government organizations can make large early investments in fundamental bioprinting technologies, many independent investors have unclear expectations for when to engage the field because it is difficult to characterize what a “fully validated product” will look like or how close bioprinted products are to widescale distribution and adoption. Investors and manufacturers need navigable and clearly defined regulatory pathways to support their confidence in real-world applicability of bioprinted products.

Second, a target consumer population has not been identified yet. This obstacle is difficult to overcome given the wide applicability of bioprinted products and the many possible end-users of these technologies. Thus, investors hesitate to commit to the field and do not allow developers to optimize their R&D efforts. Clearly, a market for bioprinted products must be defined explicitly.

Third, developers are challenged by lack of established commercial revenue. The bioprinting field must reach a critical mass of industry players equipped with a profitable revenue stream to support an established R&D infrastructure and drive engineering innovation toward commercially viable products.

All three hurdles must be negotiated before the ambitious goal of developing and commercializing scalable, safe, and therapeutic bioprint offerings can be broadly realized.

References

1 Banga B. Global Bioprinting Market to Reach $4.70 Billion by 2025, Reports BIS Research. PR Newswire, 8 June 2018; https://www.prnewswire.com/news-releases/global-bioprinting-market-to-reach-470-billion-by-2025-reports-bis-research-684939681.html.

2 Dean Kaman Launches ARMI, Aimed at Tissue Growth and Engineering. Manchester Ink Link, 28 July 2018; https://manchesterinklink.com/dean-kamen-launches-company-aimed-tissue-growth-engineering.

Corresponding author Andrew Thomson is an associate and Pascale Diesel, PharmD, and Lev Gerlovin are vice presidents in the Life Sciences Practice at Charles River Associates (CRA), 200 Clarendon St. Floor 9, Boston, MA 02216; +1-617-425-3000; [email protected]. Views expressed herein are the authors’ and not those of CRA or any of the organizations with which the authors are affiliated.

To share this in PDF or professionally printed format, contact Jill Kaletha: jkaletha@mossbergco. com, 1-574-347-4211.

You May Also Like