Influence of Process Development Decisions on Manufacturing CostsInfluence of Process Development Decisions on Manufacturing Costs

As we have discussed, cost has not always featured highly during bioprocess development, in which traditionally the focus was on product quality, regulatory compliance, and speed to generate material for the clinic (1). As the industry matures in commercializing successful products, increasing competition (both from competing products and biosimilars) leads to issues of cost and manufacturability coming to the fore. Solutions adopted will depend on each organization: At one extreme are small biotech companies developing novel therapeutic proteins; at the other end are large multinationals with full product portfolios. In all cases, choices made during process development will affect the final cost outcomes. A key early issue is why attention should be paid to cost early in development given the high attrition rates seen during clinical trials. Isn’t the top priority simply to initiate and complete phase 1–2 clinical trials? We consider the rationale for looking at cost early on as follows:

Increasing competition makes the cost benefit of a treatment a key measure of success.

For a small company, robustness and manufacturability will be important factors for success in codevelopment and partnering options.

For larger companies, the cost and time of revisiting process development later on is becoming more expensive and will become increasingly prohibitive.

Trends are occurring that will support process optimization during early phase development. The first initiative is to develop the science and understanding of how to improve the success rates of candidates entering clinical trials by improving selection methods. The second approach relates to advances in robotics technology and the development of ultra scale-down (USD) techniques used to predict large-scale performance from milliliters of material (Photo 1). In the extreme, these approaches make scale-up factors of 3,000× possible (2).

Photo 1:

Photo 1: ()

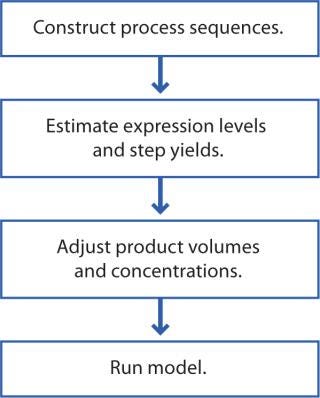

Linking predictive models to USD techniques creates the potential to screen and evaluate a large range of options and develop robust, cost-effective processes early in development. We are not there yet; it’s likely to be five or more years before we can develop total processes using USD techniques this way. It is possible to quickly screen routes now for selected unit operations (centrifugation, some aspects of chromotography). This approach will allow rapid screening early in process development, but it poses both opportunities and dilemmas that relate to how to interpret the results in the context of an industrial process.

Some issues relate to each organization and the way it deploys cost data and models. Here are some issues to be addressed both at the organizational and process development levels: How does the organization as a whole reach a consensus regarding cost targets, and how are the decisions made? For chronic applications, how quickly can you come to a view on the cost benefit of a drug substance? When designing a new process, how do you avoid manufacturability pitfalls related to exotic chemicals and materials? And how do you support standardization of materials and methods used in process development? For example, use a standard buffer unless there is a good reason not to. Looking at the fit of a new process into existing manufacturing assets can help a company ensure the optimum use of those assets before committing to new capital expenditures.

As process development addresses cost issues, it is important that a mathematical framework is developed to allow consistent structuring of information, with all assumptions clear and supported by a rapid, structured analysis of processes and related options. The mathematical framework should integrate USD models as they are developed, allowing for optimization of processes from laboratory-scale data sets.

In this series, we are interested in the experience of the people in the industry. To gain an insight into challenges faced by process development scientists, we spoke to John Higgins from MedImmune (a large biopharmaceutical company) and Scott Willett of Promedior (a startup company), both based on the eastcoast of the United States. Both talked about their application of the BioSolve process cost modeling package, which they use to analyze processes in development. (The user-configurable and scalable software is supplied by Biopharm Software Solutions, a business unit of Biopharm Services, Ltd.)

A Large-Company Perspective

John Higgins is an associate scientist in process development at MedImmune. He told us how his company is starting to use modeling to guide decisions on process and technology choices — and specifically the challenges faced: “We use the BioSolve modeling tool within process development as a cost and throughput evaluation tool. We use it at different points during process development to study the sensitivity of commercial manufacturing production costs and plant throughput to various process designs and new technologies. For example, we recently looked at replacing a viral filtration step and looked at the comparative cost with the two technologies while changing various parameters.” With such modeling, Higgins said you can estimate whether your company can make enough product for the market within the desired cost. “We can also model the response of cost with titer changes.”

Higgins admitted, “We are probably in our infancy with cost modeling. Part of the challenge is that everyone needs answers for their core function, leading to different groups trying to proceed with their own tools.” Ideally, he explains, a single model should be used across the entire organization. But even with one model, refinement and eventual validation will be required to build confidence in its results. With a robust, validated cost and capacity model, key program assessments based on cost can be made even in the preclinical phase.

“We created a cross-functional team on cost modeling to obtain consensus on the assumptions and methods used. The team is also heavily involved in developing and using a single cost model in decision-making across the organization.” This team includes members from finance, commercial manufacturing, global strategic marketing, and process development. “Both the assumptions and the values are evolving as we refine our methods and broaden the discussion. We’ve found that such a cross-functional team is vital to execute the assessments.”

A Small-Company Perspective

Scott Willett, PhD, is director of biopharmaceutical development for Promedior, a small venture-funded company that is developing a single protein. PRM-151 (recombinant human serum amyloid P) is a potent modulator of monocyte differentiation both in vitro and in vivo, with a broad antifibrotic activity across tissues, models, and species, inhibiting excess scar formation in the healing process.

A small company faces many challenges when developing a single process on which its future success depends. “We started out with no expression system, analytics, or process,” said Willett, “but only with literature-reported expression in Pichia pasto

ris and Escherichia coli, and also with reported purification of the protein from human plasma. For a company in preclinical development with a potential treatment for multiple, chronic, fibrotic indications, it is important to use cost modeling early on.” This helps to maximize the value in what will eventually become an optimized, cost-effective commercial process. To do so, Willett explained, Promedior needed to generate relative cost scenarios quickly and easily, provide useful comparisons of process scenarios, identify process design and performance issues, and screen potential process alternatives. This way, he went on, process development decisions could be framed by understanding where significant cost risks lie (Figure 1). “At the preclinical stage, it was our strategy to pursue three tracks in parallel: microbial expression in E. coli (inclusion body refolding and periplasmic); mammalian cell line development (secreted); and sourcing from human plasma (or plasma fraction).

Figure 1: ()

“However,” he told us, “this is not without its problems given the lack of hard process data. We found we were able to make progress by conducting an initial series of quick experiments comparing a number of microbial and mammalian expression technologies with the availability of sourcing plasma fractions for recovery process optimization. We then took that limited data set and made a set of assumptions to get an initial level of insight. To do this in a meaningful and consistent way, we relied on the BioSolve process and economic modeling platform, which allowed us to rapidly evaluate a variety of scenarios and conduct sensitivity analyses to facilitate process comparisons.” By using typical process sequences and parameters coupled with early available process data, Promedior could adjust the process model to create a plausible base case.

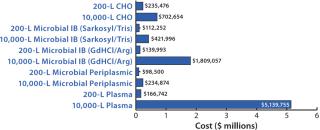

“We looked at four process models,” said Willett. These included a Chinese hamster ovary (CHO) cell culture producing secreted protein; microbial inclusion bodies refolded by either detergent solubilization and Tris buffer dilution or GdHCl solubilization with an arginine buffer dilution; microbial periplasmic secretion; or naturally sourced product from human plasma. “We were then able to examine the impact of increasing scale (200 L up to 10,000 L) and evaluate the impact of disposable technologies. This gave us the basis to conduct sensitivity analyses.” For those, Promedior focused on disposables, scale, product titer, the number of bioreactors required, and capacity use.

“So what did this tell us?” he went on (Figure 2). “As expected, the microbial processes are generally less costly per batch. However, the GdHCl–Arg refold process is materials-intensive at large scale, so refolding from E. coli is the most economical choice only without the GdHCl–Arg system. Further, the large-scale plasma process is also cost prohibitive, so sourcing from plasma is clearly not a viable alternative.” As Promedior expected, increasing product titers represent a major benefit for cost of goods sold (COGS), “so it is important to take time to develop an appropriate cell line that is amenable to large-scale cell culture and to work hard early on to maximize expression levels.” Also as expected, scale has a major impact on COGS, but Willett said it is important to use modeling to understand cost drivers as a function of scale in a process so that potential cost issues can be addressed early on.

Figure 2: ()

“Using BioSolve to assess manufacturing process options early,” he concluded, “helped us to effectively guide process development.” This resulted in a cost-effective manufacturing strategy and provided a vehicle for clearly communicating the basis of decision-making with senior management, Willett said, “to facilitate their oversight of the entire program.”

Of Increasing Importance

In response to the changing business environment, both small and large organizations need to look at cost drivers while developing a bioprocess. The cost of manufacturing drug substance is becoming an increasingly important factor for success. Tools used need to be fit for their purpose, and the whole business needs to be involved in related decision making.

Willett’s interview highlights that cost is an important criteria even for smaller companies developing single products — especially important when a drug candidate is being used for a chronic application or is entering a highly competitive environment. None of this would be possible without easy-to-use mathematically based models. They offer the means to achieve consistency of methods, to share process and cost data, and to rapidly evaluate options. The industry is at an early stage of integrating process development, quality by design (QbD), and costs — so the potential for improvement in reducing risk and cost is significant. Integrating USD experimental techniques with robotics and models such as the BioSolve package will offer a means to achieve that potential and provide precious insights into bioprocesses throughout the product lifecycle.

About the Author

Author Details

Corresponding author Andrew Sinclair is cofounder and managing director of Biopharm Services, Lancer House, East Street, Chesham HPS 1RD, United Kingdom; 44-14947-932-43, [email protected]. Miriam Monge is vice president of marketing and disposables implementation at Biopharm Services; [email protected].

REFERENCES

1.) Sinclair, A, and M. Monge. 2010. Delivering Affordable Biologics from Gene to Vial. BioProcess Int. 8:16-19.

2.) Tustian, AD. 2007. Adapted Ultra Scale-Down Approach for Predicting the Centrifugal Separation Behavior of High Cell Density Cultures. Biotechnol. Prog. 23:1404-1410.

You May Also Like