Monetizing Innovations in the Biopharmaceutical IndustryMonetizing Innovations in the Biopharmaceutical Industry

WWW.ISTOCKPHOTO.COM

The biopharmaceutical industry has seen strong growth over the past 15 years, with a compounded annual growth rate (CAGR) of 6.7%. However, if you look at that growth in five-year intervals, it becomes apparent that the rates have begun to decline in many countries. Companies have withdrawn somewhat and put initiatives into place to curb further increases in the cost of drugs. The CAGR fell from 8.7% for the period of 2002–2006 to only 3.1% for 2012–2016.

In our yearly cross-industry global pricing and sales study (1), 94% of managers from the biopharmaceutical industry reported that they have been facing increasing price pressures. The industry’s research and development (R&D) spending reached an all-time high of US$173 billion in 2017. So there should be no shortage of new products; however, only about half of all new product launches meet their sponsor companies’ profit expectations. In other words, R&D money is being spent ineffectively, and companies need to rethink their business and revenue models.

A Global Life Sciences Study

Insights from our cross-industry pricing and sales study inspired us to initiate a special life sciences study on monetizing pharmaceutical and biotechnology innovations (2). The objective was to identify key trends, challenges, and success factors for monetizing biopharmaceutical innovations for pipeline products in development and those already on the market. A quantitative online survey was followed by several qualitative in-depth discussions, from which we obtained 65 different perspectives in total.

We structured this study according to strategy and execution aspects and evaluated those by considering internal and external perspectives. The following four areas were assessed in detail: asset prioritization, operational design, new business models, and new revenue models.

Figure 1: Importance and implementation success of activities during the R&D phase; PMA = pricing and market access

Asset Prioritization: Given the overall spending on R&D, a great deal of money is being spent on drug substances that never make it to market. When we asked about the importance of certain activities throughout the development process of new drugs — and to what extent those activities are already being carried out — we discovered the insights listed in Figure 1.

Figure 2: Relative performance of more and less successful companies

Key reasons for not implementing innovative methods (and the subsequent lack of success) include a strategic misalignment on the importance of pricing and market access (PMA) and a lack of internal knowledge, capabilities, and resources devoted to it. When analyzing our data further, we found that extensive involvement of PMA teams in development does pay off. We segmented respondents according to the self-reported profitability of their companies based on earnings before interest, tax, depreciation and amortization (EBITDA). In doing so, we found that high-profit companies (EBITDA >20%) consider the needs and value drivers of payers and related decision makers more often than do less profitable companies (EBITDA <20%). Therefore, the former approach not only makes sense in theory, but it appears to be associated with an increase in profitability (Figure 2).

Operational Design: Nearly all pharmaceutical companies have PMA functions as part of their organization structure. However, when looking at the organizational models and reporting lines that they use, we see that each company has developed its own system. Based on our experience in working with many pharmaceutical companies, we know that no single model fits for every organization. However, only a very few of the managers we contacted reported that they were “extremely satisfied” with their current model, and 81% saw significant room for improvement in their companies’ PMA functions. That especially applied to their level and timing of involvement in critical decision-making phases, such as between phases 1 and 2 of new product clinical development.

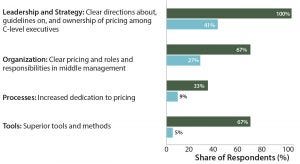

Figure 3: Top priorities in pricing at more (dark green) and less (light blue) successful companies — comparing “the best” and “the rest”

The reason for those concerns can be seen in Figure 3 from the results of a study that we conducted in 2014 (3). When separating the most successful pharmaceutical companies (in dark green) from less successful companies (in light blue) based on a number of criteria, we could see clear differences in what they see as priorities in drug pricing. The best companies have clear leadership and strategies supported by top-level executives within an organizational structure with clearly defined responsibilities and efficient management of expectations (Figure 3).

New Business Models: Many recent articles have looked at the future of the pharmaceutical industry (4), all concluding that the current standard business model cannot guarantee the survival of the industry. In our study, we surveyed the most important aspects of new business models, and the most-mentioned subject by far was further integration of drug and diagnostic development. The idea is to ensure that the right patients receive the best drugs for them so that the number of nonresponders and amount of waste both can be reduced. However, under 50% of our survey respondents have invested in integrated drug–diagnostic development programs.

In addition, although 80% of respondents emphasized that “big-data” analytics were highly important to their future business, only 60% have begun initiatives related to such data management, and only 25% of respondents view their own current activities in this area to be successful. The main reason for such a failure of progress is insufficient internal capability, most likely caused by a lack of funding. This is probably the result of internal struggles over how to operationalize the big-data concept. At many companies, related questions about leadership, strategy, and direction have not yet been answered.

New Revenue Models: With ever-increasing pressure on prices and a trend toward the emergence of new business models, biopharmaceutical companies have little option but to devise new revenue models to better monetize their future innovations. This necessity is well understood throughout the industry: Over 70% of respondents rated exploring new revenue models for innovations as having either high or very high importance. The emphasis is less on existing products than on new products that are still in development or soon to enter the market.

The traditional model is based on a fixed price per unit with additional negotiated discounts or rebates depending on volume or competitors’ actions. That still has its place for many products; however, for a widening segment of new product modalities — e.g., cell therapies — it is no longer preferred or even viable as a business model. Thus, a number of other revenue models need consideration. Not every model is suitable for every type of product. In fact, some require specific circumstances to work, but unless all options are assessed and analyzed the best model is unlikely to be chosen and put into place.

Models such as annuity payments and comprehensive indication-specific bundled payments are not appropriate for all companies. However, results-based payments and public–private partnerships should be relevant to most. Even so, such models are in use at just 60% and 47% of respondents, respectively. When asked about the reasons for those low rates of penetration, respondents report a combination of internal and external factors. The most prominent external factor is a perception that payers do not accept such models; the most important internal factor is a simple lack of in-house capabilities and PMA resources.

Significant barriers must be overcome. It is true that payers often prefer a traditional per-unit price with discounts and/or rebates. And the corporate infrastructure required to measure individual results often does not exist — for example, no patient registry is available, or accessing patient data is complicated by privacy rules. However, when we look again at the most successful companies, we see that nearly all of them are implementing new business models as described above. Such companies probably are not giving up as easily as less successful companies do. Even if they do not offer such pricing structures across the board, the best companies have made them available options and have implemented the best solutions for specific products whenever possible and feasible.

Key Insights and Recommendations

The key insights of our study derive from studying the differences between the highly profitable “best” and less profitable companies (“the rest”). The most important insight is that the former have a much broader horizon and are exploring more new business and revenue models. They also place higher importance on early integration of PMA activities in their product development processes. The general results and key insights from our study lead us to offer the following recommendations.

Asset Prioritization: Drug companies need to evolve from being simply drug manufacturers into solution providers. PMA groups need to make sure that their department activities center on what all stakeholders need and what payers will be willing to pay for.

Operational Design: To achieve pricing excellence, biopharmaceutical companies must invest in their PMA departments — and not only the size and capabilities of these groups, but also giving them the right processes and levels of involvement. Top-management support for and involvement with PMA concerns is essential for overall success. Drug companies need clear internal alignment about the role of PMA groups with clear expectations for them on all sides.

New Business Models: Biopharmaceutical companies need to pursue new business models as a means of evolving from drug manufacturers into solution providers. Digitalization will be crucial to integrating all business aspects and bringing true value to the marketplace. Big-data analytics are the most important capability to develop (or buy in). It is no longer about whether to do so; it is about how best to accomplish it.

New Revenue Models: Drug companies need to be open to new revenue models and innovative pricing schemes. They should broaden their portfolios to meet the needs of their customers. Not all models are relevant to all situations, but all relevant models should be considered and anticipated for every product in development. Be prepared to implement any of them.

References

1 The Big Digital Fail: Results and Insights of the Global Pricing and Sales Study 2017. Simon-Kucher and Partners: Cambridge, MA, 2017; https://www.simon-kucher.com/en-us/gpss2017.

2 Monetizing Innovations in the Pharma and Biotech Industry. Simon-Kucher and Partners: Cambridge, MA, 2018; https://www.simon-kucher.com/en-sg/resources/perspectives/monetizing-innovations-pharma-and-biotech-industry.

3 Global Pricing and Sales Study. Simon-Kucher and Partners: Cambridge, MA, 2014; https://www.simon-kucher.com/en-us/resources/perspectives/global-pricing-study-2014.

4 Mattke S, Klautzer L, Mengistu T. Medicines As a Service: A New Commercial Model for Big Pharma in the Postblockbuster World. Rand Corporation: Santa Monica, CA, 2012.

Further Reading

Ramanujam M, Tacke G. Monetizing Innovation: How Smart Companies Design the Product Around the Price. John Wiley and Sons: New York, NY, 2016.

Dr. Klaus Hilleke is former chief executive officer and head of the life sciences division, now a senior advisor at Simon-Kucher and Partners, Willy-Brandt-Allee 13, 53113 Bonn, Germany; 49-228-98430. Corresponding author Dirk Kars is a senior partner in the life sciences division of Simon-Kucher and Partners, Gustav-Heinemann-Ufer 56 50968 Cologne Germany; [email protected]. He supports international pharmaceutical and biotech companies in strategic marketing, international pricing and market access strategies.

You May Also Like