The Therapeutic Monoclonal Antibody Product MarketThe Therapeutic Monoclonal Antibody Product Market

Antibodies attack invaders such as the SARS-CoV-2 virus that causes COVID-19 illness.

Commercial development of therapeutic monoclonal antibodies (MAbs) began in the early 1980s, and by 1986 the first MAb product had been approved in the United States: muromonab-CD3 (trade name Orthoclone OKT3, marketed by Janssen-Cilag) for prevention of kidney-transplant rejection. Since its approval, therapeutic MAbs and antibody-related products such as Fc-fusion proteins, antibody fragments, and antibody–drug conjugates (collectively referred to herein as “MAb products”) have grown to become the dominant product class within the biopharmaceutical market. They have been approved for treating a broad range of of diseases, from those with patient populations of a few thousand or less (e.g., orphan indications such as hemophagocytic lymphohistiocytosis) to those afflicting hundreds of thousands (e.g., some cancers and multiple sclerosis) or even millions of patients (diseases such as asthma and rheumatoid arthritis). With recent approvals of MAb products for infectious diseases such as those associated with Clostridium difficile, anthrax, and human immunodeficiency virus (HIV) infections, the potential for MAb products to combat coronavirus diseases certainly exists. However, some debate remains over just how significant a role any antibody treatment could play in treating COVID-19. (Editor’s Note: See the article by Nick Hutchinson on page 14 for more of that discussion.)

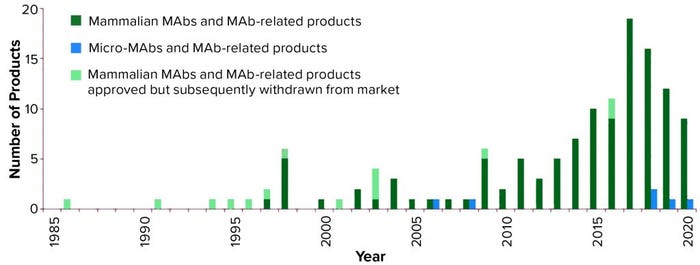

Figure 1: Annual approvals of monoclonal antibody products (3, 4) showing the number first approved for commercial sale in the United States or Europe each year since 1985; totals include all MAb and antibody-related products. Mammalian cell culture products are denoted in green, with products approved but subsequently removed from the market in light green; microbial-based products are in blue, none of which have been approved but subsequently withdrawn; 2020 total is as of 27 August 2020.

Market Growth

Sales growth and approval of additional MAb drugs was slow until the late 1990s, when the first chimeric antibodies were approved. With the approval of such products, followed over time by that of humanized and then fully human antibodies, the rate of product approvals and sales of MAb products increased dramatically. In 2019, global sales revenue for all MAb drugs was nearly US$163 billion (1), representing about 70% of the total sales for all biopharmaceutical products (about $230 billion). That is a significant (~50%) increase in both sales and proportion since 2013, when it was $75 billion (2). Continued growth in sales of currently approved MAb products, along with more than 1,200 MAb product candidates currently in development — many for multiple indications (1) — will increase sales of MAb products further in the coming years and continue to drive the overall sales of all biopharmaceutical products.

As Figure 1 shows, the number of MAb products approved for commercial sale in the United States and Europe has grown significantly, with three to five new products approved each year between 2010 and 2014, then 10–19 new products approved each year between 2015 and 2019.

Although a total of 139 MAb products have been approved in Europe and/or the United States since 1985, 14 of these products have been withdrawn for different reasons, leaving 125 approved MAb products currently on the market (Table 1). As of 27 August 2020 (1, 3, 4), only six of those products are expressed by microbial systems whereas the remaining 119 are produced by mammalian cells. Five of the six microbial products are antibody fragments, including one fragment conjugate; also, for the first time, a full-length MAb expressed in a microbial system (Pichia pastoris yeast) was approved this year. Vyepti (eptinezumab-jjmr) from Lundbeck Seattle BioPharmaceuticals has been approved for prevention of migraines (5).

Given the large number of candidates currently in development, we expect that the number of MAb products approved each year for the coming years will be similar to the numbers approved over the past several years. In fact, nine MAb products have been granted first approvals this year as of 27 August 2020, including the first developed and manufactured MAb biosimilar from China: Zercepac trastuzumab from Shanghai Henlius Biotech and Accord Healthcare (6).

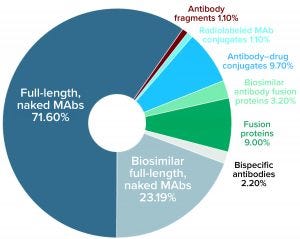

Figure 2: Distribution (number and percentage) of marketed MAb products expressed in mammalian systems by subtype currently approved for commercial sale in the United States or Europe as of 27 August 2020

Currently 21 MAb products are under regulatory review, with approval decisions expected for at least two of those by the end of this year. Based on a conservative approval rate of 10 products per year, we anticipate that 180 or more MAb drugs on the global market in 2025. Additionally, we predict that within the next year, some COVID-19 MAb products, will be included within these forecasted numbers. But none of them yet has reached the biological license application (BLA) or marketing authorization application (MAA) regulatory review phase. Based on the number of novel MAb products in development for COVID-19 (1, 7), an accelerated timeline for those high-priority drugs (8), and the prospective use of MAb products as a stop-gap preventative until a successful vaccine is launched (9), we forecast that two to four novel MAb products will be approved specifically related to COVID-19.

As Figure 2 shows, most of the 119 MAb products expressed in mammalian systems are full-length naked MAbs (60%), followed by biosimilar full-length naked MAbs (19%). Six other types of antibody products represent the remaining 21% of mammalian-expressed MAb products.

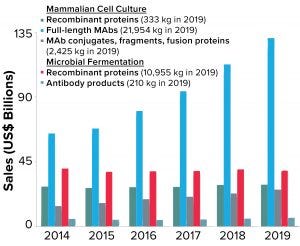

Figure 3: Total annual sales of biopharmaceutical products are shown as a function of product type. Note that recombinant proteins produced by microbial fermentation include insulin products, which represent >40% of the sales and >85% of material produced in that category

Global sales of MAb products have grown faster than all other biopharmaceutical product classes over the past five years. Figure 3 shows the breakdown of sales based on product type (e.g., full-length antibodies, antibody conjugates, fragments, and so on) and production system (mammalian cell culture or microbial fermentation). As the data show, sales of all MAb products (regardless of the production system or type) have grown from ~$84 billion in 2014 to nearly $163 billion in 2019, a 93% increase. By comparison, sales of other recombinant-protein therapeutics have remained virtually unchanged in the same time period (~$68 billion).

Corresponding to the increasing sales of MAb products, the total quantity of these products produced annually has increased to meet the market demand. Nearly 25 metric tons of MAb products were produced around the world in 2019 — compared with about 11 metric tons of all other recombinant-protein products, regardless of expression system. The demand for mammalian-expressed MAb products has resulted in a significant amount of global manufacturing capacity devoted to their production and to significant investments in improved methods and approaches to MAb manufacturing process design and optimization (10, 11).

In 2019, 36 of the MAb products listed in Table 1 achieved annual sales of over $1 billion, with five products reaching sales of >$7 billion: AbbVie’s Humira (adalimumab), Merck’s Keytruda (pembrolizumab), Regeneron’s Eylea (aflibercept), Bristol-Myers Squibb’s Opdivo (nivolumab), and Genentech/Roche’s Avastin (bevacizumab). AbbVie recorded Humira sales of about $19 billion for two consecutive years, making that the highest selling (bio)pharmaceutical product.

Based on a review of historical sales data, company annual reports, and sales-projection data collected in our group’s proprietary bioTRAK database, we determined a five-year compound annual growth rate (CAGR) of 14.1% for the MAb product market and forecast that the market feasibly could continue to grow at a CAGR of 10% or more over the next several years. With that 10% growth rate, sales of currently approved MAb products combined with those of new products approved in the coming years should drive global sales of MAb products to about $240 billion by 2023 and nearly $315 billion by 2025.

Factors Contributing to Market Growth

With MAb drug approvals rising over time (Figure 1) along with the demand for and revenue generated by such products (Figure 3), interest in developing them remains strong. No single specific reason can be cited for the increase in approvals or growth of this class of products, but several contributing factors have combined to create an environment that is conducive to rapidly expanding the number of approved MAb drugs.

Significant funding availability, ongoing advancements in MAb technologies, expansion of MAb products into new markets, and the emergence of biosimilars all have contributed to nearly all pipeline MAb products (1), thus driving regulatory approvals, widening market reach, and increasing revenues for this class of products.

Between 2015 and 2018, fundraising though venture capital, initial public offerings (IPOs), and follow-ons has exceeded such funding in 2010–2014 (12) and provided financial support for advancing our understanding of disease at a molecular level. Although failing to meet some observers’ initially high expectations, genomics, proteomics, and other systems-biology tools do continue to provide important new targets for modulating disease (13). MAb products often provide the most direct route to a clinical proof-of-concept for activating, inhibiting, or blocking those new targets. Timelines for developing a lead product to investigational new drug application (IND) have shortened while production timelines for clinical products have lengthened (8).

MAb products and industry technologies also have expanded product types from basic “naked” MAbs to more complex structures such as conjugates that deliver targeted cytotoxic or radiologic materials and bispecific antibodies that can bind multiple targets. Because production of most MAb products is easily amenable to efficient platform-based approaches for both discovery and manufacture, and because antibodies are generally well-tolerated and highly specific, the risk of unexpected safety issues is lower in human clinical trials of MAb products than with many other types of therapeutic products. Thus, for many novel targets, MAb products often are the first product candidates advancing into clinical studies. If the initial proof-of-concept results are successful, these products can make rapid progress toward commercialization, providing a “first-to-market” advantage.

Also fueling the growth in MAb product sales is the global market expansion of the pharmaceutical market overall, which results from an increasing and aging worldwide population along with improved standards of living in emerging markets. In addition, continued evaluation of MAb products for new and expanded clinical indications contributes to demand for clinical study materials and subsequent sales in newly approved indications. As the biopharmaceutical industry continues to mature, the number and types of diseases that will be treated economically with MAb products will increase. Driven in part by the need for cost-effective supply of large quantities of products for such cost-sensitive indications as rheumatology and asthma, recent improvements in MAb production technologies have improved process yields and reduced actual manufacturing costs substantially. As a result, these products have an ever-increasing opportunity to penetrate relatively cost-sensitive indications and markets.

As patents providing exclusive rights to many of high-profile and blockbuster MAb products expire, interest in biosimilar development has grown (Figure 2). In September 2013, the first biosimilar monoclonal antibodies — sold under the brand names Remsima (marketed by Celltrion) and Inflectra (marketed by Pfizer) — were approved for commercial sale in Europe. These biosimilar versions of Janssen’s blockbuster MAb product Remicade (infliximab) were the first of 32 MAb product biosimilars currently approved, and in the coming years, many more biosimilar MAb products certainly will be approved for commercial sale in both the United States and Europe.

Biosimilars have received significant attention in the press and are discussed often as an aid to lowering healthcare costs and a vehicle by which larger patient populations could receive needed treatments. However, these products actually represent a small portion of the development pipeline. But we do anticipate modest acceleration of sales growth for all MAb products as biosimilars gain market acceptance. Interest in them continues surge in the markets of Latin America, China, Southeast Asia, India, and Russia. Several such products already have been approved in these regions.

Introduction of biosimilars in those markets is likely to have a large impact on the global sales of MAb products as biosimilar MAbs are approved in regions that currently have no access to expensive innovator products.

A Bright Future Ahead

MAb products will continue to be a dominant therapeutic modality for treatment of a broad range of diseases in the foreseeable future. The potential impact of MAb therapeutics in the race to build up COVID-19 vaccine treatments is uncertain. But in spite of the ongoing pandemic, global MAb approvals and sales will continue to increase over the next five years. As approvals of biosimilar products initially bite into MAb innovator sales, adoption of biosimilars is expected to increase overall access to antibody product types for a net increase in the overall number of patients (and hence, sales) for this biopharmaceutical industry segment. Manufacturing capacity to make such products continues to expand to meet the continually growing demand as well.

References

1 BioProcess Technology Group – Life Sciences Practice, BDO USA. bioTRAK® Database. BDO USA, LLP, Boston, MA, 2020; https://www.bdo.com/industries/life-sciences/bioprocess-technology.

2 Ecker, DM, et al. The Therapeutic Monoclonal Antibody Market. mAbs 7(1) 2015: 9–14; https://doi.org/10.4161/19420862.2015.989042.

3 CBER. Drugs@FDA. US Food and Drug Administration: Silver Spring, MD, 2020; https://www.accessdata.fda.gov/scripts/cder/drugsatfda/index.cfm.

4 European Public Assessment Reports, Human Medicines. The European Medicines Agency: London, UK, 1995; https://www.ema.europa.eu/en/medicines.

5 Vyepti Prescribing Information. H. Lundbeck A/S: Valby, Denmark, 2020; https://www.lundbeck.com/upload/us/files/pdf/Products/Vyepti_PI_US_EN.pdf.

6 Henlius and Accord Healthcare Receive EMA Approval for Zercepac®, Trastuzumab Biosimilar. Shanghai Henlius Biotech, Inc.: Shanghai, China, 29 July 2000; https://www.henlius.com/en/NewsDetails-2670-26.html.

7 COVID-19. ClinicalTrials.gov. US National Library of Medicine: Bethesda, MD, 29 February 2000; https://www.clinicaltrials.gov/ct2/results?cond=COVID-19.

8 Kelly B. Developing Therapeutic Monoclonal Antibodies at Pandemic Pace. Nat. Biotechnol. 38(5) 2020: 540–545; https://doi.org/10.1038/s41587-020-0512-5.

9 Duke Margolis Center for Health Policy. COVID-19 Manufacturing for Monoclonal Antibodies. Duke Margolis Center for Health Policy: Washington, DC, 2020; https://healthpolicy.duke.edu/sites/default/files/2020-08/Issue%20Brief_COVID-19%20Manufacturing%20of%20Monoclonal%20Antibodies_August%202020%20Update_1.pdf.

10 Ecker DM, Seymour P. Supply and Demand Trends: Mammalian Biomanufacturing Industry Overview. BioProcess Int. 18(1–2) 2020: https://bioprocessintl.com/category/january-february-2020.

11 Tripathi NK, Shrivastava A. Recent Developments in Bioprocessing of Recombinant Proteins: Expression Hosts and Process Development. Front. Bioeng. Biotechnol. 20(7) 2019: 420; https://doi.org/10.3389/fbioe.2019.00420.

12 Emerging Therapeutic Company Investment and Deal Trends. Biotechnology Innovation Organization: Washington, DC, 2020; https://www.bio.org/emerging-therapeutic-company-investment-and-deal-trends.

13 Bilello JA. The Agony and Ecstasy of “OMIC” Technologies in Drug Development. Curr. Mol. Med. 5(1) 2005: 39.

Corresponding author Dawn M. Ecker is the managing director of bioTRAK Database Services, Thomas J. Crawford is a bioTRAK database senior associate, and Patti Seymour is managing director at BioProcess Technology Group — Life Sciences Practice, BDO USA, LLP, One International Place, Boston, MA 02110; https://www.bdo.com/industries/life-sciences/bioprocess-technology; [email protected].

You May Also Like