Why Conducting Marketing Due Diligence Early in Product Development Is ImportantWhy Conducting Marketing Due Diligence Early in Product Development Is Important

May 17, 2019

(WWW.STOCK.ADOBE.COM)

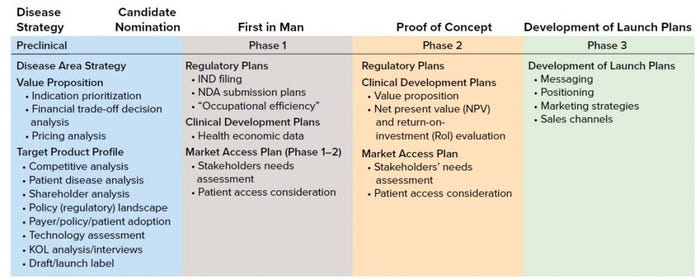

To be successful, a company needs two main ingredients: good science and good business/ marketing. Without good science, a product won’t work, and without a good marketing strategy, a product won’t sell. Two important questions should be addressed: When should marketing groups be involved in product development, and how important is that? The answer to the first is as early as basic research. Why? After a product is launched, a biomanufacturer doesn’t want to discover that its product applies only to a small market, only a few customers want to buy it, and/or insurance won’t cover it. Marketing due diligence needs to run parallel to product development to derisk a process from a business perspective. It also builds commercial value early in product development (Table 1). Below are six core reasons why.

Table 1: Product development process (KOL = key opinion leaders)

Defining an Unmet Medical Need People always ask me, “Should I start with the unmet medical need or the technology?” My answer is to always start with the unmet medical need. If you know the problem, you always can find its solution and the technology to solve that problem. If you start with the technology, then that’s a technology looking for a problem, which is difficult because there is no starting point to the problem.

For example, when nanotechnology was “hot,” innovators made their systems smaller, but there was no commercial application, so the technology stalled. For biologics, scientists had the problem of molecules being too large to get to the right therapeutic target, whereas small molecules could. Bioscientists surmised that they needed to reduce the size of their molecules by developing a delivery system using nanotechnology to solve the problem, and thus, the problem was solved.

Once you decide on the unmet medical need, then you need to validate it by using a process similar to that of conducting a scientific experiment. In validating an unmet need, you need to know whether it is “critical” or a “nice to have.”

Using a familar scenario as an example, if a person is in pain and visits a doctor, the first thing the doctor will ask is “Where is the pain?” and ask the patient to rank the intensity of pain (e.g., on a 1–10 scale, with one being no pain and 10 being the worst). If the patient indicates a pain intensity of six and below, a treatment is considered “nice to have.” There may be many choices of drugs and therapies in the market for treating pain, or the pain doesn’t warrant taking medication. The patient may decide to continue with a traditional product or decide that no treatment is necessary. However, if the patient indicates that the pain is greater than a seven, this can be classified as a “critical unmet need.” The patient is ready to buy a drug to relieve the pain. Similarly, marketing conducts this market assessment to determine where an unmet need falls within the pain scale, that positions a biomanufacturer for a successful outcome.

Marketing firms make these determinations by conducting customer interviews and obtaining their opinion on where they see critical unmet needs. It’s the customer’s needs that you are trying to fulfill, not what the company perceives to be an unmet need. It is important that customer interviews be conducted by an independent marketing firm to eliminate bias, which can lead a company down the wrong path.

Indication Prioritization

Many pharmaceutical and biotechnology companies have platform technologies that they hope to use in a number of therapeutic areas. However, just because a molecule is active in one disease, this does not automatically translate to the molecule being active in another disease. That also holds true for marketing: Each market or therapeutics area has a different critical unmet need (if any), different market and technology trends, and different competitors.

By conducting marketing due diligence, a company can narrow 10 potential therapeutic areas down to the top three with the best market potential based on product attributes. Most biomanufacturers can’t afford to work on 10 therapeutic areas at the same time because of budget limitations. Due diligence also prevents the problem of spending time and money only to discover that a market is not large enough to meet a company’s goals, customers won’t buy a product, or insurance companies won’t pay for it because they don’t see the advantage of using a new drug that is generally more expensive.

Determining Market Potential

To determine true market potential, you must address two important questions.

Where is the critical unmet need in the standard treatment regimen? Is the product a first-line, second-line, or third-line therapy? An unmet need for a first-line therapy has more market potential than for a third-line therapy. A third-line therapy is used only when first- and second-line products have failed, so the percentage of potential patients decreases.

How many people have the same definition as the hypothesized critical unmet need? The market potential should be the middle of the distribution curve, >70% of the population. A critical unmet need for only 500 people doesn’t offer a big enough market.

Target Product Profile = Commercial Profile

Once a company chooses its lead candidate, and that molecule demonstrates activity, the manufacturer develops it further to a target product profile (TPP) or commercial profile to file with the US Food and Drug Administration (FDA). That is followed by conducting clinical trials and marketing to the public.

Research and development (R&D) and marketing staffs are involved in developing TPPs. R&D personnel develop product dosing, stability, and efficacy while minimizing product side effects. Marketing staff set goals or specifications based on what the market dictates. A new product must be “better” than existing products for that therapeutic target.

If marketing staff do not set the TPP, R&D personnel could develop a product and be satisfied with a once-a-day dosage for 90% efficacy. However, what if other products already on the market are once-a-week doses with an 85% efficacy rate? You could say the company with the 90% efficacy has a better product. But marketers know that patient compliance with prescriptions is a huge issue.

Compliance decreases to 50% with once-a-day products after the first year or within two years.

A drug could have 100% efficacy, but if patients are not taking their medication, the drug simply can’t work. Therefore, to compete in the above scenario, the new product must be a once-a-week dosage and maintain its efficacy of 90%. This makes R&D’s job more difficult, but it is necessary for products to succeed.

Because patient compliance is important, biomanufacturers have strived for dosing that is administered once per month, once every six months, and even once per year. However, drugs that last longer in the human body in order for the drugs to be dosed once-a- week may have increased side-effects or adverse reaction profiles compared with shorter acting drug. Or if a patient misses a dose or takes too much of a drug, how will that affect the efficacy and side-effect profile? Developing those profiles and addressing such challenges help make drug development take a long time and add to the expense.

Other characteristics of a product that can affect patient compliance are the size, shape, color, and type of coating of a pill. Injections decrease patient compliance because they hurt compared with taking pills. It is crucial to understand the needs of a patient in addition to what the market dictates with competitors.

Product Adoption from All Seven Stakeholders

The seven stakeholders (or “7 Ps”) are

patients

physicians

other healthcare professionals

policy or regulatory agents

payer-insurance companies and government

politics or legislation groups

patient-advocacy

Each stakeholder has different needs or requirements that must be satisfied to achieve product adoption. That is because each influences whether a product will be available (market accessible) to patients when physicians prescribes it. Those needs also influences a product’s TPP. Two examples are described below for policy makers and payers.

Policy Agents: The expectation or bar for regulatory approval has become higher now than ever before. No longer do clinical trials run comparisons with placebos (except in rare circumstances) but instead compare with the “standard of care” or a similar medication already on the market. The expectation is for a manufacturer’s new product candidate to be equal to or better than existing products. A product could get FDA approval for being equally effective, but that would classify it as a “nice to have,” with no advantage over currently marketed options. Defining the TPP to be “better than” solves this issue.

Payers: Expectations for reimbursement for a new product also are higher than ever before. Payers expect new drugs to be better than existing therapies if they are going to pay what is likely to be a higher price. What value of the product warrants their spending more money?

A new product sponsor also must demonstrate that the drug will save the healthcare system money over the short and long terms. If payers are going to invest, they want to know they are spending less today than what they would spend if a patient were not on the drug in future years. Or if payers are spending more money today, they won’t be paying for those drugs in the future. For example in maintenance therapy, a patient will be taking a drug for the rest of his or her life. For the insurance company, coverage or paying for the drug will be the same today or in a year. For a cure, insurance has to cover the drug once upfront but not in the future. However, the upfront cost to the insurance company is very expensive.

To obtain those data, you need to capture them and build the protocol into a company’s clinical trial design, starting with phase 1 trials. When you file an investigational new drug (IND) application, the clinical trial design is included. If you do not include it in phase 1, you might forget to include it in phase 2 and 3 trials. It’s better to plan the clinical trial design early, then modify it later (similar to an adaptive clinical trial).

Prevent Problems Later in Development and Postlaunch

The advantages of conducting marketing due diligence early is that once you file an IND, everything in that application becomes public. Before filing, you can make mistakes or change your mind, and only people in the company will know.

The farther you go down the product development process and then discover that the indication is incorrect or that market potential is significantly lower than expected, you must decide whether to go back and develop the product further or continue down the path knowing that expectations will be lower. Going back once you are in phase 2 or phase 3 to correct a situation can be expensive because 80% of an R&D budget is allocated to clinical trials.

That is a very difficult decision to make. If you decide to go back, that means more money and time is required, resulting in delays, possibly missing milestones, and management and investors will not be happy. If you decide to move forward in product development knowing that sales may be significantly lower than forecasted, management again will be unhappy because sales already have been allocated in their five- and 10-year plans. There is nothing worse than to discover that sales projections are high, but actual sales are low or flat because the due diligence was not conducted early in product development.

Think Early for Long-Term Success

It is important to conduct marketing due diligence as early as the basic-research stage to prevent the types of problems described above. It is never too early to conduct due diligence, but it can be too late to fix things during later stages of R&D, ultimately resulting in a poor return on investment (RoI). That doesn’t mean that unexpected things can’t happen, but at least you will have derisked the process to the best of your ability.

Sometimes conducting marketing due diligence appears to be easy, and it would be tempting to do it in-house. You wouldn’t want a chemist to do biology work and visa versa. Hire an expert or consultant if conducting marketing due diligence is not your company’s expertise. A penny saved now can turn into millions of dollars flying out the window later.

Regina Au is principal, new product planning and strategic commercial consultant at BioMarketing Insight, Woburn, MA; [email protected].

You May Also Like