BioPhorum Operations Group Technology Roadmap, Part 1: Four Trends Shaping the Future of the IndustryBioPhorum Operations Group Technology Roadmap, Part 1: Four Trends Shaping the Future of the Industry

December 13, 2016

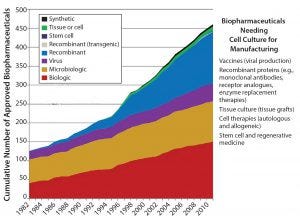

Figure 1: The number of cell culture-based products is growing

What prompts over 100 biopharmaceutical manufacturers, leading academics, supply partner R&D heads, regulators, and worldwide regional hubs to get involved in a major project? It’s when that project identifies the future technology needs of the biopharmaceutical manufacturing industry and accelerates its collective innovation. In February 2015, the BioPhorum Operations Group (BPOG) Technology Roadmapping steering committee met in Washington DC to create the first “technology roadmap” for the biopharmaceutical manufacturing industry.

The biopharmaceutical market has been experiencing dramatic changes: explosive growth coupled with increasing pressures to reduce costs while producing effective drug products. Such changes have forced manufacturers to change their legacy processes. At the same time, innovation has been slow in the bioprocess industry, with biomanufacturers developing technology in isolation and suppliers unclear on what biomanufacturers really want or need. According to Rajesh Beri (technical director of research and technology at Lonza and a member of the 18-member steering committee), “The biologics industry has been slow to innovate in the biomanufacturing area. Most companies are still doing the same manual procedures that were performed since our industry started 35 years ago.”

Acknowledging that issue, senior executives from BPOG’s member companies recognized that they needed a professionally facilitated industry collaboration to reduce the risk and uncertainty of tackling the roadmap project alone. With collaboration extending beyond the BPOG member companies, industry suppliers’ R&D heads and academia are able to comprehend fully the industry’s needs and invest in research and development work with confidence.

To establish an effective roadmapping process, the steering committee needed to create a shared vision of the future of biopharmaceutical manufacturing. That had to be followed by the more difficult task of determining how those goals could be accomplished. Identifying key enabling technologies of the bioprocess industry will be the key to progress. “Once you have a common goal, reaching that goal can’t be achieved by just wishing your way to it,” said Beri. “Not all avenues will lead to success. To get there, you need enabling technologies.”

The steering committee’s second event (held November 2015 in Washington, DC) was the platform for identifying key inputs needed to create the first biopharmaceutical manufacturing technology roadmap. Such inputs included recognizing those market trends that would be most influential in shaping the industry’s future. According to Bert Frohlich (director of bioengineering at Shire), “The industry as a whole is facing increased complexity . . . . In the face of rising costs and cost pressures, we can get stuck in our old paradigm.” Frohlich presented four main trends currently shaping the industry (described below). Those trends helped crystallize the vision for future manufacturing scenarios, and they will ultimately lead to identifying necessary future technologies.

Four BioPharmaceutical Industry Trends

Introduction of New Product Classes: Over the past 30 years, the number of “emerging” product classes such cell, gene, and tissue therapies has increased (Figure 1). A defining feature of many of these new therapies is that they target smaller specific patient populations. An autologous cell therapy is even personalized to a single patient. Thus many of these emerging products won’t necessarily be produced in bulk but rather in small batches as product variants. As the number of specialized therapies increases, such products will be targeted for smaller populations or even individuals.

Continued Growth of the Biopharmaceutical Market: According to Frohlich, “The biopharmaceutical market is growing fast, and there doesn’t seem to be an end in sight. Judging from the number of products in various phases of clinical development, this growth will be dramatic.” The fast-track routes that were introduced by regulators recently will accelerate speed to market and contribute to rapid market growth.

Pressure to Reduce Costs: Frohlich notes that the rate at which costs are rising is “unsustainably high.” He says the “pressure from healthcare payers for value, and the evidence that biosimilars will arrive faster than anticipated (reducing barriers to market entry) will force biopharmaceutical drug-innovator companies to be increasingly effective and efficient with operating expenses, including manufacturing.” Biomanufacturers are feeling the added pressures from having failures in their product pipelines as well as the high cost of human clinical trials.

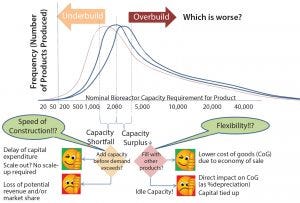

Figure 2: Decision on design capacity is influenced by projected demand and uncertainty.

Uncertainty in Approval and Sales of New Products: As profit margins decrease and costs rise, the margin for error shrinks. Consequently, biopharmaceutical manufacturers face more difficulties in market forecasting and determining whether to scale-up to manufacturing. This trend highlights a dilemma for biomanufacturers: Should they overbuild to ensure that demand is covered or underbuild to save on capital costs? Overbuilding can lead to a capacity surplus when a drug product finally is commercialized, burdening the product with higher depreciation costs. Underbuilding will lead to a capacity shortfall, and a company will be unable to meet product demands, resulting in large opportunity costs that can quickly outweigh the overcapacity alternative (Figure 2).

Against this background of rapid market growth, increased pressure on costs, and new individually tailored drug products, BPOG facilitated a process in which industry experts agreed on biomanufacturing scenarios of the future and the key enabling technologies for those future processes. The next step for the Technology Roadmapping team was to consider the context in which the emerging technology will be used. To do that, they had to identify the manufacturing scenarios that are most likely to form the backdrop to tomorrow’s technology. Once accomplished, this clear vision of the future allowed the team to list key technologies that would play a significant role.

Part 2 of this BPOG article will focus on that shared vision. And we will discuss how six teams were tasked with developing long-term visions for six technology topics identified by the Technology Roadmap committee.

Steve Jones is director of the BioPhorum Operations Group (BPOG); [email protected]; www.biophorum.com/category/resources/technology-roadmapping-resources.

You May Also Like