Reimagining the Future of Biopharmaceutical DigitalizationReimagining the Future of Biopharmaceutical Digitalization

The biopharmaceutical industry is increasingly adopting digitalization to enhance efficiency and product quality. Current systems like ELNs, LIMS, and MES often lack interoperability, driving vendors toward modular, standardized solutions, exemplified by initiatives like SiLA and the Allotrope framework. Digital twins and AI enable predictive analytics and in silico simulations, reducing costs and accelerating development timelines. However, challenges in technology transfer and data management persist. Organizations must foster collaboration among stakeholders, implement change management practices, and invest in training to overcome these hurdles. Ultimately, a digital strategy will improve connectivity and streamline processes, delivering better outcomes for patients.

September 20, 2024

The University College London (UCL)–Accenture Innovation Partnership and the UCL Future Targeted Healthcare Manufacturing (FTHM) Hub cohosted a one-day conference entitled “Reimagining the Future of Biopharma Digitalization” on 24 January 2024. The event brought together a diverse group of stakeholders including academics, biopharmaceutical developers and manufacturers, vendors, consultants, and policymakers. Presentations from Accenture (Whitney Pung, Barry Heavy, and David Twohig), UCL (Suzanne Farid), and GlaxoSmithKline (GSK, Patrick Hyett) accompanied an evidence safari providing context for breakout discussions summarized herein. The conference was organized under a broad partnership between the FTHM Hub and Accenture for addressing the business and regulatory challenges to ensuring that new targeted biological medicines can be developed quickly and manufactured at costs that will be affordable to society.

A Vision for the Future

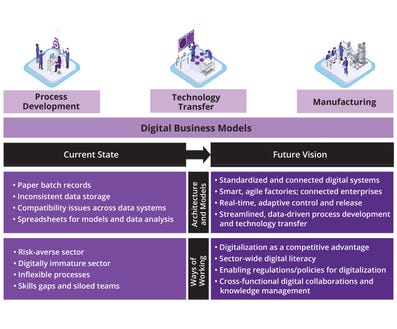

Digitalization in the biopharmaceutical industry has the potential to accelerate the creation of emerging drugs and their delivery to patients. The FTHM Hub and the UCL–Accenture Innovation Partnership envision a future in which data are democratized, standardized, and contextualized to enable connected enterprises at the industry’s core (Figure 1). Currently, many organizations still rely heavily on paper records and fragmented digital systems, leading to data silos and inefficiencies. The future vision involves flexible digital architectures that transcend functional teams (research and development (R&D), regulatory, quality, manufacturing, and supply chain) and sites/facilities to provide real-time adaptive control and improved productivity for accelerated market release. We envision a fully digital, interconnected enterprise in which real-time data and advanced analytics drive decision-making to support agile operations and enable smart factories.

Investing in digital tools could accelerate process development, smooth technology transfers across sites, and facilitate self-adapting manufacture. For example, predicting the influence of raw-material attributes on final product-quality attributes (PQAs) can reduce process-development time significantly. Additionally, demonstrating process understanding through digital tools can obviate the need for repeated clinical trials to confirm comparability when process changes are made. Achieving such a vision requires a direct change in companies’ ways of working through establishment of strong digital leadership teams that can make an underlying business case. In essence, we believe that digital architectures and software models together with new ways of working will be the main enablers to help achieve digitalization in the biopharmaceutical industry.

The main goal of this conference was to prompt participants to identify practical steps that need to be made in the next five years toward achievement of that vision — particularly across process development, technology transfer, and manufacturing. Here we summarize the resulting discussions and highlight key strategies for embedding digitalization in biopharmaceutical development.

Digitalization in the Biopharmaceutical Industry

Before engaging in breakout discussions, conference participants completed a pulse-check survey on the current state of digitalization within their own organizations. We asked four questions:

• What level of digital maturity is your organization (or the sector) currently at?

• What do you consider to be the main driver for digitalization and automation?

• What are the main challenges preventing digitalization and automation in your work?

• How strategically has digitalization been adopted in your organization?

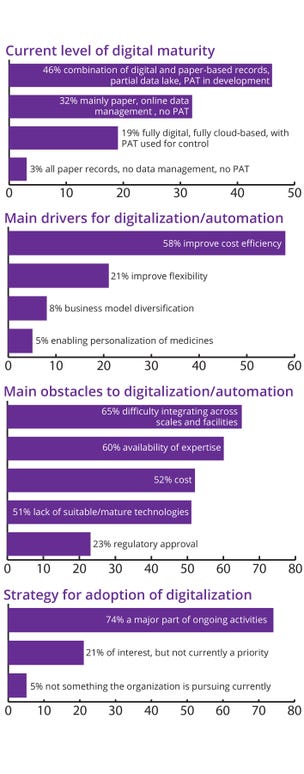

The survey results in Figure 2 underscore diverse stages of digital maturity within the biopharmaceutical sector, highlight the critical drivers and barriers to digitalization, and reflect the current range of commitment and implementation. This survey provided valuable insights into the steps needed to advance the industry’s digital transformation.

Current Level of Digital Maturity: The survey revealed a varied landscape in digital maturity across the sector. Notably, nearly half (46%) of respondents reported using a hybrid system combining digital and paper-based records, with partial data lakes and process analytical technologies (PAT) in development. That indicates a shift toward digitalization, albeit with some reliance on traditional record-keeping methods.

Conversely, nearly a third (32%) of participants indicated that their organizations primarily use paper records supplemented by an online data-management system but lacking PAT. That highlights the transitional phase in which many companies currently reside, with digital tools introduced but not yet fully integrated.

Note that only a small percentage (19%) of respondents described their systems as fully digital and cloud-based, with PAT used for control. That underscores the gap between ongoing digitalization efforts and achieving full digital maturity. Furthermore, most organizations still cope with data silos, often having crucial enterprise data captured on paper or in “data dead-ends,” which prevents seamless access and broad use. We were alarmed to find that even 3% of respondents still rely entirely on paper records, with no data management or PATs at all. Altogether, the results illustrate significant variability in digital adoption across the biopharmaceutical sector.

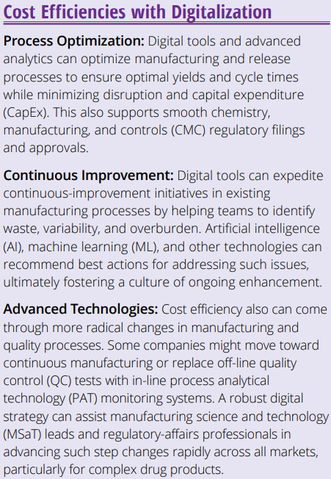

Drivers for Digitalization and Automation: Improving cost efficiency emerged as the predominant driver for digitalization and automation (cited by 58% of respondents). That reflects a clear understanding of the potential of digital tools to enhance operational efficiencies, reduce costs, and streamline processes from process development through technology transfer and manufacturing. Cost efficiency can result from process optimization, continuous improvement, and advanced technologies (see the Cost Efficiencies box).

Flexibility was the second most important driver, with 21% of participants emphasizing the need for adaptable systems and tools that can scale with their operations. Additionally, 8% of respondents highlighted business-model diversification as a key benefit of digitalization, which indicates an interest in leveraging digital tools to explore new business opportunities and revenue streams. Meanwhile, 5% of participants focused on enabling personalization of medicine, highlighting the role that digitalization can play in supporting tailored and patient-centered approaches.

Barriers to Digitalization

Our survey results highlighted several significant barriers to digitalization and automation in the biopharmaceutical industry. The most pressing issue is difficulty in integrating digital systems across different scales and facilities. That problem is compounded by enterprise-level differences in digital maturity as well as the complexity of aligning legacy systems with new technologies.

Availability of expertise emerged as another critical barrier. This underscores the need for skilled professionals who can drive digital initiatives and manage advanced digital technologies. Cost remains a notable concern, reflecting the financial investment required for digital transformations.

A lack of suitable or mature technologies further complicates digitalization efforts, particularly in this highly regulated industry. Although regulatory approval was the least concerning challenge for survey respondents, it still represents a hurdle that organizations must navigate to implement new digital tools effectively.

Strategic Adoption of Digitalization: Survey responses indicated a broad spectrum of strategic approaches to digitalization. A significant majority (74%) of participants reported that digitalization is a major part of their ongoing activities, which demonstrates a strong industry commitment to embracing digital tools and processes. However, 21% stated that although digitalization is of interest, it is not a current priority for their organizations, which suggests that some companies are still in the early stages of considering digital transformation. Finally, 5% of respondents indicated that digitalization is not something their organization is pursuing currently, highlighting that a small segment of the sector has yet to embark on the digitalization journey.

Practical Steps for Achieving the Vision

Having surveyed the current state of digitalization, conference participants broke out into smaller groups to explore the practical steps that will be necessary to realize a future vision of biopharmaceutical digitalization for process development, technology transfer, and manufacturing. Common themes emerged across the groups, especially concerning two main digital enablers: “digital architectures and software models” and “ways of working.” The “Call to Action” box summarizes practical steps and actionable strategies to address each.

Digital Architectures and Software Models — Understanding and Leveraging the Data Landscape: Among those breakout discussions, one resounding message arose to emphasize the importance of understanding what product and process data are generated across the enterprise value chain. Companies need to define clear problem statements that require specific datasets to help pinpoint where digitalization is most needed. Participants highlighted that such efforts are likely to uncover challenges such as a lack of data standardization and nomenclature alignment. Therefore, a key to success will be leveraging a structured data backbone that can be indexed and maintained.

Digitizing product and process metadata that have been captured on paper from laboratories, factory floors, and other enterprise activities will be crucial to unlocking value through layering data-analytic capabilities. The future vision supports an understanding of technology transfers, enabling manufacture of personalized medicine and investigations of batch failures. Advanced analytics and artificial intelligence (AI) methods rely on good datasets, making those important requirements, and their use should be supported by meaningful documentation.

Cloud Systems, Real-Time Data, and Security: Once the foundational data elements have been identified, a company can manage data storage and sharing through cloud-system investment. Creating “data lakes” can streamline data access but must be managed to ensure data integrity and security. Cell and gene therapy (CGT) companies are particularly receptive to using cloud systems, especially developers needing to manage complex chain-of-custody protocols for decentralized manufacture of autologous therapies. However, cybersecurity risks are of particular concern for the biopharmaceutical sector, which needs to protect proprietary information and trade secrets and may need to track sensitive patient data (e.g., for autologous CGTs). Ensuring that accessible cloud-stored data will be protected against cyberattacks is a critical step to mitigating such risks, as is maintaining robust backup systems.

Standardization: Achieving “democratization” of data through cloud-based systems is just the beginning. Standardization is crucial to ensuring the long-term reusability and integrity of data. Associated hurdles for the biopharmaceutical industry include the prevalence of paper-based records and variability in data formats and systems across the sector. Those often do not integrate well with electronic laboratory notebooks (ELNs), regulatory information management systems (RIMS), laboratory information management systems (LIMS), manufacturing execution systems (MES), or quality management systems (QMS).

Figure 2: Pulse-check survey responses on digital maturity, challenges, and drivers in the biopharmaceutical sector; PAT = process analytical technology

The need to integrate multiple platforms and solutions within organizations could incentivize vendors to make their technologies more modular and compatible, contributing to overall standardization across the industry. Open-platform communications could enhance vendor appeal, as exemplified by promising examples such as the Standardization in Lab Automation (SiLA) currently in development (1).

Consortia involving vendors, clients, academics, and regulators will play a critical role in promoting information sharing and best practices (2). The industry needs to push to develop standards and internal ontologies for knowledge storage and transfer — e.g., the Allotrope framework (3). Collaboration with regulators will be essential to devising digital product profiles (DPPs) that summarize precise information about how biopharmaceutical products are developed, produced, and distributed. Regulatory requirements based on such standards are likely to influence the types of data collected and associated industry practices in the future.

Interconnected, Interoperable, and Integrated Systems Across the Value Chain: Most enterprises grapple with a disparity in system interconnectivity and a need to improve data flow and connectivity across teams, functions, and sites (both internal and external). Technology transfer introduces further challenges, such as maintaining the integrity and consistency of data moving from process development to manufacturing while overcoming differences in systems and standards across different sites. Conference participants highlighted the potential of smart, flexible, and scalable application programming interfaces (APIs) for connecting internal and external sites. APIs can facilitate data transfer, create feedback loops for knowledge management between manufacturing and process development, and leverage AI tools to predict outcomes and optimize data fed back from “failed” experiments to improve existing models.

Embedding digital tools in modular and open-architecture solutions while investing in enterprise-level software rather than site-specific systems can promote standardization and interoperability across the industry. Most organizations currently lack the necessary digital infrastructure to build and maintain data lakes — with many spending months trying to integrate different platforms and still relying on paper for day-to-day activities. Achieving interconnected, interoperable, and integrated systems therefore will require creating a digital backbone to support improved connectivity, plug-and-play systems, and management of site-to-site variability. An online case study involving Amgen and ZS illustrates the benefits of such an approach for CMC development activities (4).

Digital Twins, Advanced Analytics, and AI: Standardized and contextualized product and process data ultimately will pave the way to enable advanced predictive capabilities. Digital twins and AI can enhance product life-cycle management (PLM) tools by providing real-time data and predictive analytics. As virtual replicas of real-world processes, digital twins could enable companies to replace many traditional laboratory experiments with in silico simulations, thus reducing costs and accelerating development timelines. Such models can enhance process understanding and optimization.

Integrating AI and real-time data with digital twins boosts their capabilities to support autonomous real-time control and automated processing in biomanufacturing, ultimately improving operational efficiency. Advanced data analytics also can leverage untapped data from PAT instruments and soft sensors both for prediction (5) and root-cause analysis (6).

Digital twins, advanced data analytics, and AI also will bolster quality-by-design (QbD) initiatives to help ensure consistent product quality and reduce risks. That represents a significant step toward industry 4.0 with smart, agile operations.

Automation also can serve as a digital enabler along with robust architectures and data structures. It frees up operators and process engineers to focus on collaboration and in-depth analyses. Opportunities here include implementing tracking systems using radio frequency identification (RFID) tags, using drones for maintenance, and programming robots for cell counts or to help manage employee workloads (7, 8). In the food industry, Ocado provides an interesting example of how a combination of tools and automation can revolutionize stock management (9).

Ways of Working — Driving Adoption of New Technologies: As alluded to above, many digital enablers are available now for organizational use, and each comes with its own set of challenges to overcome. As a result, adoption of such technologies at scale has been slow. Internal organizational change-management practices must be implemented at all levels — with cooperation among vendors, biotherapeutic developers, manufacturers, and regulators to derisk pathways and expand uptake of digital innovations. Adoption can be facilitated, for example, by providing funding opportunities to help companies lower the necessary upfront investment and to incentivize sharing of best practices.

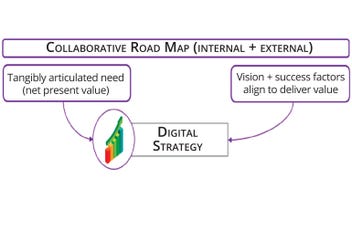

Figure 3a: Key ingredients to inform a digital strategy include a well-defined value case and success factors for guaranteed delivery.

Developing new regulatory mechanisms and incentives will be essential, especially for emerging technologies such as AI applications, digital twins, and virtual reality (VR). They often face regulatory challenges due to their complexity and data requirements. Conference participants highlighted the need for standardized regulatory reporting pathways to help increase patient safety and adoption of adaptive regulations. Such an approach will help therapy developers to navigate the phases of clinical development and implement lessons learned and continuous improvements throughout each product’s life cycle.

Additionally, information on model transferability and associated risk profiles will be necessary for regulatory approval. AI models based on identifying data correlations, for example, should offer interpretability rather than being treated as “black boxes.” Such applications are particularly relevant in fields with limited data availability — e.g., for developing rare-disease treatments — making careful evaluation of self-learning models vital to preventing deviations.

Ways of Working — Training and Productivity Savings for Resources: Other important incentives to help the industry implement automation and digitalization will emphasize training and capacity release. For instance, adopting VR and augmented reality (AR) for good manufacturing practice (GMP) operator training could lower upfront costs and improve trainee experiences. Future AR/VR technologies could enable remote review and product release, particularly for autologous therapies for which each patient’s batch needs signoff by a qualified person (QP). Introducing the concept of an electronic QP (eQP) could further streamline related processes and accelerate quality control (QC) timelines. For example, real-time visual inspections using AR glasses could be captured and entered into batch records, enabling QPs to oversee multiple batches remotely and efficiently. Such an approach would shift the sector toward release by exception, relying on digital tools to flag deviations and helping to address a current shortage of QPs.

Specialized training is essential to addressing the scope of digital literacy among staff members within and across organizations. Early involvement of regulators in related conversations will be key, not only to help keep them up to date with digital technology trends, but also to collaborate on replacing legacy systems and building trust in new tools. Collaborative efforts with operators also will be crucial, as they face different manufacturing-floor challenges that might be overlooked by other people.

Digital Leadership and Cultural Change: The COVID-19 pandemic arguably sped up the biopharmaceutical industry’s digitalization and remote working. Sustaining those ways of working and embedding lessons learned into operations requires both digital leadership and cultural change. Organizations should nurture digital champions and foster a culture of confidence in data-driven decision-making. Both business and technology stakeholders should drive those developments, working together to integrate sustainability practices in the process.

As science advances and new biological modalities emerge, managing knowledge that transcends products, processes, and people becomes crucial. Effective knowledge management captures the tacit knowledge of personnel that often is not adequately documented. Such knowledge is vital to understanding of manufacturing-site capabilities and technology-transfer constraints.

Inadequate management of tacit knowledge can allow for single points of failure when key personnel leave, which highlights the need for a broad support network. Ensuring process traceability for auditing purposes will be critical. Therefore, organizations must have clearly defined problem statements and digitalization strategies that emphasize quality and people rather than merely focusing on getting products out the door or chasing the next funding opportunity.

Figure 3b: Proposed digitalization framework to drive a valuable digital strategy with fundamental enablers

(Tier 1) and associated business-enabling elements (Tier 2)

Putting It All Together: Investing in a Digital Strategy

The intrinsic link between digital enablers and new ways of working within organizations ultimately will facilitate the rollout of digital strategies and/or road maps to provide optimal value at an enterprise level. As organizations invest in such approaches, key considerations arise regarding the value proposition of digitalization and how to measure success. The proposed road map in Figure 3 and steps in the “Call to Action” box encapsulate such a strategy to serve as a basis for upcoming conversations on how to leverage digitalization in the biopharmaceutical industry toward improved results for patients.

A well-defined value case is crucial to implementing a digital strategy effectively while providing a clear rationale for digital investment and helping to align vision and success factors. Such alignment is vital for the guaranteed delivery and success of a digital strategy. A collaborative approach involving stakeholders from process development, manufacturing, and technology transfer is essential to providing a holistic view of digitalization potential — rather than the individualistic incomplete perspective of any one group. The interconnectedness of different business enablers is key, from ways of working (e.g., training and productivity savings, digital leadership, and cultural change) to digital architectures focused on understanding and leveraging an organization’s data landscape with interconnected and interoperable systems.

We are entering a new era of biopharmaceuticals whereby manufacture and supply of complex modalities are struggling to keep pace with that of R&D and market demand. We envision industry’s future standard as a digitally connected enterprise driven by innovation in digital enablers and ways of working. Realizing that vision will enhance process efficiency and product quality, ultimately delivering better outcomes for patients than ever before.

Acknowledgments

We gratefully acknowledge funding from the UK Engineering and Physical Sciences Research Council (EPSRC) for the Future Targeted Healthcare Manufacturing Hub hosted at University College London with UK university partners (Grant Reference: EP/P006485/1). We also acknowledge financial and in-kind support from the consortium of industrial users and sector organizations. Finally, we are grateful for input from Irina Brass (UCL), Stephen Goldrick (UCL) and David Twohig (chief executive officer at Pangaea Life Sciences Solutions and ex-Accenture), particularly related to planning the conference and facilitating breakout discussions.

References

1 SiLA Rapid Integration. Zurich, Switzerland, 2018; https://sila-standard.com.

2 Medicines Manufacturing Innovation Centre. Centre for Process Innovation Limited: Wilton, UK: 2024; https://www.uk-cpi.com/about/national-centres/medicines-manufacturing-innovation-centre.

3 The Allotrope Framework. Allotrope Foundation: Washington, DC, 2024; https://www.allotrope.org/allotrope-framework.

4 Case Study: Amgen Leads a Digital Transformation To “Accelerate the Speed to Market of New Therapies.” ZS: Evanston, IL, 2024; https://www.zs.com/about/case-studies/amgen-leads-a-digital-transformation-to-accelerate-the-speed-to-market-of-new-therapies.

5 Goldrick S, et al. High-Throughput Raman Spectroscopy Combined with Innovate Data Analysis Workflow To Enhance Biopharmaceutical Process Development. Processes 8(9) 2020: 1179; https://doi.org/10.3390/pr8091179.

6 Goldrick S, et al. Advanced Multivariate Data Analysis To Determine the Root Cause of Trisulfide Bond Formation in a Novel Antibody–Peptide Fusion. Biotechnol. Bioeng. 114(10) 2017: 2222–2234; https://doi.org/10.1002/bit.26339.

7 Kesteloo H. Tesla Drone Tech Revolutionizes Warehouse Inventory Count. DroneXL, 7 December 2023; https://dronexl.co/2023/12/07/tesla-drone-warehouse-inventory-count.

8 Cobot Packs Pills. FANUC America: Rochester Hills, MI, 2024; https://www.fanuc.eu/fi/en/customer-cases/takeda.

9 Our Technology. Ocado Group: Hatfield, UK, 2024; https://www.ocadogroup.com/osp/our-technology.

Luis Miguel Lacerda is a policy adviser at UCL Policy Impact Unit STEaPP; Ava O. Flynn is a consulting development analyst at Accenture Life Sciences; Whitney Pung is a management consulting manager at Accenture Life Sciences; Barry Heavey is global lead for life sciences, Industry X, and supply chain at Accenture Life Sciences; and corresponding author Suzanne S. Farid ([email protected]) is head of biochemical engineering, codirector of the Future Targeted Healthcare Manufacturing Hub, and professor of bioprocess systems engineering at University College London.

You May Also Like