Rapid Deployment of Manufacturing Options: An Analysis of Risks and BenefitsRapid Deployment of Manufacturing Options: An Analysis of Risks and Benefits

Biomanufacturers seeking the best approach to rapid implementation of flexible manufacturing capacity take into account the benefits presented by different modular construction options. We analyzed different approaches to building manufacturing capacity and assessed the economic benefits of each approach. Our evaluation was based on biopharmaceutical products for which there is an immediate unmet need, such as treatments or vaccinations for COVID-19. Such products also might entail a sudden increase in demand (e.g., expansion of a product indication or sales ramp up faster than expected). The timing required for increasing capacity is influenced by many factors, including those related to business, technologies, and regulatory compliance. Modeling techniques can be used to mitigate investment risks associated with manufacturing facilities.

Capacity Challenges

A rapid buildup of manufacturing capacity is required when there is a huge unmet need for a drug product. Although some options are available to accomplish that, the challenge is to identify the facility construction method that best addresses the following goals:

reliable and rapid capacity implementation (≤1.5 years)

flexible capacity (ability to add capacity or change products without interrupting existing processes)

suitability for a range of locations

reduced risk (delivers capacity on time and to cost)

low lifecycle costs.

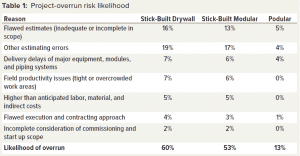

Compass International benchmarks capital projects and regularly publishes performance metrics. In a recent blog posting on capital project performance, the company reported that six out of 10 major construction projects fail to meet their established cost and schedule goals, with budget overruns ranging between 10% to 100% (1). The second part of the blog post listed major causes of overruns, as shown in Table 1 (2).

The construction sector generally is in crisis for a number of reasons (3), including skill shortages, project performance, and failure to modernize approaches. Off-site prefabrication is an opportunity to modernize construction methods, and it is being adopted by different industries (4). Industries in different countries now are considering and moving to off-site fabrication for buildings. In Germany, for example, the percentage of housing that is prefabricated increased from 15% in 2015 to 20% in 2018 (3).

Cleanroom Construction |

|---|

Stick-Built Drywall: The facility is framed out and finished with epoxy-coated gypsum walls. Wall panels have the same surface finish but are designed to accommodate custom needs such as room-to-room pass-throughs or windows. Centralized heating, ventilation, and air conditioning (HVAC) systems are located at mezzanine level and supply multiple rooms. Stick-Built Modular: The facility is framed out and finished with modular wall panels. Wall panels can have different surface finishes or be designed to accommodate custom needs such as room-to-room pass-throughs or windows. Centralized HVAC systems are located at mezzanine level and supply multiple rooms. Podular: A unit is built off-site with a fully functional cleanroom infrastructure. A standard structure and substructure platform is based on preengineered building delivery. The units are mobile and contain their own HVAC, automation, and utility connection systems. They typically are prequalified through a factory acceptance test. |

Biopharmaceutical manufacturers typically change process designs as a project progresses. The effect of that on fast-track projects is significant and a major cause of overruns. One consequence of prefabrication is that it requires an early design freeze before construction, encouraging the use of standard templates to accelerate a design process. That reduces overrun risk significantly. But the bioprocess industry is conservative and often slow to adopt new technologies.

In the past 20 years, cell culture titers have improved over tenfold, and single-use technologies have been adopted in mainstream manufacturing. Cell-culture improvements reduce the bioreactor volumes required per unit of output. Similarly, single-use technologies reduce utility requirements and facility complexity dramatically through

reducing upstream scales considerably

reducing (by fivefold) amounts of facility water required

decreasing footprints

decoupling process support pipework from main building (e.g., sterilize/clean in place, SIP/CIP) (5).

The BioPhorum Operations Group Technology Roadmap (6) provides an assessment of the state of facility design within the bioprocess industry. It covers the role and potential of modular construction compared with traditional construction methods for facilities based on stainless-steel equipment. The report on modular and mobile designs provides an excellent description of the different approaches, their applications, and the challenges and opportunities for potential added value (7).

The BioPhorum Groupʼs document provides an industry perspective. We have used it as the basis of our analysis herein on the relative benefits of the different approaches of construction. By understanding the fabrication approaches and the actual experience of real projects, our study examines the impact of

speed of construction

capital requirements

overrun risks.

Although many different approaches can be used to build a cleanroom facility, we focus on the three strategies described in the “Cleanroom Construction” box and in Table 2. The key difference among those options is the extent to which off-site fabrication is used. For stick-built drywall construction, all the building takes place on site. For stick-built modular construction, cleanroom panels and frames are prefabricated off-site and assembled on site. For podular construction, a fully functional cleanroom together with its heating, ventilation, and air conditioning (HVAC) system is built off-site and is supplied as a prebuilt module to a construction site.

Evaluating the Benefits

Our objective is to quantify the value of investments by analyzing their total cost of ownership (TCO). The biomanufacturing industry is lacking research into actual delivered capital project outcomes that are measured in a systematic and comparable way. That creates uncertainty about what benefits are attributable to off-site construction. Specific academic–industry initiatives are embarking on research in this area (8). To address the lack of published data, our collaborators provided details of the influence of different construction approaches in terms of

project duration

total capital investment cost

project cashflow

project risk.

Those data provide a basis for evaluating the benefits of different construction methods. To measure the financial performance of a project, we used standard financial accounting ratios. The “Financial Performance Metrics” box describes some standard metrics used to assess the performance of an investment in a project. For our analysis we used

net present value (NPV) to assess project profitability in today’s money

payback period as a simple means of how long it takes to cover the upfront investment

impact and likelihood of overruns in terms of additional project costs and delays.

To calculate cashflows and profitability for a project, the cost of capital must be factored into an NPV calculation. Our study covers a five-year period; n = 60 months. An investment is deemed to be profitable if NPV > 0 (returns more money than the cost of the capital invested). Weighted average cost of capital (WACC) sets the hurdle interest rate for the NPV calculation, which is calculated and tracked for all large companies. We used the following metrics as they relate to US companies (9) in the drug biotechnology sector and results aggregated from 547 companies as of January 2021:

WACC (discount rate) = 4.72%

inflation rate = 1.5%.

To carry out the analysis, we used the industry standard BioSolve Process software (from Biopharm Services) to generate

variable batch costs

labor costs

process-equipment capital costs.

To calculate the financial metrics, we used an internal software model (BioSolve Portfolio). The software takes as its inputs the outputs from BioSolve Process software.

The NPV revenue stream is based on drug-product sales prices. By comparing different modular approaches over a five-year period, we could identify how different construction times and capital requirements are translated into additional profit (as defined by NPV) and break-even points. For simplicity, we assumed that the associated supply chain is not changed and that it can accommodate any of the differences among the three modular options.

https://www.gconbio.com

Basis of Analysis

Our analysis is based on a realistic scenario in which product is required immediately to satisfy unmet patient needs or overcome stock-outs. We focus on the quantitative benefits while recognizing that the societal benefits of delivering drugs to patients as soon as possible are much more significant. Three aspects are considered: product, capital, and pricing.

Product Scenario: Our analysis is based on a therapeutic treatment for COVID-19. Many such therapies are based on monoclonal antibodies (MAbs), and standard manufacturing process details are available in the literature. The BioPhorum Technology Roadmap group (comprising manufacturers, suppliers, and service providers) has established a baseline mammalian-cell–based MAb manufacturing process. The details of that were built into a BioSolve Process model and placed in the public domain (9). This process was used as the basis of our analysis.

Manufacturing capacities required for some COVID-19 treatments are known. For example, anti-interleukin treatments such as tocilizumab require 400–1,600 mg per treatment (10). For our analysis we assumed that one patient requires 1.5 g. Demand for a drug product could vary depending on whether it is used for mild-severe or severe disease states. A biologic treatment would follow the latter path: short-term requirement (months) for 1–2 million treatments (two to three metric tons of a MAb), with follow-on capacity in place for at least 10 metric tons.

Financial Performance Metrics |

|---|

Total cost of ownership (TCO) is the purchase price of an asset plus the costs of operation. Assessing TCO represents a big-picture look at what a product is and what its value might be over time. Net present value (NPV) is a financial metric that captures the total value of a potential investment opportunity. The idea behind NPV is to project all future cash inflows and outflows associated with an investment, discount all future cashflows to the present day, and then add them together. The resulting number is the investment’s NPV. A positive NPV means that after accounting for the time value of money, you will make money if you proceed with the investment. Payback period refers to the amount of time it takes to recover the cost of an investment. Simply put, the payback period is the length of time that an investment needs to reach a break-even point. Weighted average cost of capital (WACC) is a calculation of a companyʼs cost of capital in which each category of capital is weighted proportionately. All sources of capital are included (e.g., common stock, preferred stock, bonds, and any other long-term debts). |

Capital: Determining the appropriate size of a facility is a complex undertaking. For this analysis, the requirement is for rapid implementation based on single-use technology and modular facility construction. From project experiences relating to modular facilities, we agreed on a design basis based on a module of 4 2,000-L single-use bioreactors.

The facility would include three modules. A facility can be designed in the BioSolve Process software based on a cell culture expression titer of 3 g/L and using a standard MAb process running at 75% capacity with an output of about 250 kg per year per module for a total of 750 kg per year (with the ability to increase the output to 1,000 kg per year for short periods). Those values would provide sufficient material to support 0.5 million patients at 1.5 g per dose while running at 75% capacity. Depending on the requirements, such facilities can be replicated around the world. Process intensification can be used to optimize a process and increase output of a facility.

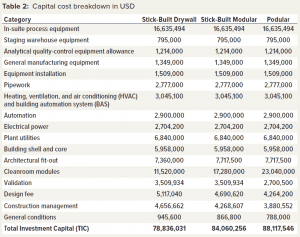

Table 2 lists the capital cost breakdown for the three modular build options. All costs except the in-suite process equipment were supplied by our collaborators. In-suite process equipment costs were generated by the BioSolve Process model.

Key capital metrics are as follows:

For the stick-built drywall construction method, total investment capital (TIC) was 78.84 million US dollars (USD) over a 27-month build.

For the stick-built modular construction method, TIC was 84.06 million USD over a 26-month build.

For the podular construction method, TIC was 88.12 million USD over a 20-month build.

We evaluated whether the benefit of a facility coming onstream early more than offsets the additional capital invested in modular construction.

Currently, 60% of traditional projects experience an overrun. Table 3 lists reasons for overruns. They apply to the stick-built drywall method of construction in which all trades work on-site to construct a facility. The reasons apply partly to stick-built modular construction in which cleanroom modules are assembled on site. Prefabricated podular construction mainly takes place offsite, thus reducing risk of overruns and scope creep.

Product Pricing: Our analysis observes incremental differences among different construction methods, so a fair basis of comparison is to use the revenue gained from additional sales. We had to consider a reasonable sales price for the MAb in our analysis. Drug-product sales-price data have been collected and published for antibodies approved by the US Food and Drug Administration (FDA) between 1997 and 2016 (11). Our price assessment is based on evaluating MAbs for 74 indications. The spread of sales price in terms of USD per gram of drug product ranges from 465 USD/g to 203,438 USD/g, with most products priced between 400 USD/g and 6,500 USD/g.

Only four indications have a sales price >16,000 USD/g. So the average sales price of 6,390 USD/g is not representative of most antibody sales prices because it is skewed by outliers. A better measure of sales price is the median value, which is 1,336 USD/g. Reference sales price for our analysis is based on that median value, and the actual value used is 1,300 USD/g.

Analysis

We used the BioSolve Portfolio software model to compare the return on investment (RoI) over a five-year period for each construction method for the manufacturing modules, for an overall project with

phase 1 capital project

phase 2 facility output ramped up to 75% capacity over a one-year period

phase 3 routine manufacturing.

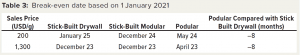

For a particular set up, our model analyzed cashflows for a facility every month for five years. Offsetting the outgoings is the USD/g income allocated to the product. We also calculated a break-even date based on the payback period and reference sales price. An earlier break-even date increases the likelihood that a project will profit and be subjected to reduced risks associated with unforeseen events. To assess the sensitivity of that break-even point to sales price, we used 15% of the reference sales price (Table 3). The dates are adjusted to account for the likelihood of a delayed project. It is interesting to note that differences among the options are not strongly influenced by sales price, with the stick-built modular option breaking even one month before the stick-built drywall option. The podular facility breaks even eight months before the stick-built drywall option — a significant benefit that would be reflected financially and in terms of risk reduction.

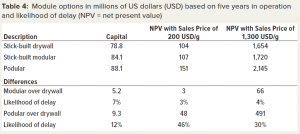

We calculated the profitability of the different modular construction methods as measured by NPV for two sales price points (Table 4). Taking the stick-built drywall as the reference, we assessed the differences of the other two construction methods. The stick-built modular and the podular options both require more capital than does the traditional stick-built drywall option — by 7% and 12% more, respectively. The additional capital spend of the stick-built modular option does not translate into a meaningful additional profit (within a 5% range) at the two sale prices.

By contrast, the additional expenditure for the podular option provides significant additional profit at a sales price of 1,300 USD/g. The additional profit is 30% higher than it is for the stick-built drywall option and amounts to an additional 491 million USD and an outlay of an additional 9.3 million USD in capital.

That differential increases at lower sales prices, and the absolute difference increases. When the sales price is reduced to 200 USD/g, the relative increase in profit by 46% equates to an additional 48 million USD. Comparing stick-built modular construction to podular construction, the latter increases profitability by 425 USD million for an additional 5.7 million USD investment at 1,300 USD/g and 45 million USD at 200 USD/g.

The podular option creates a significant additional financial value. In addition, the certainty of delivering a project on time minimizes the risk of intangible losses (loss of opportunity).

Maximizing Benefits

The need to change to standardized off-site construction in a controlled environment is recognized across different industries (12). Such methods can provide quick builds, safety, quality, and high productivities. Those benefits can be quantified in terms of financial and project-performance metrics, moving away from a simplistic focus on capital cost to one in which total project profitability is maximized. Such construction industry challenges are relevant to the biopharmaceutical sector. Traditional biomanufacturing facilities are expensive, highly specialized, and inflexible. They take a long time to build, and capacity and product needs change frequently before a facility is built.

The biomanufacturing industry as a whole recognizes that its traditional construction methods are unsustainable and in need of change. Process improvements and technology developments have facilitated the drive toward modular construction methods.

A number of organizations are offering different approaches to implementing modular and podular designs and build. One collaborator in our study is a thought leader in this area. The obstacle that always comes with innovations in the biopharmaceutical industry is a conservative approach — the “I have not done it this way before” attitude or the belief that things are fine without change. A good example of that has been the lengthy and tedious adoption of single-use technologies in commercial manufacturing. The current acceptance of single-use systems into mainstream manufacturing has taken over 25 years to come about. Some of the industryʼs arguments against single-use technologies were similar to those now used against the adoption of off-site, prefabricated construction — in particular, that it was more expensive. It took an article written in 2002 to set the economic case for single-use technologies (13). That analysis took into account the entire factory and process, explaining how single-use systems are economically attractive for certain situations. Many predicted savings have been shown in a number of actual facilities since then.

In different cases, the capital cost is higher for podular-constructed facilities, and many biopharmaceutical companies focus on the total capital investment as the key metric. But that ignores the benefits that off-site prefabrication brings in quality, safety, construction time, and absence of hidden costs. Those factors lower risk and ultimately reduce lifecycle costs. Our analysis herein has used “real” capital data from a reputable engineering firm coupled with realistic manufacturing costs generated by Biosolve Process software to map out the lifecycle costs for a COVID-19 MAb product.

This analysis has provided key lessons. To maximize benefits, compress a project-build schedule. That is best achieved using off-site fabrication. If modular cleanroom panels are assembled on site, then the project-build schedule and overrun risks are not reduced significantly compared with those of stick-built facilities. Off-site cleanroom prefabrication (podular) provides tangible benefits, even taking into account the higher capital cost of a podular facility.

The benefits for a MAb manufacturing project and with a sales price of $1,300/g are

reduced project overrun from 60% to 13%

earlier break-even points (27 months from start compared with 35 months for other methods)

increased NPV (discounted profit at today’s prices) of 30%

increased proportion of savings, with sales-price reduction at 200 USD/g leading to a percent increase in NPV of 46%

positive absolute increase in NPV in the range sale price options.

All those factors reduce risk and increase certainty. Greater relative returns would be expected if repurposing a facility was required. In the future, facilities will have far greater capacities as processes are intensified further. Radical new approaches are required for biomanufacturing that link construction methods, digital technologies, and process intensification — if the goals of the BioPhorum Technology Roadmap group are to be achieved (10 USD/g and 12 months project time). The benefits are not just economic. Bringing biologic products to market quickly and using flexible podular facilities will minimize risks of stock-out and drug shortages.

References

1 Construction Project Cost Overruns (Part One). Compass International: Celebration, FL, 2019; https://compassinternational.net/construction-project-cost-overruns-part-one-2.

2 How To Project Construction Costs. Compass International: Celebration, FL, 2019; https://compassinternational.net/construction-project-cost-overruns-part-two.

3 de Laubier R, et al. The Offsite Revolution in Construction. Boston Consulting Group Global, 8 May 2019; https://www.bcg.com/publications/2019/offsite-revolution-construction.

4 Bertram N, et al. Modular Construction: From Projects to Products. Capital Projects, 18 June 2019; https://www.mckinsey.com/business-functions/operations/our-insights/modular-construction-from-projects-to-products#.

5 Sinclair A, Monge M. Quantitative Economic Evaluation of Single Use Disposables in Bioprocessing. Pharm. Eng. 22(3) 2002: 20–34.

6 Dalby KA, et al. Improving the Biomanufacturing Facility Lifecycle Using a Standardized, Modular Design and Construction Approach. BioPhorum Operations Group Ltd.; https://www.biophorum.com/wp-content/uploads/bp_downloads/Standard-Facility-Design.pdf.

7 Technology Roadmapping: Manufacturing Technology Roadmap Tool. BioPhorum Operations Group; https://www.biophorum.com/download/manufacturing-technology-roadmap-tool.

8 van Vuuren TJ. Methodology for Quantifying the Benefits of Offsite Construction. Ciria, London, UK, 2020; https://www.prefabnz.com/Downloads/Assets/14957/1/Methodology%20for%20

quantifying%20the%20benefits%20of%20offsite%20construction.pdf.

9 Damodaran A. Cost of Capital. New York University, 2021 http://people.stern.nyu.edu/adamodar/New_Home_Page/datafile/wacc.html.

10 Xu X, et al. Effective Treatment of Severe COVID-19 Patients with Tocilizumab. Proc. Natl. Acad. Sci. USA 117(2) 2020: 10970–10975; https://doi.org/10.1073/pnas.2005615117.

11 Hernandez I. et al. Pricing of Monoclonal Antibody Therapies: Higher If Used for Cancer? Am. J. Manag. Care 24(2) 2018: 109–112.

12 Bertram N, et al. Modular Construction: From Projects to Products. McKinsey & Company, June 2019; https://www.mckinsey.com/business-functions/operations/our-insights/modular-construction-from-projects-to-products.

13 Sinclair A, Monge M. Quantitative Economic Evaluation of Single Use Disposables in Bioprocessing. Pharm. Eng. 22(3) 2002: 20–34.

Corresponding author Andrew Sinclair is president and founder of Biopharm Services, Unit 1, Chess Business Park, Chesham, HP5 1SD, United Kingdom; [email protected]. Sa’ad Ojelli is bioprocess consultant, Yuki Abe, PhD, is a senior consultant, and Rob Noel, PhD, is a marketing consultant at Biopharm Services. Collaborator Tom Piombino is vice president and biotechnology and CGT process architect at Integrated Project Services (IPS). Collaborator Dennis Powers is vice president of business development and sales engineering of G-CON Manufacturing.

You May Also Like