Microbiome-Based Therapeutics: Negotiating Key Development ChallengesMicrobiome-Based Therapeutics: Negotiating Key Development Challenges

Microbiome-based therapeutics have evolved significantly in recent years, with several promising candidates advancing through the clinical pipeline. That progress is the result of growing evidence showing that targeting and manipulating the microbiome could improve human health and treat more than 25 conditions by restoring healthy bacterial populations (1).

Microbiome-based therapeutics have evolved significantly in recent years, with several promising candidates advancing through the clinical pipeline. That progress is the result of growing evidence showing that targeting and manipulating the microbiome could improve human health and treat more than 25 conditions by restoring healthy bacterial populations (1).

The human microbiome comprises a diverse community of microorganisms, helpful and harmful. It differs by person based on factors such as genetics, environmental influences, diet, and immune function. Microorganisms play a role in just about every biologic system, helping to digest food, produce certain vitamins, regulate the immune system, and provide resistance against infections. But pathogens, antibiotics, unhealthy diets, inflammation, and other factors can disrupt a person’s microbiome (dysbiosis) and trigger disease. Complex interactions among the human microbiome, health, and disease are being discovered continually (2, 3).

Clinical research for microbiome-based therapeutics focuses on manipulating bacteria in the gut. That region houses the most abundant and diverse microbial community in the human body, and it directly influences behavior, immunity, and metabolism. Significant changes in the composition of resident gut microbiota are linked to neurodegenerative, inflammatory, and metabolic diseases, providing potential targets for microbiome therapeutics (4).

Among microbiome-based therapeutics currently in development, probiotic therapies are the most advanced (5). Such treatments administer live microbes to patients to restore bacterial symbiosis (6). A number of probiotics are nearing clinical approval, and together their progress and evidence of the relationship between microbiomes and human health signals the high growth potential of the microbiome therapeutics market.

Addressing Challenges

Although the microbiome sector holds significant promise, manufacturers face three key challenges in the clinical development and commercialization of microbiome-based therapeutics.

Such treatments generally lack robust safety and efficacy data. Some physicians agree that the microbiome influences disease pathology, whereas others believe that microbiome-targeting therapeutics should not be incorporated into treatment decisions because they lack empirical evidence supporting their use (7). Thus, it can be difficult to convince medical professionals of the value of microbiome therapies. Other stakeholders might be skeptical of the treatments’ novelty, the uncharacterized nature of the sector that produces them, and a lack of comparators for what are usually “first-of-a-kind” products. Calls for additional data confirming the safety and efficacy of microbiome therapeutics could deter drug developers and manufacturers from entering the field.

Commercial opportunities for microbiome-based therapeutics are largely undefined. Research shows that such products can address a wide range of unmet medical needs. Thus, it is difficult to predict how physicians will adopt them into clinical practice, presenting significant risks in developing first-to-market therapies for which adopters have minimal reference points. Drug companies will need to identify areas of high commercial opportunity in this untapped market, then collect supporting market data to persuade potential customers.

The novelty of the microbiome sector also can limit physicians’ and patients’ awareness of such products and their unique approach to treating disease. Often, those stakeholders understand neither the complexity of the human microbiome nor the factors that differentiate microbiome-targeting therapies from one another. Thus, drug companies must educate their target customers. Upon market approval, developers also must convey a therapy’s mechanism of action (MoA) and value proposition clearly and ensure that communications align with customer needs to support adoption.

Broad adoption of microbiome therapeutics will depend on the ability of developers and manufacturers to address such challenges effectively. That will require convincing several constituencies — ranging from patients to physicians to payers — that such therapies can improve patient outcomes.

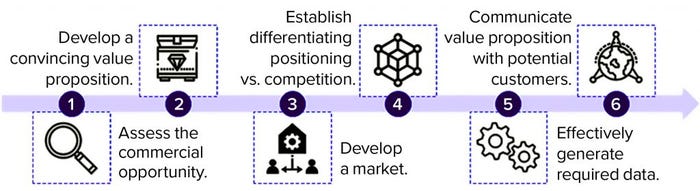

Figure 1: Opportunities to encourage development and adoption of microbiome-based therapeutics (analysis conducted by Charles River Associates, 2021)

Encouraging Adoption

Developers of microbiome-based therapies must enter the market methodically to establish their products’ value propositions. That involves six key steps (Figure 1).

Assess Commercial Opportunities: Drug companies must develop a deep understanding of the commercial opportunities in the market and focus their efforts on the best prospects. Developers can apply an opportunity-assessment framework that uses defined metrics to evaluate factors such as strength of a product’s potential value proposition and clinical benefit, size of target patient population (based on specific intervention points), probability of physician and patient adoption, current and future levels of competitive intensity, and likelihood of insurance coverage and reimbursement.

Live Biotherapeutic Products (LBPs) |

|---|

4D pharma develops drug products using live bacteria — LBPs. To date, the company has ushered four candidates into eight clinical trials for a range of conditions, and new candidates are slated to begin clinical trials in 2022. BPI’s associate editor spoke with chief executive officer Duncan Peyton to learn about advantages of microbiome therapeutics and challenges that lie ahead for the companies commercializing them. Why does your company focus on microbiome therapeutics? The pharmaceutical industry has tended to look outside the human body for new drugs. Until recently, we’ve not looked inside the human body — or asked why we have microbiomes and what they do. Our immune systems are designed to kick things out, yet we have 2.5 kg of bacteria in our gut. Those are there for a reason, and they profoundly influence biological functions. Part of the rationale for our initial interest in LBPs was that such therapies show clean safety profiles. Roughly two-thirds of drug candidates fail to gain regulatory approvals, primarily because of safety and toxicity problems. LBPs avoid such concerns, helping to ensure patient safety and clinical success. 4D pharma has developed the tools and understanding to identify bacteria that modulate particular disease pathways. Our MicroRx drug-discovery platform enables us to evaluate how specific bacteria interact with host cells and systems, much as a traditional pharmaceutical company studies a small-molecule drug’s mechanism of action. From such insights, we can identify bacteria with activity relevant to treating target diseases. Current literature suggests that microbiome therapeutics are difficult to formulate and deliver. Why is that the case, and how is your company addressing that concern? Considering the novelty of such therapeutics, scalable, good manufacturing practice (GMP) manufacturing is going to be a hurdle for the space. LBPs, living bacterial cells, are inherently more complex products than small-molecule drugs are. Their core manufacturing processes — fermentation, separation, and lyophilization — are nothing new; the skill lies in developing repeatable, scalable, commercially viable processes that comply with pharmaceutical standards. 4D pharma specifically develops single-strain LBPs, which reduces complexity compared with “consortium” products comprising multiple strains. Our drugs also are produced from carefully managed cell banks, rather than using human fecal donor material. When 4D pharma was formed, very few contract manufacturers were capable of working with the strains that we were interested in, so we decided to bring manufacturing in house. That investment is paying off, supporting research and development (R&D), accelerating candidate development, and giving us ultimate control, as well as generating intellectual property (IP) and know-how that companies can’t get from contracting-out for manufacturing. Besides gastrointestinal diseases, what other conditions could LBPs treat? Our research shows that LBPs can treat a wide range of conditions, from cancer to autoimmune and even neurological conditions. 4D pharma was the first company to release proof-of-concept clinical trial data using LBPs to treat cancers, with our MRx0518 in combination with Merck’s Keytruda (pembrolizumab) immune-checkpoint inhibitor. Since then, we have begun a second collaboration, combining MRx0518 with Merck KGaA and Pfizer’s Bavencio (avelumab) for urothelial carcinoma, which we expect to start by the end of the year. We also are studying MRx0518 with radiotherapy for pancreatic cancer. Aside from cancer, we expect the first clinical data for our MRx-4DP0004 candidate for asthma later this year. If successful, this proof-of-principle — that LBPs can modify the immune system to treat diseases away from the gut— raises significant opportunities. An area we are hugely excited about is the “gut–brain axis.” We are planning to start clinical trials for two new candidates for Parkinson’s disease in 2022. |

Develop a Convincing Value Proposition: Once a company identifies the opportunity with the highest commercial potential, it must crystallize the value proposition of its product. That proposition must align with the unmet needs of target customers, resonate with as many stakeholders as possible, and be supported by available clinical data. Developing a compelling value proposition in the emerging microbiome market is essential to drive uptake and capitalize on identified commercial prospects.

Develop the Market: Drug developers and manufacturers must prepare the market for their products ahead of launch. Such efforts involve building broad awareness about the human microbiome in general, providing evidence of its role in disease, describing why targeting the microbiome is an effective treatment approach, and highlighting how a product offers a novel solution. To establish baseline understanding of such topics, drug companies might consider launching educational campaigns in local markets and through traditional and social media, conducting physician training, and creating educational resources and support materials for different audiences. Effective communication will help to generate demand and support market entry for microbiome-based therapeutics.

Establish a Differentiating Position: Given increased interest in the microbiome as a therapeutic target and the number of therapies that are progressing in clinical development, a developer must establish compelling positioning against competing companies. Strategically differentiating a product from existing standard-of-care treatments and future market entrants can support uptake after launch.

Generate Requisite Data: Another important step to encourage postlaunch adoption is generating safety and efficacy data that are required by regulators and preferred by physicians, healthcare providers (HCPs), and payers. Manufacturers must develop comprehensive evidence-generation strategies to guide data collection beyond what will be obtained during ongoing clinical trials. Planning for that should begin with identifying data gaps that could diminish a product’s value proposition (e.g., patient outcomes and health economic data) and then focus on generating data that substantiate a product’s clinical use, value proposition, and positioning. Developers must apply several such activities (e.g., retrospective claims analyses and prospective chart studies) expediently yet affordably to ensure that resulting data fully support a product’s value proposition.

Communicate Value Proposition to Target Customers: After compiling requisite clinical data, a drug company should apply targeted marketing and field efforts to communicate those findings with a product’s value proposition to customers. This might include providing physician and patient testimonials, training sales teams to handle concerns that physicians raise, creating a list of frequently asked questions (FAQs) for distribution to patients, and developing a payer budget-impact model. Activities and materials should be tailored to each product and stakeholder to ensure effective and cost-effective targeting and strong communication of a product’s value proposition to different constituencies.

Outside Experts and Examples

Strategic execution of such efforts might require support from subject-matter experts who understand how to drive development, commercialization, and adoption of innovative technologies. Developers also should observe strategies implemented by competitors, assess the benefits and risks of those tactics, and apply those learnings to their operations.

For example, a company might consider the shortcomings of fecal microbiota transplantation (FMT), which is used to treat recurring Clostridioides difficile infections (rCDIs). FMT involves extracting healthy bacteria from a donor’s fecal matter and transferring them directly to an infected patient (2). Although FMT is accepted at many medical centers as an effective treatment, it has failed to achieve US Food and Drug Administration (FDA) approval, and data show that the approach can interact poorly with a patient’s existing microbiome, inadvertently introducing disease-causing bacteria. Drug companies might be able to highlight their products as alternative, risk-diminishing approaches to FMT based on new and better understanding of the microbiome.

The Path Ahead

Increasing evidence that healthy microbial ecosystems can restore the proper function of organs and metabolic systems heralds the significant promise and market potential of microbiome-based therapeutics. Such therapies could enable targeted treatments, improve patient quality of life, reduce risks of recurring infection, and decrease healthcare costs based on fewer hospitalizations. Successful adoption of such treatments depends on effective execution of specific activities throughout clinical development and commercialization to address the challenges described above.

Developers of investigational therapies should maintain collaborative discussions with regulatory agencies regarding clinical trial design and regulatory pathways to ensure that their product candidates remain on track. Close communication also will help to prevent commercialization challenges and prepare stakeholders — including patients, physicians, payers, HCPs, and investors — for treatments in this novel modality. Strong regulatory support will enable promising microbiome-based therapeutics including probiotics and potentially curative treatments to reach patients who need them as quickly as possible in the years ahead.

References

1 de Vos WM, de Vos EA. Role of the Intestinal Microbiome in Health and Disease: From Correlation to Causation. Nutrition Reviews 70(1) 2012: S45–S56; https://doi.org/10.1111/j.1753-4887.2012.00505.x.

2 Gupta S, Allen-Vercoe E, Petrof E. Fecal Microbiota Transplantation: In Perspective. Gastroenterol. 9(2) 2016: 229–239; https://doi.org/10.1177/1756283×15607414.

3 Statement on Safety Alert Regarding Use of Fecal Microbiota for Transplantation and Risk of Serious Adverse Events Likely Due to Transmission of Pathogenic Organisms. Microbiome Therapeutics Innovation Group, 12 March 2020; https://microbiometig.org/statements.

4 Ghaisas S, Maher J, Kanthasamy A. Gut Microbiome in Health and Disease: Linking the Microbiome–Gut–Brain Axis and Environmental Factors in the Pathogenesis of Systemic and Neurodegenerative Diseases. Pharmacol. Therap. 158, 2016: 52–62; https://doi.org/10.1016/j.pharmthera.2015.11.012.

5 Wischmeyer P, McDonald D, Knight, R. Role of the Microbiome, Probiotics, and “Dysbiosistherapy” in Critical Illness. Curr. Opin. Crit. Care 22(4) 2016: 347–353; https://doi.org/10.1097/mcc.0000000000000321.

6 Vanderhoof, J. 147 Early Changes in the Human Microbiome Alter Immune Function and Immunologically Mediated Disorders. J. Anim. Sci. 95(2) 2017: 69–70; https://doi.org/10.2527/asasmw.2017.12.147.

7 Tilg H, Moschen A. Food, Immunity, and the Microbiome. Gastroenterol. 148(6) 2015, 1107–1119; https://doi.org/10.1053/j.gastro.2014.12.036.

Andrew Thomson is consulting associate, Brian Carpenter is principal, and Robert Broadnax is vice president in the Life Sciences Practice at Charles River Associates (CRA); [email protected]. The views expressed herein are the authors’ and not those of CRA or any of the organizations with which the authors are affiliated.

You May Also Like