March 2022 Featured Report

HTTPS://WWW.ADOBESTOCK.COM

Scalability remains a critically important topic for biopharmaceutical companies. For conventional protein products, the strategy once was straightforward: Drug makers would scale up, beginning with cultures in flasks and roller bottles to grow enough cells to inoculate laboratory-scale (often glass) bioreactors, then again to pilot- and commercial-scale, stainless-steel, stirred-tank bioreactors. At their highest volumes, such reactors can handle tens of thousands of liters of cells and growth media. If a drug developer did not have the requisite equipment to scale up, then it needed to leverage the bioreactor capacity of a contract manufacturing organization (CMO).

By contrast, scalability possibilities have been limited for cell and gene therapies (CGTs). Many of their developers have scaled out rather than up, expanding sensitive, anchorage-dependent cell cultures in multiple small-volume vessels. Even when production could take place in suspension culture, as is the case fo...

Boosting Yield and Preserving Quality: Increasing Production of Induced Pluripotent Stem Cells for Cell Therapy and Regenerative Medicine ApplicationsBoosting Yield and Preserving Quality: Increasing Production of Induced Pluripotent Stem Cells for Cell Therapy and Regenerative Medicine Applications

Photo 1:

Production of 15 billion human induced pluripotent stem cells (iPSCs) in a 10-L bioreactor using the TreeFrog Therapeutics C-Stem technology, with 276-fold amplification in 6.59 days.

Induced pluripotent stem cells (iPSCs) are promising starting materials for several clinical and industrial applications in cell therapy production, drug discovery, and in vitro screening. But as I learned from Maxime Feyeux (cofounder and chief science officer of TreeFrog Therapeutics in Bordeaux, France), such cells are a relatively new option in the toolbox of cell therapy developers. Advanced-therapy products can require controlled proliferation and differentiation of millions or even billions of iPSCs depending on the clinical indication, he pointed out, yet culture methods and technologies for their stable mass production remain in early development stages (

1, 2

). Thus, drug developers working with iPSCs today must choose between scaling out production using stacks of two-dimensional (2D) culture vessels or...

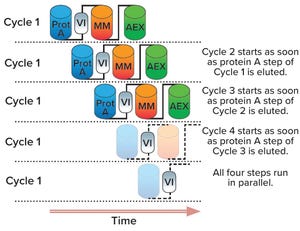

The biopharmaceutical industry generally acknowledges that upstream and downstream aspects of drug-substance manufacturing are experiencing a capacity mismatch. Today, many recombinant proteins can be produced at expression titers of 3 g/L, with some yields exceeding 10 g/L. Such titers represent 100-fold increases in production capability compared with values from twenty years ago (

1, 2

). Increases in cell-culture density and improvements to perfusion-mode bioreactor systems hold promise for increasing yields further still. Such developments, combined with the broad availability of concentrated fed-batch options for both pilot- and commercial-scale production, now require downstream teams to process harvests ranging from 5 kg to 40 kg per batch (

1

). Despite improvements to chromatographic media capacity and membrane performance, however, downstream operations have not experienced corresponding gains in productivity. And whereas process intensification efforts are helping to reduce facility requiremen...

Large-scale production of adenoassociated virus (AAV) vectors at Takeda’s 1,000-L good manufacturing practice (GMP) gene therapy facility in Orth, Austria.

Adenoassociated virus (AAV) has emerged as the leading vector for gene therapy delivery. Compared with options such as lentivirus and adenovirus, AAV exhibits a strong safety profile because it has low pathogenicity and requires a helper virus to replicate. AAV is also capable of long-term gene expression, and it can infect both dividing and nondividing cells (

1–5

). Developers of advanced therapies have found such advantages to be quite attractive. As of January 2021, two gene therapy products have gained US Food and Drug Administration (FDA) approval: Luxturna (voretigene neparvovec) from Spark Therapeutics and Zolgensma (onasemnogene abeparvovec) from AveXis/Novartis. Both products use AAV vectors (serotypes 2 and 9, respectively), as do many candidate therapies moving through clinical studies. Cost-effective AAV manufacturing remains elusive, howe...

Subscribe to receive our monthly print or digital publication

Join our 70,000+ readers. And yes, it's completely free.