Good Manufacturing Practice in China: Equipment Strategy and Quality Management to Compete with the WestGood Manufacturing Practice in China: Equipment Strategy and Quality Management to Compete with the West

June 12, 2019

Although the concept of good manufacturing practice (GMP) was created about half a century ago in the United States, the history of GMP biomanufacturing is relatively short in China, with the first version of GMP rules issued by the Ministry of Health in 1998. In 2010, the ministry issued its fourth version of China’s GMP rules, which came into effect in March of 2011 (1). According to a recent report from BioPlan Associates, the 2010 version raised the standards to be met by biopharmaceutical developers in China significantly, pushing the country to make rapid progress in its overall pharmaceutical manufacturing standards (1).

(HTTPS://STOCK.ADOBE.COM)

From Quality by Test to Quality by Design

When China GMP 2010 was issued, the former China Food and Drug Administration (CFDA) — now the State Drug Administration (SDA) — required that sterile production facilities making blood products, vaccines, and so on meet the standards of the new version before 31 December 2013. Existing oral solid-dose preparation facilities were allowed a transitional period of no more than five years to meet those requirements. Promulgation and implementation of the new version of GMP — and subsequent adjustment and improvement of industry practices — have had a significant impact on the growth and development of the pharmaceutical industry in China. According to statistical data released by the SDA in the first half of 2016, one quarter (1,795) of the 7,179 pharmaceutical manufacturers in China failed to pass the newly revised drug GMP certification requirements.

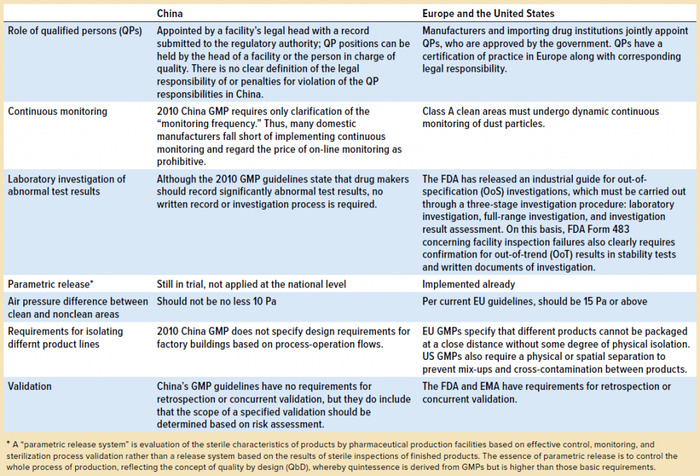

By and large, the requirements of China 2010 GMPs are similar to those of GMPs in the European Union and consistent with with requirements from the China 2010 GMP’s 14 chapters, 313 articles, and five appendices. However, some gaps remain, as listed in Table 1.

Table 1: Gaps between good manufacturing practices (GMPs) as defined in China’s 2010 and EU/US regulations

Like similar initiatives of the US FDA, European Medicines Agency (EMA), and International Council on Harmonisation of Technical Requirements for the Registration of Pharmaceuticals for Human Use (ICH), China’s 2010 GMP guidelines transform quality management of the pharmaceutical industry from something simply measured through testing to quality achieved through process design and monitoring. Drug quality used to be evaluated based on the results of a quality test report. Certain volumes of products would be sampled for analysis, and whether those sampled products could reach specific standards or thresholds served as the basic criteria for determining their qualification. That methodology has major weaknesses such as the possibility of sampling bias and delays in determination of a product’s actual quality when sampling is performed after deviations occur.

At the start of this century, the FDA put forth the concept of assessing and determining a product’s quality by design (QbD). That is defined as a systematic research and development (R&D) method based on reliable science and quality risk management to set objectives in advance with a focus on understanding both product and process and controlled manufacturing to ensure results of specified quality. The 2010 China GMP guidelines also support the QbD paradigm by clarifying that a quality control system covers the entire process of pharmaceutical design, R&D, production, testing, storage, shipment, and use — and that key quality properties and process parameters are determined through overall scientific, reasonable, and systematic test solutions during the design and R&D phases of a drug product’s lifecycle.

This is intended to ensure continuous stability of production processes and steady reliability of pharmaceutical product quality.

The core of the 2010 China GMP guidelines is quality risk management, a systematic process for evaluating, controlling, and reviewing the quality risks of a medicine throughout its lifecycle by introducing ICH Q9 and Q10 guidelines to reduce and control risks to ensure quality (1–3).

Equipment Strategy and Quality Management Improvements Needed: The four elements for compliance with GMP guidelines include hardware, software, human resources, and standard operating procedures (SOPs) and other set procedures based on comprehensive process and product-quality–related risk assessments and process controls.

In recent years, many large and luxurious bioprocessing facilities with cutting-edge equipment have been built in China. A wave of biosimilar/biobetter versions of monoclonal antibody (MAb) therapeutics has increased implementation of single-use technology, which can speed up development significantly in early clinical product stages. Although at initial groundbreaking these plants are well designed and filled with highly advanced automation equipment, many of them need to make improvements in information technology design for incorporation into their production processes.

Currently laboratory-information management systems (LIMS), quality management systems (QMS), and enterprise resource planning (ERP) systems all are part of regulatory compliance. But many managers still need to learn to understand the functions of such systems. Most companies in China do not have dedicated groups of designers who are familiar with GMP (bio)pharmaceutical production, the regulations of computerized systems in this industry, or large-scale process flow and quality management of relevant system software. All are needed to ensure that process design and equipment selection can be controlled from the very start.

Manufacturing execution systems (MES), also known as production management systems (PMS), are especially needed by domestic Chinese pharmaceutical companies. These systems are implemented at production sites for manufacturing efficiency, and they provide a two-way information exchange connecting operations and to company management. With functions such as tracking, supervision, and control, MES data-acquisition methods offer stronger real-time performance, higher accuracy, and more integrity than a traditional manual data acquisition approach can give. A company’s MES can provide immediate processing in the form of electronic data when onsite events happen and integrate and store related information in the database afterward. The system can monitor the latest status and historical process of manufacturing units as well as the latest state of a production run, process specifications, and specified production targets in real time — all of which can increase overall production efficiency significantly.

ERP systems provide MES with production information, including product name, production quantity, product lot number, and so on. The MES subsequently feeds back real production data related to production cycle and process, costs, finished product qualities, production quantities, and other parameters. In combination with the enterprise system and operation software, MES makes the “black-box operation” of traditional production management more transparent and can help company managers find problems affecting the product quality and costs.

(HTTPS://STOCK.ADOBE.COM)

Aside from software, talent shortage is creating another bottleneck in raising the manufacturing standards of China’s biopharmaceutical industry. A recent boom in the development of MAb therapeutics highlighted the challenge associated with a lack of experience in quality management. Chinese biopharmaceutical companies have only limited quality management experience, and returnees coming from the West are overwhelmingly R&D scientists who have little experience in GMPs and quality management. An overall lack of GMP manufacturing-related experience hinders hundreds of biopharmaceutical companies in China from making the transition from leading R&D organizations with early stage drug candidates into commercial biopharmaceutical manufacturing and marketing companies.

Most Chinese biotechnology companies that truly understand the importance of quality management are investing in high-quality product development infrastructure. But a shortage of experienced GMP and quality professionals also has created opportunities for technical services: from all-encompassing biopharmaceutical service providers, biopharmaceutical companies that can open their GMP facilities for contract manufacturing services, and contract quality organizations (CQOs) that provide tailored quality management services to companies needing to upgrade their GMP compliance. A CQO provides quality staff based on the specific needs of a client company, develops quality strategies, and leads quality system implementation. Thus, it can be of great help to many small and medium-sized Chinese biotechnology companies in ensuring quality and compliance during product development and initial product launch, particularly those without enough resources to build up their own quality management teams. I predict that specialized quality service providers — both contract research organizations (CROs) and some contract manufacturing organizations (CMOs) — will grow in number and contribute significantly to China’s booming biopharmaceutical sector.

Opening Up to the World

In June 2017, China announced its new status as a formal member of ICH, which gives the country a position to participate in global drug-regulation harmonization. Although widely regarded as a signal that China will be more open to drugs developed by multinational corporations, this strategic move also highlights the country’s ambition to export pharmaceuticals overseas. The 15th annual report on biopharmaceutical manufacturing capacity and production from BioPlan Associates showed that most Chinese pharmaceutical companies would like to export their products in the next decade (4). Meanwhile, China-based CMOs are striving to win commercial manufacturing deals from multinational clients.

However, whether the international biopharmaceutical industry and regulators will deem GMP manufacturing by Chinese drug companies to be compatible with US/EU GMP regulations remains untested. China definitely will make progress in that direction, but it may be unable to compete with the West in the near future unless significant improvements can be made in needed software, human resources, and service-company support in adopting quality management systems.

References

1 Langer ES, et al. Advances in Biopharmaceutical Technology in China, 2nd Edition. BioPlan Associates, Inc. and Society for Industrial Microbiology and Biotechnology: Rockville, MD, Fairfax, VA, November 2018; www.bioplanassociates.com/china.

2 ICH Q9: Quality Risk Management. US Fed. Reg. 71(106) 2006: 32105–32106; https://www.ich.org/fileadmin/Public_Web_ Site/ICH_Products/Guidelines/Quality/Q9/ Step4/Q9_Guideline.pdf.

3 ICH Q10: Pharmaceutical Quality System. US Fed. Reg. 74(66) 2009: 15990– 15991; https://www.ich.org/fileadmin/ Public_Web_Site/ICH_Products/Guidelines/ Quality/Q10/Step4/Q10_Guideline.pdf.

4 Langer ES, et al. 15th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity. BioPlan Associates, Inc.: Rockville, MD, April 2018.

Vicky (Qing) Xia is senior project director at BioPlan Associates, Inc., 2275 Research Boulevard, Suite 500, Rockville, MD 20850; 1-301-921-5979, fax 1-301-926-2455; [email protected], www.bioplanassociates.com.

You May Also Like