Improved Downstream Technologies Are Needed to Boost Single-Use AdoptionImproved Downstream Technologies Are Needed to Boost Single-Use Adoption

May 1, 2011

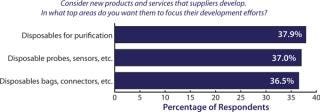

Greater adoption of single-use systems in biomanufacturing is going to require downstream device innovation. To get there, over a third of the biopharmaceutical industry is demanding that suppliers innovate and develop new single-use purification devices, according to BioPlan Associates, Inc.’s annual survey of biopharmaceutical manufacturing capacity (1). Such new products would create exceptional opportunities for innovators. However, calls for new, more fully integrated single-use technologies and processes will require more adventurous innovation on the part of biomanufacturers and their suppliers. In our study, we evaluated 21 key areas of industry innovation (see the “Survey Methodology” box). Among more than 350 qualified biomanufacturers surveyed in 31 countries, the need for new disposable devices topped the list again in 2011 (Figure 1), and made up the largest individual grouping of new products. In addition, purification or separation products were the second most frequently mentioned grouping of new product or services. What’s more telling is that the segment of the industry looking for single-use downstream devices grew by 8% over the past year.

Figure 1: ()

In Budgeting for Downstream, Single-Use Tops the List

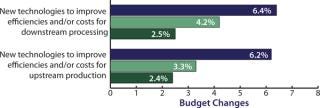

Biopharmaceutical companies are not just wishing for new products. To match their interest in downstream innovation, they are also increasing their own budgets for downstream improvements. In fact, our study shows that “new technologies to improve efficiencies/costs for downstream production” this year received the highest budget allocation increase, nearly tripling the growth rate from a 2.5% increase in 2009 during the lean years of the recession to a (seriously) whopping 6.4% average industry increase this year (Figure 2). It seems that global biomanufacturers are ready to spend for improved downstream performance, and they are especially interested in single-use innovations. This is primarily because disposables are increasingly viewed as highly viable candidate technologies for alleviating downstream bottleneck constrictions.

Figure 2: ()

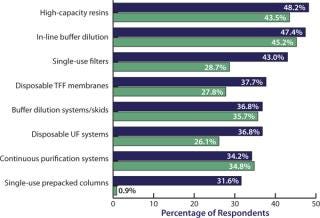

We evaluated 21 new downstream technologies that respondents are considering currently and compared this year’s responses to those from last year. Although we see strong, steadily growing interest in high-capacity resins and in-line buffer dilution systems, the most rapid growth area of interest has been in single-use prepacked columns, which rose from single digits last year to 31.6% this year (Figure 3). Disposable filters are growing rapidly too, as are disposable UF systems (from 26.1% last year to 36.8% this year).

Figure 3: ()

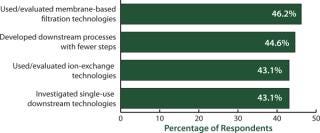

Downstream bottlenecks continue to be the largest source of capacity constraint today. When we asked biomanufacturers how they were dealing with the problem, we found that evaluating single-use downstream technologies was high on the list of potential solutions (Figure 4). Disposable devices for downstream purification are under active consideration by >43% of biopharmaceutical manufacturers to reduce their downstream bottleneck problems. We asked, “Within the past 12 months, which (activities) has your organization implemented to improve downstream purification?” Among the top 10 factors indicated, disposables for downstream purification tied for third with “used or evaluated ion-exchange technologies.” And significantly, those came in just a few percentage points below the top two considerations: “used or evaluated membrane-based filtration technologies” (46.2%) and “developed downstream processes with fewer steps” (44.6%).

Figure 4: ()

No Quick Fix

Incremental improvements in manufacturing are important. But real growth will come when single-use technologies span the manufacturing spectrum to include downstream production: when all portions of the costly and difficult downstream purification and separation steps can use disposable or modular devices. Single-use downstream unit operations are becoming available from manufacturers as independent modules at client sites and at contract manufacturing organizations. For now, downstream production using disposables continues largely to be a hybrid solution of stainless steel and disposables.

This year’s study shows that suppliers of single-use devices clearly have a financial motivation to create single-use downstream devices. Most of their products reflect incremental improvements that mimic existing stainless steel components, but many vendors have successfully developed new and innovative products. The challenge continues to be getting novel, emerging devices into commercial processes. Much focus today is on the necessity to standardize design and manufacture of disposables. “Most single-use device manufacturers have the ability to innovate beyond their current product offering,” says Ken Bibbo (vice president of operations at HyNetics Corporation). “However, we as an industry sector are not being challenged by the end users for innovation, but r

ather towards harmonization and standardization.”

Many of today’s single-use products are scaled-up versions of other medical and laboratory devices, such as intravenous (IV) solution bags. Those were not developed specifically for pharmaceutical processing. Truly novel devices or material sciences have yet to play a major role in the next generation of single-use devices. Because new product development is so costly, most vendors are hesitant to move out too far in front of the biopharmaceutical industry with radical new solutions. Although vendors must listen to the industry they serve, Christopher Smalley (associate director of biosterile validation at Merck) says, “Suppliers of single-use devices have responded …. to many of the biopharmaceutical industry’s issues, [but] it is the responsibility of the industry to clearly communicate what is needed beyond saying that they would like to replace reusable stainless steel tanks and fittings.” Smalley is convinced that, when given reason, single-use device suppliers will respond quickly.

Bringing new product innovation to market in this industry can require deep pockets, but many industry suppliers see the importance and are willing to take the risk. Paul Priebe (director of fluid-management technologies at Sartorius Stedim Biotech) believes that over time there will be greater focus on “more fundamental improvements to single-use solutions. The supplier base is quite varied, with at least a few major players with significant R&D budgets. Clearly we will see continued innovation in single-use solutions.”Getting New Products into a Conservative Industry

Overcoming inertia for new product acceptance in any industry can be tough, and in the biopharmaceutical industry it can be painfully slow. Providing strong data on functional performance is a start, but often not enough. Bibbo, for example, has experience introducing several radically new single-use devices that were not well embraced by end-users. “These innovations were focused on production-scale single-use processing,” he explains, “where the market had not yet migrated. Moreover, [even today] the end-user community is not pushing for anything ‘outside the box,’ so many new products or ideas cannot be tested outside our own laboratories.”

Smalley summarized the imperative for innovation and the need to constantly innovate, “The industry no longer makes insulin the same way we did in the 1940s; we have innovated the product structure and delivery systems to improve patient outcomes. We must innovate to constantly improve quality.”

Clearly, though, regulatory hurdles in Western markets continue to play a large strategic role in how quickly single-use solutions are developed and implemented. It may well be up to regulators at the US FDA and the EMA in these developed markets to set the pace for innovation in new materials. In fact, some people in the biopharmaceutical industry believe that the real drivers for change may come from emerging markets. For example, Doug Neugold (ATMI’s chief executive officer) believes that a lot of fundamental innovation will be adopted by necessity in, “capable countries like China and India, where they have a different expectation for cost to treat people …. [and] the drive for economy and efficiency is relentless.” Neugold believes outsiders are usually the disruptive ones. Regulators and new companies in emerging markets will no doubt be more willing to deploy new and perhaps disruptive approaches to innovative technologies.

A Need for Revolutionary Downstream Devices: Today, integrating downstream single-use systems into commercial processing is limited by many factors such as scale, flow rates, pressure, temperature range, and construction materials. Drivers of innovation for disposables are only now expanding beyond the most common applications such as mammalian cell systems. Bibbo notes, “Having built hundreds of stainless-steel–based systems for food, pharmaceutical, and biotech processing as an emerging technology, we have yet to address commercial-scale GMP manufacturing …. But the end-user community is not willing to test beyond what has been in place for close to 20 years.”

Current devices, tubes, bags, bioreactors, and materials adequately meet the needs of most R&D and scale-up production. However, many people feel that the requirements for downstream, commercial-scale, GMP manufacturing processes with disposables have not been met. That may be partly because users often don’t often perceive a need before an innovative product is introduced. Jerold Martin (senior vice president of global scientific affairs in biopharmaceuticals at Pall Life Sciences) says, “Prior to regulatory challenges for cleaning and cleaning validation, there was little perceived need for single-use systems ….It took the suppliers to come up with these solutions and a lot of pioneering to convince users and regulators the new approach was a viable solution.”

SURVEY METHODOLOGY

This eighth in a series of annual evaluations by BioPlan Associates, Inc. yields a composite view and trend analysis from 352 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 31 countries. The methodology encompassed an additional 186 direct suppliers of materials, services, and equipment to this industry. This year’s survey covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the United States and Europe.

Most existing single-use products have limited applications in commercial-scale GMP manufacturing because of a lack of “start-to-finish” integration. This is changing, however, as the integration of a number of downstream single-use devices is being evaluated to solve bottleneck problems. Mani Krishnan (director of single-use processing systems for EMD Millipore) says that today, many companies have to “go to stainless steel or hybrid systems …. due to single-use system performance limitations of separations/purifications technologies such as chromatographic media, virus filters, UF/DF cassettes, and so on. We are slowly increasing our knowledge base, [and] it is highly likely that we will see the need for different materials or processing/handling methods for such applications.”

Priebe is optimistic, “The readiness of single-use technologies for commercial-scale GMP manufacturing depends on the process. Many vaccines could certainly be nearly 100% single use, and …. it could be argued that MAb production is nearly achievable in an (almost) entirely single-use process. Chromatography columns remain reusable, with few exceptions due to economics.”

Where Are Improvements Most Needed? This year’s BioPlan study shows that the largest unmet need in bioprocessing is for lower-cost single-use chromatography and ultrafiltration. In addition, general industry consensus points to a continuing need for improvements in single-use sensors, larger-bore disposable sterile connectors, better high-pressure applications, higher–flow-rate pumps, improved cost of commercially available connectors and tubing, higher-capacity single-use pumping, better device handling, manual or automated valves, improved process automation, better bioreactor design, applications for bacterial fermentations, standardization of materials and design, higher levels of supply chain security, faster delivery, global material and specification standards, and co

mplete “start-to-finish” single-use products with scale-up possibilities. An Inventive Future

Demand for better downstream processing continues, as it has for the past five years. The industry has shown energy and initiative for developing innovative disposable devices and systems, but only a few are novel disposable reactors and viable single-use sensors. Critical gaps remain: in particular, a need for complete “start-to-finish,” scalable, easy-to-implement, single-use technology product lines. In some ways, single-use technologies today are already revolutionary, and we are just beginning to realize the potential applications.

As the biomanufacturing industry matures and gains experience integrating disposables in all areas of manufacturing, the track record of single-use technology will allow it to be more rapidly integrated into overall manufacturing processes. Advancing disposables acceptance, including the steps of standardizing and creating simpler devices and processes, will require industry coordination and cooperation. Substantial growth is likely to require a plug-and-play approach to managing product design and innovation. This will increase not only where disposables are implemented within a process, but more broadly where they are used geographically and among what different technology platforms. Vendors are working toward GMP manufacturing for the most rapid growth in single-use devices. Trends toward new technology integration, increased budgets for new technologies, and greater coordination of industry innovation suggest that advances in new single-use device development paired with broadening user knowledge will help ensure long-term growth and faster adoption in this industry segment.

About the Author

Author Details

Eric S. Langer is president and managing partner of BioPlan Associates, Inc., 2275 Research Boulevard, Suite 500, Rockville, MDMD 20850; 1-301-921-5979, fax 1-301-926-2455; [email protected], www.bioplanassociates.com. He is editor of numerous studies, including Advances in Large-Scale Biopharmaceutical Manufacturing, and publisher of several industry reports.

REFERENCES

1.) 2011.Preliminary Data 8th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, Inc., Rockville.

You May Also Like