- Sponsored Content

- Gene Therapies

Roundtable Discussion — Recombinant Protein Manufacturing: Lessons to Be Taken from the Emerging Cell and Gene Therapy SpaceRoundtable Discussion — Recombinant Protein Manufacturing: Lessons to Be Taken from the Emerging Cell and Gene Therapy Space

August 24, 2022

Sponsored by WuXi Advanced Therapies

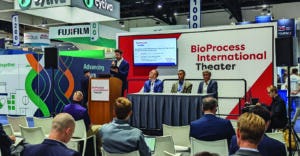

Moderator Dan Stanton (BioProcess Insider) with Christopher Peterson (Latham BioPharm Group), Neal Gordon (BDO), and David Chang (WuXi Advanced Therapies)

Dan Stanton (cofounder and editor of the BioProcess Insider) opened the BPI Theater at BIO with the first panel discussion of the week. He noted that current news focuses on overcoming manufacturing issues that impede bringing cell and gene therapies to market and, crucially, producing them in the most cost-effective ways possible. By comparison, the first monoclonal antibody (MAb) product was launched in 1986, so after 35 years, much progress has been made in the traditional biologic space toward making processes more efficient and overcoming bottlenecks. But Stanton raised the prospect that perhaps the hundreds of millions of dollars being pumped into advanced therapy production could have implications across the wider field.

Stanton was joined by panelists David Chang, Neal Gordon, and Christopher Peterson. David Chang is CEO of WuXi Advanced Therapies, the advanced therapies unit of WuXi AppTec. He has worked in biotechnology for 30 years, about two of those with WuXi Advanced Therapies. Neal Gordon is the managing director of a CMC consultancy formally known as BioProcess Technology Consultants, but now a part of BDO. He was trained as a chemical and biochemical engineer. Beginning with work at emerging life-science start-ups, his experience spans work on cancer vaccines and, more recently, novel delivery technologies for cell and gene therapies. Christopher Peterson, also a chemical engineer, has 15 years of experience in vaccine manufacturing at large pharmaceutical companies. In the past six years at the Latham BioPharm Group he has supported clients developing recombinant therapies, and he provides strategic consulting work for cell and gene therapy companies.

Identifying the Bottlenecks

Stanton began by asking the panelists to identify where the biggest bottlenecks reside in both recombinant protein manufacturing and in the cell and gene therapy space.

Chang: Before we start with technology bottlenecks, we should look at the shortage of talent as creating the biggest bottleneck overall. I thought that after 30 years the entire industry would have built a solid “people pipeline” from which top talent could drive innovation. I thought our gene and cell therapy businesses could benefit from that. But with fast growth in the gene therapy space, the technology has been caught red-handed. Products are moving quickly into clinical phases, but our corresponding manufacturing and testing technologies cannot keep up.

Gordon: Another bottleneck we’re all facing is the supply chain. It’s like real estate, right? Location, location, location. Bottlenecks are not found just in terms of sourcing materials and long lead times, but in long waits for manufacturing slots. From a technology perspective, the biggest bottleneck lies in not knowing how a cell or gene therapy relates to the biology. If we don’t really know what the molecules are, how to measure what we need to measure, and how to control a process, it makes manufacturing extremely challenging.

Peterson: The final large bottleneck that we’ve been struggling with is created by the need to increase the yields in downstream purification for non-MAb recombinant proteins and gene therapy viral vectors. We face increased characterization and analytical requirements, as well, especially in the gene therapy space, but we have limited material from which to derive relevant information.

Processing Comparisons

Stanton: How do downstream purification processes differ from one another for MAb and gene therapy production?

Gordon: On the downstream side, when recombinant proteins first came out, we weren’t talking about antibodies. But because of the commercial successes and the number of products in development and on the market, we’ve all migrated to platform processes. How any new product gets handled is typically driven by the requirement for speed. Everyone wants to get into the clinic in one year or less. We always start with a platform process. But a lot of nonantibodies just don’t perform well. So it isn’t only a matter of not being able to, say, use protein A for capture, but doing efficient screens across multiple different types of media, determining what conditions you want to screen against. But that is all designed around antibodies and forms one big bottleneck.

In the cell and gene therapy area, downstream is challenging partly because we don’t have an experience base to draw on. For example, when we get to lentiviral vectors and work involving whole cells, those are very large entities. Most chromatographic supports that work well for antibodies or smaller molecules don’t translate that well when you need to purify much larger solutes. Sterile filtration of lentiviral vectors also becomes challenging.

Chang: For upstream, our current industrial best practice [for viral vectors] is to use a transient expression system — and 30 years ago, that was the technology we used for generating quick and dirty laboratory material. Sad to say, that’s our current standard practice. To develop an upstream production system for both AAV and lentiviruses that is scalable economically and reliable operationally is a current challenge that needs to be met. We know that the transient expression system can get us through to proof-of-concept, but to make manufacturing commercially feasible, I doubt that the supply chain for current production systems can catch up with the demands from companies transitioning from research grade to good manufacturing practice (GMP) materials.

Gordon: In fairness, the biology is more complex for CGTs than it is for antibodies. So I hope we’ve learned enough over the past 30 years that we don’t need another 30 to get to an equivalent time point for cell and gene therapies. But such products present more challenging problems, as well.

Driving Innovation

Stanton: Are we seeing innovation in the cell gene therapy space being reflected back into the recombinant protein space?

Peterson: I have seen the opposite, where some groups could not gain traction with a recombinant protein or MAb. Now they are choosing the pathway of the gene therapy space because there is more innovation there to provide an alternative to a platform process.

Gordon: A lot of the complicated mechanism-of-action and novel potency assays and cell-characterization tools are equally applicable to traditional recombinant protein analytics. This is especially true when considering potency and novel potency assays and measurements made in the clinic, whether it’s through the use of biomarkers or other markers of clinical efficacy on a cellular basis.

Chang: Right now the industry workhorse is disposable technology. The antibody manufacturers have been developing single-use technologies for the past 10–20 years, with many established suppliers to make it happen. We wouldn’t have such mature disposable technologies for cell and gene therapy processes without that work from the MAb companies.

Cell and gene therapy manufacturing also demands new regulatory requirements. For example, for autologous CAR-T therapies, you require a chain of identity and chain of custody. Such information is not that critical for recombinant proteins made in batches. So electronic and technical/scientific advances made by the cell therapy industry will come back to revolutionize the recombinant protein industry.

Changing Attitudes

Stanton: Neal, have you seen attitudes change regarding technologies being embraced by either side of the industry?

Gordon: I think everyone now expects that the speed at which drugs and vaccines can get approved will apply to all product areas. But you have to take a pragmatic look at all the different steps in a process. What is rate limiting, what is feasible, and what isn’t?

You can’t work at that same pandemic speed without tremendous investment. If it weren’t for all the government money that went into [development of COVID vaccines and therapeutics], I don’t think it would have happened. Another factor was the tremendous amount of collaboration. I hope that will continue, but it is not guaranteed in such a competitive industry. A third important aspect is how quickly a company can run a clinical trial to show proof of efficacy. In our recent experience, the SARS-CoV-2 virus infected so many people so quickly that we had enough cases in a totally unprecedented timeframe to be able to stop the trials and read out the results. That became a double-edged sword because then people who are not scientifically trained and/or who don’t look into the details are saying, “Wait a minute. Something strange is going on here. There must have been short cuts because things don’t happen this quickly.”

Cost may not be a huge driver for innovation unless it’s an absolute necessity and you won’t have a product without it. The high cost of a CAR-T therapy is because it’s an autologous product and process. But an allogeneic approach, even if it uses the same manufacturing paradigm and testing, will treat more patients with one batch and will be much less expensive. So the industry needs to address cost concerns beyond trying take a few dollars out of a manufacturing process.

Chang: Another consideration is cost of goods (CoG). I remember making one MAb for about $1,000 per gram. Right now, 20 to 30 years later, we make antibodies for $50 per gram, $20 per gram. That contributes to making antibody therapeutics widely accessible — still not cheap, but good enough that healthcare agencies will pay for them. But when we consider the $2 million cost for a gene therapy treatment, it isn’t that its manufacturer wants to charge that much. It’s just really expensive to make such a product. To charge a half million to $2 million dollars for it does not ensure patient accessibility. Do I believe those costs will be reduced? Yes, I do. But that process for therapeutic proteins has taken 20 to 30 years. We just don’t have that much time to establish a viable cell and gene therapy industry.

Stanton: So is the industry at somewhat of a stop-gap before the more scalable and theoretically cheaper-to-produce allogeneic products reach the approval stage?

Gordon: That’s one of many components. But part of the issue with viral vectors is that the amount we can make upstream is pretty low. If you look at cost reductions in antibodies, a lot of that was driven just by setting higher expression in some cells. The other side is that the dose requirement is extremely large. If you think about it, the number of particles you need to get an infective transduction in vivo is tremendous. It’s a numbers game. So how do you make particles that are more infectious? How do you deliver those particles into the cells more efficiently? These all are the steps along the way that will help bring down the costs in addition to lowering manufacturing costs.

Peterson: And it won’t work when it’s one batch per patient.

The Benefits of Automation

Chang: I think we still need to face reality. Autologous CAR-T is a proven therapy, but we still need to optimize that process toward reducing the COGs. If we can reduce labor costs using automation and reduce the COGs for raw materials, especially for lentiviruses, we would be reducing a large portion of those costs.

Stanton: Automating systems and reducing labor all are principles of what is called Bioprocess 4.0, which has been a topic in the antibody space for many years. Are you confident that the push for automation and improved analytical systems and data will be well applied in the cell and gene therapy space?

Peterson: Such tools have to be applied in the cell and gene therapy space given the lack of a platform process that performs well upstream and enables predictable downstream benefit.

Stanton: Who’s leading the drive? Is it the cell and gene therapy developers themselves, or does the industry rely on bioprocess companies and CDMOs to implement new automation systems?

Chang: Benefits of Industry 4.0 already are affecting manufacturers of recombinant proteins and small molecules. But the challenge is not in automating separate steps, but in automating transitions from one unit operation to the next. If those steps are not integrated and fully automated, the most difficult task is directing a robot arm to transition from one unit to another. The benefit of automation will be reduced if those two steps are not integrated.

Gordon: The need is for fully closed processes because you can’t sterilize your cells after processing. But it is expensive to run an entire process aseptically, especially when you have open operations. Once a process is fully closed, then automation can facilitate doing it over and over again. But an automated process still has risk of contamination. I’m not sure what problem we’re solving if we are using automation for automation’s sake.

Chang: Product owners and suppliers of equipment/raw material should consolidate their individual domain knowledge. That is an excellent opportunity for CDMOs in the cell and gene therapy space. They not only have experience working with different product types under conditions of confidentiality, but they also can partner with suppliers of equipment and raw materials.

Peterson: Especially in the cell and gene therapy space, CDMOs are becoming a lot more flexible and taking on new technologies. They are beginning to integrate technologies and bring in suppliers to test them out. It’s different from our experience in the MAb space, for which platform processes have been developed.

Gordon: I spent a couple of stints in my career on the vendor or tool side. One of the things that always struck me is that we always got enamored with our technology. But at the end of the day, one of the things that we all have to appreciate — no matter which side of the fence we’re on — is that technology itself isn’t really as important as the solution that it provides.

My biggest advice to manufacturers and suppliers is to focus on the solution they are providing and to make a case for its economic value. Why is the problem big enough, and why is your solution better than existing options? Then there’s an audience willing to bring it on. I agree that we have to bring all constituents together, but we also have to put technology in its rightful place.

Final Thoughts About mRNA

Stanton: Do you expect mRNA to drive resurgence of the vaccine space — affecting overall bioprocessing technologies — over the next few years?

Gordon: One of the things that I find so exciting about mRNA from the manufacturing perspective is its simplicity. If we can get away from using cells as factories and move toward cell-free synthesis, that would be a huge advance. One reason why the mRNA vaccines became available so quickly is that most of the challenges in terms of how to get them to work, how to deliver them and formulate them, already had been conquered. What was needed was investment into scaling up and manufacturing at a larger scale.

From an engineering perspective, the in vitro translation reaction for making mRNA is simple. It’s a known process using well-characterized reagents and simple downstream purification. So I do think this is going to supplant other products over time if the biology works out. There’s no reason why you can’t use human factories, so to speak, to manufacture in vivo rather than in a manufacturing plant. I think that any technology that is simple has a better chance of being adopted and holding true over time.

Dan Stanton is the cofounder and editor of the BioProcess Insider. David Chang is CEO, WuXi Advanced Therapies; Neal Gordon is managing director, BPTG, at BDO Life Sciences; and Christopher Peterson is associate director, strategic consulting, with the Latham BioPharm Group.

Fill out the form below to view the full BPI Theater panel.

You May Also Like