Top Trends in Global Biomanufacturing: 20 Years of Analyzing Biologics Production and SupplyTop Trends in Global Biomanufacturing: 20 Years of Analyzing Biologics Production and Supply

February 8, 2024

The biopharmaceutical industry continues to grow globally as it recovers from the COVID-19 pandemic. The significant COVID-driven expansion of bioprocessing activities worldwide created supply-chain pressures, availability problems, and delivery delays. Suppliers increased revenues by reducing standard discounts, and contract manufacturers overordered equipment and consumables to reduce their supply-chain risks.

According to the BioPlan Associates 20th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, industry growth is stabilizing, shifting back to previous standards of 12–13% annually (1). However, many subsegments in bioprocessing — e.g., that for single-use (SU) devices — continue to experience post-COVID downturns in growth.

Over the past 20 years, the biomanufacturing industry has shown great adaptability to economic swings and supply-chain challenges. Healthcare tends to be recession resistant, and the biopharmaceutical industry’s resilience comes in part from strong innovation pipelines, advances in novel modalities such as cell and gene therapies (CGTs), and demand for biosimilars in emerging markets. Technological improvements made by bioprocess suppliers also are helping to streamline production and enable cost-effective bioprocessing globally. Below are some key trends identified in BioPlan’s report.

Top Trends in 2023

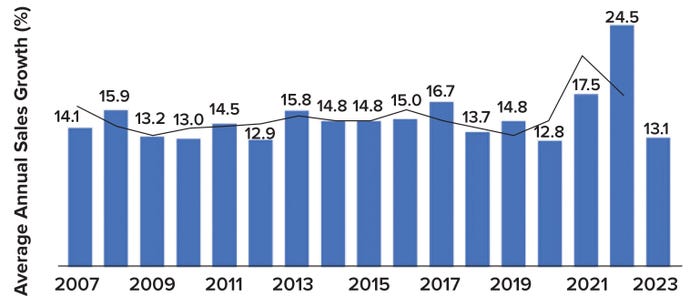

Supplier revenue growth rates almost doubled during the COVID-19 pandemic. In 2023, the average biopharmaceutical-industry supplier reported a return to normal revenue trends (Figure 1). However, because survey respondents tended to represent companies much smaller than most of the industry’s primary suppliers, the unweighted “average” revenue change better reflects the experiences of smaller companies. Suppliers estimated overall growth in bioprocess-related sales by a rate of 13.1% in 2023, down from 24.5% in 2022. The industry is adjusting to the end of extraordinary growth during the COVID period and has returned to an annual growth rate that aligns with trends from the past 16 years.

Figure 1: Growth in vendor sales for biologics from 2007 through 2023, as represented by an annual average growth rate with a two-period moving trend line; unweighted data come from reference (1).

COVID-related supply-chain worries have yet to abate. We asked vendors how the COVID-19 pandemic was affecting their businesses. The most common response was that they (not unexpectedly) were spending more time than ever addressing customers’ supply-chain concerns. In 2023, 85.5% of suppliers reported having that experience. In effect, the pandemic has created a long-term drag on industry suppliers. Amid increases in both demand and supply-chain problems, manufacturers’ fears about unavailability of supplies are influencing the entire biopharmaceutical pipeline. That problem is expected to continue causing disruptions, at least into the coming year.

Respondents identified 14 key areas for development of new upstream bioprocess products and technologies. In 2023, the top three areas related to upstream production were cell-culture media, bioreactors (especially in SU formats), and information technology (IT), including automation, software, and networking. The number of respondents interested in IT solutions increased from 21.1% in 2022 to 29% in 2023.

Demand continues to increase for low-cost SU devices. Over the past 15 years and especially for clinical-scale operations, SU bioprocessing devices such as bags, tubing, bioreactors, and mixers have taken a leading position over stainless-steel formats for biomanufacturing equipment. When COVID-19 created serious availability problems, cost concerns dissipated. Now, as the pandemic abates, the industry is returning its focus to cost. Respondents identified lower-cost SU devices as the most important area of interest for new products and technologies in 2023.

Cost per gram for recombinant proteins continues to decline. The overall cost to manufacture recombinant proteins has decreased steadily for the past five years. BioPlan has observed a 29.5% decrease over four years in total cost per gram of antibody — partly the result of continuing improvements in process efficiency and productivity.

Five-year capacity constraints are predicted to decrease despite COVID-19. In 2023, only 17.2% of respondents expected “severe” or “significant” capacity constraints within five years. That figure is down from 21.7% in 2022 and continuing along a downward trend. The number of companies expecting no capacity constraints over that period remains about the same as last year.

Automation is needed to minimize capacity constraints. Respondents identified 27 ways in which they might prevent capacity constraints. Among the most important solutions selected was to add automation capabilities, as indicated by 34.5% of respondents.

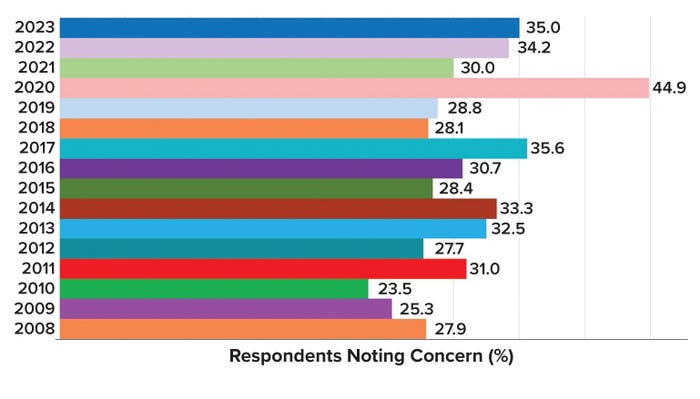

Biomanufacturers and suppliers have been unable to hire and retain both new and experienced production staff. Survey respondents identified several major factors that they expected would constrain their facilities’ biologics production capacity over the next five years. Of the 22 factors evaluated, the most critical staffing factor involved finding both new and experienced technical and production personnel (Figure 2). Continued growth in capacity demand at both new and existing biomanufacturing facilities is impeding efforts to train and retain manufacturing staff.

Figure 2: Percentage of BioPlan survey respondents who cited the “inability to hire new and experienced technical and production staff” as a likely constraint on biomanufacturing capacity over the next five years (1).

Gene-therapy manufacturers critically need better analytical methods and instrumentation. Among the 11 factors being evaluated, gene-therapy companies identified virus/vector analytical testing as needing the most improvement. That factor also showed the most dramatic increase in importance, with 46.7% of respondents indicating need in 2023 compared with 22.7% in 2019.

Applications of disposable equipment proliferated significantly between 2006 and 2023. Disposables uptake has grown relatively steadily in nearly all areas of biopharmaceutical manufacturing and for a breadth of applications. This year, more than half of the 16 applications measured showed moderate or large increases in use. “Bags, empty” took the top position again this year, with 93.9% of respondents indicating their use of such disposables (up from 64.5% 17 years ago in 2006). Steady growth in the use of such devices also reflects increases in SU-device uptake more generally.

The United States of America and Germany are today’s top international outsourcing destinations. We inquired about five-year plans for international expansion in biomanufacturing capacity. Of the 36 countries identified as potential foreign (outside a respondent’s country) outsourcing destinations, respondents most often highlighted the United States, with 47.8% of non-US respondents indicating a “strong likelihood” or “likelihood” that they would outsource production to US-based facilities.

Since we started recording data for possible international outsourcing, however, we have observed dramatically increasing interest in China as a potential outsourcing destination.

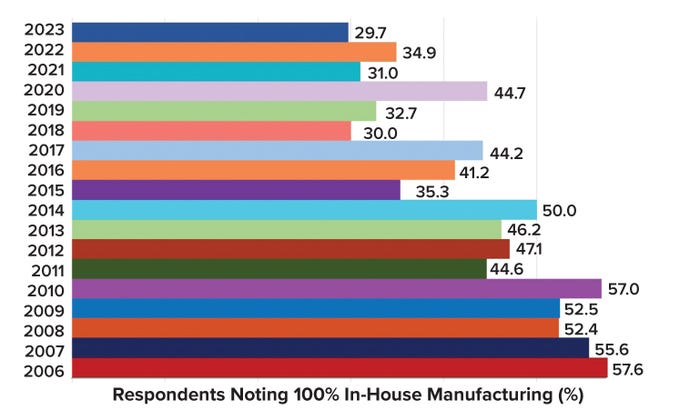

Outsourcing has become commonplace over the past 17 years of biologics production. The percentage of the industry that contracts for manufacturing services is clearly on the rise as fewer drug developers seek to keep their entire production processes in house. That is the case particularly for developers whose products require mammalian-cell culture, with 70.3% of such respondents projecting at least some outsourcing in 2023 (Figure 3).

Figure 3: Percentage of respondent companies that reported performing all manufacturing activities internally, by year (1).

Biomanufacturing offshoring is likely to increase in low-cost regions over the next five years. We evaluated responses from 2011 through 2023 regarding biomanufacturers’ plans to outsource (internationally) at least some of their biomanufacturing operations to low-cost regions. This year, 67.8% of respondents reported that that they would offshore at least some of their biomanufacturing operations to such locations within the next five years. That percentage is up significantly from pre-COVID responses. Consider, too, that 12 years ago (in 2011), only 29.6% of companies believed that they would offshore work to lower-cost regions within five years.

Suppliers and technology developers are working to improve bioprocess automation. Automation is the hottest area of opportunity for vendors’ new-product–development departments. Automation will be critical if the biopharmaceutical industry is to continue maturing and optimizing. We asked suppliers what top new technologies or new-product–development areas their companies were working on. They highlighted 60 areas for work and investment, many relating to improving efficiency. The largest percentage of responses from vendors (of all types) identified automation.

Two-thirds of clinical bioproduction processes leverage SU components. Disposable bioprocess equipment continues to gain industry acceptance because of its advantages for both contract manufacturing organizations (CMOs) and drug developers. Across the board, we observed increased application of SU systems at all production scales, from research and development (R&D) to commercial manufacturing and for both up- and downstream operations. Most notable is that SU equipment was applied in 64.0% of upstream clinical production processes, up from 45.0% in 2021.

Highlighted Developments

Revenue Growth During COVID: Before the COVID-19 pandemic, the biomanufacturing-supply industry grew at an annual rate of ~13–14% for decades. During the pandemic, year-on-year revenues for the average supplier increased by nearly 25%. That near-doubling in growth was experienced fairly broadly across the industry. Now, however, many biomanufacturing suppliers have experienced significant downturns in revenue. In some subsegments, such as that for SU equipment, companies continue to report 20–30% reductions in revenue.

As described above, our annual report points to a reversal of that trend and a return to the more standard growth rate of 12–13%. Note, however, the unweighted “average” revenue change is more reflective of smaller respondents’ experiences than of large suppliers’ experiences. The latter companies made big gains — but then had large downturns.

For the SU and related subsegments, a return to normal growth has yet to occur. When performing research for other reports, we found that most SU suppliers this year have experienced a 21–24% decrease in order volumes. However, such companies also expect a return to normal growth by mid-2024.

The rapid downturn in revenue and order volumes during 2023 has been felt most by segments that experienced rapid increases in revenue. Several factors are implicated in the decline. Manufacturers have begun drawing down safety stocks and inventories that were overordered during the pandemic. Suppliers have returned to standard discounting, a strategy that accounts for some drop in revenue. And new competitors entered the market during the pandemic. Meanwhile, customers are “belt-tightening” in response to economic (e.g., inflation) and political concerns. End users also continue to harbor concerns about supply-chain risks leading to dips in production capacity growth.

However, several factors are driving underlying growth in biomanufacturing operations and supply. New biopharmaceutical companies are developing and/or expanding bioprocessing capacity. New biological products continue to enter clinical trials, and drug-development pipelines remain full. Because numbers of new-product approvals continue to increase, more products are being manufactured. Marketed drugs also are being approved for new indications, leading to a higher volume of products being manufactured. At the same time, aging populations in major-market countries are driving demand for biopharmaceuticals, and the middle class continues to grow in many industrially developing countries. Supporting all of those factors is the ability to manufacture biologics at scales large enough for global populations.

Inability To Hire and Retain Experienced Staff: Manufacturers’ inability to hire qualified operational and manufacturing staff has created production constraints. As it has for the past 15 years, this slow-burning problem continued to expand in 2023. The most critical staffing factor involved is finding experienced technical and production workers. The inability to hire for such roles was noted by 35.0% of industry respondents to our survey. Continued growth in capacity demand at new and existing facilities makes it particularly difficult to train and retain experienced manufacturing staff. Experienced workers sometimes are leaving regions with established biomanufacturing infrastructure for facilities in Asia and regions with emerging capabilities. Rapid growth in the CGT sector and industry responses to the COVID-19 pandemic also have created challenges over the past three years, complicating companies’ efforts to retain stable workforces.

The Continuing Rise of Outsourcing: Over the past 17 years, the percentage of biotherapeutic developers performing all of their production activities in house clearly has trended downward. Meanwhile, the percentage of developers outsourcing such work to CMOs continues to rise.

Fewer companies are performing all of their manufacturing in house. That report aligns with a global trend that we have observed since 2006. The trend reflects the value of external service providers, which have become crucial to the industry. CMOs provide access to production capabilities, flexibility, and staffing that would be nearly impossible for some developers — especially small innovator companies — to establish internally.

A History of Resilience

Both current and historical data support a gradual return to prepandemic growth trends in production-capacity demand and consumables order volumes from suppliers. However, some business analysts are warning about a potential “COVID back-swing,” during which facilities’ inventory-management systems might not align with actual use. If that occurs, another period of transient shortages and delayed shipments could follow.

Nevertheless, the biomanufacturing industry’s rebound from the unprecedented challenges left by the pandemic has showcased its resilience and ability to anticipate future needs. Although subsegments such as that for SU systems continue to negotiate near-term hurdles, the broader biomanufacturing segment has adjusted in ways that demonstrate innovative management and a rich history of adaptation and growth.

Reference

1 20th Annual Report of Biopharmaceutical Manufacturing Capacity and Demand. BioPlan Associates: Rockville, MD, April 2023; https://www.bioplanassociates.com/20th.

Erica L. Friedman is a senior research analyst at BioPlan Associates, Inc. Please send inquiries to Donnie Gillespie, 1 Research Court, Suite 450, Rockville, MD 20850; [email protected]; 1-301-921-5979; https://bioplanassociates.com.

You May Also Like