China Ranked Top Potential Biopharma Outsourcing DestinationChina Ranked Top Potential Biopharma Outsourcing Destination

June 1, 2011

Until recently, China had not been considered a global contender for outsourced biopharmaceutical manufacturing. In fact, it’s been less than a decade since pharmaceutical contract manufacturing in China became legal (1). Yet, the industry now ranks China as the most likely biomanufacturing outsourcing location. According to our recently released study, 17% of the industry considers China as the top future offshore production destination (Figure 1). The BioPlan 2011 Eighth Annual Report and Survey of Biomanufacturing Capacity and Production shows China moving from seventh place last year to first this year — surpassing the United States, which moves to second place with 15.1%.

As the pharmaceutical market expands globally, outsourcing takes on an increasingly seamless international dimension. In the study, we asked respondents to consider their five-year time horizon (lead-up to 2015) and evaluate their facility’s current plans for international capacity expansion (not domestic). The 352 respondents identified 35 countries as potential outsourcing destinations. Following China and the United States as potential international outsourcing destinations were India (13.2% of respondents) and Germany (12.3%).

China’s jump in these rankings indicates active interest in the Asia–Pacific biomanufacturing environment, as well as its potential for growth as domestic pharmaceutical markets expand. With increasing domestic middle classes comes expanded economic clout and greater demand for pharmaceuticals. Changes in Factors Driving Outsourcing Choice

Usually, geographical outsourcing trends reflect availability of contract manufacturing organizations (CMOs), testimonials, and colleague recommendations. However, in China, there are relatively few CMO facilities, and CMOs’ reputations and experiences are very limited. So, the interest in China is being driven more by an awareness of domestic market opportunities and — in some cases — a perceived imperative that biopharmaceutical companies must develop their own “China strategy.”

Concerns regarding intellectual property (IP) have abated in India and China. As recently as six years ago, we conducted a survey that showed IP was, by far, biomanufacturers’ critical reason for avoiding doing business in China. That was the main factor inhibiting biopharmaceutical companies consideration of China as an outsourcing destination. With recent court decisions on IP in China, World Trade Organization agreements, and other international recognition of trade rights, this issue has taken a back seat to the opportunities that are opening up.

Increased interest is also driven by dynamic developments in new investments, facilities coming on-line, clients’ accumulated experiences with CMOs in general, and expanded capabilities and expertise among other Asia–Pacific CMOs. Locations with regulatory accreditations and conforming new construction draw business — especially as CMOs build facilities compliant with good manufacturing practices (GMP). As outsourcing and off-shoring become part of mainstream operations strategies and CMOs improve, companies expect increasingly more value from their partners’ services beyond low-cost performance of low-level activities. Results from US and Western European Respondents

Together, the United States and Western Europe biopharmaceutical companies represent >70% of the global research and development efforts, and the primary sources of new drug innovation. They represent an even greater percentage of commercial manufacturing capacity. However, when we compare US and European destinations for future biomanufacturing outsourcing locations, we find significant differences in geographical interest.

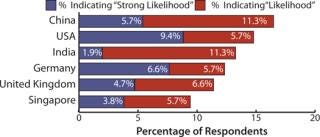

US-based biomanufacturers mentioned China most often in the study, with India and Singapore in close proximity. China topped US consideration, with 15.3% considering China either a “likelihood” or a “strong likelihood,” followed by India with 13.9%. This is a significant shift from only a year ago when China ranked fifth as a destination for US outsourcing.

Western European biomanufacturers registered a less favorable view of emerging Asia–Pacific markets than did US respondents. This result is likely due to proximity to other EU countries’ outsourcing vendors with capability, capacity, and experience. China was a location with a “strong likelihood” or “likelihood” for 9.4% of European respondents but was outranked by Germany, the United Kingdom, and the United States (12.5%, 12.4%, 9.4%, respectively). Compared with 2010, both China and India showed a drop in popularity on this question for Western European biopharmaceutical companies.

Figure 1: ()

China’s GMP Exports Are Still Years Away

Chinese biologics are approved for export to Africa, Middle East, Nepal, and elsewhere. However, China is not exporting to developed regions, because it does not have qualified current GMP (CGMP) biopharmaceutical manufacturing. That is changing because some companies are now designing and installing fully compliant CGMP facilities for contract biopharmaceutical manufacturing. Those are led by capable teams with experience from the United States and Europe and will come on line in the next three to five years for domestic operations. In addition, multinational pharmaceutical companies continue to look carefully at potential CMO partners in China. Some of the interest in China outsourcing may be derived from general interest in establishing such relationships.

Today, Western expertise is being leveraged to develop Chinese capabilities. For example, according to Scott Wheelwright, PhD, president of Strategic Manufacturing Worldwide, Inc., a CGMP manufacturing consultant with offices in China, “Several product development companies are building biopharmaceutical manufacturing plants [in China] that fully comply with US and European requirements for CGMP. These companies are well funded and rely on outside experts to ensure they meet the highest standards for quality.”

Despite the rapid growth in interest in China as an outsourcing destination, selecting a CMO in 2011 remains a very complex decision. The process is not likely to differ when evaluating a Chinese partner. This year’s study evaluated critical issues concerning outsourcing of biopharmaceutical manufacturing to a CMO. Of those indicating that an attribute was “important” or “very important,” a key issue was the ability to “stick to a schedule” (with 93.2%). “Establish a good working relationship” was second on the list (91%) of those considering the issue ‘important or ‘very impor

tant.” However, as shown in the “Selecting a CMO” box, when considering only “very important” responses, the top factors this year continue to be “comply with my company’s quality standards” (59%) followed by “protect intellectual property” (57%).

Those results continue to show that biomanufacturers demand that clients’ product-specific manufacturing operations be kept proprietary. This factor is increasing in importance as a result of a general focus on outsourcing operations. Sponsors are demanding greater levels professionalism, performance, and effectiveness in both managerial and technical areas from their outsourcing vendors.

REGULATORY, LEGAL, IP NEWS

March 2011

Eli Lilly files suit against Hospira for selling a generic of its cancer drug Gemzar.

World Health Organization assessment shows China is complying with international standards.

SFDA states all Chinese drug manufacturers (new and reconstructed facilities) must comply with new good manufacturing practices (GMP).

January 2011

3SBio receives grant from SFDA to manufacture TPIAO human recombinant for treatment of ITP.

SFDA deputy director Zhang Jingli is fired from post after bribery allegations.

December 2010

China and Taiwan will adopt same standards for use in clinical trials and exchange information over disease outbreaks.

Lead suspect in fake cancer-drug case is sentenced to 10 years in prison.

It is unlikely that China will be in a position to fully address those two key factors (quality and IP) within the next five years. But strides will probably be made during that time, and perhaps within 10 years we will see CGMP exports from China to Western markets.

China’s State Food and Drug Administration (SFDA) issued new GMP regulations in 2011 that significantly raise quality standards. Those standards are shuttering older plants and providing guidance to new facilities being constructed for domestic use, so they will incorporate standard practices used in the United States and Europe. According to Wheelwright, “It is only a matter of time before we see multiple plants in China that meet full CGMP requirements. In this respect, China is behind India, where multiple CMOs already meet CGMP requirements.

SELECTING A CMO IN CHINA

Survey participants provided their top considerations (rated “very important”) when selecting a CMO:

Comply with my company’s quality standards (59.1%)

Protect intellectual property (56.8%)

Effectively handle cross-contamination issues (52.3%)

Stick to a schedule (48.9%)

Establish a good working relationship (45.5%)

Demonstrate a track record with products similar to mine (35.2%)

Offer a secure supply (control of capacity) (34.1%)

A CMO’s location continues to show up in the report as being relatively unimportant (10.4% in 2005, and 2.3% in 2011 indicated the factor is “very important”). That may be a function related to globalization of this industry, off-shoring greater numbers of successful production projects, and degree of outsourcing-management expertise that sponsors are acquiring.

The “fit” between CMO and client is critical, and it may require years to build effective relationships. In this industry, flexibility, and a cooperative business environment are important because the variability and challenges in production, management, and regulatory documentation require exceptional collaborative relations.

Dr. Wolfgang Noe, senior consultant at BPTC notes, “Project management, compatibility of quality systems, compliance track record, efficient technology transfers, the entire system of documentation [are important], but I would rank ‘general fit,’ flexibility, and overall reputation higher than minor differences in ‘systems’.”Steep Learning Curve for Customer Service Delivery

Report data also suggest other areas where China may require additional time to reach world-class biologics CMO expectations. For example, “soft” factors such as establishing and maintaining good client–vendor relationships is increasing in importance to clients. Poor communication among clients and vendors will probably continue to be a major factor in persistent “working relationship” issues. If Chinese outsource partners are to succeed globally, they will likely need to achieve a customer-service orientation as they do business with overseas partners. This may seem like an easy task, but simple problems such as “sticking to a schedule” remain at the very top of the list of frustrations among CMO clients, including those doing business with local service suppliers. If China is to succeed, it will need to do a significantly better job of customer service than current CMOs and outsourcing vendors, including Western operations that have been in the business for decades. China’s CMO Business Incubators

China’s and India’s biopharmaceutical industries both benefit from government-sponsored funding of biotechnology incubators, biotech parks, and pilot level facilities. In China, ongoing development of these incubators is a part of the state’s five-year plans. The country has more than 100 well-established research parks, having begun a formal development program in 1983. The Zhongguancun Haidian Park includes three-year old AutekBio, a US China-based CMO. Its parent organization — with SUMA Ventures and Beijing E-Town Harvest International Capital Management Corporation — is building China’s largest CMO to service international biologic developments, with combined volumes of bioreactors up to 20,000 L in multiple production lines.

By establishing industrialized manufacturing lines, “AutekBio is set to ease the two bottlenecks and promote China’s biomedicine to the global market,” says Sun Lei, manufacturing president of AutekBio Inc. After introducing China’s first large-scale mammalian cell culture system, Lei indicates that AutekBio enjoyed the largest productivity last year among companies in China.

AutekBio management believes that some older core competencies involved in biomanufacturing are now routine, so it is logical for companies to shift them toward an outsourcing model. Says Julius Li, CEO at AutekBio, “In my view, growth in biologic CMOs is ripe for China over the next few years; this coincides with the booming of biosimilars in international markets and the need for high-end therapeutic biologics in the domestic Chinese markets.”

As the Chinese economy grows, so too are the personal disposable incomes and governmental fiscal revenues. Many cities are exceeding US$10,000 in gross domestic product (GDP) per capita. As a result, many local governments are looking to invest in the next big thing. Says J. Li, “Biologic manufacturing is certainly an opportunity that catches the eye of local leaders. I expect there will be several sizeable CMO companies emerging along the coast line with governmental subsidies and private investments. International companies may be able to capture this opportunity by collaborating with these CMO companies.”

BIOBUSINESS IN CHINA

March 2011

Novartis to increase sales force in China

February 2011

Bayer Healthcare expands Beijing R&D Center to 300 researchers.

China life science VC investing up 319% in 2010 to break $1 billion

ScinoPharm establishes contract manufacturing through new GMP plant in Changshu

Pfizer to move drug-discovery antibiotics research group to China

January 2011

Research Triangle Park (NC) and China to create biosciences gateway in US

Merck buys Beijing Skywing Technology for $18.2 mil to enhance upstream processing capabilities, cell-culture media products

China biopharma sales revenue up 30% in 2010; increased sales revenue 30% to $16 bil during first 11 months of 2010

PPD to extend China drug discovery services to include discovery of biotherapeutics with Taijitu Biologics Ltd to contribute Mab platform

Microbix announces $7 mil JV with Hunan for influenza vaccine facility

Toward International Standards

China is rapidly becoming one of world’s largest biopharmaceutical markets and is likely to be among the top five by 2025 — along with the United States, Europe, and Japan. That projection is based on the country’s middle-class growth, rapid economic expansion, commitment to accessible healthcare, active and public support of biotechnology segments, investment in pharmaceutical R&D, and focus on increasing exports of biologics. China has a GDP of >$8 trillion. The country has >$3 trillion in foreign-exchange holdings to spend on its increasing appetite for foreign investment in technology sectors. So the country recognizes that it is likely to benefit greatly from adherence to global, international regulatory standards, intellectual property protection, and international legal standards. We find ample evidence of Chinese companies’ moves toward more world-centric views in recent news reports (3) (see summaries in “Regulatory” and “Biobusiness” boxes).

To get to International CGMP standards, pharmaceutical companies will need trained staff. Education and training programs are being developed to meet these needs. According to Dr. Qiang Zheng, professor at the College of Engineering and director of the Center for Pharmaceutical Information and Engineering Research at Peking University, “One obstacle to successfully starting a biologics CMO is lack of technical staff in process and product development, quality management, and regulatory affairs, with knowledge consistent with international requirements. To address this, our educational program is promoting international standards and management practices. We’re adding more courses on biologics CMC and GMP. I think it will take more than five years for large biologics CMOs to become a major theme in China. However, small nimble companies may get there in three to five years.”Opportunity and Uncertainty

China was a very late starter in contract manufacturing, and it is unlikely that this area will match growth prospects without a hitch. The few internationally based CMOs in China are working hard to establish a global presence. Nevertheless, there is opportunity mixed with uncertainty: regulations covering CMOs are not finalized. Moreover, pharmaceutical production capacity in China is still in excess, and outsourcing is likely to improve when the idle capacity of many production facilities can be managed.

SURVEY METHODOLOGY

The 2011 Eighth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production by BioPlan Associates, Inc. yields a composite view and trend analysis from 352 individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 31 countries. The methodology encompassed an additional 186 direct suppliers of materials, services, and equipment to this industry. This year’s survey covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provided details and comparisons of production by biotherapeutic developers and CMOs. It evaluated trends over time and assessed differences in the world’s major markets in the United States and Europe.

To succeed, China and other Asia– Pacific CMOs must be prepared to offer higher end functions than traditional outsourcing fill–finish operations. They must offer more complex services previously performed in-house, including up- and downstream development and cell line development. Single-use manufacturing platforms are likely to be used for such capability upgrades and expansions.

China does not have an approval pathway for biosimilars, although most biologics on the Chinese market are copies of Western drugs. All drugs follow the same development pathway, and many companies with years of biosimilar experience are even looking toward biobetters for the domestic market. Armed with this experience, some companies are building plants designed to meet full CGMP compliance with an eye to future exports.

In the recent past, biopharmaceutical sponsor companies considered Chinese and Indian service providers as viable locations for biopharmaceutical outsourcing because of their low cost of labor, Today, however, to succeed globally, CMOs must first contend with significant quality, IP, and customer service issues. They face new and old challenges — as do their outsourcing competition in other regions. Both China and India are dealing with their own rising labor costs, risks of inflation, and internal growth, so the future is not by any means a complete picture.

Most of the 100 Chinese biopharmaceutical facilities today have approval for making material for local markets, but not for the US or EU market. This may change within the next 10 years as China begins to provide products and API for the EU and US markets. The fact that 17% of global outsourcing today is likely to be considered “China directed” indicates the global recognition of the growth potential in this market.

About the Author

Author Details

Eric S. Langer is president and managing partner of BioPlan Associates, Inc., 2275 Research Boulevard, Suite 500, Rockville, MD 20850; 1-301-921-5979, fax 1-301-926-2455; [email protected], www.bioplanassociates.com.

REFERENCES

1.) 2007. Advances in Biopharmaceutical Technology in China, BioPlan Associates, Inc., Rockville.

2.) 2011. 8th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, Inc., Rockville.

3.) BioChina Newsletter.

You May Also Like